Boeing 2015 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2015 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Total Backlog*

$ in billions

Commercial

Airplane Deliveries

Commercial

Airplanes and

Services Markets

(2015–2024)

$ in billions

Defense, Space &

Security Served

Markets (2015–2024)

$ in billions

11 12 13 14 15 1 2 3 4 5 6 Int’l U.S. Total

Served

355.4

390.2

440.9

502.4

489.3

11 12 13 14 15

477

601

648

723

762

60

120

500

650

1,140

1,250

11 12 13 14 15 11 12 13 14 15

68.7

81.7

86.6

90.8

96.1

11 12 13 14 15

5.79

5.88

7.07

8.60

7.72

4.0

7.5

8.2

8.9

9.4

Revenues

$ in billions

FINANCIAL RESULTS

BUSINESS HIGHLIGHTS

Core Earnings

Per Share†

Operating Cash Flow

$ in billions

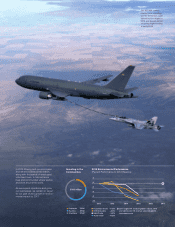

COMPARISON OF CUMULATIVE* FIVE-YEAR

TOTAL SHAREHOLDER RETURNS

1 Regional Jets

2 Large Wide-body

3 Medium Wide-body

4 Small Wide-body

5 Single-Aisle

6 Services

1,890

1,150

3,000

Services

Products

Boeing

S&P 500

Index

S&P 500

Aerospace

& Defense

Company/Index

Years Ending December

Base Period

2010

100

100

100

115.20

105.28

102.11

2011

121.23

120.61

118.45

2012

223.96

186.85

156.82

2013

218.30

208.21

178.29

2014 2015

10 11 12 13 14 15

248.97

219.52

180.75

$100

$300

$200

*Cumulative return assumes $100 invested; includes reinvestment of dividends.

The Boeing Company

S&P 500 Aerospace & Defense

S&P 500 Index

Our backlog remains strong at

$489 billion with net orders of

$83 billion for 2015, as we continued

to focus on productivity and posi-

tioning Boeing to deliver sustained

growth and strong business

performance for years to come.

We delivered a record 762 commer-

cial airplanes and grew our services

business while continuing to improve

productivity and quality, prepare the

production system for the transition

to new models, and adjust rates.

Increased production rates, supe-

rior new commercial airplanes and

continued innovation will help keep

Boeing competitive across address-

able markets, valued at $3.7 trillion

over the next 10 years.

With proven products and services

and a commitment to improved

productivity and affordability,

Boeing remains well positioned in

global defense, space and security

markets worth $3.0 trillion over the

next decade.

Revenues in 2015 rose 6 percent

to a record $96.1 billion driven by

record commercial deliveries and

solid performance in our defense,

space and security business.

Core earnings per share reflected

charges for the KC-46A tanker and

747 programs, which were partially

offset by strong core operating

performance across the company.

In 2015, our operating cash flow

continued to grow, supporting a

20 percent increase in our dividend

and a new share repurchase

authorization of $14 billion.

* Total backlog includes contractual and

unobligated backlog. See page 24 of

the Form 10-K.

†Non-GAAP measures. See page 123.

5