Cablevision 2014 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2014 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.33

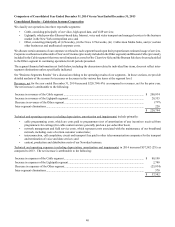

Other

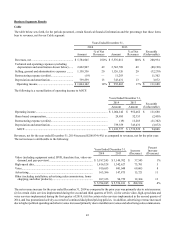

Our Other segment, which accounted for 5% of our consolidated revenues, net of inter-segment eliminations, for the year ended

December 31, 2014, includes the operations of (i) Newsday, which includes the Newsday daily newspaper, amNew York, Star

Community Publishing Group, and online websites, (ii) the News 12 Networks, our regional news programming services, (iii)

Cablevision Media Sales, a cable television advertising company, and (iv) certain other businesses and unallocated corporate costs.

Newsday

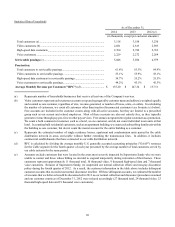

Newsday's revenue is derived primarily from the sale of advertising and the sale of the Newsday daily newspaper, including home

delivery, digital subscriptions, and single copy sales through local retail outlets ("circulation revenue"). For the year ended

December 31, 2014, advertising revenues accounted for 65% and circulation revenues accounted for 34% of the total revenues of

Newsday.

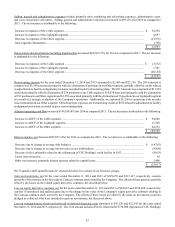

The newspaper industry generally has experienced significant declines in circulation and readership levels due to competition from

new media news formats and less reliance on newspapers by consumers. Readership and circulation levels, as well as economic

conditions and the existence of other advertising outlets, impact the demand for and level of our advertising. These factors will

continue to negatively impact Newsday’s revenues.

Newsday's largest categories of operating expenses relate to the production and distribution of its print products. These costs are

driven by volume (number of newspapers printed and number of pages printed) and the number of pages printed are impacted by

the volume of advertising and editorial pages. The majority of Newsday's other costs, such as editorial content creation, rent and

general and administrative expenses do not directly fluctuate with changes in advertising and circulation revenue.

News 12 Networks

Our News 12 Networks, which include seven 24-hour local news channels and five traffic and weather services dedicated to

covering areas within the New York metropolitan area, derives its revenues from the sale of advertising on its networks and

affiliation fees paid by cable operators, principally Cablevision.

Cablevision Media Sales

Cablevision Media Sales is a cable television advertising company that derives its revenues primarily from the sale of local and

regional commercial advertising time on cable television networks in the New York metropolitan area, which offers advertisers

the opportunity to target geographic and demographic audiences.

Critical Accounting Policies

In preparing its financial statements, the Company is required to make certain estimates, judgments and assumptions that it believes

are reasonable based upon the information available. These estimates and assumptions affect the reported amounts of assets and

liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the periods presented.

The significant accounting policies, which we believe are the most critical to aid in fully understanding and evaluating our reported

financial results, include the following:

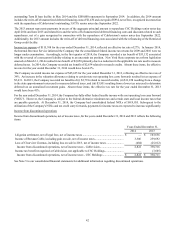

Impairment of Long-Lived and Indefinite-Lived Assets:

The Company's long-lived and indefinite-lived assets at December 31, 2014 include goodwill of $264,690, other intangible assets

of $775,879 ($739,098 of which are indefinite-lived intangible assets), and $3,025,747 of property, plant and equipment. Such

assets accounted for approximately 60% of the Company's consolidated total assets. Goodwill and identifiable indefinite-lived

intangible assets, which represent primarily the Company's cable television franchises and various trademarks, are tested annually

for impairment during the first quarter ("annual impairment test date") and upon the occurrence of certain events or substantive

changes in circumstances.

We assess qualitative factors for certain of our reporting units that carry goodwill. Among other relevant events and circumstances

that affect the fair value of these reporting units, we assess individual factors such as:

• macroeconomic conditions;

• industry and market conditions;

• cost factors;

• overall financial performance of the reporting unit;

• changes in management, strategy or customers;

• relevant reporting unit specific events such as a change in the carrying amount of net assets, a more-likely-than-not

expectation of selling or disposing all, or a portion, of a reporting unit; and

• sustained decrease in share price, as applicable.