Barclays 2011 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2011 Barclays annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Your Chief Executive’s view

The Chief Executive Officer is responsible for managing the daily

operations of Barclays through working closely with the Executive

Committee and overseeing successful delivery of the Group strategy.

His priorities are a focus on four areas of execution: Capital, Funding

and Liquidity; Returns; Income Growth; and Citizenship, which he uses

to guide Barclays through the uncertain economic and regulatory

environment and deliver shareholder returns.

In this summary, he reflects on the year, giving his views on progress

towards delivery of our strategy.

2011 was marked by a challenging market and

economic environment and our solid performance

relative to global peers demonstrates the strength

of our universal banking model and our relentless

focus on clients and customers. Our focus in 2011

was firmly on delivering progress against the four

execution priorities. I’d like to give you a review of

what we achieved.

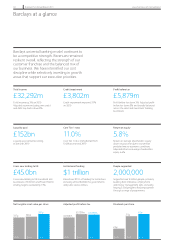

Capital, Funding and Liquidity

When I look back over the last few years, one of Barclays best decisions

came in October 2008 when regulators made clear that they wanted

banks to raise the bar for equity capital. We decided to raise capital swiftly

and in scale, to put our ratios ahead of regulatory requirements. We

wanted to put a metaphorical sign up for customers and clients saying

that Barclays was open for business. Today we’re recognised for our

strength in terms of capital, liquidity and funding, and as a result we are

seen by customers as a safe haven in times of stress.

Our capital position remains rock solid. Even after absorbing the full

impact of the third Capital Requirements Directive, our Core Tier 1 ratio

stands at 11% and we have a liquidity pool of £152bn that provides

protection against unexpected market fluctuations.

Returns

While we use many metrics to manage and measure the business,

return on equity is the financial measure that correlates most closely with

shareholder value, so it’s extremely important to us. Our 13% return target

was a vital factor in helping us make disciplined choices over the last

12 months, but we know that our returns today remain unsatisfactory

and that we have a lot more work to do.

Since we set this target last year we have faced some significant external

headwinds which are detailed over the page in our review of the market

and operating environment. Notwithstanding these, we have made a lot of

progress on the journey towards achieving our targets. Through operating

as a more integrated business we have been able to begin to drive the cost

efficiency that will be necessary to deliver that goal, and as a result have

increased our cost target to a saving of £2bn by 2013.

Our portfolio of businesses continued to evolve and strengthen, and most

of our businesses increased their return on equity in 2011.

We continue to believe that a return on equity of 13% is the right goal,

but our ability to achieve this by 2013 will depend upon economic, market

and regulatory developments. We remain fully committed to delivering

13% returns over time, by driving improved business performance,

reducing expenses, and maintaining a disciplined approach to capital

and funding costs.

Income growth

Given the difficult economic environment, we’re pleased that we were

able to grow income, underlying profit, and market share in many of our

businesses. We enter 2012 in a stronger competitive position.

In UK Retail and Business Banking net operating income grew 11%,

Barclaycard net income was up 21%, our African business net income

grew 11% in local currencies, and Wealth Management had its third

successive year of double digit income growth as we continue to build

that business.

Income and profits were down in Investment Banking in a very tough

market but we continue to have real momentum, which is particularly

evident in those areas where we’ve been actively investing, such as

Equities and Advisory. This progress was recognized by International

Financing Review (IFR) when it named Barclays Capital its “2011 Bank

of the Year” for “growing market share across the board, and becoming

an increasingly go-to investment bank”.

Citizenship

We have recognized that banks need to become better citizens and that

our ability to do this is critical to generate long term value for shareholders.

This is not philanthropy – it’s about using Barclays unique skills and

resources to deliver real commercial benefits in a way that also creates

sustainable value for society.

We have made firm progress against our Citizenship agenda in 2011,

delivering benefits to the real economy. We exceeded our Project Merlin

targets by 13% and delivered £44bn to UK business; we helped 108,000

businesses start up; we helped corporates and institutions raise $1 trillion

of financing through the capital markets globally, including almost $400bn

for governments and the public sector; we employed almost 1,500

graduates and have committed to creating over 1,000 apprenticeships;

and we will continue to do everything we can to support our customers

and clients in 2012.

We know we have a responsibility to help generate economic growth and

create jobs – and we are fully committed to playing our part.

You will find additional information relating to our Citizenship agenda in

this document and a Citizenship Report with detailed information on our

goals, our targets and our achievements will be available online from

23 April 2012.

Looking forward to 2012

As I look back at 2011, we made firm progress and right across Barclays

we entered 2012 in a stronger position. We recognise that in order to

achieve our return target we need to improve profitability substantially

going forward and we are determined to do that, using all the means

within our control to drive the business.

Turning to the external environment, while there are some positive signs

of economic recovery, particularly in the US, and increasing clarity on

regulation, the global macro-economic, political and regulatory

environment remains uncertain and we must again expect a challenging

environment in 2012.

As we have shown in the past year, however, Barclays is well positioned

to improve our competitive positioning across businesses in challenging

environments. Our universal banking model, as well as our rock solid

capital, liquidity and funding positions, give us the balance and flexibility

to meet the challenges ahead. We are confident that by putting clients

and customers at the center of everything we do, we will support

economic growth more broadly and generate the financial returns we’re

targeting over time.

When we’re at our best, we serve the real economy by doing our best for

all our stakeholders: our customers and clients, the communities we serve,

our people and our shareholders. To be anything less than our best is

letting all these people down. That’s why we aspire for Barclays to be one

of the best organised, best managed and most productive private sector

banks in the world.

Barclays PLC Annual Report 2011 www.barclays.com/annualreport 07

The strategic report Governance Risk management Financial review Financial statements Shareholder information