Bank of the West 2006 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2006 Bank of the West annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We offer a broad array of banking products and services

that help commercial customers manage their companies,

enable small businesses to grow, assist consumers to meet

their nancial goals and support the economic health of

our communities.

Banking on

R E L A T I O N S H I P S

4

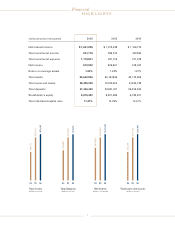

Relationship banking has been the

key to growth and success at Bank of

the West ever since our founding

as a California community bank in

1874. With assets of $55.6 billion and

3.75 million business and household

accounts, Bank of the West is among

the 25 largest regional commercial

banks in the United States and the

second largest bank headquartered

in California.

Bank of the West has more than 700

branch, commercial and specialty

business locations in 19 states:

Arizona, California, Colorado, Idaho,

Iowa, Kansas, Minnesota, Missouri,

Nebraska, Nevada, New Mexico,

North Dakota, Oklahoma, Oregon,

South Dakota, Utah, Washington,

Wisconsin and Wyoming.

Throughout our entire network, we

offer a broad array of banking

products and services that help

commercial customers manage their

companies, enable small businesses

to grow, assist consumers to meet

their financial goals and support the

economic health of our communities.

“Relationship banking starts with

understanding the company’s

business and proactively

delivering products and services

that meet all of the customer’s

commercial banking needs.”

-Kevin Murphy

Commercial Relationship Banker, CA

Middle market companies and small

businesses will find a large bank

product set available, including capital

markets, cash management, credit

cards, equipment finance, foreign

exchange, loan syndication, SBA loans,

trade finance and wealth management.

These commercial banking services

are available throughout our regional

network. Our commercial bankers

serve all industry segments, and

we have specialized expertise in

agribusiness, commercial real estate,

construction, financial institutions,

healthcare, municipalities and religious

institutions.

Our branch network provides

comprehensive banking services for

individuals and small business owners

that include checking, credit card

and savings accounts, direct consumer

loans and lines of credit, mortgages,

insurance, investment products,

construction loans and private banking

services as well as BusinessLink and

AgLink, our specialized loan products

for small business. To facilitate

efficient and timely delivery of our

broad product set, we have decentral-

ized operations at eight regional

centers: Albuquerque, Denver, Fargo,

Los Angeles, Omaha, Portland,