Berkshire Hathaway 2013 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion (Continued)

Investment and Derivative Gains/Losses

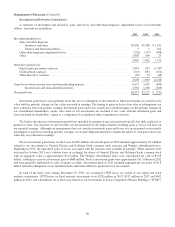

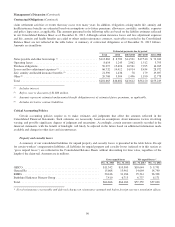

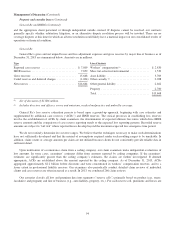

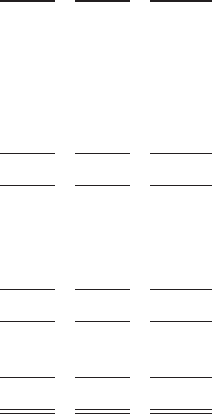

A summary of investment and derivative gains and losses and other-than-temporary impairment losses on investments

follows. Amounts are in millions.

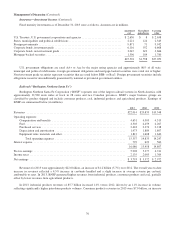

2013 2012 2011

Investment gains/losses:

Sales and other disposals

Insurance and other ........................................................ $2,830 $1,288 $ 1,991

Finance and financial products ............................................... 5 2 162

Other-than-temporary impairment losses ........................................... (228) (337) (908)

Other ....................................................................... 1,458 509 29

4,065 1,462 1,274

Derivative gains/losses:

Equity index put option contracts ................................................. 2,843 997 (1,787)

Credit default contracts ......................................................... (213) 894 (251)

Other derivative contracts ....................................................... (22) 72 (66)

2,608 1,963 (2,104)

Gains/losses before income taxes and noncontrolling interests .............................. 6,673 3,425 (830)

Income taxes and noncontrolling interests ...................................... 2,336 1,198 (309)

Net gains/losses ................................................................... $4,337 $2,227 $ (521)

Investment gains/losses arise primarily from the sale or redemption of investments or when investments are carried at fair

value with the periodic changes in fair values recorded in earnings. The timing of gains or losses from sales or redemptions can

have a material effect on periodic earnings. Investment gains and losses usually have minimal impact on the periodic changes in

our consolidated shareholders’ equity since most of our investments are recorded at fair value with the unrealized gains and

losses included in shareholders’ equity as a component of accumulated other comprehensive income.

We believe the amount of investment gains/losses included in earnings in any given period typically has little analytical or

predictive value. Our decisions to sell securities are not motivated by the impact that the resulting gains or losses will have on

our reported earnings. Although our management does not consider investment gains and losses in a given period as necessarily

meaningful or useful in evaluating periodic earnings, we are providing information to explain the nature of such gains and losses

when they are reflected in earnings.

Pre-tax investment gains/losses in 2013 were $4,065 million. Investment gains in 2013 included approximately $2.1 billion

related to our investments in General Electric and Goldman Sachs common stock warrants and Wrigley subordinated notes.

Beginning in 2013, the unrealized gains or losses associated with the warrants were included in earnings. These warrants were

exercised in October 2013 on a cashless basis in exchange for shares of General Electric and Goldman Sachs common stock

with an aggregate value of approximately $2.4 billion. The Wrigley subordinated notes were repurchased for cash of $5.08

billion, resulting in a pre-tax investment gain of $680 million. Pre-tax investment gains were approximately $1.5 billion in 2012

and were primarily attributable to sales of equity securities. Investment gains in 2011 included aggregate pre-tax gains of $1.8

billion from the redemptions of our Goldman Sachs and General Electric preferred stock investments.

In each of the three years ending December 31, 2013, we recognized OTTI losses on certain of our equity and fixed

maturity investments. OTTI losses on fixed maturity investments were $228 million in 2013, $337 million in 2012 and $402

million in 2011, and substantially all of the losses related to our investments in Texas Competitive Electric Holdings (“TCEH”)

86