Big Lots 2009 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2009 Big Lots annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DEAR SHAREHOLDERS:

BIG LOTS, INC. 2009 ANNUAL REPORT

Steven S. Fishman

Chairman, CEO and President

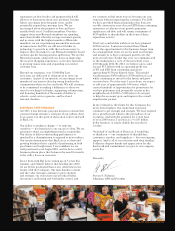

When I decided to join Big Lots nearly five years ago,

I looked at this business as any investor would. What

was clear to me from the beginning was that we

had talented people and a strong niche in the retail

marketplace. At the same time, we had an incredible

opportunity to transform Big Lots from a good company

to a world-class organization.

We set out looking at our business in new ways,

challenging how we operate and our assumptions about

what our customers expect. We cast aside a “business

as usual” approach, knowing that in retail if you are

not changing or reinventing your business constantly,

you run the risk of losing ground with your customer.

We reviewed all aspects of our strategy and business

processes. We worked diligently to test, learn, and

develop a long-range plan for our business. We focused

on creating shareholder value through programs to

improve merchandising, marketing, and store-level

performance, supplemented by diligent and strict

expense control. We committed to healthy growth,

and we said we would not grow the store base until

we could assure you that we were doing so in a profitable

manner. These strategies and disciplines are now deeply

embedded in our culture and have served us well. We

have grown our operating profit from $27 million in 2005

to over $325 million in 2009 — a year that will likely

go down as one of the most difficult environments in

retail history. And along the way, we have generated

nearly $1.2 billion of cash, the majority of which we have

returned to you, our shareholders, in the form of share

repurchase activity.

I am very proud of the team’s effort. During this past

year, when the global recession took its toll on the

market and economic news turned morning coffee bitter:

• We completed our 3rd consecutive year of record

EPS performance, a span that now dates back

13 consecutive quarters.

• We generated record operating profit dollars

of over $325 million.

• We grew our store base for the first time since

2004 by opening more stores in 2009 than we

have in the last 3 years combined.

• We invested in new systems and put capital to work

in our business and fleet of stores to enhance the

customer experience.

• And, in a world where cash is king, we generated

over $300 million in cash.

• Our Board of Directors has authorized the repurchase

of up to $400 million of our common shares.

In the balance of this letter, I will detail some of the

significant 2009 highlights, and also lay out for you

some of our thoughts on the future and our plans for

continuing to enhance shareholder value.

READY FOR GROWTH

Our business has generated a significant amount

of cash in recent years. My job as CEO is to ensure

we are investing your cash in the opportunities that

we expect to generate strong returns, whether that is in

our existing concepts or new strategies. I have said on a

number of occasions that we have “an open to receive”

and would look at any opportunity to drive profitable

growth and shareholder value. Looking forward to 2010

and beyond, we believe the best opportunity (internal or

external) is to reinvest in our current locations and grow

our fleet of stores profitably.

Clearly our business model has gotten stronger each

year, and we are confident in our plans heading into

2010. Additionally, the difficulties experienced in the

economy have taken their toll on retailers and the

commercial real estate market. As a result, today

there are fewer retailers vying for locations and, in

our estimation, real estate prices are becoming more

appropriately valued in the marketplace. The

combination of our improved performance and a softer

real estate market enabled us to move into a store