Berkshire Hathaway 2013 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2013 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

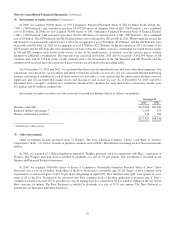

(7) Investment gains/losses (Continued)

in the cost basis of the investment, but not the fair value. Accordingly, such losses that are included in earnings are generally

offset by a corresponding credit to other comprehensive income and therefore have no net effect on shareholders’ equity as of

the balance sheet date.

We recorded OTTI losses on bonds issued by Texas Competitive Electric Holdings (“TCEH”) of $228 million in 2013,

$337 million in 2012 and $390 million in 2011. In 2011, OTTI losses also included $337 million with respect to 103.6 million

shares of our investment in Wells Fargo & Company (“Wells Fargo”) common stock. These shares had an aggregate original

cost of $3.6 billion. On March 31, 2011, when we recorded the losses, we also held an additional 255.4 million shares of Wells

Fargo which were acquired at an aggregate cost of $4.4 billion and which had unrealized gains of $3.7 billion. However, the

unrealized gains were not reflected in earnings but were instead recorded directly in shareholders’ equity as a component of

accumulated other comprehensive income.

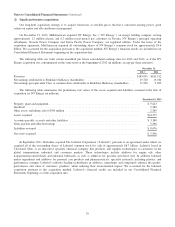

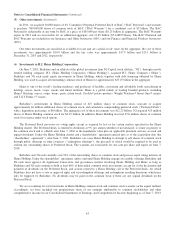

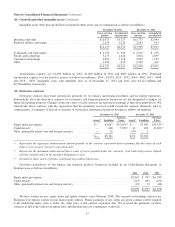

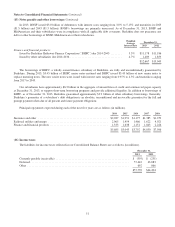

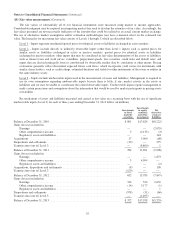

(8) Receivables

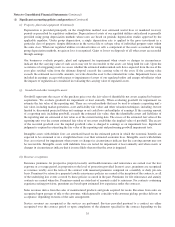

Receivables of insurance and other businesses are comprised of the following (in millions).

December 31,

2013 2012

Insurance premiums receivable ............................................................. $ 7,474 $ 7,845

Reinsurance recoverable on unpaid losses .................................................... 3,055 2,925

Trade and other receivables ................................................................ 10,328 11,369

Allowances for uncollectible accounts ....................................................... (360) (386)

$20,497 $21,753

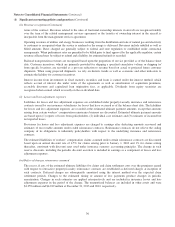

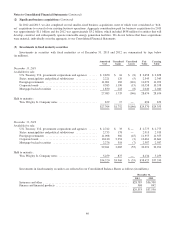

Loans and finance receivables of finance and financial products businesses are comprised of the following (in millions).

December 31,

2013 2012

Consumer installment loans, commercial loans and finance receivables ............................. $13,170 $13,170

Allowances for uncollectible loans .......................................................... (344) (361)

$12,826 $12,809

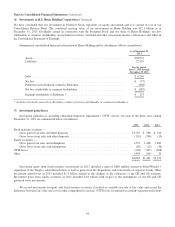

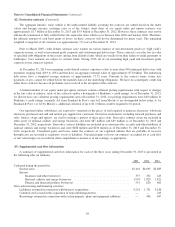

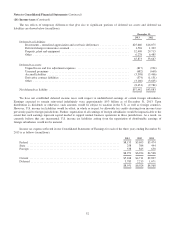

Consumer installment loans represent approximately 95% and 96% of the aggregate consumer installment loans,

commercial loans and finance receivables as of December 31, 2013 and 2012, respectively. Allowances for uncollectible loans

predominantly relate to consumer installment loans. Provisions for loan losses for 2013 and 2012 were $249 million and $312

million, respectively. Loan charge-offs, net of recoveries, were $266 million in 2013 and $339 million in 2012. Loan amounts

are net of unamortized acquisition discounts of $406 million at December 31, 2013 and $459 million at December 31, 2012. At

December 31, 2013, approximately 94% of the loan balances were evaluated collectively for impairment, and the remainder

were evaluated individually for impairment. As a part of the evaluation process, credit quality indicators are reviewed and loans

are designated as performing or non-performing. At December 31, 2013, approximately 98% of the loan balances were

determined to be performing and approximately 93% of those balances were current as to payment status.

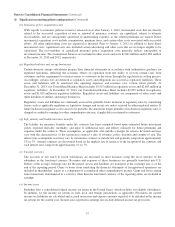

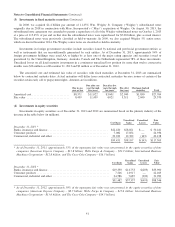

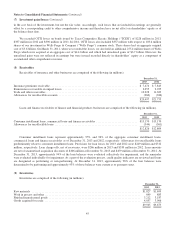

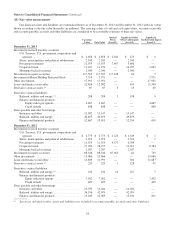

(9) Inventories

Inventories are comprised of the following (in millions).

December 31,

2013 2012

Raw materials ............................................................................ $1,827 $1,699

Work in process and other ................................................................... 849 883

Finished manufactured goods ................................................................ 3,212 3,187

Goods acquired for resale ................................................................... 4,057 3,906

$9,945 $9,675

45