Barnes and Noble 2010 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2010 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cost of sales and occupancy increased $593.2 million, or

16.8%, to $4.13 billion in fiscal 2010 from $3.54 billion

in fiscal 2008. Cost of sales and occupancy increased as

a percentage of sales to 71.1% in fiscal 2010 from 69.1%

during fiscal 2008. B&N Retail Segment cost of sales and

occupancy increased as a percentage of sales to 69.9% from

69.1% during the 52 weeks ended May 1, 2010 and January

31, 2009, respectively. This increase was primarily attribut-

able to higher online sales due to the promotional launch

of EDLP, NOOK™ and eBook sales, offset by reductions

in returns to suppliers due to tighter inventory purchas-

ing controls and reductions in the Company’s distribution

center average cost per unit processed, as well as lower

freight costs in general.

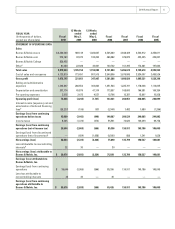

Selling and Administrative Expenses

52 weeks ended

Dollars in thousands

May 1,

2010 % Sales

January

31, 2009 % Sales

B&N Retail Segment $ 1,240,039 24.9% $ 1,251,524 24.4%

B&N College Segment 152,168 18.2% — 0.0%

Total Selling and

Administrative Expenses $ 1,392,207 24.0% $ 1,251,524 24.4%

Selling and administrative expenses increased $140.7

million, or 11.2%, to $1.39 billion in fiscal 2010 from $1.25

billion in fiscal 2008. Selling and administrative expenses

decreased as a percentage of sales to 24.0% in fiscal 2010

from 24.4% during fiscal 2008. B&N Retail Segment selling

and administrative expenses increased as a percentage of

sales to 24.9% during the 52 weeks ended May 1, 2010 from

24.4% during the 52 weeks ended January 31, 2009. This

increase was primarily due to $10.4 million of Acquisition-

related costs, increased resources into the Company’s

digital strategies and the deleveraging of fixed expenses

with the negative comparable store sales, offset by a $6.7

million benefit related to an insurance settlement.

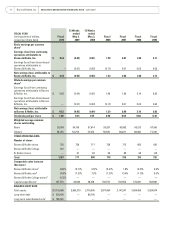

Depreciation and Amortization

52 weeks ended

Dollars in thousands

May 1,

2010 % Sales

January

31, 2009 % Sales

B&N Retail Segment $ 182,911 3.7% $ 173,557 3.4%

B&N College Segment 24,863 3.0% — 0.0%

Total Depreciation and

Amortization $ 207,774 3.6% $ 173,557 3.4%

Depreciation and amortization increased $34.2 million,

or 19.7%, to $207.8 million in fiscal 2010, from $173.6

million in fiscal 2008. During the 52 weeks ended May 1,

2010, B&N Retail Segment depreciation and amortization

increased $9.4 million, or 5.4%, to $182.9 million from

$173.6 million during the 52 weeks ended January 31,

2009. This increase was primarily due to the shift in capital

expenditures from new store openings to existing store

maintenance and technology investments that have shorter

economic lives.

Pre-opening Expenses

52 weeks ended

Dollars in thousands

May 1,

2010 % Sales

January

31, 2009 % Sales

B&N Retail Segment $ 3,461 0.1% $ 12,796 0.2%

B&N College Segment 57 0.0% — 0.0%

Total Pre-opening Expenses $ 3,518 0.1% $ 12,796 0.2%

Pre-opening expenses decreased $9.3 million, or 72.5%,

in fiscal 2010 to $3.5 million from $12.8 million in fiscal

2008. This decrease was primarily the result of the lower

volume of Barnes & Noble new store openings.

Operating Profit

52 weeks ended

Dollars in thousands

May 1,

2010 % Sales

January

31, 2009 % Sales

B&N Retail Segment $ 73,170 1.5% $ 143,331 2.8%

B&N College Segment 76 0.0% — 0.0%

Total Operating Profit $ 73,246 1.3% $ 143,331 2.8%

The Company’s consolidated operating profit decreased

$70.1 million, or 48.9%, to $73.2 million in fiscal 2010

from $143.3 million in fiscal 2008. This decrease in

operating profit was primarily due to the matters discussed

above.

Interest Expense, Net and Amortization of Deferred

Financing Fees

52 weeks ended

Dollars in thousands

May 1,

2010

January 31,

2009

% of

Change

Interest Expense, Net and

Amortization of Deferred

Financing Fees $ 28,237 $ 2,344 1,104.7%

Net interest expense and amortization of deferred financ-

ing fees increased $25.9 million, or 1,104.7%, to $28.2

million in fiscal 2010 from $2.3 million in fiscal 2008. This

increase in interest expense was primarily due to the inter-

est expense related to the notes issued in connection with

the Acquisition of B&N College.

2010 Annual Report 15