Black & Decker 2014 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2014 Black & Decker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

these markets, for these markets — is

expected to continue to produce share

gains in emerging markets for years to

come. And the CDIY innovation machine

is working on breakthrough technology

that has the potential to support growth

momentum in developed markets well

through the latter part of the decade.

The global tools market remains

fragmented despite CDIY/IAR’s strong

#1 market position and high relative

market share. Our combined global

share in tools is approximately 20%,

so continued consolidation of the tools

industry through bolt-on acquisitions

presents an opportunity to create value

by leveraging our scale and filling gaps

in existing product and geographic

oerings.

Engineered Fastening: Engineered

Fastening is also an attractive high

growth, high margin franchise with

global reach. Our ability to expand the

market through increased platform

penetration enables the business to

generate organic growth at increased

multiples of end-market growth rates.

Due to its high value-added business

model, Engineered Fastening has

unique expertise in a highly technical

field and is a critical design and supply

chain partner to our automotive and

other customers. As a consequence, we

command strong margins on equipment

sales and a recurring revenue stream for

the life of the platform, in most cases.

Recently, with the successful addition

of Infastech, Engineered Fastening

has also achieved strong operating

leverage while bolstering its growth and

profitability in electronics and other

manufacturing verticals. Looking ahead,

Engineered Fastening remains one of

our highest priority growth platforms

and we see a significant opportunity to

expand this business both organically

and through accretive acquisitions.

Security: Our Security segment, which

represents approximately 20% of

the Company’s total revenues, is the

#2 commercial electronic security

services provider in the world, with a

broad global footprint, a comprehensive

suite of security products, services

and solutions, and enormous strategic

potential. Historically, Security

represented a source of stable, above

Company line average operating margin

and provided a source of profit when

revenues declined in CDIY and Industrial

during the 2008–2009 period.

Since acquiring Niscayah in 2011,

however, Security has pressured

both organic revenue and operating

margin growth. We believe we are now

on a path to organic growth as well

as restoring operating margin to the

mid-teens with rigorous, disciplined

management; however, we estimate it

will take two plus years to achieve this.

Importantly, the overall turnaround

depends upon, among other things,

our success in scaling and exploiting

the Vertical Market initiative that is

beginning to produce results in North

America. The Vertical initiative: (1)

aords us the ability to dierentiate

our value proposition, (2) enables us to

grow organically with premium gross

margins, and (3) positions us favorably

as advances in software, electronics

and advanced analytics inevitably blur

the distinction between commercial

security and various adjacencies. It will

also be important for Security Europe to

successfully market these solutions, as

well as grow its monitoring recurring

revenue base as its turnaround progresses.

Although much has been accomplished

during the past year, the Security

turnaround is still in the relatively early

stages. We do, however, have the right

people, the right strategy and are in

the right markets, giving us cause for

cautious optimism that we can return

this business to successful levels of

growth and profitability and therefore

secure its place as part of our long-

term portfolio.

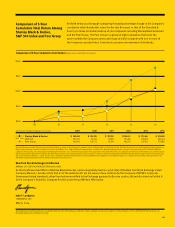

25%

17%

9%

49%

EMERGING

MARKETS

EUROPE

R.O.W.

U.S.

GLOBAL PRESENCE

% OF REVENUES