Big Lots 2009 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2009 Big Lots annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Spine - Printer, please adjust to required nished dimension

(Currently set as .3125”(W) x 10.875”(H))

Inside Front Cover

8.25”(W) x 10.875”(H)

BL09AR_Covers_Print_032610.indd 2

Spine - Printer, please adjust to required nished dimension

(Currently set as .3125”(W) x 10.875”(H))

Inside Front Cover

8.25”(W) x 10.875”(H)

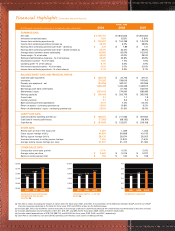

EARNINGS DATA

Net sales $ 4,726,772 $ 4,645,283 $ 4,656,302

Net sales increase (decrease) 1.8% (0.2)% (1.8)%

Income from continuing operations (a) $ 195,627 $ 154,798 $ 145,079

Income from continuing operations increase (a) 26.4% 6.7% 28.8%

Earnings from continuing operations per share - diluted (a) $ 2.37 $ 1.89 $ 1.41

Earnings from continuing operations per share - diluted increase (a) 25.4% 34.0% 39.6%

Average diluted common shares outstanding 82,681 82,076 102,542

Gross margin - % of net sales 40.6% 40.0% 39.5%

Selling and administrative expenses - % of net sales (a) 32.3% 32.8% 32.8%

Depreciation expense - % of net sales 1.6% 1.7% 1.9%

Operating profit - % of net sales (a) 6.7% 5.5% 4.9%

Net interest expense (income) - % of net sales 0.0% 0.1% (0.1)%

Income from continuing operations - % of net sales (a) 4.1% 3.3% 3.1%

BALANCE SHEET DATA AND FINANCIAL RATIOS

Cash and cash equivalents $ 283,733 $ 34,773 $ 37,131

Inventories 731,337 736,616 747,942

Property and equipment - net 491,256 490,041 481,366

Total assets 1,669,493 1,432,458 1,443,815

Borrowings under bank credit facility - 61,700 163,700

Shareholders’ equity 1,001,412 774,845 638,486

Working capital (b) $ 580,446 $ 355,776 $ 390,766

Current ratio 2.1 1.7 1.8

Inventory turnover 3.7 3.6 3.5

Bank borrowings to total capitalization 0.0% 7.4% 20.4%

Return on assets - continuing operations (a) 12.6% 10.8% 9.2%

Return on shareholders’ equity - continuing operations (a) 22.0% 21.9% 16.4%

CASH FLOW DATA

Cash provided by operating activities (c) $ 392,027 $ 211,063 $ 307,932

Cash used in investing activities (d) (77,937) (88,192) (58,764)

Cash flow (e) $ 314,090 $ 122,871 $ 249,168

STORE DATA

Stores open at end of the fiscal year 1,361 1,339 1,353

Gross square footage (000’s) 40,591 39,888 40,195

Selling square footage (000’s) 29,176 28,674 28,902

Increase (decrease) in selling square footage 1.8% (0.8)% (1.6)%

Average selling square footage per store 21,437 21,415 21,362

OTHER SALES DATA

Comparable store sales growth 0.7% 0.5% 2.0%

Average sales per store $ 3,462 $ 3,416 $ 3,377

Sales per selling square foot $ 162 $ 160 $ 158

(a) This item is shown excluding the impact of certain items for fiscal years 2007 and 2009. A reconciliation of the difference between GAAP and the non-GAAP

financial measures presented in this table for fiscal years 2007 and 2009 is shown on the following page.

(b) Includes $61,700 in fiscal 2008 for current maturities of borrowings under bank credit facility because the credit facility was terminating in less than one year.

(c) Includes depreciation and amortization of $71,501, $73,787, and $83,103 for fiscal years 2009, 2008, and 2007, respectively.

(d) Includes capital expenditures of $78,708, $88,735, and $60,360 for fiscal years 2009, 2008, and 2007, respectively.

(e) Cash flow is calculated as cash provided by operating activities less cash used in investing activities.

($ in thousands, except per share amounts and sales per selling square foot) 2009 2008 2007

FISCAL YEAR

$3.00

$2.40

$1.80

$1.20

$0.60

$0.00

EARNINGS FROM CONTINUING

OPERATIONS PER SHARE -

DILUTED (a)

2007

2008

2009

$1.41

$1.89

10.0%

8.0%

6.0%

4.0%

2.0%

0.0%

OPERATING PROFIT - % OF NET

SALES (a)

2007

2008

2009

4.9%

4.0

3.8

3.6

3.4

3.2

3.0

INVENTORY TURNOVER

2007

2008

2009

3.5

3.6

6.7% 3.7

Financial Highlights (Unaudited Adjusted Results)

$2.37

5.5%

BL09AR_Covers_Print_032610.indd 2

Spine - Printer, please adjust to required nished dimension

(Currently set as .3125”(W) x 10.875”(H))

Inside Front Cover

8.25”(W) x 10.875”(H)

EARNINGS DATA

Net sales $ 4,726,772 $ 4,645,283 $ 4,656,302

Net sales increase (decrease) 1.8% (0.2)% (1.8)%

Income from continuing operations (a) $ 195,627 $ 154,798 $ 145,079

Income from continuing operations increase (a) 26.4% 6.7% 28.8%

Earnings from continuing operations per share - diluted (a) $ 2.37 $ 1.89 $ 1.41

Earnings from continuing operations per share - diluted increase (a) 25.4% 34.0% 39.6%

Average diluted common shares outstanding 82,681 82,076 102,542

Gross margin - % of net sales 40.6% 40.0% 39.5%

Selling and administrative expenses - % of net sales (a) 32.3% 32.8% 32.8%

Depreciation expense - % of net sales 1.6% 1.7% 1.9%

Operating profit - % of net sales (a) 6.7% 5.5% 4.9%

Net interest expense (income) - % of net sales 0.0% 0.1% (0.1)%

Income from continuing operations - % of net sales (a) 4.1% 3.3% 3.1%

BALANCE SHEET DATA AND FINANCIAL RATIOS

Cash and cash equivalents $ 283,733 $ 34,773 $ 37,131

Inventories 731,337 736,616 747,942

Property and equipment - net 491,256 490,041 481,366

Total assets 1,669,493 1,432,458 1,443,815

Borrowings under bank credit facility - 61,700 163,700

Shareholders’ equity 1,001,412 774,845 638,486

Working capital (b) $ 580,446 $ 355,776 $ 390,766

Current ratio 2.1 1.7 1.8

Inventory turnover 3.7 3.6 3.5

Bank borrowings to total capitalization 0.0% 7.4% 20.4%

Return on assets - continuing operations (a) 12.6% 10.8% 9.2%

Return on shareholders’ equity - continuing operations (a) 22.0% 21.9% 16.4%

CASH FLOW DATA

Cash provided by operating activities (c) $ 392,027 $ 211,063 $ 307,932

Cash used in investing activities (d) (77,937) (88,192) (58,764)

Cash flow (e) $ 314,090 $ 122,871 $ 249,168

STORE DATA

Stores open at end of the fiscal year 1,361 1,339 1,353

Gross square footage (000’s) 40,591 39,888 40,195

Selling square footage (000’s) 29,176 28,674 28,902

Increase (decrease) in selling square footage 1.8% (0.8)% (1.6)%

Average selling square footage per store 21,437 21,415 21,362

OTHER SALES DATA

Comparable store sales growth 0.7% 0.5% 2.0%

Average sales per store $ 3,462 $ 3,416 $ 3,377

Sales per selling square foot $ 162 $ 160 $ 158

(a) This item is shown excluding the impact of certain items for fiscal years 2007 and 2009. A reconciliation of the difference between GAAP and the non-GAAP

financial measures presented in this table for fiscal years 2007 and 2009 is shown on the following page.

(b) Includes $61,700 in fiscal 2008 for current maturities of borrowings under bank credit facility because the credit facility was terminating in less than one year.

(c) Includes depreciation and amortization of $71,501, $73,787, and $83,103 for fiscal years 2009, 2008, and 2007, respectively.

(d) Includes capital expenditures of $78,708, $88,735, and $60,360 for fiscal years 2009, 2008, and 2007, respectively.

(e) Cash flow is calculated as cash provided by operating activities less cash used in investing activities.

($ in thousands, except per share amounts and sales per selling square foot) 2009 2008 2007

FISCAL YEAR

$3.00

$2.40

$1.80

$1.20

$0.60

$0.00

EARNINGS FROM CONTINUING

OPERATIONS PER SHARE -

DILUTED (a)

2007

2008

2009

$1.41

$1.89

10.0%

8.0%

6.0%

4.0%

2.0%

0.0%

OPERATING PROFIT - % OF NET

SALES (a)

2007

2008

2009

4.9%

4.0

3.8

3.6

3.4

3.2

3.0

INVENTORY TURNOVER

2007

2008

2009

3.5

3.6

6.7% 3.7

Financial Highlights (Unaudited Adjusted Results)

$2.37

5.5%

BL09AR_Covers_Print_032610.indd 2

Spine - Printer, please adjust to required nished dimension

(Currently set as .3125”(W) x 10.875”(H))

Inside Front Cover

8.25”(W) x 10.875”(H)

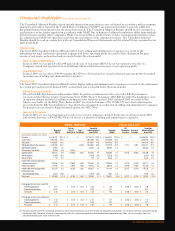

(a) This item is shown excluding the impact of certain items for fiscal years 2007 and 2009. A reconciliation of the difference between GAAP and the non-GAAP

financial measures presented in this table for fiscal years 2007 and 2009 is shown on the following page.

(b) Includes $61,700 in fiscal 2008 for current maturities of borrowings under bank credit facility because the credit facility was terminating in less than one year.

(c) Includes depreciation and amortization of $71,501, $73,787, and $83,103 for fiscal years 2009, 2008, and 2007, respectively.

(d) Includes capital expenditures of $78,708, $88,735, and $60,360 for fiscal years 2009, 2008, and 2007, respectively.

(e) Cash flow is calculated as cash provided by operating activities less cash used in investing activities.

BL09AR_Covers_Print_032610.indd 2

Spine - Printer, please adjust to required nished dimension

(Currently set as .3125”(W) x 10.875”(H))

Inside Front Cover

8.25”(W) x 10.875”(H)

EARNINGS DATA

Net sales $ 4,726,772 $ 4,645,283 $ 4,656,302

Net sales increase (decrease) 1.8% (0.2)% (1.8)%

Income from continuing operations (a) $ 195,627 $ 154,798 $ 145,079

Income from continuing operations increase (a) 26.4% 6.7% 28.8%

Earnings from continuing operations per share - diluted (a) $ 2.37 $ 1.89 $ 1.41

Earnings from continuing operations per share - diluted increase (a) 25.4% 34.0% 39.6%

Average diluted common shares outstanding 82,681 82,076 102,542

Gross margin - % of net sales 40.6% 40.0% 39.5%

Selling and administrative expenses - % of net sales (a) 32.3% 32.8% 32.8%

Depreciation expense - % of net sales 1.6% 1.7% 1.9%

Operating profit - % of net sales (a) 6.7% 5.5% 4.9%

Net interest expense (income) - % of net sales 0.0% 0.1% (0.1)%

Income from continuing operations - % of net sales (a) 4.1% 3.3% 3.1%

BALANCE SHEET DATA AND FINANCIAL RATIOS

Cash and cash equivalents $ 283,733 $ 34,773 $ 37,131

Inventories 731,337 736,616 747,942

Property and equipment - net 491,256 490,041 481,366

Total assets 1,669,493 1,432,458 1,443,815

Borrowings under bank credit facility - 61,700 163,700

Shareholders’ equity 1,001,412 774,845 638,486

Working capital (b) $ 580,446 $ 355,776 $ 390,766

Current ratio 2.1 1.7 1.8

Inventory turnover 3.7 3.6 3.5

Bank borrowings to total capitalization 0.0% 7.4% 20.4%

Return on assets - continuing operations (a) 12.6% 10.8% 9.2%

Return on shareholders’ equity - continuing operations (a) 22.0% 21.9% 16.4%

CASH FLOW DATA

Cash provided by operating activities (c) $ 392,027 $ 211,063 $ 307,932

Cash used in investing activities (d) (77,937) (88,192) (58,764)

Cash flow (e) $ 314,090 $ 122,871 $ 249,168

STORE DATA

Stores open at end of the fiscal year 1,361 1,339 1,353

Gross square footage (000’s) 40,591 39,888 40,195

Selling square footage (000’s) 29,176 28,674 28,902

Increase (decrease) in selling square footage 1.8% (0.8)% (1.6)%

Average selling square footage per store 21,437 21,415 21,362

OTHER SALES DATA

Comparable store sales growth 0.7% 0.5% 2.0%

Average sales per store $ 3,462 $ 3,416 $ 3,377

Sales per selling square foot $ 162 $ 160 $ 158

(a) This item is shown excluding the impact of certain items for fiscal years 2007 and 2009. A reconciliation of the difference between GAAP and the non-GAAP

financial measures presented in this table for fiscal years 2007 and 2009 is shown on the following page.

(b) Includes $61,700 in fiscal 2008 for current maturities of borrowings under bank credit facility because the credit facility was terminating in less than one year.

(c) Includes depreciation and amortization of $71,501, $73,787, and $83,103 for fiscal years 2009, 2008, and 2007, respectively.

(d) Includes capital expenditures of $78,708, $88,735, and $60,360 for fiscal years 2009, 2008, and 2007, respectively.

(e) Cash flow is calculated as cash provided by operating activities less cash used in investing activities.

($ in thousands, except per share amounts and sales per selling square foot) 2009 2008 2007

FISCAL YEAR

$3.00

$2.40

$1.80

$1.20

$0.60

$0.00

EARNINGS FROM CONTINUING

OPERATIONS PER SHARE -

DILUTED (a)

2007

2008

2009

$1.41

$1.89

10.0%

8.0%

6.0%

4.0%

2.0%

0.0%

OPERATING PROFIT - % OF NET

SALES (a)

2007

2008

2009

4.9%

4.0

3.8

3.6

3.4

3.2

3.0

INVENTORY TURNOVER

2007

2008

2009

3.5

3.6

6.7% 3.7

Financial Highlights (Unaudited Adjusted Results)

$2.37

5.5%

BL09AR_Covers_Print_032610.indd 2

Spine - Printer, please adjust to required nished dimension

(Currently set as .3125”(W) x 10.875”(H))

Inside Front Cover

8.25”(W) x 10.875”(H)

EARNINGS DATA

Net sales $ 4,726,772 $ 4,645,283 $ 4,656,302

Net sales increase (decrease) 1.8% (0.2)% (1.8)%

Income from continuing operations (a) $ 195,627 $ 154,798 $ 145,079

Income from continuing operations increase (a) 26.4% 6.7% 28.8%

Earnings from continuing operations per share - diluted (a) $ 2.37 $ 1.89 $ 1.41

Earnings from continuing operations per share - diluted increase (a) 25.4% 34.0% 39.6%

Average diluted common shares outstanding 82,681 82,076 102,542

Gross margin - % of net sales 40.6% 40.0% 39.5%

Selling and administrative expenses - % of net sales (a) 32.3% 32.8% 32.8%

Depreciation expense - % of net sales 1.6% 1.7% 1.9%

Operating profit - % of net sales (a) 6.7% 5.5% 4.9%

Net interest expense (income) - % of net sales 0.0% 0.1% (0.1)%

Income from continuing operations - % of net sales (a) 4.1% 3.3% 3.1%

BALANCE SHEET DATA AND FINANCIAL RATIOS

Cash and cash equivalents $ 283,733 $ 34,773 $ 37,131

Inventories 731,337 736,616 747,942

Property and equipment - net 491,256 490,041 481,366

Total assets 1,669,493 1,432,458 1,443,815

Borrowings under bank credit facility - 61,700 163,700

Shareholders’ equity 1,001,412 774,845 638,486

Working capital (b) $ 580,446 $ 355,776 $ 390,766

Current ratio 2.1 1.7 1.8

Inventory turnover 3.7 3.6 3.5

Bank borrowings to total capitalization 0.0% 7.4% 20.4%

Return on assets - continuing operations (a) 12.6% 10.8% 9.2%

Return on shareholders’ equity - continuing operations (a) 22.0% 21.9% 16.4%

CASH FLOW DATA

Cash provided by operating activities (c) $ 392,027 $ 211,063 $ 307,932

Cash used in investing activities (d) (77,937) (88,192) (58,764)

Cash flow (e) $ 314,090 $ 122,871 $ 249,168

STORE DATA

Stores open at end of the fiscal year 1,361 1,339 1,353

Gross square footage (000’s) 40,591 39,888 40,195

Selling square footage (000’s) 29,176 28,674 28,902

Increase (decrease) in selling square footage 1.8% (0.8)% (1.6)%

Average selling square footage per store 21,437 21,415 21,362

OTHER SALES DATA

Comparable store sales growth 0.7% 0.5% 2.0%

Average sales per store $ 3,462 $ 3,416 $ 3,377

Sales per selling square foot $ 162 $ 160 $ 158

(a) This item is shown excluding the impact of certain items for fiscal years 2007 and 2009. A reconciliation of the difference between GAAP and the non-GAAP

financial measures presented in this table for fiscal years 2007 and 2009 is shown on the following page.

(b) Includes $61,700 in fiscal 2008 for current maturities of borrowings under bank credit facility because the credit facility was terminating in less than one year.

(c) Includes depreciation and amortization of $71,501, $73,787, and $83,103 for fiscal years 2009, 2008, and 2007, respectively.

(d) Includes capital expenditures of $78,708, $88,735, and $60,360 for fiscal years 2009, 2008, and 2007, respectively.

(e) Cash flow is calculated as cash provided by operating activities less cash used in investing activities.

($ in thousands, except per share amounts and sales per selling square foot) 2009 2008 2007

FISCAL YEAR

$3.00

$2.40

$1.80

$1.20

$0.60

$0.00

EARNINGS FROM CONTINUING

OPERATIONS PER SHARE -

DILUTED (a)

2007

2008

2009

$1.41

$1.89

10.0%

8.0%

6.0%

4.0%

2.0%

0.0%

OPERATING PROFIT - % OF NET

SALES (a)

2007

2008

2009

4.9%

4.0

3.8

3.6

3.4

3.2

3.0

INVENTORY TURNOVER

2007

2008

2009

3.5

3.6

6.7% 3.7

Financial Highlights (Unaudited Adjusted Results)

$2.37

5.5%

BL09AR_Covers_Print_032610.indd 2

191021_BigLot_CVR_R1.indd 2