Barnes and Noble 2007 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2007 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Contractual Obligations

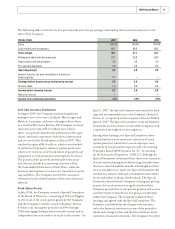

The following table sets forth the Company’s contractual obligations as of February 2, 2008 (in millions):

CONTRACTUAL OBLIGATIONS PAYMENTS DUE BY PERIOD

Total

Less Than

1 Year 1-3 Years 3-5 Years

More Than

5 Years

Long-term debt $ — $ — $ — $ — $ —

Capital lease obligations —————

Operating leases 2,092.6 360.8 641.7 456.9 633.2

Purchase obligations 60.1 36.0 20.7 3.4 —

Other long-term liabilities refl

ected on the

registrant’s balance sheet under GAAPa—————

Total $ 2,152.7 $ 396.8 $ 662.4 $ 460.3 $ 633.2

a Excludes $18.9 million of unrecognized tax benefi ts for which the Company cannot make a reasonably reliable estimate of the amount and period of

payment. See Note 9 to the Notes to Consolidated Financial Statements.

See also Note 8 to the Notes to Consolidated Financial Statements for information concerning the Company’s Pension and Postretirement Plans.

Off-Balance Sheet Arrangements

As of February 2, 2008, the Company had no off -balance

sheet arrangements as defi

ned in Item 303 of Regulation

S-K.

Impact of Infl ation

The Company does not believe that infl ation has had a

material eff

ect on its net sales or results of operations.

CERTAIN RELATIONSHIPS AND RELATED

TRANSACTIONS

See Note 16 to the Notes to Consolidated Financial

Statements.

CRITICAL ACCOUNTING POLICIES

“Management’s Discussion and Analysis of Financial

Condition and Results of Operations” discusses the

Company’s consolidated fi

nancial statements, which

have been prepared in accordance with accounting

principles generally accepted in the United States. The

preparation of these fi

nancial statements requires

management to make estimates and assumptions in

certain circumstances that aff

ect amounts reported in

the accompanying consolidated fi

nancial statements

and related footnotes. In preparing these fi

nancial state-

ments, management has made its best estimates and

judgments of certain amounts included in the fi

nancial

statements, giving due consideration to materiality. The

Company does not believe there is a great likelihood that

materially diff

erent amounts would be reported related

to the accounting policies described below. However,

application of these accounting policies involves the

exercise of judgment and use of assumptions as to future

uncertainties and, as a result, actual results could diff

er

from these estimates.

Merchandise Inventories

Merchandise inventories are stated at the lower of cost

or market. Cost is determined primarily by the retail

inventory method on the fi

rst-in, fi

rst-out (FIFO)

basis for 99% and 96% of the Company’s merchandise

inventories as of February 2, 2008 and February 3, 2007,

respectively. The remaining merchandise inventories

are recorded based on the average cost method.

Market is determined based on the estimated net realiz-

able value, which is generally the selling price. Reserves

for non-returnable inventory are based on the Company’s

history of liquidating non-returnable inventory.

The Company also estimates and accrues shortage for

the period between the last physical count of inventory

and the balance sheet date. Shortage rates are estimated

and accrued based on historical rates and can be aff

ected

by changes in merchandise mix and changes in actual

shortage trends.

2007 Annual Report 15