Cablevision 2014 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

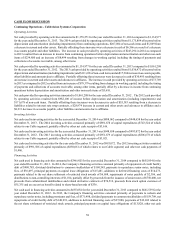

65

subsidiaries that own interests in Newsday on a senior secured basis. The Newsday Credit Agreement is secured by a lien on the

assets of Newsday and Cablevision senior notes with an aggregate principal amount of $611,455 owned by Newsday Holdings.

The principal financial covenant for the Newsday Credit Agreement is a minimum liquidity test of $25,000 which is tested bi-

annually on June 30 and December 31. The Newsday Credit Agreement also contains customary affirmative and negative covenants,

subject to certain exceptions, including limitations on indebtedness, investments and restricted payments. Certain of the covenants

applicable to CSC Holdings under the Newsday Credit Agreement are similar to the covenants applicable to CSC Holdings under

its outstanding senior notes.

Newsday was in compliance with its financial covenant under the Newsday Credit Agreement as of December 31, 2014.

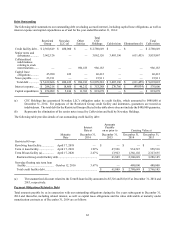

Capital Expenditures

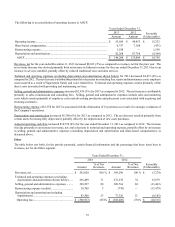

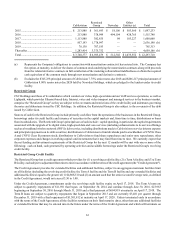

The following table provides details of the Company's capital expenditures for the years ended December 31, 2014 and 2013:

Years Ended December 31,

2014 2013

Customer premise equipment............................................................................................................ $ 263,466 $ 251,886

Scalable infrastructure....................................................................................................................... 233,530 311,162

Line extensions.................................................................................................................................. 18,924 29,040

Upgrade/rebuild................................................................................................................................. 44,024 34,402

Support .............................................................................................................................................. 183,580 180,188

Total Cable...................................................................................................................................... 743,524 806,678

Lightpath............................................................................................................................................ 109,749 111,830

Other.................................................................................................................................................. 38,405 33,171

Total Cablevision............................................................................................................................ $ 891,678 $ 951,679

Capital expenditures for 2014 decreased $60,001 (6)% as compared to 2013. This decrease was primarily related to lower spending

on various network projects.

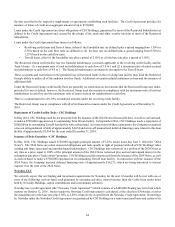

Monetization Contract Maturities

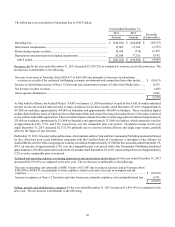

The following monetization contracts relating to our Comcast common stock matured in 2014:

Month of

Maturity Shares covered under

monetization contract

April 2014 ................................ 2,732,184

June 2014.................................. 2,668,875

August 2014 ............................. 2,668,875

We settled our obligations under the related collateralized indebtedness by delivering cash from the net proceeds of a new

monetization transaction on our Comcast common stock that will mature in April, June, and August 2016.

During the next 12 months, monetization contracts covering 13,407,684 shares (including 2,668,875 shares settled in January

2015) of Comcast common stock held by us will mature. We intend to settle such transactions by either delivering shares of the

Comcast common stock and the related equity derivative contracts or by delivering cash from the net proceeds of new monetization

transactions.

See "Item 7A. Quantitative and Qualitative Disclosures About Market Risk" for a discussion of our monetization contracts.

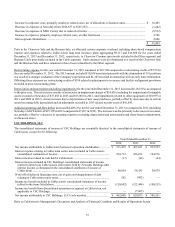

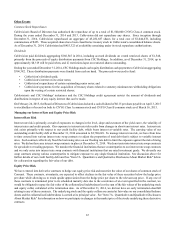

Contractual Obligations and Off Balance Sheet Commitments

Our contractual obligations to affiliates and non-affiliates as of December 31, 2014, which consist primarily of our debt obligations

and the effect such obligations are expected to have on our liquidity and cash flow in future periods, are summarized in the following

table: