Barclays 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Barclays annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Delivering on

our promises

Barclays PLC

Annual Report

2010

barclays.com/annualreport10

Table of contents

-

Page 1

Delivering on our promises Barclays PLC Annual Report 2010 barclays.com/annualreport10 -

Page 2

..., UK domestic and global economic and business conditions, the effects of continued volatility in credit markets, market related risks such as changes in interest rates and exchange rates, effects of changes in valuation of credit market exposures, changes in valuation of issued notes, the policies... -

Page 3

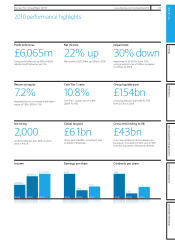

About Barclays About Barclays 02 03 04 05 07 09 About Barclays 2010 Performance highlights Executing our strategy Key performance indicators Group Chairman's statement Leadership and governance Strategy Perforuance Risk uanageuent and governance Financial stateuents Shareholder inforuation -

Page 4

... Annual Report 2010 www.barclays.com/annualreport10 About Barclays We are a major global financial services provider engaged in retail banking, credit cards, corporate and investment banking, and wealth management with an extensive international presence. Group total incoue £31 ,440m By business... -

Page 5

... returns on average shareholders' equity of 7.2% (2009: 6.7%) 10.8% Core Tier 1 capital ratio of 10.8% (2009: 10.0%) £154bn Group liquidity pool improved by 21% from £127bn in 2009 Net hiring Global tax paid Gross new lending to UK Risk uanageuent and governance 2,000 Created 2,000 new jobs... -

Page 6

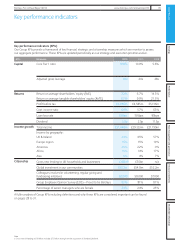

... of Barclays, perforuance is uanaged against a specific set of key perforuance indicators (KPIs). These KPIs are closely aligned to our execution priorities in order to deliver on our goal of generating top quartile shareholder returns over time. Our execution priorities are: - Capital - operating... -

Page 7

... region Americas Africa Asia Citizenship Gross new lending to UK households and businesses Global investment in our communities Colleagues involved in volunteering, regular giving and fundraising initiatives Group Employee Opinion Survey (EOS) - Proud to be Barclays Percentage of senior managers who... -

Page 8

Whilst it is too early to say that the financial crisis is over, I believe it is important to reflect on the progress that has been made over the last few years in improving the resilience of the banking sector Marcus Agius Group Chairman -

Page 9

... regulatory environment. I stated in my report last year that the new regulatory architecture should meet three objectives and it is important to reiterate them: - A safer and more secure financial system; - A banking industry that is well equipped to support the needs of the global economy; and... -

Page 10

...Barclays PLC Annual Report 2010 www.barclays.com/annualreport10 Group Chairman's statement continued Payuent of Tax Successful banks pay tax on their profits and in the last 'normal' year before the credit crunch (2006), the total direct and indirect taxation paid by the banking sector in the UK... -

Page 11

... held various key positions, including Head of Government Bond Trading, Head of Mortgage Trading, Sales and Finance and Head of Global Operations and Technology. Perforuance Risk uanageuent and governance Term of office Marcus joined the Board in September 2006 as a non-executive Director and was... -

Page 12

...Co, where she worked for 10 years. Alison also held the positions of a senior partner of Phoenix Securities and Managing Director, New York at Donaldson, Lufkin & Jenrette. Alison has wide board level experience and is currently non-executive Chairman of Land Securities Group PLC, Senior Independent... -

Page 13

... Group Finance Director and became a member of the Executive Committee in April 2007. Chris was last re-elected by shareholders at the AGM in 2010. No UK Head of Financial Services and Global Head of Banking and Capital Markets of PricewaterhouseCoopers LLP until 2006. Dambisa joined the Board... -

Page 14

... support areas. He became Chief Operating Officer (COO) of Barclays Global Investors (BGI) and a member of the BGI Executive Committee in December 2002. In January 2005, Rich was appointed COO of Barclays Investment Banking and Investment Management businesses comprising Barclays Capital, Barclays... -

Page 15

About Barclays Strategy Perforuance Risk uanageuent and governance Financial stateuents Shareholder inforuation Strategy 15 17 18 24 Chief Executive's review Financial strength Business review Citizenship -

Page 16

I am proud of what we achieved in 2010, especially our profit growth and enhanced capital and liquidity positions Bob Diauond Chief Executive -

Page 17

...loans when we acquired Standard Life Bank at the beginning of the year. We are open for business. Risk uanageuent and governance Our focus is on execution, which means delivering on our commitments in four key areas: maintaining a strong capital base; improving returns; delivering selective income... -

Page 18

... Wealth (where our strategic investment programme, known as our Gamma plan, is now one year into delivery); Barclaycard's Global Business Solutions activities which provides commercial payment services; monetising the build-out of Equities and Investment Banking in Barclays Capital; and capitalising... -

Page 19

... consistent with current FSA standards. The Basel Committee of Banking Supervisors (BCBS) issued its final guidelines for liquidity risk management, standards and monitoring in December 2010. These guidelines include a short term liquidity stress metric (the Liquidity Coverage Ratio (LCR)) and... -

Page 20

.... We made a strong start in 2010. GRB improved its loan to deposit ratio by 4 percentage points to 140%. Return on equity increased from 10% to 11% reflecting strong profit growth in UKRB, Barclaycard and Barclays Africa. We are facing challenging economic conditions in Western Europe but remain... -

Page 21

...half a million people, helping them build the skills and confidence to manage their money effectively, achieve financial independence and build a secure future. In the UK, Barclays Money Skills is working with key partners to develop a range of projects and tools to help vulnerable young people. For... -

Page 22

... long-term investment needs of their customers. The strategic build in key growth areas at Barclays Capital is delivering tangible benefits to clients around the world, alongside the focused execution of robust plans for the future right across the business. Barclays Corporate continues to invest in... -

Page 23

... acquires AXA's UK Life business Perforuance Corporate and Investment Banking is about helping corporate, government and institutional clients to finance and grow their operations, manage their risks and invest their capital. Capital raising and financing - We lend money, and enable companies... -

Page 24

... and processes in order to achieve a step change in client experience and a significant improvement to our productive efficiency. We believe we can set a standard for the industry. At the end of 2010 we are on or ahead of all our target metrics. Client assets grew by 8% over the year to £164bn, and... -

Page 25

... balance inquiry, air time purchases) with the merchant providing these services using a point of sale terminal with our In-Store Banking application; - a remote account opening service for savings and transmission accounts using mobile phone technology; and - a tap-and-go card product for low value... -

Page 26

24 Barclays PLC Annual Report 2010 www.barclays.com/annualreport10 Citizenship Our role is to help improve the lives of our customers. We must provide mortgages, allow businesses to invest and create jobs, protect savings, pay tax, be a good neighbour in the community while also generating ... -

Page 27

...Support Team working alongside the customer's relationship manager. This maintains close links and consistency throughout the relationship. Perforuance - £43bn gross new lending to UK households and businesses - 106,000 business start-ups supported in the UK Investing in our communities Barclays... -

Page 28

... PLC Annual Report 2010 www.barclays.com/annualreport10 Citizenship continued Our People Global uiniuuu standards To maintain balance between overall control and effective local decision making we have established global governance frameworks and minimum standards to regulate how we manage and... -

Page 29

... 32 33 40 41 44 Key performance indicators Consolidated summary income statement Income statement commentary Consolidated summary balance sheet Balance sheet commentary Analysis of results by business Strategy Performance Risk management and governance Financial statements Shareholder information -

Page 30

28 Barclays PLC Annual Report 2010 www.barclays.com/annualreport10 Key performance indicators Capital KPIs Definition Core Tier 1 ratio Capital requirements are part of the regulatory framework governing how banks and depository institutions are managed. Capital ratios express a bank's capital ... -

Page 31

... an indicator of the cost of granting credit. During 2010 impairment continued to improve across all our businesses with one exception, the corporate portfolio in Spain, resulting in a loan loss rate of 118bps compared to 156bps reported in 2009. Dividend It is the Group's policy to declare and pay... -

Page 32

... of Standard Life Bank. We see this as an important performance metric and have formally measured UK gross lending since 2009. Global investment in our communities Defined as Barclays total contribution to supporting the communities where we operate. The success and competitiveness of a business and... -

Page 33

... updated periodically as our strategy and execution priorities evolve. Measures no longer identified as KPIs that were reported in the prior year are as follows: Measures Total shareholder returna Economic (loss)/profit Tier 1 ratio Loan funding ratio Average term of unsecured liabilities UK Retail... -

Page 34

... share from continuing operations Diluted earnings per share Dividends per ordinary share Dividend payout ratio Profit attributable to the equity holders of the Parent as a percentage of: - average shareholders' equity - average total assets Average United States Dollar exchange ratea Average Euro... -

Page 35

...inclusion of the acquired Lehman Brothers North American business. The Group total cost:income ratio improved from 63% to 57%. At Barclays Capital the compensation:income ratio improved from 44% to 38%. Strategy Performance Risk management and governance Financial statements Shareholder information -

Page 36

... net funding costs and hedging recognised in Head Office Functions and Other Operations. Group net interest income includes the impact of structural hedges which function to reduce the impact of the volatility of short-term interest rate movements on equity and customer balances that do not re-price... -

Page 37

... in loan balances. Strategy Performance Risk management and governance Net Trading Income Trading income/(loss) Gain on foreign exchange dealings Own Credit gain/(charge) Net trading income Net investment income Net gain from disposal of available for sale assets Dividend income Net gain/(loss... -

Page 38

... of the final salary scheme in 2009 offset by the credit of £250m resulting from amendments to the treatment of minimum defined benefits and £54m relating to the Group's recognition of a surplus in Absa, as well as favourable investment returns over the period. Operating expenses Staff costs... -

Page 39

... of Standard Life Bank, the build-out of Barclays Shared Services in India, the insourcing of operations and the further international development of technology infrastructure. Barclays Capital staff numbers increased 1,600 to 24,800 (2009: 23,200) as a result of investment in sales, origination... -

Page 40

...77m profit arising from sale of Barclays Africa custody business to Standard Chartered Bank. On 1st January 2010, the Group acquired 100% ownership of Standard Life Bank PLC realising a gain on acquisition of £100m. On 31st March 2010, the Group acquired 100% of the Italian credit card business of... -

Page 41

...the gain on sale of Barclays Global Investors (BGI) of £6,331m (2008: £nil) and other profit before tax from BGI of £726m (2008: £941m). The results for 2009 included 11 months of operations compared to 12 months for 2008. Strategy Performance Risk management and governance Financial statements... -

Page 42

... Risk weighted assets Core Tier 1 ratio Tier 1 ratio Risk asset ratio Selected financial statistics Net asset value per ordinary share Number of ordinary shares of Barclays PLC (in millions) Year-end United States Dollar exchange rate Year-end Euro exchange rate Year-end Rand exchange rate 2010... -

Page 43

...of the acquisition of Standard Life Bank, offset by a reduction in borrowings by wholesale customers and banks. Available for sale financial investments increased £8.6bn primarily driven by purchase of government bonds increasing the Group's liquid assets and the transfer from loans and advances to... -

Page 44

...within a month end range of 24x to 29x, driven by trading activity fluctuations noted above, as well as changes in gross interest rate derivatives and settlement balances. The Basel Committee of Banking Supervisors (BCBS) issued final guidelines for 'Basel III: a global regulatory framework for more... -

Page 45

... fair value of the Group's holding in BlackRock, Inc. resulted in an adverse impact of approximately 20bps on the Core Tier 1 ratio over the year. The Basel Committee of Banking Supervisors issued final Basel III guidelines in December 2010 and January 2011. The new standards include changes to risk... -

Page 46

... by business UK Retail Banking Barclaycard £m £m Western Europe Retail Banking £m Barclays Africa £m Absa £m Barclays Capital £m Barclays Corporate £m Barclays Wealth £m Head Office Investment Functions Manage- and Other ment Operations £m £m As at 31st December 2010 Total income... -

Page 47

... funding activity as money market dislocations eased and a reclassification of profit from the currency translation reserve to the income statement. Risk management and governance Financial statements Shareholder information In the following results by business pages, return measures for 2008 data... -

Page 48

... Operating expenses Share of post-tax results of associates and joint ventures Gains on acquisition Profit before tax Balance sheet information Loans and advances to customers at amortised cost a Customer accounts a Total assets Risk weighted assets Note a In 2010 the acquisition of Standard Life... -

Page 49

... arrears rates - UK loans Cost: income ratio Cost: net income ratio 12% 24% 2.2% 70 2.6% 62% 76% 8% 17% 1.5% 98 3.8% 59% 78% n/a n/a n/a n/a n/a 55% 63% Key Facts Number of UK current accounts Number of UK savings accounts a Number of UK mortgage accounts a Number of Barclays Business customers... -

Page 50

... 20% of income was generated from products other than consumer credit cards. Barclaycard's UK businesses reported income at £2,453m (2009: £2,493m) reflecting the continued run-off of the FirstPlus secured lending portfolio and lower insurance-related income. International income increased 1% to... -

Page 51

...equity Return on average risk weighted assets Loan loss rate (bps) 1 month arrears rates - UK cards 1 month arrears rates - US cards 1 month arrears rates - Absa cards Cost: income ratio Cost: net income ratio Key Facts Number of Barclaycard UK customers Number of Barclaycard International customers... -

Page 52

..., the 2009 result benefited notably from a £157m gain on the sale of 50% of Barclays Iberian life insurance and pensions business. Income fell 12% to £1,164m (2009: £1,318m), due to lower net interest income and the 3% decline in the average value of the Euro against Sterling, partially offset by... -

Page 53

.... Strategy Performance Risk management and governance 2010 2009 2008 Financial statements Performance Measures Return on average equity a Return on average tangible equity a Return on average risk weighted assets a Loan loss rate (bps) Cost: income ratio Cost: net income ratio Key Facts Number... -

Page 54

52 Barclays PLC Annual Report 2010 www.barclays.com/annualreport10 Financial review Analysis of results by business continued Global Retail Banking Barclays Africa Barclays Africa provides retail, corporate and credit card services across Africa and the Indian Ocean. It provides tailored banking... -

Page 55

... statements Performance Measures Return on average equity Return on average tangible equity Return on average risk weighted assets Loan loss rate (bps) Cost: income ratio Cost: net income ratio Key Facts Number of customers Number of branches Number of sales centres Number of distribution points... -

Page 56

... banking services and insurance products through a variety of distribution channels. It also offers customised business solutions for commercial and large corporate customers. It is part of one of South Africa's largest financial services organisations. 2010 Impact of Absa Group Limited on Barclays... -

Page 57

.... Strategy Performance Risk management and governance 2010 2009 2008 Financial statements Performance Measures Return on average equity a Return on average tangible equity b Return on average risk weighted assets Loan loss rate (bps) Cost: income ratio Cost: net income ratio Key Facts Number... -

Page 58

... exchange rate movements, offset by reductions resulting from capital 2010 £m 2009 £m 2008 £m Income statement information Net interest income Net fee and commission income Net trading income Net investment income/(loss) Other income Total income Impairment charges and other credit provisions... -

Page 59

... Risk management and governance 2010 2009 2008 Financial statements Performance Measures Return on average equity Return on average tangible equity Return on average risk weighted assets Loan loss rate (bps) Cost: income ratio Cost: net income ratio Cost: net income ratio (excluding own credit... -

Page 60

... lower levels of customer assets across the business and improvements in the credit quality of the UK portfolio. 2010 £m 2009 £m 2008 £m Income statement information Net interest income Net fee and commission income Net trading income Net investment income/(loss) Gains on debt buy-backs and... -

Page 61

...New Markets. Risk management and governance Financial statements 2010 2009 2008 Performance measures Return on average equity Return on average tangible equity Return on average risk weighted assets Loan loss rate (bps) Cost: income ratio Cost: net income ratio Income Statement Information Year... -

Page 62

...collateral management. Stable returns on average equity and average tangible equity, and the improved return on average risk weighted assets reflected the strong performance of the business offset by the cost of strategic investment and the increase in capital allocation. 2009 Barclays Wealth profit... -

Page 63

...net new asset inflows of £3bn. Strategy Performance Risk management and governance 2010 2009 2008 Financial statements Performance Measures Return on average equity Return on average tangible equity Return on average risk weighted assets Loan loss rate (bps) Cost: income ratio Other Financial... -

Page 64

62 Barclays PLC Annual Report 2010 www.barclays.com/annualreport10 Financial review Analysis of results by business continued Investment Management Investment Management manages the Group's 19.9% economic interest in BlackRock, Inc. and the residual elements relating to Barclays Global Investors... -

Page 65

...). Strategy Performance Risk management and governance 2010 £m 2009 £m 2008 £m Financial statements Income statement information Net interest income/(expense) Net fee and commission expense Net trading loss Net investment income/(loss) Net premiums from insurance contracts Gains on debt buy... -

Page 66

64 Barclays PLC Annual Report 2010 ///.barclays.com/annualreport10 -

Page 67

... Market risk management Capital risk management Liquidity risk management Operational risk management Supervision and regulation Directors' report Corporate governance report Remuneration report Strategy Performance Risk management and governance Financial statements Shareholder information -

Page 68

...The Board is also responsible for the Internal Control and Assurance Framework (Group Control Framework). It oversees the management of the most significant risks through the regular review of risk exposures and related key controls. Executive management responsibilities relating to this are set via... -

Page 69

... on the risk profile and risk strategy across the Group. - Considers issues escalated by Risk Type Heads and Business Risk Directors. - Sets policy/controls for liquidity, maturity transformation and structural interest rate exposure. - Monitors the Group's liquidity and interest rate maturity... -

Page 70

.... Governance structure by key risk type Board Internal Audit Chief Executive proup Finance Director Divisional Chief Executive Officers Chief Risk Officera proup Treasurer Business Heads Business Risk Directors proup Risk Heads Capital and Liquidity Risk - Manage the Group's capital plan... -

Page 71

Barclays PLC Annual Report 2010 www.barclays.com/annualreport10 69 About Barclays Internal Audit is responsible for the independent review of risk management and the control environment. Its objective is to provide reliable, valued and timely assurance to the Board and Executive Management over ... -

Page 72

... Group's risk profile - Re-balance the risk profile of the medium-term plan where breaches are indicated, thereby achieving a superior risk-return profile - Identify unused risk capacity, and thus highlight the need to identify further profitable opportunities - Improve executive management control... -

Page 73

...direct external market data where possible. When this is not possible, more analytic techniques are used, such as industry consensus pricing services. Strategy Performance Risk management and governance Financial statements Model Governance Group Risk Oversight Committee Executive Models Committee... -

Page 74

...PLC Annual Report 2010 www.barclays.com/annualreport10 Risk management Barclays risk management strategy continued These services enable peer banks to compare structured products and model input parameters on an anonymous basis. The conclusions and any exceptions to this exercise are communicated... -

Page 75

... and brand. Business conditions and the general economy Barclays operates a universal banking business model and its services range from current accounts for personal customers to inflation-risk hedging for governments and institutions. The Group also has significant activities in a large number of... -

Page 76

... years include: Credit Market Exposures Barclays Capital holds certain exposures to credit markets that became illiquid during 2007. These exposures primarily relate to commercial real estate, leveraged finance and a loan to Protium. The Group actively managed down some of these exposures in 2010... -

Page 77

... rate risk and the pension fund. Principal Risk Management Key Specific Risks and Mitigation Strategy The Board approves market risk appetite for trading and non-trading activities, with limits set within this context by the Group Market Risk Director. The head of each business market risk team... -

Page 78

... with central banks and investments in highly liquid securities or deposits. Stress reporting for a number of liquidity scenarios is run on a daily basis. These tests measure the survival periods under Barclays defined stress scenarios. Similar stresses are run for key entities within the Group as... -

Page 79

... effectiveness of the controls operated in the business units is overseen by the Group Legal Executive Committee. Specific risks relating to Legal Risk are reported on a quarterly basis to the Executive Committee and the Board. Key Legal Risks to which the Group was exposed during 2010 have included... -

Page 80

... on adherence to the regulatory framework currently in place. Specific reports on regulatory compliance are prepared on a regular basis for the Group Operating Committee, the Group Governance and Control Committee and the Board Audit Committee. Compliance risk and control issues are also included in... -

Page 81

...is managed through a formal risk governance framework. A set of Key Risk Indicators (KRIs), consistent across Business Units, is periodically collated and reviewed by management. Each KRI has a specific target state, defining the Group's attitude to risk. Any areas falling short of this standard are... -

Page 82

... and quarterly review meetings are held between the Group Financial Controller and business unit Finance Directors to review and challenge the business unit Financial Reporting Risk status and assessment. Quarterly Financial Reporting Risk reports are submitted to the Group Operating Committee for... -

Page 83

.... Governance and controls have been put in place to ensure compliance with the UK government's Code of Practice for Taxation of Banks. The profit forecasts that support the Group's deferred tax assets, principally in the UK, US and Spain, have been subject to close scrutiny by management. The Group... -

Page 84

... of credit risk include only financial assets subject to credit risk. They exclude other financial assets, mainly equity securities held in the trading portfolio or as available for sale assets, as well as non-financial assets. The nominal value of off-balance sheet credit related instruments... -

Page 85

Barclays PLC Annual Report 2010 www.barclays.com/annualreport10 83 About Barclays Maximum exposure to credit risk (audited) Loans and advancesa £m Debt securities and other billsb £m Asset class Reverse repurchase agreementsd £m Strategy As at 31st December 2010 On-balance sheet: Cash and ... -

Page 86

...Barclays PLC Annual Report 2010 www.barclays.com/annualreport10 Risk management Credit risk management continued Maximum exposure to credit risk (audited) Loans and advances £m Debt securities and other bills £m Asset class Reverse repurchase agreements £m As at 31st December 2009 On-balance... -

Page 87

... European Union £m United States £m Africa £m Rest of the World £m Total £m Strategy As at 31st December 2010 On-balance sheet: Cash and balances at central banks Items in the course of collection from other banks Trading portfolio assets Financial assets designated at fair value Derivative... -

Page 88

... £m Government £m Business and other services £m Other £m Total £m As at 31st December 2010 On-balance sheet: Cash and balances at central banks - Items in the course of collection from other banks 1,378 Trading portfolio assets 51,337 Financial assets designated at fair value 11... -

Page 89

... undrawn facilities and guarantees. b Credit market related impairment charges within Barclays Capital comprised £660m (2009: £1,205m; 2008: £1,517m) against loans and advances, a write back of £39m (2009: £464m charge; 2008: £192m charge) against available for sale assets and a charge against... -

Page 90

... and strategic plans. The credit risk management teams in each business are accountable to the business risk directors in those businesses who, in turn, report to the heads of their businesses and also to the Chief Risk Officer. The role of the Group Risk function is to provide Group wide direction... -

Page 91

Barclays PLC Annual Report 2010 www.barclays.com/annualreport10 89 About Barclays C. Credit risk mitigation Barclays employs a range of techniques and strategies to actively mitigate credit risks to which it is exposed. These can broadly be divided into three types: - netting and set-off; - ... -

Page 92

... conditions, giving a 'downturn LGD'. E. Reporting The Group dedicates considerable resources to gaining a clear and accurate understanding of credit risk across the business and ensuring that its balance sheet correctly reflects the value of the assets in accordance with applicable accounting... -

Page 93

... the Group although Barclays can also be exposed to other forms of credit risk through, for example, loans to banks, loan commitments and debt securities. Barclays risk management policies and processes are designed to identify and analyse risk, to set appropriate risk appetite, limits and controls... -

Page 94

92 Barclays PLC Annual Report 2010 www.barclays.com/annualreport10 Risk management Credit risk management continued As a general principle, charge-off marks the point at which it becomes more economically efficient to treat an account through a recovery function or debt sale rather than a ... -

Page 95

...and - Potential credit risk loans coverage ratio (impairment allowances as a percentage of total CRL and PPL balances). Strategy Performance Risk management and governance Financial statements Loan loss rate (bps) - longer-term trends bps FY Annualised LLRa TTC Average LLR 30 Year Average LLR 226... -

Page 96

94 Barclays PLC Annual Report 2010 www.barclays.com/annualreport10 Risk management Credit risk management continued Appropriate coverage ratios will vary according to the type of product but can be broadly bracketed under three categories: secured retail home loans; credit cards, unsecured and ... -

Page 97

... lending in Home Finance and the acquisition of Standard Life Bank at the beginning of 2010; - Western Europe Retail Banking where loans and advances increased 6% to £44,500m, which primarily reflected growth in Italian mortgages partially offset by the depreciation in the value of the Euro... -

Page 98

...European Union £m United States £m Africa £m Rest of the World £m Total £m As at 31st December 2010 Financial institutions Manufacturing Construction Property Government Energy and water Wholesale and retail distribution and leisure Business and other services Home loans Cards, unsecured loans... -

Page 99

... £m Exchange and other adjustments £m Amounts written off £m Amounts charged to income statement £m Balance at 31st December £m Strategy Recoveries £m 2010 Loans and advances to banks Loans and advances to customers: Home loans Credit card receivables Other personal lending Wholesale... -

Page 100

...of Standard Life Bank. Credit Cards, Unsecured and Other Retail Lending increased 7% to £8,277m (2009: £7,745m) reflecting higher recovery balances as accounts rolled through to later cycles in most businesses and a weak debt sale sector. Potential Problem Loans The Group's Potential Problem Loans... -

Page 101

..., including commercial real estate and leveraged finance; - impact of potentially deteriorating sovereign credit quality; and - potential impact of increasing inflation on economic growth and corporate profitability. Strategy Performance Risk management and governance Wholesale loans and advances... -

Page 102

... of impairment £m Credit risk loansa £m CRLs h of gross loans and advancesa h Impairment charges £m Loan loss rates bps As at 31st December 2010 Loans and advances to banks Cash collateral and settlement balances Interbank lending Loans and advances to customers Government lending ABS CDO Super... -

Page 103

...a weak debt sale market. The CRL coverage ratios were higher at 31st December 2010 in Retail Home Loans at 19.9% (2009: 17.0%) and in Retail Credit Cards Unsecured and Other Retail Lending at 72.8%, (2009: 70.8%) but remained within typical severity rate ranges for these types of products. Strategy... -

Page 104

... portfolios. Impairment charges reduced in Barclays Africa as a result of an improved collections performance. Home loans principal portfoliosa The loan loss rate across the Group's Retail portfolios for 2010 was 140bps (2009: 184bps). The principal uncertainties relating to the performance of the... -

Page 105

... the impact of improving economic conditions during 2010, while UK Loans arrears rates fell to 2.6% (2009: 3.8%) and US Cards arrears rates fell to 2.5% (2009: 3.3%). Risk management and governance Credit cards and unsecured loans principal portfolios One month arrearsa % Three month arrearsa... -

Page 106

104 Barclays PLC Annual Report 2010 www.barclays.com/annualreport10 Risk management Credit risk management continued The recoveries impairment coverage ratios as at 31st December 2010 were 83.9% for UK Cards (2009: 81.3%), 82.5% for UK Loans (2009: 80.7%), and 93.8% for US Cards (2009: 91.7%). ... -

Page 107

... risk loansc £m Coverage ratio % As at 31st December 2010 Trading portfolio: Traded loans Financial assets designated at fair value: Loans and advances Other financial assets Loans and advances to banks Loans and advances to customers: Home loans Credit card receivables Other personal lending... -

Page 108

... risk £m As at 31st December Trading portfolio: Traded loans Financial assets designated at fair value: Loans and advances Other financial assets Loans and advances to banks Loans and advances to customers: Home loans Credit card receivables Other personal lending Wholesale and corporate Finance... -

Page 109

...Of which credit risk loans £m Performance As at 31st December 2010 Financial assets designated at fair value: Loans and advances Loans and advances to banks Loans and advances to customers: Home loans Credit card receivables Other personal lending Wholesale and corporate Finance lease receivables... -

Page 110

... lenders. mny additional funds are returned to the customer. Barclays does not, as a rule, occupy repossessed properties for its business use. The Group does not use assets obtained in its operations. mssets obtained are normally sold, generally at auction, or realised in an orderly manner for the... -

Page 111

...31st December Trading portfolio Financial assets designated at fair value mvailable for sale financial investments Total debt securities % of total Debt securities As at 31st December Of which issued by: Governments and other public bodies US agency Mortgage and asset-backed securities Corporate and... -

Page 112

... to each type of collateral and will be largely based on liquidity and price volatility of the underlying security. The collateral obtained for derivatives is either cash, direct debt obligation government (G14+) bonds denominated in the domestic currency of the issuing country, debt issued by... -

Page 113

...future value to be estimated, for example: current market rates, market volatility and legal documentation (including collateral rights). Risk management and governance Reverse Repurchase Agreements and Other Financial Assets (audited) Credit quality (audited) AAA to BBB(investment grade) £m 2010... -

Page 114

...Barclays Capital's credit market exposures primarily relate to commercial real estate, leveraged finance and a loan to Protium Finance LP. These include positions subject to fair value movements in the income statement and positions that are classified as loans and advances and as available for sale... -

Page 115

... PLC mnnual Report 2010 www.barclays.com/annualreport10 113 About Barclays B. Commercial Mortgages B1. Commercial Real Estate and Mortgage-Backed Securities Commercial mortgages include commercial real estate loans of £5,455m (2009: £6,534m), commercial real estate properties owned of £1,651m... -

Page 116

114 Barclays PLC mnnual Report 2010 www.barclays.com/annualreport10 Risk management Credit risk management continued C. Other Credit Market C1. Leveraged Finance Leveraged finance loans, by region As at 31st December UK Europe msia US Total lending and commitments Impairment Net lending and ... -

Page 117

...Risk management and governance Financial statements As at 31st December Trading portfolio assets Other US sub-prime whole loans and real estate Other US sub-prime securities mlt-m Other trading portfolio assets Fair value of underlying assets wrapped by monoline insurers Derivative financial assets... -

Page 118

... of Barclays valuation control framework. E. Barclays Capital Credit Market Exposures by asset class Analysis of Barclays Capital Credit Market Exposures by asset class Trading portfolio assets - debt securities £m Financial assets designated at fair value - equity securities £m Financial assets... -

Page 119

... LTV lending, with average mark to market LTVs at 31st December 2010 in Spain of 58% and in Italy of 45%. Credit risk loan balances in Spain and Italy increased by 22% to £832m and 15% to £553m, respectively. Wholesale exposures Loans and advances at amortised cost Of which Government £m Assets... -

Page 120

... control structure Group Market Risk Director Risk type Traded - Interest rate risk - Credit spread risk - Commodity risk - Equity risk - Foreign exchange risk ...managed by Barclays Capital Non-traded - Interest rate risk - Foreign exchange risk Non-traded - Pension risk Non-traded - Asset... -

Page 121

...and infrastructure. Group Market Risk is a member of both these committees. Risk reporting Barclays Capital Market Risk team produce a number of detailed and summary market risk reports daily, weekly, fortnightly and monthly. These include, new for 2010, the Executive Key Risk Report (daily) and the... -

Page 122

120 Barclays PLC Annual Report 2010 www.barclays.com/annualreport10 Risk management Market risk management continued Analysis of traded market risk exposures (audited) The trading environment in 2010 was characterised by weak underlying economic growth as well as unclear market direction ... -

Page 123

... market risk developments, as well as verifying conformance with Barclays policies and standards as detailed in the Barclays Market Risk Control Framework. The interest rate risk for balances with no defined maturity date and an interest rate that is not linked to the base rate is managed by Group... -

Page 124

...income on Group equity, held within Head Office Functions and Other Operations. In 2009 there were additional costs of central funding activity, relating to money market dislocations, which did not reoccur in 2010. Net interest margin The net interest margin for Global Retail Banking, Absa, Barclays... -

Page 125

... is to appropriately give credit to businesses with net surplus liquidity and to charge those businesses in need of wholesale funding at Barclays internal funding rate, which is driven by prevailing market rates and includes a term premium. The objective is to price internal funding for assets and... -

Page 126

... the Group's capital ratio management strategy for foreign exchange rate movements. To create foreign currency Tier 1 and Total Capital resources additional to the Core Tier 1 capital resources, the Group issues, where possible, debt capital in non-Sterling currencies. This is primarily achieved by... -

Page 127

...PLC Annual Report 2010 www.barclays.com/annualreport10 125 About Barclays Other market risks Barclays maintains a number of defined benefit pension schemes for past and current employees. The ability of the Pension Fund to meet the projected pension payments is maintained through investments and... -

Page 128

...targets To support its capital management objectives, the Group sets internal targets for its key capital ratios. Internal targets are reviewed regularly by Group Treasury Committee to take account of: - changes in forecast demand for capital caused by accessing new business opportunities, including... -

Page 129

... returns on risk weighted assets and economic capital when setting limits for business capital demand. Executive management will also review the forecast capital ratios to ensure internal targets continue to be met over the medium-term plan. The Treasury Committee reviews the limits on capital... -

Page 130

... risk weighted assets 2010 £m 2009 £m Risk weighted assets by business UK Retail Banking Barclaycard Western Europe Retail Banking Barclays Africa Barclays Capital Barclays Corporate Barclays Wealth Investment Management Absa Head Office Functions and Other Operations Total risk weighted assets... -

Page 131

... to manage the Barclays balance sheet and leverage ratio. Barclays Capital's adjusted tangible assets are managed and reviewed monthly by the Barclays Capital Balance Sheet Steering Committee which includes members of Treasury, Finance and the businesses. The Steering Committee agrees limits with... -

Page 132

... Barclays Africa Absa Barclays Capital Barclays Corporate Barclays Wealth Investment Management Head Office Functions and Other Operations Historical goodwill and intangibles arising on acquisition Variance to average shareholders' funds (excluding non-controlling interest) Economic loss 2010... -

Page 133

... and limit setting by providing relevant and expert input for their local markets and customers. Execution of the Group's liquidity risk management strategy is carried out at country level within agreed policies, controls and limits, with the Country Treasurer providing reports directly to Barclays... -

Page 134

... consistent with current FSA standards. The Basel Committee of Banking Supervisors (BCBS) issued its final guidelines for liquidity risk management, standards and monitoring in December 2010. These guidelines include a short term liquidity stress metric (the Liquidity Coverage Ratio (LCR)) and... -

Page 135

... in a stressed environment are covered. Much of the short term funding is invested in highly liquid assets and central bank cash and therefore contributes towards the Group liquidity pool. Barclays Capital undertakes secured funding in the repo markets based on liquidity characteristics. 66% (2009... -

Page 136

... ten years £m At 31st December 2010 Assets Cash and balances at central banks Items in the course of collection from other banks Trading portfolio assets Financial assets designated at fair value Derivative financial instruments Loans and advances to banks Loans and advances to customers Reverse... -

Page 137

...of the Group's trading strategies. For these instruments, which are mostly held by Barclays Capital, liquidity and repricing risk is managed through the Daily Value at Risk (DVaR) methodology; - retail deposits, which are included within customer accounts, are repayable on demand or at short notice... -

Page 138

...Over five years £m Total £m At 31st December 2010 Deposits from banks Items in the course of collection due to other banks Customer accounts Repurchase agreements and other similar secured borrowing Trading portfolio liabilities Financial liabilities designated at fair value Derivative financial... -

Page 139

.... The Internal Audit function provides further independent review and challenge of the Group's operational risk management controls, processes and systems and reports to the Board and senior management. Strategy Performance Risk management and governance Financial statements Shareholder information -

Page 140

...a member of the Operational Risk data eXchange (ORX), a not-for-profit association of international banks formed to share anonymous loss data information. Barclays uses this external loss information to support and inform risk identification, assessment and measurement. Key indicators Key Indicators... -

Page 141

... supervision of deposit taking, life insurance, home mortgages, general insurance and investment business. Barclays Bank PLC is authorised by the FSA under the Financial Services and Markets Act 2000 to carry on a range of regulated activities within the UK and is subject to consolidated supervision... -

Page 142

140 Barclays PLC Annual Report 2010 www.barclays.com/annualreport10 Risk management Supervision and regulation continued The UK regulatory agenda is considerably shaped and influenced by the directives emanating from the EU. These form part of the European Single Market programme, an important ... -

Page 143

... of large UK banks including Barclays. While the Basel Committee on Banking Supervision has largely completed the process of setting new standards for capital and liquidity, a number of workstreams remain active that will affect the Group. These include a fundamental review of the trading book in... -

Page 144

... standards for specific institutions the DFA, separate and apart from Basel III, also imposes higher capital, liquidity and leverage requirements on US banks and bank holding companies generally; and - The ability of the CPFB to regulate the credit card industry, including the terms of credit card... -

Page 145

... on the transfer of securities in the Company, including limitations on the holding of securities and requirements to obtain approvals for a transfer of securities; - Restrictions on voting rights; - The powers of the Directors, including in relation to issuing or buying back shares in accordance... -

Page 146

..., offices and subsidiaries in the UK and overseas. An indication of likely future developments is set out in the Chief Executive's Review on pages 15 and 16 and in the Business Review on pages 18 to 22. Holder Number of Barclays Shares BlackRock, Inc.b Nexus Capital Investing Ltd Legal & General... -

Page 147

... Group. Staff are encouraged to participate in share option and share purchase schemes and have a substantial sum invested in Barclays shares. Employees are kept informed of matters of concern to them in a variety of ways, including business unit news magazines, intranets, briefings and mobile phone... -

Page 148

...type of forecasted transaction for which hedge accounting is used, and the exposure to market risk, credit risk and liquidity risk are set out on pages 66 to 126 under the headings, 'Barclays risk management strategy', 'Credit risk management', 'Market risk management' and 'Liquidity risk management... -

Page 149

...approach to internal control and details Group policies and processes. The GICAF is reviewed and approved on behalf of the Chief Executive by the Group Governance and Control Committee. Regular risk reports are made to the Board covering risks of Group significance including credit risk, market risk... -

Page 150

... and reported within the time periods specified in the US Securities and Exchange Commission's rules and forms. As of the date of the evaluation, the Chief Executive and Group Finance Director concluded that the design and operation of these disclosure controls and procedures were effective... -

Page 151

... that standard with the report that follows. Strategy Performance The corporate governance report is my opportunity, as Group Chairman, to explain how our Company has been managed during the year; how the Board has performed and how our systems of governance and control have operated. What... -

Page 152

...Executive, and Chris Lucas, Group Finance Director, are full time employees of the Group and form part of the senior management of Barclays. They are responsible for the day to day management of our businesses, supported by the Group Executive Committee, which Bob chairs. The non-executive Directors... -

Page 153

... relating to capital structure or status as a PLC - Approval of annual Capital Plan - Approval of Risk Appetite and Liquidity Risk Appetite Financial Results and Dividends - Approval of interim and final financial statements, dividends and any significant change in accounting policies or practices... -

Page 154

... a year. Directors may on request also take independent professional advice at the Company's expense. I chair the Board Corporate Governance and Nominations Committee in addition to the Board and I am a member of the Board Remuneration Committee. I attend other Board Committee meetings on an ad hoc... -

Page 155

... non-executive Directors 3 Risk management and governance Key responsibilities Group Chairman Lead the Board and manage the business of the Board through setting its agenda and taking full account of the issues and concerns of Board members Ensure that Board members receive accurate, timely and... -

Page 156

... business and affairs to enable them to properly evaluate the information and responses provided by Management. Director Re-election In accordance with the new UK Corporate Governance Code, the Board has agreed that all Directors will submit themselves for re-election at the Company's Annual General... -

Page 157

... - Western Europe Retail Banking Group Functions - Compliance - Group Legal - Group Strategy - Human Resources - Internal Audit - Investor Relations - Risk Other - Brand & Marketing - External Audit Strategy Performance Risk management and governance Financial statements Shareholder information -

Page 158

...to the Board. One of our meetings in 2010 was held in Doha, where we received an update on our business operations in the Middle East. We also received updates on Brand & Marketing strategy, Investor Relations strategy, Sustainability and Franchise Health (covering customer and employee satisfaction... -

Page 159

... Corporate Governance and Nominations Committee is being extended to cover succession planning at business unit level. The form and content of strategy presentations has been revised to include enhanced financial and risk information. In addition to the regular monthly management accounts, the Board... -

Page 160

...our meetings. We dealt with a number of significant issues in 2010, primarily the succession planning for the appointment of a new Chief Executive, the process for which I describe on page 159. Our role in the annual review of Board effectiveness is described in my evaluation statement, which is set... -

Page 161

... Chief Executive position, covering both the general background/experience required and the desired attributes across a range of key competencies. Essential, of course, was that the next Chief Executive should have financial services experience and, given the size of our investment banking business... -

Page 162

... formal meetings I am in regular contact with Management, including the Group Finance Director, the Chief Risk Officer, the Chief Internal Auditor (who may raise with me any issues of concern) and the lead audit partner of our external auditors. During the year, I also visited the Group's businesses... -

Page 163

...online The Board Audit Committee terms of reference are available from the corporate governance section of our website at: www.barclays.com/corporategovernance Strategy Board Audit Committee Chairman's report continued - The Group's investment in BlackRock, Inc declined in value during 2010. As it... -

Page 164

...other attest and assurance services - accountancy advice and training - risk management and controls advice - transaction support - taxation services - business support and recoveries - translation services Fig. 8: Board Audit Committee allocation of time 2010 % 1 Control Issues 8 41 8 5 23 15 2009... -

Page 165

... end of September 2010. My report on the Committee's work during 2010 is set out below. What is our role? As a bank, Barclays is in the business of taking risk: taking appropriate levels of credit, market, capital and liquidity risk is how we generate profits. The Board Risk Committee is responsible... -

Page 166

... Group Executive Committee, which greatly assists the Committee's understanding of the issues faced by Management. 5 4 3 1 2 2 Key Risk Issues including ABS and Leveraged Credit Markets 3 Internal Control/Risk Policies 4 Regulatory Frameworks 5 Other (including remuneration and governance issues... -

Page 167

...AGM and report back to the Board on any significant issues that are raised. Directors regularly receive copies of analysts' reports and a monthly report from the Investor Relations team, which covers matters such as share price movement, analyst consensus, updates on market sentiment and shareholder... -

Page 168

...the risk profile of the Group - Reviewing the remuneration package for the new Chief Executive The Committee reports to the Board after every meeting and brings specific issues to it. In 2010 Board discussions on remuneration included remuneration strategy for the businesses, compensation ratios and... -

Page 169

...), Code Staff and senior management, deferred incentive awards for 2010 are made under the Share Value Plan (SVP) in the form of Barclays shares and under the Contingent Capital Plan (CCP) in the form of contingent capital awards. Vesting of contingent capital awards is linked to the Group's core... -

Page 170

... terms of reference were revised in both February 2010 and February 2011 in light of best practice and to take account of regulatory and corporate governance developments. The Committee met formally 11 times during 2010. The Chairman of the Committee reported to the Board on the substantive issues... -

Page 171

... them brilliantly Strategy Performance Risk management and governance iv) Pioneering - Driving new ideas, especially those that make Barclays profitable and improve control - Improving operational excellence - Adding diverse skills to stimulate new perspectives and bold steps v) Trusted - Acting... -

Page 172

... proper oversight. The Global Retirement Fund Governance Framework is operated to ensure best practice in respect of regulatory compliance, governance, investment and administration. As set out in the Committee's 2009 report, Barclays closed its UK Final Salary pension schemes to future accrual with... -

Page 173

... term incentive awards reward execution against the Group strategy and the creation of sustained growth in shareholder value. The awards are designed to align the most senior employees' goals with the long term success of Barclays Financial statements Shareholder information Retirement benefits... -

Page 174

... Diamond relates to his performance as Barclays Chief Executive from 2011. Table 6 sets out the annual base salaries for executive Directors. Table 7 sets out the executive Directors' retirement and other benefits. Mr Varley stepped down as Chief Executive, and from the Barclays Boards and the Group... -

Page 175

... performance condition metrics for the 2011 awards, and further details on the Barclays LTIP, are in the Notice of Meeting for the 2011 AGM at www.barclays.com/investorrelations. Pensions Mr Varley ceased to be an active member of the Group's non-contributory UK defined benefit pension scheme from... -

Page 176

... PLC Annual Report 2010 www.barclays.com/annualreport10 Corporate governance Remuneration report continued Outstanding share plan and long term incentive plan awards Barclays operates a number of share plans to align the interests of employees with shareholders and the execution of Group strategy... -

Page 177

... was £2.55. The Barclays share price at year end was £2.62. Strategy Performance Market price on release/ exercise date Number of shares lapsed in 2010 Number of shares under award/option at 31st December 2010 (maximum) Vested number of shares under option Value of release/exercise End of... -

Page 178

... and pension scheme rules. The Committee has reviewed its approach to executive Director service contracts in light of best practice and regulatory and corporate governance developments. The Committee does not intend to include automatic contractual incentive payments upon termination in relation to... -

Page 179

...the year are set out in Table 14. Details of non-executive Director beneficial interests in Barclays shares are set out in Table 15. Strategy Performance Table 14: 2010 fees Board Corporate Governance and Nominations Committee £000 Chairman £000 Deputy Chairman £000 Board Member £000 Board... -

Page 180

...-executive Directors are standing for re-election at the 2011 AGM. Table 16: Terms of letters of appointment Notice period from the Company Potential compensation for loss of office Effective date Group Chairman 12 months contractual remuneration 6 months fees 6 months fees 6 months fees 6 months... -

Page 181

.... Code Staff are the Group's employees whose professional activities could have a material impact on the Group's risk profile. Risk management and governance Table 20: Aggregate 2010 remuneration of Code Staff by business Barclays Capital (£m) Barclays Corporate (£m) Barclays Wealth (£m) Global... -

Page 182

180 Barclays PLC Annual Report 2010 www.barclays.com/annualreport10 Corporate governance Remuneration report continued Share plans and long term incentive plans Barclays operates a number of share plans and long term incentive plans. The principal plans under which awards were made in 2010 are ... -

Page 183

... a discount of 20% with shares or - Opportunity to purchase Barclays shares at a discount cash value of savings delivered price (currently at 20%) set on award date with savings after 3 - 7 years made over 3, 5 or 7 year term - Maximum individual saving of £250 per month (â,¬300 in Ireland, â,¬225... -

Page 184

... Code Staff and senior management future service and subject to plan - Awards vest over three years in equal annual tranches committee discretion dependant on future service and subject to plan committee discretion - The vesting of contingent capital awards is subject to the condition that the Group... -

Page 185

...comprehensive income 189 Consolidated balance sheet 190 Consolidated statement of changes in equity 191 Consolidated cash flow statement 192 Parent Company accounts 194 Notes to the financial statements Strategy Performance Risk management and governance Financial statements Shareholder information -

Page 186

... certain information required to be included in the Barclays PLC and Annual Report on Form 20-F for 2010. Form 20-F will contain as exhibits certificates pursuant to Sections 302 and 906 of the Sarbanes-Oxley Act of 2002, signed by the Chief Executive and the Group Finance Director. BBA Code for... -

Page 187

... the Directors' Report for the financial year for which the financial statements are prepared is consistent with the financial statements; and - the information given in the Corporate Governance Statement with respect to internal control and risk management systems and about share capital structures... -

Page 188

...on these financial statements and on the Company's internal control over financial reporting based on our integrated audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the... -

Page 189

... on debt buy-backs and extinguishments Other income Total income Net claims and benefits incurred on insurance contracts Total income net of insurance claims Impairment charges and other credit provisions Net income Staff costs Administration and general expenses Depreciation of property, plant and... -

Page 190

188 Barclays PLC Annual Report 2010 www.barclays.com/annualreport10 Consolidated financial statements Consolidated statement of comprehensive income For the year ended 31st December Profit after tax Other comprehensive income from continuing operations: Currency translation reserve - Currency ... -

Page 191

... Report 2010 www.barclays.com/annualreport10 189 About Barclays Consolidated financial statements Consolidated balance sheet As at 31st December Assets Cash and balances at central banks Items in the course of collection from other banks Trading portfolio assets Financial assets designated... -

Page 192

... Balance as at 1st January 2010 Profit after tax Other comprehensive income net of tax: Currency translation movements Available for sale investments Cash flow hedges Other Total comprehensive income for the year Issue of new ordinary shares Issue of shares under employee share schemes Net purchase... -

Page 193

...at central banks Loans and advances to banks with original maturity less than three months Available for sale treasury and other eligible bills with original maturity less than three months Trading portfolio assets with original maturity less than three months 2010 £m 2009 £m 2008 £m Strategy... -

Page 194

192 Barclays PLC Annual Report 2010 www.barclays.com/annualreport10 Financial statements of Barclays PLC Parent company accounts Income statement For the year ended 31st December Dividends received from subsidiary Interest income Trading gain Management charge from subsidiary Profit before tax ... -

Page 195

... cash, balances with central banks and other assets which had no credit or market risk. During 2008 Barclays Bank PLC issued £4,050m of Mandatorily Convertible Notes (MCNs), which had mandatorily converted into ordinary shares of Barclays PLC by 30th June 2009. Barclays PLC's right to receive... -

Page 196

... 2010 1 Significant accounting policies 1. Reporting entity These financial statements are prepared for the Barclays PLC Group under Section 399 of the Companies Act 2006. The Group is a major global financial services provider engaged in retail and commercial banking, credit cards, investment... -

Page 197

...of loans, shares or other securities or the purchase or sale of businesses, are recognised on completion of the underlying transaction. Portfolio and other management advisory and service fees are recognised based on the applicable service contracts. Asset management fees related to investment funds... -

Page 198

...investment strategy and reported to key management personnel on that basis. Regular way purchases and sales of financial instruments held for trading or designated under the fair value option are recognised on trade date, being the date on which the Group commits to purchase or sell the asset. Loans... -

Page 199

... as a financial liability. Loan commitments Loan commitments, where the Group has a past practice of selling the resulting assets shortly after origination, are held at fair value through profit or loss. Other loan commitments are accounted for in accordance with accounting policy 23. Financial... -

Page 200

... recognised impairment loss is reversed by adjusting the allowance account. The amount of the reversal is recognised in the income statement. Equity securities or properties acquired in exchange for loans in order to achieve an orderly realisation are accounted for as a disposal of the loan and an... -

Page 201

...as described in Note 36 to the accounts. All financial assets continue to be held on the Group balance sheet, and a liability recognised for the proceeds of the funding transaction, unless: a) substantially all the risks and rewards associated with the financial instruments have been transferred, in... -

Page 202

... hedge accounting are held at fair value through profit or loss. 13. Property, plant and equipment Property, plant and equipment is stated at cost less accumulated depreciation and provisions for impairment, if required. Cost includes the original purchase price of the asset and the costs directly... -

Page 203

...use in the business. The Group initially recognises investment properties at cost, and subsequently at their fair value at each balance sheet date reflecting market conditions at the reporting date. The fair value of investment property is determined by reference to current market prices for similar... -

Page 204

... and any related income tax. Dividend and other payments to equity holders are deducted from equity, net of any related tax. 18. Share capital Share issue costs Incremental costs directly attributable to the issue of new shares or options including those issued on the acquisition of a business are... -

Page 205

... using a methodology similar to that for defined benefit pensions plans. All expenses related to employee benefits are recognised in the income statement in staff costs, which is included within operating expenses. Strategy Performance Risk management and governance Financial statements Shareholder... -

Page 206

...the income statement over the period that employees provide services, which is generally the vesting period. The fair value of the options granted is determined using option pricing models, which take into account the exercise price of the option, the current share price, the risk-free interest rate... -

Page 207

... pension liabilities arising from defined benefit pension schemes to be recognised in full. In addition to the above, the IASB plans to issue new standards on Insurance Contracts, Consolidation, Fair Value Measurement, the Presentation of Other comprehensive Income and Revenue recognition. The Group... -

Page 208

...Barclays PLC Annual Report 2010 www.barclays.com/annualreport10 Notes to the financial statements For the year ended 31st December 2010 continued 2 Net interest income 2010 £m 2009 £m 2008 £m Cash and balances with central banks Available for sale investments Loans and advances to banks Loans... -

Page 209

... PLC Annual Report 2010 www.barclays.com/annualreport10 207 About Barclays 5 Net investment income 2010 £m 2009 £m 2008 £m Strategy Net gain from disposal of available for sale assets Dividend income Net gain/(loss) from financial instruments designated at fair value Other investment income... -

Page 210

...Barclays PLC Annual Report 2010 www.barclays.com/annualreport10 Notes to the financial statements For the year ended 31st December 2010 continued 8 Administration and general expenses continued Auditors' remuneration Auditors' remuneration is included within outsourcing and professional services... -

Page 211

...charge) principally relating to share based payments. Factors impacting income tax charge for the year The table below shows the reconciliation between the tax charge that would result from applying the standard UK corporation tax rate to the Group's profit before tax and the actual tax charge. 2010... -

Page 212

... for sale investments £m Pensions and other retirement benefits £m Allowance for impairment on loans £m Tax losses carried forwarda £m Share based payments £m Cash flow hedges £m Other provisions £m Other £m Total £m Assets Liabilities As at 1st January 2010 Income statement Equity... -

Page 213

... date, the Group continued to make on-market purchases of treasury shares for the purposes of satisfying its various employee share schemes. No adjustment has been made to earnings per share in respect of these purchases. Financial statements Risk management and governance 11 Dividends on Ordinary... -

Page 214

212 Barclays PLC Annual Report 2010 www.barclays.com/annualreport10 Notes to the financial statements For the year ended 31st December 2010 continued 12 Trading portfolio 2010 £m 2009 £m Debt securities Equity securities Traded loans Commodities Trading portfolio assets Debt securities Equity... -

Page 215

... purchase or sell a fixed amount of a currency at a specified exchange rate on or before a future date. As compensation for assuming the option risk, the option writer generally receives a premium at the start of the option period. Strategy Performance Risk management and governance Interest rate... -

Page 216

214 Barclays PLC Annual Report 2010 www.barclays.com/annualreport10 Notes to the financial statements For the year ended 31st December 2010 continued 14 Derivative financial instruments continued The Group's total derivative asset and liability position as reported on the balance sheet is as ... -

Page 217

... rate borrowings in issue, fixed rate loans to banks and customers and investments in fixed rate debt securities held. Currency derivatives are primarily designated as hedges of the foreign currency risk of net investments in foreign operations. Risk management and governance Financial statements... -

Page 218

216 Barclays PLC Annual Report 2010 www.barclays.com/annualreport10 Notes to the financial statements For the year ended 31st December 2010 continued 14 Derivative financial instruments continued The Group has hedged the following forecast cash flows, which primarily vary with interest rates. ... -

Page 219

... loans receivable. The related securities purchased or borrowed subject to an agreement with the counterparty to repurchase them are not recognised on-balance sheet where the risks and rewards of ownership remain with the counterparty. 2010 £m 2009 £m Strategy Banks Customers Reverse... -

Page 220

...PLC Annual Report 2010 www.barclays.com/annualreport10 Notes to the financial statements For the year ended 31st December 2010 continued 19 Goodwill and intangible assets Internally generated software £m Other software £m Core deposit intangibles £m Customer lists £m Mortgage servicing rights... -

Page 221

... projections include the estimated benefits from changes in product mix, improved product pricing and impairment levels coming back into line with historic loan loss rates. There is no impact from any cost restructuring or any future planned investments included within the forecasts. An increase in... -

Page 222

220 Barclays PLC Annual Report 2010 www.barclays.com/annualreport10 Notes to the financial statements For the year ended 31st December 2010 continued 20 Property, plant and equipment Investment property £m Property £m Equipment £m Leased assets £m Total £m 2010 Cost As at 1st January 2010 ... -

Page 223

... associated with the Group's short-term non-life business are £131m (2009: £132m). The maximum amounts payable under all of the Group's insurance products, ignoring the probability of insured events occurring and the contribution from investments backing the insurance policies were £71bn (2009... -

Page 224

... Notes to the financial statements For the year ended 31st December 2010 continued 23 Subordinated liabilities Subordinated liabilities, which are all issued by Barclays Bank PLC ('The Bank') or other subsidiaries of the Group, include accrued interest and comprise dated and undated loan capital... -

Page 225

Barclays PLC Annual Report 2010 www.barclays.com/annualreport10 223 About Barclays 23 Subordinated liabilities continued Interest All undated loan capital bears a fixed rate of interest until the initial call date, with the exception of the 9% Bonds which are fixed for the life of the issue, and... -

Page 226

... Barclays PLC Annual Report 2010 www.barclays.com/annualreport10 Notes to the financial statements For the year ended 31st December 2010 continued 23 Subordinated liabilities continued Dated loan capital Non-convertible Barclays Bank PLC 12% Unsecured Capital Loan Stock 5.75% Subordinated Notes... -

Page 227

... Tier 2 Notes were registered under the US Securities Act of 1933. All other issues of dated loan capital have been made in the euro currency market, local markets and/or under Rule 144A. Repayment terms Those Notes with a call date are repayable at the option of the issuer, on conditions governing... -

Page 228

...securities held by funds under management were lent to third parties. Borrowers provided cash or investment grade assets as collateral equal to 100% of the market value of the securities lent plus a margin of 2%-10%. The Group agreed with BlackRock, Inc. to continue to provide indemnities to support... -

Page 229

... the United States District Court for the Southern District of New York. The consolidated amended complaint, dated 12th February 2010, alleges that the registration statements relating to American Depositary Shares representing Preferred Stock, Series 2, 3, 4 and 5 (ADS) offered by Barclays Bank PLC... -

Page 230

... the defined period Barclays meets the conditions set down in its agreements with the US Authorities. Barclays does not anticipate any further regulatory actions relating to these issues. 28 Retirement benefit obligations Pension schemes The Group has in place a number of defined benefit and defined... -

Page 231

... salary. - The Pension Investment Plan (PIP): a defined contribution plan created from 1st July 2001 to provide benefits for employees of Barclays Capital. The costs of ill-health retirements and death in service benefits are generally borne by the UKRF. Governance The UKRF operates under trust... -

Page 232

... Group's defined benefit schemes are actuarially valued using the projected unit credit method. Principal assumptions UK schemes 2010 % p.a. 2009 % p.a. Overseas schemes 2010 % p.a. 2009 % p.a. Discount rate Rate of increase in salaries Inflation rate Rate of increase for pensions in payment Rate... -

Page 233

... equities, bonds, property and other appropriate assets. This recognises that different asset classes are likely to produce different long-term returns and some asset classes may be more volatile than others. The long-term strategy ensures that investments are adequately diversified. Asset managers... -

Page 234

... within Equities. Amounts included in the fair value of plan assets include £14m (2009: £4m) relating to shares in Barclays Group, £13m (2009: £5m) relating to bonds issued by the Barclays Group, and £10m (2009: £10m) relating to property occupied by Group companies. The UKRF also invests in... -

Page 235

...of long-term future investment returns from the current and assumed future investment strategy. The Scheme Actuary prepares an annual update of the funding position as at 30th September. The latest annual update was carried out as at 30th September 2010 and showed a deficit of £4.8bn. The Group has... -

Page 236

...Barclays PLC Annual Report 2010 www.barclays.com/annualreport10 Notes to the financial statements For the year ended 31st December 2010 continued 29 Ordinary shares, share premium, and other equity Called up share capital, allotted and fully paid As at 1st January 2010 Issued to staff under share... -

Page 237

... Non-controlling interests Profit attributable to Non-controlling interests 2010 £m 2009 £m Equity attributable to Non-controlling interests 2010 £m 2009 £m Strategy Barclays Bank PLC issued: - Preference shares - Reserve Capital Instruments - Upper Tier 2 instruments Absa Group Limited Other... -

Page 238

... information in relation to such entities as required by the Companies Act 2006 Section 410(2)(b). Percentage of ordinary share capital held % Equity shareholders' funds £m Retained Profit for the year £m Country of registration or incorporation Name UK Cayman Islands Fitzroy Finance Limited... -

Page 239

Barclays PLC Annual Report 2010 www.barclays.com/annualreport10 237 About Barclays 34 Discontinued operations continued The Group has provided BlackRock with customary warranties and indemnities in connection with the sale. Barclays will also continue to indemnify securities lending arrangements... -

Page 240

...Report 2010 www.barclays.com/annualreport10 Notes to the financial statements For the year ended 31st December 2010 continued 35 Acquisition of subsidiaries Goodwill/ (Gain on sale) £m % Acquired Acquisition Date Standard Life Bank PLC Citibank International PLC - Italian credit card business... -

Page 241

Barclays PLC Annual Report 2010 www.barclays.com/annualreport10 239 About Barclays 36 Securitisations The Group was party to securitisation transactions involving its residential mortgage loans, business loans and credit card balances. In addition, the Group acts as a conduit for commercial ... -

Page 242

240 Barclays PLC Annual Report 2010 www.barclays.com/annualreport10 Notes to the financial statements For the year ended 31st December 2010 continued 37 Leasing The Group is both lessor and lessee under finance and operating leases, providing asset financing for its customers and leasing assets ... -

Page 243

...sell consumer or trade receivables to the conduit, which then issues commercial paper to investors to fund the purchase. The conduits have sufficient collateral, credit enhancements and liquidity support to maintain an investment grade rating for the commercial paper. Asset securitisations The Group... -

Page 244

... Barclays PLC Annual Report 2010 www.barclays.com/annualreport10 Notes to the financial statements For the year ended 31st December 2010 continued 38 Off-balance sheet arrangements continued Client intermediation The Group has structured transactions as a financial intermediary to meet investor... -

Page 245

... expiry of a fixed term of three, five or seven years (Spain: three years) have the option to use these savings to acquire shares in the Company at a discount, calculated in accordance with the rules of the scheme. The discount is currently 20% of the market price at the date the options are granted... -

Page 246

... performance conditions are substantially completed at the date of grant. Consequently the fair value of these awards is based on the market value at that date. As described above, the terms of the ESAS scheme require shares to be held for a set number of years from the date of vest. The calculation... -

Page 247

Barclays PLC Annual Report 2010 www.barclays.com/annualreport10 245 About Barclays 39 Share-based payments continued Movements in options Analysis of the movement in the number and weighted average exercise price of options for the major schemes is set out below: ESASa,b Number (000s) 2010 2009 ... -