Berkshire Hathaway 2013 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

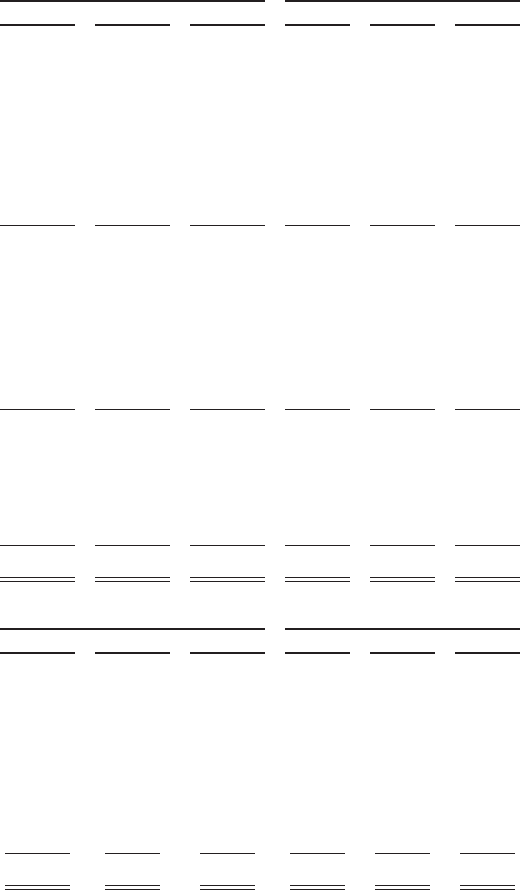

Notes to Consolidated Financial Statements (Continued)

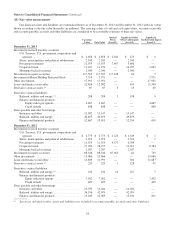

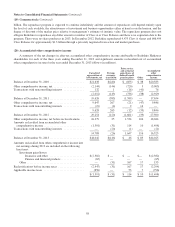

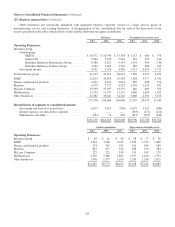

(23) Business segment data (Continued)

Other businesses not specifically identified with reportable business segments consist of a large, diverse group of

manufacturing, service and retailing businesses. A disaggregation of our consolidated data for each of the three most recent

years is presented in the tables which follow on this and the following two pages (in millions).

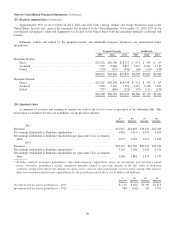

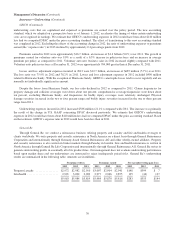

Revenues Earnings before income taxes

2013 2012 2011 2013 2012 2011

Operating Businesses:

Insurance group:

Underwriting:

GEICO ................................... $ 18,572 $ 16,740 $ 15,363 $ 1,127 $ 680 $ 576

General Re ................................ 5,984 5,870 5,816 283 355 144

Berkshire Hathaway Reinsurance Group ........ 8,786 9,672 9,147 1,294 304 (714)

Berkshire Hathaway Primary Group ............ 3,342 2,263 1,749 385 286 242

Investment income ............................. 4,735 4,474 4,746 4,713 4,454 4,725

Total insurance group ............................... 41,419 39,019 36,821 7,802 6,079 4,973

BNSF ............................................ 22,014 20,835 19,548 5,928 5,377 4,741

Finance and financial products ........................ 4,291 4,110 4,014 985 848 774

Marmon .......................................... 6,979 7,171 6,925 1,176 1,137 992

McLane Company .................................. 45,930 37,437 33,279 486 403 370

MidAmerican ..................................... 12,743 11,747 11,291 1,806 1,644 1,659

Other businesses ................................... 42,382 38,647 32,202 5,080 4,591 3,675

175,758 158,966 144,080 23,263 20,079 17,184

Reconciliation of segments to consolidated amount:

Investment and derivative gains/losses .............. 6,673 3,425 (830) 6,673 3,425 (830)

Interest expense, not allocated to segments .......... — — — (303) (271) (221)

Eliminations and other .......................... (281) 72 438 (837) (997) (819)

$182,150 $162,463 $143,688 $28,796 $22,236 $15,314

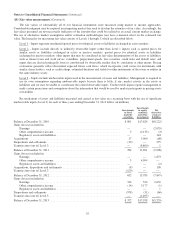

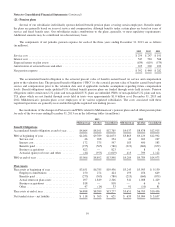

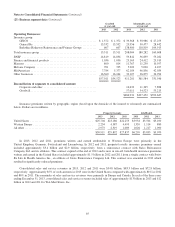

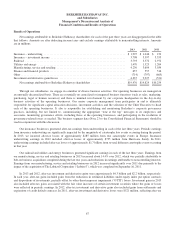

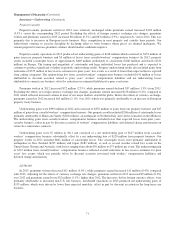

Capital expenditures Depreciation of tangible assets

2013 2012 2011 2013 2012 2011

Operating Businesses:

Insurance group .................................... $ 89 $ 61 $ 40 $ 58 $ 57 $ 56

BNSF ............................................ 3,918 3,548 3,325 1,655 1,573 1,480

Finance and financial products ........................ 251 367 331 182 184 180

Marmon .......................................... 847 817 514 498 479 484

McLane Company .................................. 225 225 188 159 149 129

MidAmerican ..................................... 4,307 3,380 2,684 1,577 1,440 1,333

Other businesses ................................... 1,450 1,377 1,109 1,289 1,264 1,021

$11,087 $9,775 $8,191 $5,418 $5,146 $4,683

64