Barnes and Noble 2007 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2007 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Amended New Facility, as did the New Facility,

includes an . million fi ve-year revolving credit

facility, which under certain circumstances may be

increased to . billion at the option of the Company.

The New Facility replaced the Amended and Restated

Credit and Term Loan Agreement, dated as of August ,

(the Prior Facility), which consisted of a .

million revolving credit facility and a . million

term loan. The revolving credit facility portion was

due to expire on May , and the term loan had a

maturity date of August , . The Prior Facility was

terminated on June , , at which time the prior

outstanding term loan of . million was repaid.

Letters of credit issued under the Prior Facility, which

totaled approximately . million as of June , ,

were transferred to become letters of credit under the

New Facility.

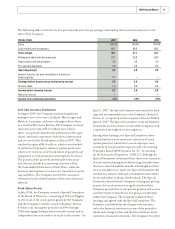

Selected information related to the Company’s Amended

New, New, and Prior Facilities (in thousands):

FISCAL YEAR 2007 2006 2005

Revolving credit facility at

year end $ — — —

Average balance

outstanding during the year $ 1,392 23,337 121,915

Maximum borrowings

outstanding during the year $ 37,600 91,800 245,000

Weighted average interest

rate during the yeara173.16% 15.40% 6.91%

Interest rate at end of year — — —

a The fi scal 2007 and 2006 interest rates are higher than prior periods

due to the lower average borrowings and the fi xed nature of the

amortization of the deferred fi nancing fees and commitment fees.

Excluding the deferred fi nancing fees and the commitment fees in

fi scal 2007 and 2006, the weighted average interest rate was 7.51%

and 7.70%, respectively.

Fees expensed with respect to the unused portion of the

Amended New, New and Prior Facilities were . mil-

lion, . million and . million, during fi scal ,

and , respectively.

The Company has no agreements to maintain compen-

sating balances.

Capital Investment

Capital expenditures totaled . million, .

million and . million during fi scal , and

, respectively. Capital expenditures in fi scal

, primarily for the opening of to new Barnes

& Noble stores, the maintenance of existing stores and

system enhancements for the retail stores and the web-

site, are projected to be in the range of . million to

. million, although commitment to many of such

expenditures has not yet been made.

Based on current operating levels and the store expan-

sion planned for the next fi scal year, management

believes cash and cash equivalents on hand, cash fl ows

generated from operating activities, short-term vendor

fi nancing and borrowing capacity under the Amended

New Facility will be suffi cient to meet the Company’s

working capital and debt service requirements, and

support the development of its short- and long-term

strategies for at least the next months.

In fi scal , the Board of Directors of the Company

authorized a common stock repurchase program for

the purchase of up to . million of the Company’s

common stock. The Company completed this .

million repurchase program during the fi rst quarter of

fi scal . On March , , the Company’s Board

of Directors authorized an additional stock repurchase

program of up to . million of the Company’s

common stock. The Company completed this .

million repurchase program during the third quarter

of fi scal . On September , , the Company’s

Board of Directors authorized an additional stock

repurchase program of up to . million of the

Company’s common stock. The Company completed this

. million repurchase program during the third

quarter of fi scal . On May , , the Company’s

Board of Directors authorized a new stock repurchase

program for the purchase of up to . million of the

Company’s common stock. The maximum dollar value

of common stock that may yet be purchased under the

current program is approximately . million as of

February , .

Stock repurchases under this program may be made

through open market and privately negotiated transac-

tions from time to time and in such amounts as manage-

ment deems appropriate. As of February , , the

Company has repurchased ,, shares at a cost of

approximately . million under its stock repurchase

programs. The repurchased shares are held in treasury.

The Amended New Facility, as did the New Facility,

includes an . million five-year revolving credit

facility, which under certain circumstances may be

increased to . billion at the option of the Company.

The New Facility replaced the Amended and Restated

Credit and Term Loan Agreement, dated as of August ,

(the Prior Facility), which consisted of a .

million revolving credit facility and a . million

term loan. The revolving credit facility portion was

due to expire on May , and the term loan had a

maturity date of August , . The Prior Facility was

terminated on June , , at which time the prior

outstanding term loan of . million was repaid.

Letters of credit issued under the Prior Facility, which

totaled approximately . million as of June , ,

were transferred to become letters of credit under the

New Facility.

Selected information related to the Company’s Amended

New, New and Prior Facilities (in thousands):

FISCAL YEAR 2007 2006 2005

Revolving credit facility at

year end $ — — —

Average balance

outstanding during the year $ 1,392 23,337 121,915

Maximum borrowings

outstanding during the year $ 37,600 91,800 245,000

Weighted average interest

rate during the yeara173.16% 15.40% 6.91%

Interest rate at end of year — — —

a The fiscal 2007 and 2006 interest rates are higher than prior periods

due to the lower average borrowings and the fixed nature of the

amortization of the deferred financing fees and commitment fees.

Excluding the deferred financing fees and the commitment fees in

fiscal 2007 and 2006, the weighted average interest rate was 7.51%

and 7.70%, respectively.

Fees expensed with respect to the unused portion of the

Amended New, New and Prior Facilities were . mil-

lion, . million and . million, during fiscal ,

and , respectively.

The Company has no agreements to maintain compen-

sating balances.

Capital Investment

Capital expenditures totaled . million, .

million and . million during fiscal , and

, respectively. Capital expenditures in fiscal

, primarily for the opening of to new Barnes

& Noble stores, the maintenance of existing stores and

system enhancements for the retail stores and the web-

site, are projected to be in the range of . million to

. million, although commitment to many of such

expenditures has not yet been made.

Based on current operating levels and the store expan-

sion planned for the next fiscal year, management

believes cash and cash equivalents on hand, cash flows

generated from operating activities, short-term vendor

financing and borrowing capacity under the Amended

New Facility will be sufficient to meet the Company’s

working capital and debt service requirements, and

support the development of its short- and long-term

strategies for at least the next months.

In fiscal , the Board of Directors of the Company

authorized a common stock repurchase program for

the purchase of up to . million of the Company’s

common stock. The Company completed this .

million repurchase program during the first quarter of

fiscal . On March , , the Company’s Board

of Directors authorized an additional stock repurchase

program of up to . million of the Company’s

common stock. The Company completed this .

million repurchase program during the third quarter

of fiscal . On September , , the Company’s

Board of Directors authorized an additional stock

repurchase program of up to . million of the

Company’s common stock. The Company completed this

. million repurchase program during the third

quarter of fiscal . On May , , the Company’s

Board of Directors authorized a new stock repurchase

program for the purchase of up to . million of the

Company’s common stock. The maximum dollar value

of common stock that may yet be purchased under the

current program is approximately . million as of

February , .

Stock repurchases under this program may be made

through open market and privately negotiated transac-

tions from time to time and in such amounts as manage-

ment deems appropriate. As of February , , the

Company has repurchased ,, shares at a cost of

approximately . million under its stock repurchase

programs. The repurchased shares are held in treasury.

14 Barnes & Noble, Inc. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS continued

14 Barnes & Noble, Inc. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS continued