Barnes and Noble 2013 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2013 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOOK

This segment includes the Company’s digital business,

which includes the Company’s eBookstore, digital news-

stand and sales of NOOK® devices and accessories through

B&N Retail, B&N College and third party distribution

partners.

The underlying strategy of the NOOK business is to offer

customers any digital book, newspaper or magazine any

time on any device. The Company remains committed to

delivering to customers the best digital bookstore experi-

ence, while reducing its existing cost structure. As part

of this commitment, the Company intends to continue to

offer the best black-and-white and color eReaders on the

market, backed by quality customer service and technol-

ogy support for those devices. The Company will continue

to sell its existing device inventory through reduced and

promotional pricing. At the same time, it will leverage all

Barnes & Noble retail, digital and partnership assets, as

well as existing NOOK customer relationships.

The Company sells digital content in the U.K. directly

through its NOOK devices and its nook.co.uk website.

The Company plans to continue to expand into additional

international markets and believes that its partnership

with Microsoft will help foster that expansion. Under its

partnership agreements with Microsoft, the Company pre-

viously disclosed that it expected to be in 10 international

markets by June 30, 2013. While substantial progress has

been made towards meeting the target expansion require-

ment, the Company now expects expansion into these 10

markets to be accomplished by the end of 2013.

The digital products group has knowledgeable product

development and operational management teams in the

areas of reading software, digital content retailing and

mobile device development. NOOK’s development office

in Palo Alto employs experienced engineers in its digital

product area. The NOOK digital products management

team is currently focused on next generation digital read-

ing products to enhance the reading experience and help

consumers discover content in new and interesting ways.

The Digital Services team, which includes the Cloud and

Commerce groups, is responsible for maintaining and

developing the NOOK digital bookstore service.

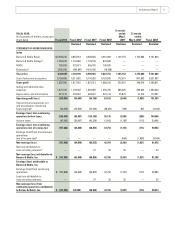

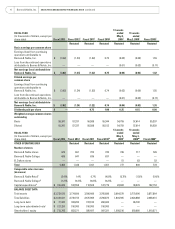

RESTATEMENT OF PRIOR PERIOD FINANCIAL

STATEMENTS

The Company has restated its previously reported consoli-

dated financial statements for the years ended April 28,

2012 and April 30, 2011, including the opening stockhold-

ers’ equity balance, in order to correct certain previously

reported amounts. In fiscal 2013, management determined

that the Company had incorrectly overstated certain

accruals for the periods prior to April 27, 2013, as a result

of inadequate controls over its Distribution Center accrual

reconciliation process. In accordance with ASC 250-10-

S99-2, Considering the Effects of Prior Year Misstatements

when Quantifying Misstatements in Current Year Financial

Statements (ASC 250), the Company recorded an adjust-

ment to decrease cost of sales by $6.7 million ($4.0

million after tax) and $8.5 million ($5.1 million after tax)

to correctly present the statement of operations for fiscal

2012 and 2011, respectively. The Company also decreased

accounts payable by $81.0 million, $89.5 million and $96.2

million at May 1, 2010, April 30, 2011 and April 28, 2012,

respectively and increased retained earnings by $69.5

million, $74.6 million and $78.6 million, net of tax at May

1, 2010, April 30, 2011 and April 28, 2012, respectively, to

correct the consolidated balance sheet.

2013 Annual Report 11