Barnes and Noble 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Barnes & Noble

Annual Report 2010

Table of contents

-

Page 1

Barnes & Noble Annual Report 2010 -

Page 2

by Barnes & Noble "Best New Gadget of 2009." - TechCrunch Crunchies Award In stock now at Barnes & Noble stores and at NOOK.COM -

Page 3

... Annual Report 1 C O N TEN TS 2 Barnes & Noble 2010 Letter to Shareholders 4 Selected Consolidated Financial Data 8 Management's Discussion and Analysis of Financial Condition and Results of Operations 28 29 30 32 34 65 67 68 71 72 Consolidated Statements of Operations Consolidated Balance Sheet... -

Page 4

... eBook Reader on the market, which quickly gained acclaim and awards. We also opened the doors to our virtual BN eBookstore, a vast digital offering of more than one million titles, and we created free, easy to use NOOK eReader software, which enables customers to enjoy their Barnes & Noble eBooks... -

Page 5

... for book lovers. And, we will continue to drive traffic to our stores through our digital programs and promotions, which are giving our customers another reason to shop with us. Another important milestone for 2009 was the acquisition of the Barnes & Noble College bookstore business. Bringing... -

Page 6

... should be read in conjunction with the consolidated ï¬nancial statements and notes included elsewhere in this report. On September 29, 2009, the Board of Directors of Barnes & Noble, Inc. authorized a change in the Company's ï¬scal year end from the Saturday closest to the last day of January to... -

Page 7

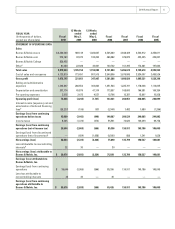

...Annual Report 5 FISCAL YEAR (In thousands of dollars, except per share data) STATEMENT OF OPERATIONS DATA Fiscal 2010 13 Weeks ended May 2, 2009 13 Weeks ended May 3, 2008 Fiscal 2008 Fiscal 2007 Fiscal 2006 Fiscal 2005 Sales Barnes & Noble stores Barnes & Noble.com Barnes & Noble College... -

Page 8

... 65,212 68,388 67,560 71,336 Number of stores Barnes & Noble stores Barnes & Noble College B. Dalton stores Total Comparable sales increase (decrease) Barnes & Noble storesf Barnes & Noble.comg Barnes & Noble College storesh Capital expendituresi BALANCE SHEET DATA 720 637 - 1,357 726 - 51 777... -

Page 9

2010 Annual Report 7 a Includes primarily third-party sales of Sterling Publishing Co., Inc., a wholly-owned subsidiary of the Company, and B. Dalton store sales. b Amounts for ï¬scal 2010, the transition period, the 13 weeks ended May 3, 2008, ï¬scal 2008, 2007, 2006 and 2005 are net of ... -

Page 10

...titles, mass market paperbacks (such as mystery, romance, science ï¬ction and other popular ï¬ction), children's books, eBooks and other digital content, eReaders and related accessories, bargain books, magazines, gifts, café products and services, music and movies direct to customers through its... -

Page 11

...which offers direct home delivery of millions of books, music CDs, DVDs/BluRay discs and other related items, which include complementary categories such as toys, games, electronics and gift items. Barnes & Noble stores range in size from 3,000 to 60,000 square feet depending upon market size, with... -

Page 12

...-party websites with comparable reach. In this way, Barnes & Noble.com serves as both the Company's direct-to-home delivery service and as an important broadcast channel and advertising medium for the Barnes & Noble brand. For example, the online store locator at Barnes & Noble.com receives millions... -

Page 13

...management service agreements under which a school designates B&N College to operate the official school bookstore on campus and B&N College provides the school with regular payments that typically represent a percentage of store sales with a minimum ï¬xed guarantee. B&N College's business strategy... -

Page 14

... sales from stores that have been open for at least 15 months and does not include closed or relocated stores. d Represents the number of B&N College stores opened and closed since the Acquisition date. e Includes the four B. Dalton stores converted to B&N Bookseller stores at February 1, 2010... -

Page 15

... major competitive asset. The Company plans to integrate its traditional retail, trade book and college bookstores businesses with its electronic and internet offerings, using retail stores in attractive geographic markets to promote and sell digital devices and content. Customers can see, feel and... -

Page 16

... the 52 weeks ended May 2, 2009, which contributed to lower transaction volumes, as well as decreases in comparable music and audio department sales caused by industry trends toward electronic downloads, offset by sales of NOOK™ at Barnes & Noble stores. t Barnes & Noble.com sales increased $106... -

Page 17

... resources into the Company's digital strategies and the deleveraging of ï¬xed expenses with the negative comparable store sales, offset by a $6.7 million beneï¬t related to an insurance settlement. Depreciation and Amortization 52 weeks ended Dollars in thousands B&N Retail Segment B&N College... -

Page 18

... decrease in comparable store sales was also attributable to the decrease in comparable music and audio department sales caused by industry trends toward electronic downloads. t Barnes & Noble.com sales decreased $7.2 million, or 7.2%, to $93.1 million during the 13 weeks ended May 2, 2009 from $100... -

Page 19

2010 Annual Report 17 During the 13 weeks ended May 2, 2009, the Company opened six Barnes & Noble stores and closed six, bringing its total number of Barnes & Noble stores to 726 with 18.8 million square feet. The Company closed one B. Dalton store, ending the period with 51 B. Dalton stores and ... -

Page 20

....3 million, offset by new Barnes & Noble store sales of $208.5 million. The 5.4% decrease in comparable store sales was also due to a decrease in comparable music and audio department sales caused by industry trends toward electronic downloads. t Barnes & Noble.com sales decreased $10.8 million, or... -

Page 21

... use taxes on sales made by Barnes & Noble.com from 1999 to 2005, $4.1 million of severance related to the elimination of certain corporate office expenses and a $3.0 million charge related to a management resignation. Included in selling and administrative expenses in ï¬scal 2007 were legal costs... -

Page 22

... portion of sales and operating proï¬t realized during the second and third ï¬scal quarters, when college students generally purchase textbooks for the upcoming semesters. L IQUIDITY AN D CAPITAL RESOURCES On February 25, 2009, the Company sold its interest in Calendar Club to Calendar Club and... -

Page 23

... emphasis on working capital management strengthened the Company's balance sheet in ï¬scal 2010. On September 30, 2009, in connection with the closing of the Acquisition described in Note 4 to the Consolidated Financial Statements contained herein, the Company issued the Sellers (i) a senior... -

Page 24

...- and longterm strategies for at least the next 12 months. However, the Company may determine to raise additional capital to support the growth of online and digital businesses. On May 15, 2007, the Company announced that its Board of Directors authorized a stock repurchase program for the purchase... -

Page 25

.... As of May 1, 2010, May 2, 2009 and January 31, 2009, 87%, 100% and 100%, respectively, of the Company's inventory on the retail inventory method was valued under the FIFO basis. B&N College's textbook and trade book inventories are valued using the LIFO method, where the related reserve was not... -

Page 26

24 Barnes & Noble, Inc. MANAGEMENT 'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPER ATIONS continued Market is determined based on the estimated net realizable value, which is generally the selling price. Reserves for non-returnable inventory are based on the Company's ... -

Page 27

... cash ï¬,ows would have no impact on the Company's results of operations. The Company sells gift cards which can be used in its stores or on Barnes & Noble.com. The Company does not charge administrative or dormancy fees on gift cards, and gift cards have no expiration dates. Upon the purchase of... -

Page 28

26 Barnes & Noble, Inc. MANAGEMENT 'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPER ATIONS continued Recent Accounting Pronouncements In June 2009, the FASB issued ASC 105-10, The FASB Accounting Standards Codiï¬cation and the Hierarchy of Generally Accepted Accounting ... -

Page 29

...and information currently available to the management of the Company. When used in this report, the words "anticipate," "believe," "estimate," "expect," "intend," "plan" and similar expressions, as they relate to the Company or the management of the Company, identify forward-looking statements. Such... -

Page 30

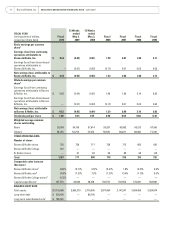

28 Barnes & Noble, Inc. C O N SOLIDATED STATEMEN TS OF OPERAT I O N S (In thousands, except per share data) Sales Cost of sales and occupancy Gross proï¬t Selling and administrative expenses Depreciation and amortization Pre-opening expenses Operating proï¬t (loss) Interest income (expense), ... -

Page 31

2010 Annual Report 29 C O NSOLIDATE D BALAN CE SHEET (In thousands, except per share data) ASSETS MAY 1, 2010 MAY 2, 2009 JANUARY 31, 2009 Current assets Cash and cash equivalents Receivables, net Merchandise inventories Prepaid expenses and other current assets Current assets of discontinued ... -

Page 32

...488 common stock options Stock options and restricted stock tax beneï¬ts Stock-based compensation expense Begin Smart LLC Acquisition (See Note 16) Cash dividend paid to stockholders Treasury stock acquired, 6,604 shares Balance at January 31, 2009 - - - - - - 1,642 - - 1,612 - - - 1 - - - - - 88... -

Page 33

2010 Annual Report 31 C O NSOLIDATE D STATEMEN TS OF CHA N G E S I N S H A R E H O LD E R S ' E Q U I T Y Barnes & Noble, Inc. Shareholders' Equity ACCUMLATED ADDITIONAL OTHER PAID-IN COMPREHENSIVE CAPITAL LOSSES TREASURY STOCK AT COST (In thousands) Balance at January 31, 2009 COMPREHENSIVE ... -

Page 34

...facility Proceeds from exercise of common stock options Excess (reversal) tax beneï¬t from stock-based compensation Purchase of treasury stock Cash dividends paid to shareholders Financing fees paid related to debt used to acquire Barnes & Noble College Booksellers, Inc. Net cash ï¬,ows provided by... -

Page 35

...501 2,772 15,729 6,000 - 1,812 50,383 - - - - - (8,251) 60,716 - - - - - $ 1,416,134 1,227,945 $ 188,189 $ - Note receivable on sale of Calendar Club Notes payable on acquisition of Barnes & Noble College Booksellers, Inc. $ 250,000 See accompanying notes to consolidated ï¬nancial statements. -

Page 36

...mass market paperbacks (such as mystery, romance, science ï¬ction and other popular ï¬ction), children's books, eBooks and other digital content, eReaders and related 2 Based upon sales reported in trade publications and public ï¬lings. The consolidated ï¬nancial statements include the accounts... -

Page 37

...'s textbook and trade book inventories are valued using the LIFO method, where the related reserve was not material to the recorded amount of the Company's inventories or results of operations. Market is determined based on the estimated net realizable value, which is generally the selling price... -

Page 38

.... Advertising costs charged to selling and administrative expenses were $33,304, $5,478, $28,772 and $27,158 during ï¬scal 2010, the transition period, ï¬scal 2008 and 2007, respectively. The Company receives payments and credits from vendors pursuant to co-operative advertising and other programs... -

Page 39

...nancial statement and tax bases of assets and liabilities. The deferred tax assets and liabilities are measured using the enacted tax rates and laws that are expected to be in effect The Company sells gift cards which can be used in its stores or on Barnes & Noble.com. The Company does not charge... -

Page 40

... Barnes & Noble, Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued differ from the amounts recorded. Through ï¬scal 2010, the Company also sold online gift certiï¬cates for use solely on Barnes & Noble.com, which were treated the same way as gift cards. The Company recognized gift card... -

Page 41

...November 1, 2009. See Note 1 for the Company's revenue recognition policy. Retrospective application does not apply to the Company because the initial sales of products that contain multiple elements were sold in the ï¬scal quarter of adoption. In January 2010, the FASB issued ASU No. 2010-06, Fair... -

Page 42

40 Barnes & Noble, Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued 2. TRA N SI T I O N PE R IO D On September 30, 2009, the Company's ï¬scal year end changed from the Saturday closest to the last day of January to the Saturday closest to the last day of April. Accordingly, the Company... -

Page 43

...ï¬xed charge coverage ratio. Proceeds from the Prior Credit Facility were used for general corporate purposes, including seasonal working capital needs. Selected information related to the Company's Credit Facility and Prior Credit Facility: 13 Weeks Ended May 2, 2009 - Fiscal 2010 Credit facility... -

Page 44

42 Barnes & Noble, Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued As a result of the Acquisition, the Company expects to capitalize on the revenue stream derived from the sale of textbooks and course-related materials, emblematic apparel and gifts, trade books, school and dorm supplies... -

Page 45

...certain compensation arrangements, termination of textbook royalties, non-operating expenses not acquired in the Acquisition, interest expense and income tax expense: 52 weeks ended May 1, 2010 Sales Net income (loss) from continuing operations attributable to Barnes & Noble, Inc. Income (loss) from... -

Page 46

... performance and technology related targets through 2011. The acquisition provided a core component to the Company's overall digital strategy, enabling the launch of one of the world's largest eBookstores on July 20, 2009. The eBookstore on Barnes & Noble.com enables customers to buy eBooks and read... -

Page 47

2010 Annual Report 45 7. ST O CK- B A SE D C O M P E N S AT IO N The Company maintains three share-based incentive plans: the 1996 Incentive Plan, the 2004 Incentive Plan and the 2009 Incentive Plan. Prior to June 2, 2009, the Company issued restricted stock and stock options under the 1996 and ... -

Page 48

... by the number of options exercised) was $2,321, $1,094, $3,997 and $43,649, respectively. As of May 1, 2010, there was $2,781 of total unrecognized compensation expense related to unvested stock options granted under the Company's share-based compensation plans. That expense is expected to be... -

Page 49

...IN STRUMEN TS Receivables represent customer, private and public institutional and government billings, credit/debit card, advertising, landlord and other receivables due within one year as follows: May 1, 2010 Credit/debit card receivablesa Trade accounts Advertising Receivables from landlords for... -

Page 50

... reï¬,ect current rates. The Company believes that the terms and conditions of the Seller Notes are consistent with comparable market debt issues. In accordance with ASC 260-10-45, Determining Whether Instruments Granted in Share-Based Payment Transactions Are Participating Securities, the Company... -

Page 51

2010 Annual Report 49 The following is a reconciliation of the Company's basic and diluted earnings per share calculation: Fiscal 2010 Numerator for basic earnings per share Income (loss) from continuing operations attributable to Barnes & Noble, Inc. Less allocation of earnings and dividends to ... -

Page 52

..., and the Pension Plan will continue to hold assets and pay beneï¬ts. The actuarial assumptions used to calculate pension costs are reviewed annually. Pension expense was $1,951, $752, $1,301 and $576 for ï¬scal 2010, the transition The Company ï¬les a consolidated federal return with all... -

Page 53

...accruals Stock-based compensation Insurance liability Pension Inventory Investments in equity securities Total deferred tax assets Net deferred tax liabilities Balance Sheet caption reported in: Prepaid expenses and other current assets Deferred tax liabilities Net deferred tax liabilities $ 108,491... -

Page 54

... gain, net of tax Foreign currency translation adjustments Balance at January 31, 2009 Sale of Calendar Club (See Note 17) Balance at May 2, 2009 Net actuarial loss, net of tax Amortization of net actuarial gain, net of tax Prior service credit Balance at May 1, 2010 2,488 2,488 - - - $ 2,488... -

Page 55

... as it is realized on the Company's income tax return. 16. N ON CON TROL L IN G IN TEREST Sterling Publishing has entered into a joint venture in Begin Smart LLC, acquiring a 50% interest to develop, sell, and distribute books for infants, toddlers, and children under the brand name BEGIN SMART... -

Page 56

... Rights Agreement) with Mellon Investor Services LLC, as Rights Agent. The Rights will be exercisable upon the earlier of (i) such date the Company learns that a person or group, without Board approval, acquires or obtains the right to acquire beneï¬cial ownership of 20% or more of Barnes & Noble... -

Page 57

... expense over actual lease payments (net of tenant allowances) is reï¬,ected primarily in other long-term liabilities in the accompanying balance sheets. On June 26, 2008, the Company exercised its purchase option under a lease on one of its distribution facilities located in South Brunswick, New... -

Page 58

...music department, a magazine section and a calendar of ongoing events, including author appearances and children's activities. In addition, this segment includes Barnes & Noble.com (an online retailer of eBooks, books, music, DVDs/videos and other items), the Company's publishing operation, Sterling... -

Page 59

...of the settlement overturned, the Company intends to vigorously defend this lawsuit. Hostetter v. Barnes & Noble Booksellers, Inc. et al. The class action lawsuit In re Initial Public Offering Securities Litigation ï¬led in the United States District Court for the Southern District of New York in... -

Page 60

... against the Company's directors. The complaints generally allege breach of ï¬duciary duty, waste of corporate assets and unjust enrichment in connection with the Company's entry into a deï¬nitive agreement to purchase Barnes & Noble College Booksellers, which was announced on August 10, 2009 (the... -

Page 61

...to a Stock Purchase Agreement dated as of August 7, 2009 among the Company and the Sellers. As part of the Acquisition, the Company acquired the Barnes & Noble trade name that had been owned by B&N College and licensed to the Company (described below). The purchase price paid to the Sellers was $596... -

Page 62

....com, Barnes & Noble.com was granted the right to sell college textbooks over the Internet using the "Barnes & Noble" name. Pursuant to the Textbook License Agreement, Barnes & Noble.com paid Textbooks.com a royalty on revenues (net of product returns, applicable sales tax and excluding shipping and... -

Page 63

2010 Annual Report 61 Barnes & Noble.com from the sale of books designated as textbooks. Royalty expense was $3,431, $973, $5,814, and $4,864 during ï¬scal 2010 prior to Acquisition, the transition period, ï¬scal 2008 and 2007, respectively, under the terms of the Textbook License Agreement. ... -

Page 64

... 2010, the transition period, ï¬scal 2008 and 2007, respectively. At the time of the agreement, the cost of freight delivered to the stores by Argix was comparable to the prices charged by publishers and the Company's other third party freight distributors. However, due to higher contracted fuel... -

Page 65

2010 Annual Report 63 24. SE L E CT E D Q UA R T E R LY FIN A NC IA L IN FO R MATION (UN AUDITED) A summary of quarterly ï¬nancial information for ï¬scal 2010 and ï¬scal 2008 is as follows: Fiscal 2010 Quarter Ended On or About Sales Gross proï¬t Earnings (loss) from continuing operations ... -

Page 66

... Barnes & Noble, Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued Fiscal 2008 Quarter Ended On or About Sales Gross proï¬t Earnings (loss) from continuing operations attributable to Barnes & Noble, Inc. Loss from discontinued operations Net earnings (loss) attributable to Barnes & Noble... -

Page 67

... statements and prospectively adopted ASC Topic 805 as it relates to business combinations. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), Barnes & Noble, Inc.'s internal control over ï¬nancial reporting as of May 1, 2010... -

Page 68

... internal controls of Barnes & Noble College Booksellers, LLC, which was acquired on September 30, 2009, and which is included in the consolidated balance sheet of Barnes & Noble, Inc. as of May 1, 2010 and the related consolidated statements of operations, changes in shareholders' equity and cash... -

Page 69

... include amounts based on judgments and estimates. Financial information elsewhere in the Annual Report is consistent with that in the Consolidated Financial Statements. The Company maintains a comprehensive accounting system which includes controls designed to provide reasonable assurance as to the... -

Page 70

...Del Giudice Chief Executive O6cer - Barnes & Noble Retail Group Joseph J. Lombardi Chief Financial O6cer Mary Ellen Keating Senior Managing Director Millennium Capital Markets LLC William Dillard, II Senior Vice President of Corporate Communications and Public Affairs Mark Bottini Chairman and... -

Page 71

2010 Annual Report 69 P R I CE RA N G E O F C O M M O N S T O C K A ND D IV IDEN D IN F ORMATION The Company's common stock is traded on the New York Stock Exchange (NYSE) under the symbol BKS. The following table sets forth, for the quarterly periods indicated, the high and low sales prices of ... -

Page 72

... Jersey City, NJ 07310-1900 Stockholder Inquiries: (800) 524-4458 Website: www.bnymellon.com/shareowner/isd Counsel: Cravath, Swaine & Moore LLP, New York, New York Independent Public Accountants: Investor Relations Department, Barnes & Noble, Inc. 122 Fifth Avenue, New York, New York 10011 Phone... -

Page 73

... Beer in Hell Nicholas Sparks Grand Central Publishing 290,547 The Lovely Bones Stephenie Meyer Little, Brown & Company 274,381 Eclipse Charlaine Harris Ace Hardcover 125,309 South of Broad Tom Rath Gallup Press 130,441 Act Like a Lady, Think Like a Man Alice Sebold Back Bay Books 237,520 My... -

Page 74

... Jerry Pinkney Little, Brown & Company N EW BERY MEDAL When You Reach Me Spencer Quinn Atria 44,429 Prayers for Sale Sandra Dallas St. Martin's Press 38,681 House of Cards Diana Athill W.W. Norton & Company Autobiography Notes from No Man's Land Rebecca Stead Wendy Lamb Books William D. Cohan... -

Page 75

by Barnes & Noble "Best of the Best. " - G4, 2010 Consumer Electronics Show Shop over 1 million titles t Newspapers and magazines Free 3G wireless t Holds 1,500 eBooks t Exclusive LendMeâ„¢ technology See for yourself at our stores nationwide and NOOK.COM N ow at Be st Bu y -

Page 76

... time I ran away from home. In college, I got caught up in a love triangle. And then I discovered what true love really is. Announcer (Voice Over): Experience the only eBook reader from the bookstore you've grown up with. NOOK by Barnes & Noble. Browse and download... ...over a million titles...