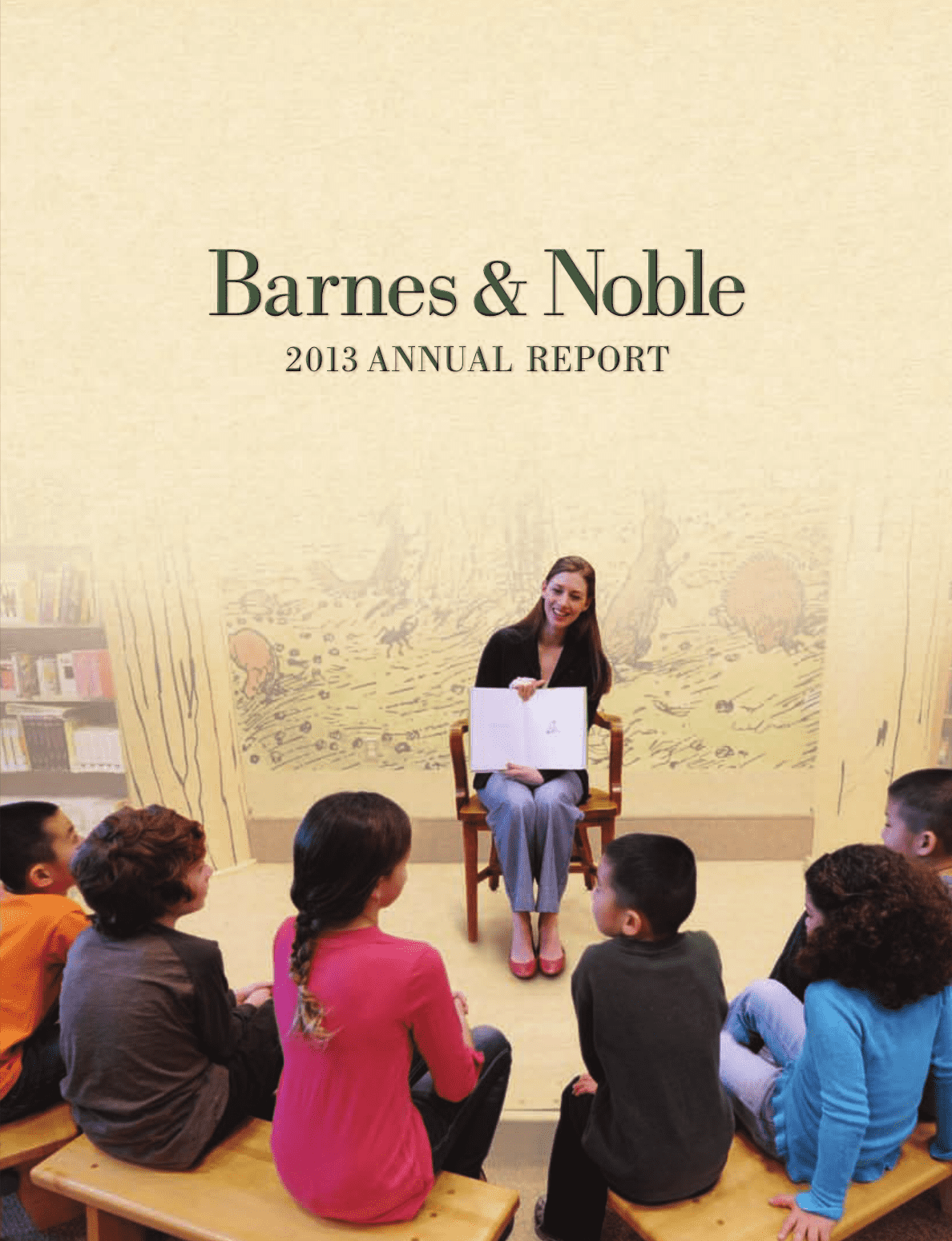

Barnes and Noble 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

Table of contents

-

Page 1

-

Page 2

-

Page 3

... Noble 2013 Letter To Shareholders Selected Consolidated Financial Data Management's Discussion and Analysis of Financial Condition And Results Of Operations Results of Operations Consolidated Statements of Operations Consolidated Statements of Comprehensive Income (Loss) Consolidated Balance Sheets...

-

Page 4

... and color eReaders on the market. Our bookstores had a solid year, with a 16% increase in earnings before interest, taxes, depreciation and amortization (EBITDA), due primarily to gross margin expansion and lower expenses. Driving sales was the runaway success of E.L. James' "Fifty Shades of Grey...

-

Page 5

.... Our bookstores continue to be the centerpieces of the communities we serve and our College business breaks new ground every day as an innovative leader in that space. We have confidence in the future of our NOOK business, and believe that along with our industry leading technology partners, we...

-

Page 6

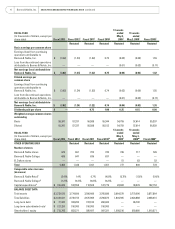

... 30, 2011 (fiscal 2011), and the Balance Sheet Data as of April 27, 2013 and April 28, 2012 are derived from, and are qualified by reference to, audited consolidated financial statements which are included elsewhere in this report. The Statement of Operations Data for the 52 weeks ended May 1, 2010...

-

Page 7

... Restated

13 weeks ended May 2, 2009 j Restated

13 weeks ended May 3, 2008j Restated

Fiscal 2008j Restated

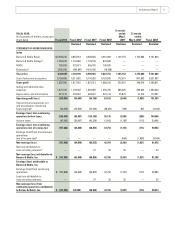

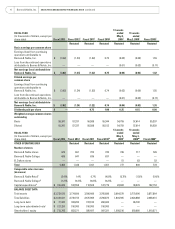

Sales Barnes & Noble Retail Barnes & Noble Collegea NOOK Eliminationb Total sales Cost of sales and occupancy Gross proï¬t Selling and administrative expenses Depreciation and amortization...

-

Page 8

... 2013

OTHER OPERATING DATA

Fiscal 2012 Restated

Fiscal 2011 Restated 705 636 - 1,341

Fiscal 2010k Restated 720 637 - 1,357

Fiscal 2008n Restated 726 - 52 778

Number of stores Barnes & Noble stores Barnes & Noble College B. Dalton stores Total Comparable sales increase (decrease) Barnes & Noble...

-

Page 9

... months and all eReader device revenue deferred in accordance with ASC 605-25 Revenue Recognition, Multiple Element Arrangements, and does not include sales from closed or relocated stores. Additionally, for textbook rentals, comparable store sales reï¬,ects the retail selling price of a new or used...

-

Page 10

...(NOOK Studyâ„¢). The Company offers its customers a full suite of textbook options-new, used, digital and rental. To address dynamic changes in the book selling industry, Barnes & Noble has been transforming its business from a store-based model to a multi-channel model centered on its retail stores...

-

Page 11

... 27, 2013, primarily under the Barnes & Noble Booksellers trade name. These stores generally offer a dedicated NOOK® area, a comprehensive trade book title base, a café, and departments dedicated to Juvenile, Toys & Games, DVDs, Music, Gift, Magazine and Bargain products. The stores also offer...

-

Page 12

... stores, including textbooks and course-related materials, emblematic apparel and gifts, trade books, computer products, NOOK® products and related accessories, school and dorm supplies, convenience and café items, and more recently, textbook rentals. B&N College provides extensive textbook rental...

-

Page 13

... color eReaders on the market, backed by quality customer service and technology support for those devices. The Company will continue to sell its existing device inventory through reduced and promotional pricing. At the same time, it will leverage all Barnes & Noble retail, digital and partnership...

-

Page 14

... months and all eReader device revenue deferred in accordance with ASC 605-25 Revenue Recognition, Multiple Element Arrangements, and does not include sales from closed or relocated stores. Additionally, for textbook rentals, comparable store sales reï¬,ects the retail selling price of a new or used...

-

Page 15

...In 2009, the Company entered the eBook market. Since then, the Company launched its NOOK® brand of eReading products, which provide a fun, easyto-use and immersive digital reading experience. With

NOOK®, customers gain access to the expansive NOOK Store™ of more than three million digital books...

-

Page 16

...The Company sells digital content in the U.K. directly through its NOOK devices and its nook.co.uk website. The Company plans to continue to expand into additional international markets and believes that its partnership with Microsoft will help foster that expansion. Under its partnership agreements...

-

Page 17

...price markdowns accelerate. Also contributing to the increase was higher occupancy costs on increased office space in Palo Alto, CA, partially offset by a higher mix of higher margin content sales.

In fiscal 2013, the Company opened two and closed 18 Barnes & Noble stores, bringing its total number...

-

Page 18

16

Barnes & Noble, Inc.

MANAGEMENT 'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPER ATIONS continued

Gross Margin

52 weeks ended Dollars in thousands B&N Retail B&N College NOOK Total Gross Margin April 27, 2013 $ 1,399,723 405,076 (122,293) $ 1,682,506 % Sales 30.6% 23.0% (...

-

Page 19

... trade, juvenile and bargain, were essentially flat as the Company benefited from the Borders liquidation. The increase in comparable store sales was primarily attributable to the strategic expansion of non-book categories, such as NOOK® devices and accessories, Toys & Games and Gift products...

-

Page 20

... store productivity. • B&N College selling and administrative expenses increased as a percentage of sales to 16.0% in fiscal 2012 from 15.2% in fiscal 2011. This increase was primarily attributable to deleveraging against the increase in textbook rentals, which have a lower price than new or used...

-

Page 21

... the rental period. The NOOK business, like that of many technology companies, is impacted by the launch of new products and the promotional efforts to support those new products, as well as the traditional retail holiday selling seasonality.

L IQUIDITY AN D CAPITAL RESOURCES

Net interest expense...

-

Page 22

... inventory to support increased sales and new store growth. Receivables, net decreased $20.6 million or 12.1% to $149.4 million as of April 27, 2013, compared to $169.9 million as of April 28, 2012. This decrease was due to lower channel partner receivables. Prepaid expenses and other current...

-

Page 23

... percentage of eligible inventories with the ability to include eligible real estate, accounts receivable and accrued interest, at the election of the Company, at Base Rate or LIBO Rate, plus, in each case, an Applicable Margin (each term as defined in the 2011 Amended Credit Agreement). In addition...

-

Page 24

22

Barnes & Noble, Inc.

MANAGEMENT 'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPER ATIONS continued

On April 27, 2012, the Company entered into an amendment to the 2011 Amended Credit Agreement in order to permit the transactions contemplated by the investment agreement ...

-

Page 25

... these estimates.

Revenue Recognition

The "Management's Discussion and Analysis of Financial Condition and Results of Operations" section of this report discusses the Company's consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted...

-

Page 26

24

Barnes & Noble, Inc.

MANAGEMENT 'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPER ATIONS continued

ECommerce revenue from sales of products ordered through the Company's internet site is recognized upon delivery and receipt of the shipment by its customers. Sales taxes ...

-

Page 27

2013 Annual Report

25

textbook and trade book inventories are valued using the LIFO method, where the related reserve was not material to the recorded amount of the Company's inventories or results of operations at April 27, 2013. NOOK merchandise inventories are recorded based on the average cost...

-

Page 28

..., the Company used cash flows that reflected management's forecasts and discount rates that included risk adjustments consistent with the current market conditions. Based on the results of the Company's step one testing, the fair values of the B&N Retail, B&N College and NOOK reporting units...

-

Page 29

... in labor costs, possible increases in shipping rates or interruptions in shipping service, effects of competition, possible risks that inventory in channels of distribution may be larger than able to be sold, possible risks associated with reducing the extent of internal manufacturing and design of...

-

Page 30

...under the Microsoft commercial agreement, including with respect to the development of applications and international expansion, and the consequences thereof, the costs and disruptions arising out of any such separation of the NOOK digital and College businesses or other separation of Barnes & Noble...

-

Page 31

2013 Annual Report

29

C O NSOLIDATED STATEMEN TS OF OPE R ATI O N S

Fiscal 2013 (In thousands, except per share data) Sales Cost of sales and occupancy Gross proï¬t Selling and administrative expenses Depreciation and amortization Operating loss Interest expense, net and amortization of deferred...

-

Page 32

30

Barnes & Noble, Inc.

C O N SOLIDATED BAL AN CE SHEETS

April 27, 2013 (In thousands, except per share data)

ASSETS

April 28, 2012 Restated, Note 2

Current assets: Cash and cash equivalents Receivables, net Merchandise inventories, net Prepaid expenses and other current assets Total current ...

-

Page 33

... & Noble, Inc. Shareholders' Equity

ACCUMLATED OTHER NONCONTROLLING ADDITIONAL COMPREHENSIVE INTEREST COMMON STOCK PAID-IN CAPITAL GAINS (LOSSES) RETAINED TREASURY STOCK AT COST EARNINGS

(In thousands) Balance at May 1, 2010 as previously reported Revision to prior period ï¬nancial statements (see...

-

Page 34

... STATEMEN TS OF CHAN G E S I N S H A R E H O LD E R S ' E Q U I T Y

Barnes & Noble, Inc. Shareholders' Equity (In thousands) Balance at April 28, 2012 Net loss as restated, Note 2 Minimum pension liability, net of tax Reduction of junior note Deferred tax adjustment Exercise of 279 common stock...

-

Page 35

... from sale of distribution center Purchase of Borders Group, Inc. intellectual property Fictionwise earn-out payments Purchase of non-controlling interest Net cash ï¬,ows used in investing activities

CASH FLOWS FROM FINANCING ACTIVITIES:

Net proceeds from issuance of Preferred Membership interests...

-

Page 36

...

Receivables, net Merchandise inventories Prepaid expenses and other current assets Accounts payable and accrued liabilities Changes in operating assets and liabilities, net

SUPPLEMENTAL CASH FLOW INFORMATION:

Cash paid (received) during the period for: Interest paid Income taxes (net of refunds...

-

Page 37

... other digital content, textbooks and course-related materials, NOOK®4 and related accessories, bargain books, magazines, gifts, emblematic apparel and gifts, school and dorm supplies, café products and services, educational toys & games, music and movies direct to customers through its bookstores...

-

Page 38

...'s textbook and trade book inventories are valued using the LIFO method, where the related reserve was not material to the recorded amount of the Company's inventories or results of operations at April 27, 2013. NOOK merchandise inventories are recorded based on the average cost method. Market is...

-

Page 39

..., the Company used cash flows that reflected management's forecasts and discount rates that included risk adjustments consistent with the current market conditions. Based on the results of the Company's step one testing, the fair values of the B&N Retail, B&N College and NOOK reporting units as...

-

Page 40

... promotions via e-mail or direct mail for an annual fee of $25.00, which is non-refundable after the first 30 days. Revenue is recognized over the twelve-month period based upon historical spending patterns for Barnes & Noble Members.

Research and Development Costs for Software Products

The Company...

-

Page 41

2013 Annual Report

39

obligations, net of expected sublease recoveries. Costs associated with store closings of $5,006, $551 and $3,899 during fiscal 2013, fiscal 2012 and fiscal 2011, respectively, are included in selling and administrative expenses in the accompanying consolidated statements of ...

-

Page 42

40

Barnes & Noble, Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

The Company reclassified $47,026 from other long-term liabilities to accrued liabilities related to the current portion of deferred rent and tenant allowances on the April 28, 2012 balance sheet for comparative purposes ...

-

Page 43

2013 Annual Report

41

As of April 30, 2011 Balance Sheet Data: (In thousands, except per share data)

ASSETS

As Previously Reported

Corrections

Other Adjustments

Restated

Current assets: Cash and cash equivalents Receivables, net Merchandise inventories, net Prepaid expenses and other current ...

-

Page 44

42

Barnes & Noble, Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

As of April 28, 2012 Balance Sheet Data: (In thousands, except per share data)

ASSETS

As Previously Reported

Corrections

Other Adjustments

Restated

Current assets: Cash and cash equivalents Receivables, net ...

-

Page 45

... share Net income (loss) attributable to Barnes & Noble, Inc. $ (1.31) Fiscal 2012 Statement of Operations Data: (In thousands, except per share data) Sales Cost of sales and occupancy Gross proï¬t Selling and administrative expenses Depreciation and amortization Operating income (loss) Interest...

-

Page 46

... costs of $16,341 and new charges of $10,180 relating to the Company's 2011 Amended Credit Facility were deferred and are being amortized over the five-year term of the 2011 Amended Credit Facility. On April 27, 2012, the Company entered into an amendment the 2011 Amended Credit Agreement in order...

-

Page 47

... the fair market value of the restricted stock unit is determined based on the closing price of the Company's common stock on the grant date. The Company uses the Black-Scholes option-pricing model to value the Company's stock options for each stock option award. Using this option-pricing model, the...

-

Page 48

... WEIGHTED AVERAGE AVERAGE REMAINING EXERCISE CONTRACTUAL PRICE TERM

NUMBER OF SHARES (in thousands)

AGGREGATE INTRINSIC VALUE (in thousands)

Balance, May 1, 2010 Granted Vested Forfeited Balance, April 30, 2011 Granted Vested Forfeited Balance, April 28, 2012 Granted

2,330 684 (435) (154) 2,425...

-

Page 49

..., store closing expenses and long-term deferred revenues. The Company had the following long-term liabilities at April 27, 2013 and April 28, 2012:

April 27, 2013 Deferred rent Junior Seller Note (see Note 21) Microsoft Commercial Agreement ï¬nancing transaction (see Note 12) Tax liabilities...

-

Page 50

48

Barnes & Noble, Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

8.

N E T E A RN I N G S (LO S S ) P E R S H A R E

In accordance with ASC 260-10-45, Share-Based Payment Arrangements and Participating Securities and the TwoClass Method, the Company's unvested restricted shares, ...

-

Page 51

... 2012 and fiscal 2011, respectively. In addition, the Company provides certain health care and life insurance benefits (the Postretirement Plan) to retired employees, limited to those receiving benefits or retired as of April 1, 1993. Total Company contributions charged to employee benefit expenses...

-

Page 52

50

Barnes & Noble, Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

The tax effects of temporary differences that give rise to significant components of the Company's deferred tax assets and liabilities as of April 27, 2013 and April 28, 2012 are as follows:

April 27, 2013 Deferred tax ...

-

Page 53

..., would affect the Company's effective tax rate. A reconciliation of the beginning and ending amount of unrecognized tax benefits for fiscal 2013, fiscal 2012 and fiscal 2011 is as follows:

Balance at May 1, 2010 Additions for tax positions of the current period Additions for tax positions of prior...

-

Page 54

52

Barnes & Noble, Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

As of April 27, 2013 Amortizable intangible assets Useful Life Customer relationships Technology Distribution contracts Other Unamortizable intangible assets Trade name Publishing contracts Total amortizable and ...

-

Page 55

... commercial agreement, NOOK Media and Microsoft share in the revenues, net of certain items, from digital content purchased from NOOK Media by customers using the NOOK Media Windows 8 applications or through certain Microsoft products and services that may be developed in the future and are designed...

-

Page 56

54

Barnes & Noble, Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

of approximately $1,789,000 in exchange for preferred membership interests representing a 5% equity stake in NOOK Media. Following the closing of the transaction, the Company owns approximately 78.2% of the NOOK Media ...

-

Page 57

..., although some extend beyond ten years. Many contracts have a 90 to 120 day cancellation right by B&N College, or by the college or university, without penalty. The Company leases office space in New York, New York and Palo Alto, California for its NOOK operations. Rental expense under operating...

-

Page 58

...NOOK Study™. The 686 B&N College stores generally offer new, used, rental and digital textbooks, course-related materials, emblematic apparel and gifts, trade books, computer products, NOOK® products and related accessories, school and dorm supplies, and convenience and café items.

NOOK

Capital...

-

Page 59

... before taxes in the consolidated financial statements is as follows:

52 weeks 52 weeks 52 weeks ended ended ended April 27, 2013 April 28, 2012 April 30, 2011 Reportable segments operating loss Interest expense, net and amortization of deferred ï¬nancing costs Consolidated loss before taxes $ (220...

-

Page 60

... the District Court's judgment in favor of Barnes & Noble, Inc. and barnesandnoble.com llc.

On July 24, 2012, Technology Properties Limited, LLC, Phoenix Digital Solutions, LLC, and Patriot Scientific Corporation (collectively, TPL) submitted a complaint to the U.S. International Trade Commission...

-

Page 61

... Barnes & Noble, Inc., barnesandnoble.com LLC and Nook Media LLC in the United States District Court for the Southern District of New York alleging that various B&N Nook products and related online services infringe U.S. Patent 7,298,851, U.S. Patent 7,299,501, and U.S. Patent 7,620,703. The current...

-

Page 62

...Barnes & Noble, Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

It alleges violations of California Civil Code section 1747.08 (the Song-Beverly Credit Card Act of 1971) due to the Company's alleged improper requesting and recording of zip codes from California customers who used credit...

-

Page 63

...the Company's Vice Chairman and Chief Executive Officer) and other members of the Riggio family. MBS is a new and used textbook wholesaler, which also sells textbooks online and provides bookstore systems

and distant learning distribution services. Pursuant to the Supply Agreement, which has a term...

-

Page 64

... interest and expires in 2016. The space was rented at an aggregate annual rent including real estate taxes of approximately $5,098, $4,843 and $4,868 during fiscal 2013, fiscal 2012 and fiscal 2011, respectively. The Company leases one of its B&N College stores from a partnership owned by Leonard...

-

Page 65

... for the NOOK developer program whereby Sirius applications were made available for consumer download on NOOK® devices. Total commissions received from Sirius during fiscal 2013 were $0. In fiscal 2012, the Company entered into agreements with third parties who sell Barnes & Noble products through...

-

Page 66

... the closing price of the Company's common stock on July 8, 2013 of $17.66. Additionally, on July 8, 2013, the Company announced the promotion of Chief Financial Officer Michael P. Huseby to Chief Executive Officer of NOOK Media LLC and President of the Company; Vice President, Corporate Controller...

-

Page 67

... ended April 28, 2012. See Note 2 for further information regarding these adjustments.

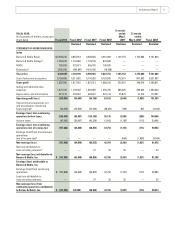

13 weeks ended July 28, 2012 Statement of Operations Data: (In thousands, except per share data) Sales Cost of sales and occupancy Gross proï¬t Selling and administrative expenses Depreciation and amortization...

-

Page 68

66

Barnes & Noble, Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

13 weeks ended October 27, 2012 Statement of Operations Data: (In thousands, except per share data) Sales Cost of sales and occupancy Gross proï¬t Selling and administrative expenses Depreciation and amortization ...

-

Page 69

2013 Annual Report

67

13 weeks ended July 30, 2011 Statement of Operation Data: (In thousands, except per share data) Sales Cost of sales and occupancy Gross proï¬t Selling and administrative expenses Depreciation and amortization Operating income (loss) Interest expense, net and amortization of ...

-

Page 70

68

Barnes & Noble, Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

13 weeks ended January 28, 2012 Statement of Operations Data: (In thousands, except per share data) Sales Cost of sales and occupancy Gross proï¬t Selling and administrative expenses Depreciation and amortization ...

-

Page 71

2013 Annual Report

69

As of July 28, 2012 Balance Sheet Data: (In thousands, except per share data)

ASSETS

As Previously Reported

Corrections

Other Adjustments

Restated

Current assets: Cash and cash equivalents Receivables, net Merchandise inventories, net Prepaid expenses and other current ...

-

Page 72

70

Barnes & Noble, Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

As of October 27, 2012 Balance Sheet Data: (In thousands, except per share data)

ASSETS

As Previously Reported

Corrections

Other Adjustments

Restated

Current assets: Cash and cash equivalents Receivables, net ...

-

Page 73

...: Accounts payable Accrued liabilities Gift card liabilities Total current liabilities Long-term debt Deferred taxes Other long-term liabilities Redeemable Preferred Shares; $.001 par value; 5,000 shares authorized; 204 shares issued Preferred Membership Interests in NOOK Media, LLC Shareholders...

-

Page 74

72

Barnes & Noble, Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

As of July 30, 2011 Balance Sheet Data: (In thousands, except per share data)

ASSETS

As Previously Reported

Corrections

Other Adjustments

Restated

Current assets: Cash and cash equivalents Receivables, net ...

-

Page 75

2013 Annual Report

73

As of October 29, 2011 Balance Sheet Data: (In thousands, except per share data)

ASSETS

As Previously Reported

Corrections

Other Adjustments

Restated

Current assets: Cash and cash equivalents Receivables, net Merchandise inventories, net Prepaid expenses and other ...

-

Page 76

74

Barnes & Noble, Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

As of January 28, 2012 Balance Sheet Data: (In thousands, except per share data)

ASSETS

As Previously Reported

Corrections

Other Adjustments

Restated

Current assets: Cash and cash equivalents Receivables, net ...

-

Page 77

... consolidated balance sheet of Barnes & Noble, Inc.(the "Company") as of April 27, 2013 and the related consolidated statements of operations, comprehensive income (loss), changes in shareholders' equity and cash flows for the year then ended. Our audit also includes the financial statement schedule...

-

Page 78

... in controls related to the Company's review and reconciliation of distribution center accruals. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheet of Barnes & Noble, Inc. as of April 27, 2013, and...

-

Page 79

... M

Board of Directors and Stockholders Barnes & Noble, Inc. New York, New York We have audited the accompanying consolidated balance sheet of Barnes & Noble, Inc., as of April 28, 2012 and the related consolidated statements of operations, comprehensive income (loss), changes in shareholders' equity...

-

Page 80

... employed to regularly test and evaluate both internal accounting controls and operating procedures, including compliance with the Company's statement of policy regarding ethical and lawful conduct. The Audit Committee of the Board of Directors composed of directors who are not members of management...

-

Page 81

... Campbell Jr.

President and Chief Executive Officer, Barnes & Noble College Booksellers

Michael P. Huseby

President Emeritus The Cooper Union

Mark D. Carleton

Chief Financial Officer

Mary Ellen Keating

The Company's common stock is traded on the New York Stock Exchange (NYSE) under the symbol...

-

Page 82

...and other financial information, free of charge, on the "For Investors" section of the Company's Corporate Website: www.barnesandnobleinc.com.

All other inquiries should be directed to:

$100

$50

$0

2/2/2008 1/31/2009

5/2/2009

5/1/2010 4/30/2011 4/28/2012 4/27/2013

Barnes & Noble, Inc.

S&P 500...

-

Page 83

...Study Guide, 2nd Edition

E L James Knopf Doubleday

Fifty Shades Freed

Suzanne Collins Scholastic

Mockingjay

J.K. Rowling Little, Brown

A Dance with Dragons

George R.R. Martin Random House

A Memory of Light

Bill O'Reilly and Martin Dugard Henry Holt

StrengthsFinder 2.0

The College Board College...

-

Page 84

82

Barnes & Noble, Inc.

AWA R D W I N N E R S

TOP 1 0 N O O K BOOKS Fifty Shades of Grey S LE E P E R S To Heaven and Back T HE PUL ITZER P R IZE The Orphan Master's Son THE N ATION AL BOOK CRITICS CIRCL E AWARDS Billy Lynn's Long Halftime Walk THE CAL DECOTT MEDAL This Is Not My Hat

E L James ...

-

Page 85

[THIS PAGE INTENTIONALLY LEFT BLANK]

-

Page 86

[THIS PAGE INTENTIONALLY LEFT BLANK]

-

Page 87

-

Page 88