Blizzard 2002 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2002 Blizzard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

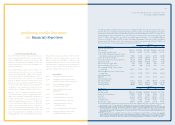

24/25

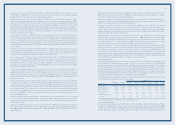

CONSOLIDATED BALANCE SHEETS

In thousands, except share data

March 31, 2002 2001

Assets

Current assets:

Cash and cash equivalents $279,007 $125,550

Accounts receivable, net of allowances of $42,019 and $28,461 at

March 31, 2002 and 2001, respectively 76,733 73,802

Inventories 20,736 43,888

Software development 36,263 21,265

Intellectual proper ty licenses 6,326 6,237

Deferred income taxes 22,608 14,292

Other current assets 15,200 13,196

Total current assets 456,873 298,230

Software development 3,254 2,154

Intellectual proper ty licenses 10,899 12,549

Property and equipment, net 17,832 15,240

Deferred income taxes 28,795 13,759

Other assets 3,242 7,709

Goodwill 35,992 10,316

Total assets $556,887 $359,957

Liabilities and Shareholders’ Equity

Current liabilities:

Current por tion of long-term debt $ 168 $ 10,231

Accounts payable 64,410 60,980

Accrued expenses 59,096 44,039

Total current liabilities 123,674 115,250

Long-term debt, less current portion 3,122 3,401

Convertible subordinated notes — 60,000

Total liabilities 126,796 178,651

Commitments and contingencies (Note 12)

Shareholders’ equity:

Preferred stock, $.000001 par value, 3,750,000 and 5,000,000 shares

authorized, no shares issued at March 31, 2002 and 2001, respectively — —

Series A Junior Preferred stock, $.000001 par value, 1,250,000 and no shares

authorized, no shares issued at March 31, 2002 and 2001, respectively — —

Common stock, $.000001 par value, 125,000,000 and 50,000,000 shares

authorized, 61,034,263 and 45,249,683 shares issued and 56,705,504 and

40,923,714 shares outstanding at March 31, 2002 and 2001, respectively — —

Additional paid-in capital 397,528 200,786

Retained earnings 64,384 12,146

Accumulated other comprehensive loss (11,498) (11,377)

Less: Treasury stock, at cost, 4,328,759 and 4,325,969 shares at

March 31, 2002 and 2001, respectively (20,323) (20,249)

Total shareholders’ equity 430,091 181,306

Total liabilities and shareholders’ equity $556,887 $359,957

The accompanying notes are an integral part of these consolidated financial statements.

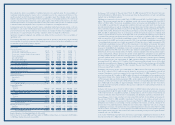

REPORT OF INDEPENDENT ACCOUNTANTS

The Board of Directors and Shareholders

Activision, Inc.:

We have audited the accompanying consolidated statements of operations, changes in shareholders’ equity

and cash flows of Activision, Inc. and subsidiaries for the year ended March 31, 2000. These consolidated

financial statements are the responsibility of the Company’s management. Our responsibility is to express

an opinion on these consolidated financial statements based on our audit.

We conducted our audit in accordance with auditing standards generally accepted in the United States of

America. Those standards require that we plan and perform the audit to obtain reasonable assurance about

whether the financial statements are free of material misstatement . An audit includes examining, on a test

basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes

assessing the accounting principles used and significant estimates made by management, as well as evaluat-

ing the overall financial statement presentation. We believe that our audit provides a reasonable basis for

our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects,

the results of operations and cash flows of Activision, Inc. and subsidiaries for the year ended March 31,

2000, in conformity with accounting principles generally accepted in the United States of America.

KPMG LLP

Los Angeles, California

May 5, 2000,

except as to Note 6,

which is as of April 1, 2001,

and the first paragraph of Note 14,

which is as of November 6, 2001