Buffalo Wild Wings 2008 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2008 Buffalo Wild Wings annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

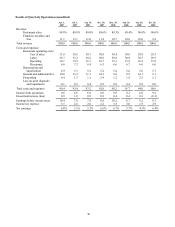

BUFFALO WILD WINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

Fiscal years ended December 28, 2008, December 30, 2007, and December 31, 2006

(Dollar amounts in thousands)

Common Stock

Shares

Amount

Deferred

Compensation

Retained

Earnings

Total

Balance at December 25, 2005 16,979,900 $ 74,503 $ (2,568) $ 24,913 $ 96,848

Net earnings — — — 16,273 16,273

Shares issued under employee stock purchase plan 36,804 528 — — 528

Shares issued from restricted stock units 113,560 — 2,568 — (2,375)

Units effectively repurchased for required employee

withholding taxes (34,226) (4,943) — — —

Exercise of stock options 171,978 573 — — 573

Tax benefit from stock issued — 1,153 — — 1,153

Stock-based compensation — 3,216 — — 3,216

Balance at December 31, 2006 17,268,016 $ 75,030 $ — $ 41,186 $116,216

Net earnings — — — 19,654 19,654

Shares issued under employee stock purchase plan 30,791 685 — — 685

Shares issued from restricted stock units 168,952 — — — —

Units effectively repurchased for required employee

withholding taxes (52,176) (413) — — (413)

Exercise of stock options 241,437 761 — — 761

Tax benefit from stock issued — 1,007 — — 1,007

Stock-based compensation — 3,755 — — 3,755

Balance at December 30, 2007 17,657,020 $ 80,825 $ — $ 60,840 $141,665

Net earnings — — — 24,435 24,435

Shares issued under employee stock purchase plan 43,948 905 — — 905

Shares issued from restricted stock units 153,891 — — — —

Units effectively repurchased for required employee

withholding taxes (45,320) (1,249) — — (1,249)

Exercise of stock options 77,732 322 — — 322

Tax benefit from stock issued — 615 — — 615

Stock-based compensation — 4,900 — — 4,900

Balance at December 28, 2008 17,887,271 $ 86,318 $ — $ 85,275 $171,593

See accompanying notes to consolidated financial statements.