Barnes and Noble 2010 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2010 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

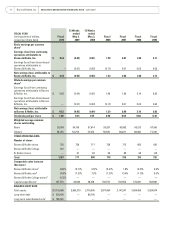

Income Taxes

52 weeks ended

Dollars in thousands

May 1,

2010

Effective

Rate

January 31,

2009

Effective

Rate

Income Taxes $ 8,365 18.6% $ 55,591 39.4%

Income taxes were $8.4 million in fiscal 2010 compared

with $55.6 million in fiscal 2008. The Company’s effective

tax rate in fiscal 2010 decreased to 18.6% compared with

39.4% during fiscal 2008. The decrease in the effective

tax rate was due primarily to the recognition of previ-

ously unrecognized tax benefits for years settled with the

applicable tax authorities. This benefit was partially offset

by additional accruals for subsequent years’ unrecognized

tax benefits.

Loss from Discontinued Operations

On February 25, 2009, the Company sold its interest in

Calendar Club to Calendar Club and its chief executive offi-

cer for $7.0 million, which was comprised of $1.0 million in

cash and $6.0 million in notes. Calendar Club is no longer

a subsidiary of the Company and the results of Calendar

Club have been classified as discontinued operations in all

periods presented. Accordingly, the Company reported a

$9.5 million loss from discontinued operations for the 52

weeks ended January 31, 2009.

Net Loss Attributable to Noncontrolling Interests

Net loss attributable to noncontrolling interests was $0.03

million during fiscal 2010 and fiscal 2008, and relates to

the 50% outside interest in Begin Smart LLC.

Net Earnings Attributable to Barnes & Noble, Inc.

52 weeks ended

Dollars in thousands

May 1,

2010

Diluted

EPS

January 31,

2009

Diluted

EPS

Net Earnings

Attributable to

Barnes & Noble, Inc. $ 36,676 $ 0.63 $ 75,920 $ 1.29

As a result of the factors discussed above, the Company

reported consolidated net earnings of $36.7 million (or

$0.63 per diluted share) during fiscal 2010, compared with

consolidated net earnings of $75.9 million (or $1.29 per

diluted share) during fiscal 2008.

13 WEEKS ENDED MAY 2, 2009 COMPARED WITH

13 WEEKS ENDED MAY 3, 2008

Sales

The following table summarizes the Company’s sales for the

13 weeks ended May 2, 2009 and May 3, 2008:

13 weeks ended

Dollars in thousands

May 2,

2009 % Total

May 3,

2008 % Total

B&N Retail Segment

B&N Stores $ 989,149 89.5% $ 1,024,667 88.6%

B&N.com 93,075 8.4% 100,254 8.7%

Other 22,928 2.1% 30,961 2.7%

Total Sales $ 1,105,152 100.0% $ 1,155,882 100.0%

During the 13 weeks ended May 2, 2009, the Company’s

sales decreased $50.7 million, or 4.4%, to $1.11 billion

from $1.16 billion during the 13 weeks ended May 3, 2008.

This decrease was primarily attributable to the following:

tBarnes & Noble store sales for the 13 weeks ended May

2, 2009 decreased $35.5 million, or 3.5%, to $989.1

million from $1.02 billion during the 13 weeks ended

May 3, 2008, and accounted for 89.5% of total Company

sales. The 3.5% decrease in Barnes & Noble store sales

was primarily attributable to a 4.9% decrease in transac-

tion volume driven by a decline in traffic stemming from

general economic conditions, which resulted in a 5.7%

decrease in comparable store sales or $54.6 million, and

closed stores that decreased sales by $23.4 million, offset

by new Barnes & Noble store sales of $42.2 million.

The 5.7% decrease in comparable store sales was also

attributable to the decrease in comparable music and

audio department sales caused by industry trends toward

electronic downloads.

tBarnes & Noble.com sales decreased $7.2 million, or

7.2%, to $93.1 million during the 13 weeks ended May

2, 2009 from $100.3 million during the 13 weeks ended

May 3, 2008. This decrease was primarily due to lower

conversion ratio, which measures the ratio of online

orders to visits. The decrease was also due to lower aver-

age online order values.

tOther includes B. Dalton sales. B. Dalton sales decreased

$5.3 million, or 32.7%, to $10.8 million during the 13

weeks ended May 2, 2009 from $16.1 million during the

13 weeks ended May 3, 2008. This decrease was primarily

attributable to the closing of 32 B. Dalton stores over the

prior 12 months.

16 Barnes & Noble, Inc. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS continued