Black & Decker 2014 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2014 Black & Decker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Stanley Black & Decker 2014 Annual ReportStanley Black & Decker Annual Report

10 11 14

$5.37 $5.67

$4.98

$4.72

$3.54

$3.28

$2.75

12 13

$3.60

$1.01

$4.65

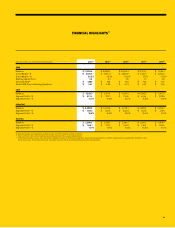

MILLIONS OF DOLLARS

Net earnings from continuing operations $ $ $ $ $

Interest income

Interest expense

Income taxes

Depreciation and amortization

EBITDA from continuing operations $ , $ , $ , $ , $

Merger and acquisition-related charges 442 227 478

Adjusted EBITDA $ , $ , $ , $ , $ ,

(b), (c), (d), (e) and (f) refer to the inside back cover.

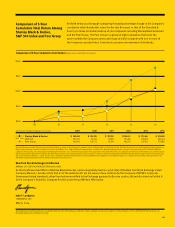

2010–2014

CAGR:

11%

Adjusted EBITDA

(Continuing Operations)(a)

$ MILLIONS

Working Capital Turns(d)

Free Cash Flow(c)

$ MILLIONS

Cash Flow Return on

Investment(f)

2010–2014

CAGR:

12%

EPS

(Continuing Operations)(b)

Average Capital Employed(e)

$ BILLIONS

Total Sales Growth

LONGTERM OBJECTIVE: +%

Organic Sales Growth

LONGTERM OBJECTIVE: +%

(a) “EBITDA” (earnings before interest, taxes, depreciation, and amortization) is a non-GAAP measurement. Management believes it is important for the ability to determine the earnings power

of the Company and to properly value the Company, due to high levels of non-cash expenses related to recent acquisitions. The Company’s 2014 results exclude $54 million (pretax) of charges

related to merger and acquisition-related charges. The Company’s 2013 results exclude $390 million (pretax) of charges related to merger and acquisition-related charges as well as the

charges associated with the extinguishment of debt during the fourth quarter of 2013. The Company’s 2012 results exclude $442 million (pretax) of charges related to merger and acquisition-

related charges, the charges associated with the $200 million in cost actions implemented in 2012, as well as the charges associated with the extinguishment of debt during the third quarter

of 2012. In 2011 and 2010, EBITDA excludes pretax merger and acquisition-related charges of $227 million and $478 million, respectively, primarily associated with the Black & Decker merger

and Niscayah acquisitions.

14

$1,745

13

$1,560

12

$1,510

10

$1,053

11

$1,372

14

$1,005

13

$528

12

$593

10

$557

11

$706

SCORECARD

9.2

8.1

7.8

5.9

7.3

14131210 11

$10.7

$7.0

$10.5

$10.4

$10.7

14131210 11 14

13.1%

13

.%

.%

.%

.%

20

(%)

120

11 12 13 14

4%

117%

26%

7%

9%

30

2

6

4

(%)

8

11 12 13 14

5%

5%

6%

2%

3%