Blizzard 2002 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2002 Blizzard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28/29

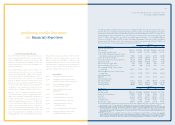

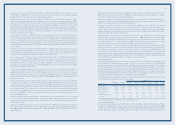

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

In thousands

Accumulated

Additional Retained Other

Common Stock Paid-In Earnings Treasury Stock Comprehensive Shareholders’

For the years ended March 31, 2002, 2001 and 2000 Shares Amount Capital (Deficit) Shares Amount Loss Equity

Balance, March 31, 1999 35,706 $— $109,251 $ 25,727 (750) $ (5,278) $ (2,510) $127,190

Components of comprehensive income:

Net loss for the year — — — (34,088) — — — (34,088)

Foreign currency translation adjustment — — — — — — (3,556) (3,556)

Total comprehensive loss (37,644)

Issuance of common stock and common stock warrants — — 8,529 — — — — 8,529

Issuance of common stock and common stock options to employees 3,605 — 22,480 — — — — 22,480

Tax benefit attributable to employee stock options and common stock warrants — — 3,017 — — — — 3,017

Tax benefit derived from net operating loss carryforward utilization — — 1,266 — — — — 1,266

Issuance of common stock to effect business combinations 421 — 7,171 — — — — 7,171

Balance, March 31, 2000 39,732 — 151,714 (8,361) (750) (5,278) (6,066) 132,009

Components of comprehensive income:

Net income for the year — — — 20,507 — — — 20,507

Foreign currency translation adjustment — — — — — — (5,311) (5,311)

Total comprehensive income 15,196

Issuance of common stock and common stock warrants 150 — 1,050 — — — — 1,050

Issuance of common stock and common stock options to employees 5,368 — 32,538 — — — — 32,538

Tax benefit attributable to employee stock options and common stock warrants — — 11,832 — — — — 11,832

Tax benefit derived from net operating loss carryforward utilization — — 3,652 — — — — 3,652

Purchase of treasury shares — — — — (3,576) (14,971) — (14,971)

Balance, March 31, 2001 45,250 — 200,786 12,146 (4,326) (20,249) (11,377) 181,306

Components of comprehensive income:

Net income for the year — — — 52,238 — — — 52,238

Foreign currency translation adjustment — — — — — — (121) (121)

Total comprehensive income 52,117

Issuance of common stock and common stock warrants 1,037 — 1,044 — — — — 1,044

Issuance of common stock and common stock options to employees 8,773 — 63,053 — — — — 63,053

Tax benefit attributable to employee stock options and common stock warrants — — 48,513 — — — — 48,513

Issuance of common stock pursuant to conversion of conver tible subordinated notes 4,763 — 58,651 — — — — 58,651

Issuance of common stock to effect business combinations 1,211 — 25,481 — — — — 25,481

Purchase of treasury shares — — — — (3) (74) — (74)

Balance, March 31, 2002 61,034 $— $397,528 $ 64,384 (4,329) $(20,323) $(11,498) $430,091

The accompanying notes are an integral part of these consolidated financial statements.