Cablevision 2014 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except share and per share amounts)

F-32

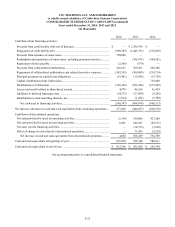

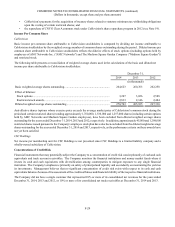

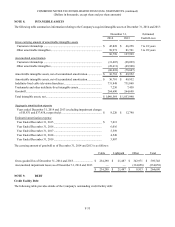

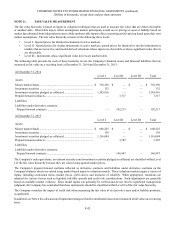

Year Ended December 31, 2013

Bresnan

Cable (a)

Clearview

Cinemas

(b) (c) Litigation

Settlement (d) Total

Revenues, net ........................................................................... $ 262,323 $ 27,307 $ — $ 289,630

Income (loss) before income taxes........................................... $ 439,870 $ (42,437) $ 173,690 $ 571,123

Income tax benefit (expense) (e).............................................. (180,178) 17,425 (70,054)(232,807)

Income (loss) from discontinued operations, net of taxes-

Cablevision ........................................................................... 259,692 (25,012) 103,636 338,316

Income tax benefit recognized at Cablevision, not applicable

to CSC Holdings................................................................... (6,602) — (1,003)(7,605)

Income (loss) from discontinued operations, net of income

taxes- CSC Holdings............................................................. $ 253,090 $ (25,012) $ 102,633 $ 330,711

(a) Includes the pretax gain recognized in connection with the Bresnan Sale of approximately $408,000.

(b) Includes the pretax loss recognized in connection with the Clearview Sale of approximately $19,300.

(c) As a result of the Company's annual impairment test in the first quarter of 2013, the Company recorded an impairment

charge of $10,347, relating to goodwill of the Company's Clearview business which reduced the carrying value to zero.

The Company determined the fair value of the Clearview business, which was a single reporting unit, assuming highest

and best use, based on either an income or market approach on a theater by theater basis.

(d) Represents primarily the proceeds from the final allocation of the DISH Network, LLC litigation settlement. See discussion

below for additional information.

(e) Includes tax benefit of $7,605 resulting from a decrease in the valuation allowance for certain state net operating loss

carry forwards.

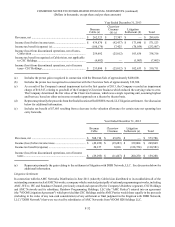

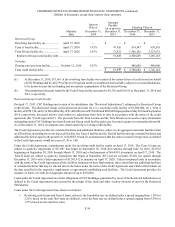

Year Ended December 31, 2012

Bresnan

Cable Clearview

Cinemas Litigation

Settlement (a) Total

Revenues, net ........................................................................... $ 508,710 $ 65,076 $ — $ 573,786

Income (loss) before income taxes........................................... $ (49,452) $ (19,683) $ 339,004 $ 269,869

Income tax benefit (expense) ................................................... 20,157 8,016 (138,754)(110,581)

Income (loss) from discontinued operations, net of income

taxes...................................................................................... $(29,295) $ (11,667) $ 200,250 $ 159,288

(a) Represents primarily the gain relating to the settlement of litigation with DISH Network, LLC. See discussion below for

additional information.

Litigation Settlement

In connection with the AMC Networks Distribution in June 2011 (whereby Cablevision distributed to its stockholders all of the

outstanding common stock of AMC Networks, a company which consisted principally of national programming networks, including

AMC, WE tv, IFC and Sundance Channel, previously owned and operated by the Company's Rainbow segment), CSC Holdings

and AMC Networks and its subsidiary, Rainbow Programming Holdings, LLC (the "AMC Parties") entered into an agreement

(the "VOOM Litigation Agreement") which provided that CSC Holdings and the AMC Parties would share equally in the proceeds

(including in the value of any non-cash consideration) of any settlement or final judgment in the litigation with DISH Network,

LLC ("DISH Network") that were received by subsidiaries of AMC Networks from VOOM HD Holdings LLC.