Black & Decker 2014 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2014 Black & Decker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We achieved record earnings per share

and free cash flow and a cash conversion

ratio of over 130% while delivering

5% organic growth in a slower global

GDP environment. We enjoyed share

gains in many of our businesses, most

notably CDIY and Engineered Fastening,

as well as success with our Vertical

Markets initiative in Security. A sharp

focus on cost control and a proactive

approach to managing pricing and mix

led to margin expansion across much

of our portfolio despite severe foreign

currency headwinds. A clear priority

in 2014 was addressing our Security

business’ recent underperformance.

We were pleased with the progress

on this front, as Security stabilized in

the first half of the year and continued

forward on the path to recovery in

the second half. Our Vertical Markets

initiative has been a success in North

America and the operational and

commercial improvements implemented

in Security Europe have positioned this

business for improved results during

2015 and beyond. As a result of the

overall Company’s strong financial

performance, we exited the year with

a strong balance sheet and, consistent

with our near-term capital allocation

plan, we are positioned to ramp up our

planned stock repurchases in 2015.

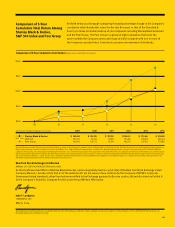

The market clearly recognized our

performance as reflected in the

19% increase in our share price in 2014

compared to 2013, outperforming our

peer group (up 14%) and the overall

S&P (up 11%).

Our long-term mission and objectives

remain firmly in place — to continue

to invest in building world-class

franchises with sustainable strategic

characteristics that create exceptional

shareholder value. Our opportunity is

significant across our businesses: we

plan to both leverage and build upon our

existing scalable, world-class Tools and

Engineered Fastening platforms while

continuing to improve Security in order

to reach its full potential.

In 2014 Stanley Black & Decker made

significant progress towards our long-term

financial objectives while continuing to

position for a strong future.

LETTER TO SHAREHOLDERS

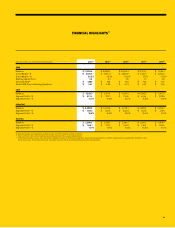

SUMMARY OF RESULTS

• Total revenues increased 4% to a

record $11.3 billion, with organic

growth of 5%

• Operating margin increased to

13.6%* compared to 12.7%* in 2013,

a 90 basis point increase in the

face of approximately $85 million

of foreign currency headwinds

• Earnings per share increased 14% to

a record $5.67* from $4.98* in 2013

• Free cash flow totaled a record

$1 billion, up $477 million from 2013,

and we rewarded our shareholders

with our 47th consecutive annual

dividend increase

• Working capital turns increased by

over a full turn to 9.2 demonstrating

the continued success of the Stanley

Fulfillment System, with CDIY

exceeding 10 turns for the first time

* Excluding charges