Blizzard 2002 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2002 Blizzard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14/15

Net Revenues. Net revenues for the year ended March 31, 2002 increased 27% from the prior fiscal year,

from $620.2 million to $786.4 million. This increase was driven by the performance of both our publishing

segment and our distribution segment.

Publishing net revenues for the year ended March 31, 2002 increased 18% from $466.1 million to $549.5

million. This increase primarily was due to publishing console net revenues increasing 24% from $349.5

million to $432.2 million. The increase in publishing console net revenues was attributable to the release

in fiscal 2002 of several titles for next-generation platforms that sold very well in both the domestic and

international marketplaces, as well as continuing strong worldwide sales for titles released on existing plat-

forms. Such titles included Tony Hawk’s Pro Skater 3 for PS2, GameCube and PS1, Tony Hawk’s Pro Skater 2

for GBA, N64 and PS1, Wreckless: The Yakuza Missions for Xbox, as well as Mat Hoffman’s Pro BMX for PS1,

GBA and GBC. A significant portion of our revenues is derived from products based on a relatively small

number of popular brands each year. In fiscal 2002, 50% of our worldwide net publishing revenues (35% of

consolidated net revenues) was derived from two brands, one of which accounted for 44% and the other of

which accounted for 6% of worldwide net publishing revenues (31% and 4%, respectively, of consolidated

net revenues). In fiscal 2001, two brands accounted for 49% of our worldwide net publishing revenues (37%

of consolidated net revenues), one of which accounted for 39% and the other of which accounted for 10%

of worldwide net publishing revenues (29% and 8%, respectively, of consolidated net revenues). We expect

that a limited number of popular brands will continue to produce a disproportionately large amount of our

revenues. In fiscal 2002, 56% of publishing console net revenues were derived from sales of titles for next-

generation platforms while 44% were derived from sales of titles for existing platforms. When new console

platforms are announced or introduced into the market, consumers typically reduce their purchases of game

console entertainment software products for current console platforms in anticipation of new platforms

becoming available. We expect sales from existing generation platform titles to decline and sales from next-

generation platform titles to increase as the installed base of next-generation platforms grows. Publishing

PC net revenues for the year ended March 31, 2002 remained relatively consistent with the prior year,

increasing from $116.5 million to $117.3 million. Our PC business was flat primarily due to the fact that,

despite the successful launch of Return to Castle Wolfenstein for the PC in the third quar ter of fiscal 2002,

there was a lower number of premium PC titles released in the year ended March 31, 2002, as compared

to the year ended March 31, 2001.

Distribution net revenues for the year ended March 31, 2002 increased 54% from the prior fiscal year,

from $154.1 million to $236.9 million, primarily driven by an increase in our distribution console net

revenues. Distribution console net revenues for the year ended March 31, 2002 increased 77% over the

prior fiscal year, from $117.4 million to $207.6 million. We are the sole distributor of Sony products in the

independent channel in the United Kingdom (“UK”). Accordingly, we benefited from the price reduction

on PS2 hardware that was effective September 2001, as this resulted in both an increase in sales of PS2

hardware, as well as an increase in sales of PS2 software due to the corresponding larger installed hardware

base. Additionally, in fiscal 2002, we began distributing Nintendo products within the UK. These items,

along with the improved market conditions in Europe, have resulted in the continued improvements in our

distribution business.

Domestic net revenues grew 15% from $352.9 million to $404.9 million. International net revenues

increased by 43% from $267.3 million to $381.5 million. The increase in domestic net revenues is reflective

of the improvements in our publishing segment as described above, and the increase in international net

revenues is reflective of the improvements in our publishing and distribution segments as described above.

Costs and Expenses. Cost of sales—product costs represented 56% and 52% of consolidated net revenues for

the year ended March 31, 2002 and 2001, respectively. The increase in cost of sales—product costs as a

percentage of consolidated net revenues for the year ended March 31, 2002 was due to the increase in

distribution net revenues as a percentage of total consolidated net revenues, as well as a change in the

product mix of our publishing business. Distribution net revenues have a higher per unit cost as compared

to publishing net revenues. The product mix of our publishing business for the year ended March 31, 2002

reflects a heavier concentration of console products and hand held devices. Console products generally

have a higher manufacturing per unit cost than PCs. Hand held devices generally have the highest manufac-

turing per unit cost of all platforms.

Cost of sales—intellectual property licenses decreased as a percentage of publishing net revenues to 7% for

the year ended March 31, 2002, from 9% for the year ended March 31, 2001. The decrease is reflective of

We evaluate the future recoverability of capitalized amounts on a quarterly basis. The recoverability of

capitalized intellectual proper ty license costs is evaluated based on the expected performance of the

specific products in which the licensed trademark or copyright is used. The following criteria is used to

evaluate expected product performance: historical performance of comparable products; the commercial

acceptance of prior products released on a given game engine; orders for the product prior to its release;

estimated performance of a sequel product based on the performance of the product on which the sequel

is based; and actual development costs of a product as compared to our budgeted amount.

Commencing upon the related product’s release, capitalized intellectual property license costs are

amortized to cost of sales—intellectual property licenses based on the ratio of current revenues to total

projected revenues. For products that have been released, we evaluate the future recoverability of capital-

ized amounts on a quarterly basis. The primary evaluation criterion is actual title performance.

Significant management judgment and estimates are utilized in the assessment of the recoverability of

capitalized costs.

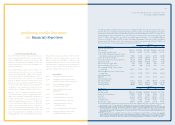

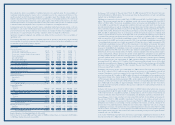

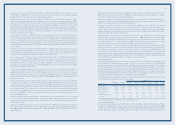

The following table sets forth certain consolidated statements of operations data for the periods indicated

as a percentage of total net revenues and also breaks down net revenues by territory and platform, as well

as operating income (loss) by business segment:

Fiscal years ended March 31, (In thousands) 2002 2001 2000

Net revenues $786,434 100% $620,183 100% $572,205 100%

Costs and expenses:

Cost of sales—product costs 435,725 56 324,907 52 319,422 56

Cost of sales—intellectual proper ty licenses 40,114 5 39,838 6 49,174 9

Cost of sales—software royalties and amortization 58,892 7 49,864 8 42,064 7

Product development 40,960 5 41,396 8 26,275 5

Sales and marketing 86,161 11 85,378 14 87,303 15

General and administrative 44,008 6 37,491 6 36,674 6

Amortization of intangibles — — 1,502 — 41,618 7

Total costs and expenses 705,860 90 580,376 94 602,530 105

Income (loss) from operations 80,574 10 39,807 6 (30,325) (5)

Interest income (expense), net 2,546 1 (7,263) (1) (8,411) (2)

Income (loss) before income tax provision 83,120 11 32,544 5 (38,736) (7)

Income tax provision (benefit) 30,882 4 12,037 2 (4,648) (1)

Net income (loss) $ 52,238 7% $ 20,507 3% $ (34,088) (6%)

Net Revenues by Territory:

United States $404,905 51% $352,893 57% $282,847 49%

Europe 368,799 47 256,228 41 277,485 49

Other 12,730 2 11,062 2 11,873 2

Total net revenues $786,434 100% $620,183 100% $572,205 100%

Segment/Platform Mix:

Publishing:

Console $432,163 79% $349,528 75% $281,204 71%

PC 117,345 21 116,534 25 115,487 29

Total publishing net revenues 549,508 70 466,062 75 396,691 69

Distribution:

Console 207,574 88 117,365 76 129,073 74

PC 29,352 12 36,756 24 46,441 26

Total distribution net revenues 236,926 30 154,121 25 175,514 31

Total net revenues $786,434 100% $620,183 100% $572,205 100%

Operating Income (Loss) by Segment:

Publishing $ 68,675 9% $ 35,687 5% $ (35,049) (6%)

Distribution 11,899 1 4,120 1 4,724 1

Total operating income (loss) $ 80,574 10% $ 39,807 6% $ (30,325) (5%)

Results of Operations—Fiscal Years Ended March 31, 2002 and 2001

Net income for fiscal year 2002 was $52.2 million or $0.88 per diluted share, as compared to $20.5 million

or $0.50 per diluted share in fiscal year 2001.