Bank of Montreal 1998 Annual Report Download

Download and view the complete annual report

Please find the complete 1998 Bank of Montreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98

THE YEAR EVERYTHING CHANGED

BANK OF MONTREAL GROUP OF COMPANIES

181ST A N N U A L R E P O R T 19 9 8

Table of contents

-

Page 1

B A N K OF M O N T R E A L G R O U P OF C O M P A N I E S 19 9 8 181ST A N N U A L R E P O R T 98 THE YEAR EVERYTHING CHANGED -

Page 2

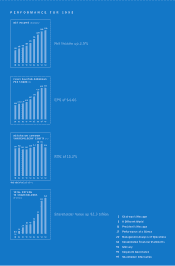

...) 14.6 15.9 8.8 Shareholder Value up $1.3 billion 2 5 13 17 Chairman's Message A Different World President's Message Performance at a Glance Management Analysis of Operations Consolidated Financial Statements Glossary Corporate Governance Shareholder Information 5.8 4.0 4.2 2.8 1.2 (0.4) 90 91... -

Page 3

..., credit and debit cards, Cebra ®†Inc., North American cash management, BMO Global Custody, and the Bank's interest in Grupo Financiero Bancomer. Investment and Corporate Banking (I&CB) Together, Nesbitt Burns, Global Treasury and Trading, the Asset Management Services Group, the Merchant Bank... -

Page 4

... Bond Obligation Group ranks among the largest high-yield managers in Canada. Integrated Trade Finance with Global Financial Institutions and Governments. â- â- â- â- Establish a "best in class" Risk Management Group. Asset Portfolio Management Group to pro-actively manage corporate assets... -

Page 5

... ï¬nancial services around the world. Bank of Montreal responded strongly in 1998 with our proposed merger with Royal Bank of Canada. We were disappointed by the Canadian government's decision to reject the merger, but our well-developed strategic framework for value-based management shows us... -

Page 6

... YEAR EVERY THING CHANGED CHAIRMAN'S MESSAGE Our Annual Report's theme this year makes a dramatic claim, but one that has been well justiï¬ed in the event. On January 23, 1998, we announced our agreement to merge with Royal Bank of Canada, long one of our most important competitors. Under Canadian... -

Page 7

...some of the largest full-service banks in the world. Others are "monoline" companies, specializing in a single product such as credit cards or home mortgages, and often having more assets in that single product line than all the Canadian banks together. As yet the market share of the new arrivals is... -

Page 8

... work by many people, planning for value-based management is already well advanced. We will begin to make it operational in 1999. . . . The past year saw Bank of Montreal employees support our merger strategy by writing letters to MPs, taking part in talk shows and organizing highly successful... -

Page 9

...Darwinism" or "the law of the jungle." The reality is that successful businesses not only adapt to changes in their environment, they anticipate change and help to drive change through the development and delivery of new products and services. The following essays discuss some of the major forces of... -

Page 10

... services supermarket to customers around the globe. By the end of the year 2000, close to 20% of families in Canada and the United States will do their banking on the Internet, representing close to one-third of proï¬ts in retail banking. In the technology businesses themselves, the old order... -

Page 11

-

Page 12

...in Canada, the United States and Britain. Bond mutual funds handily outperformed equity funds, for most of 1998, which demonstrated anew the value of diversiï¬cation. This is the ï¬rst economic cycle in which a majority of North American investors have been able to get the information and products... -

Page 13

-

Page 14

... The Home Depot for home improvement materials. But today's innovation is often yesterday's news. While Chapters' superstores were busy introducing Canadians to a dramatically different way to buy books, Seattle-based Amazon.com changed the landscape again by selling discounted books on the Internet... -

Page 15

-

Page 16

... and businesses in Canada. Bank of Montreal provided $63.7 billion to individuals and small and medium-sized businesses in 1998. FINANCIAL SUCCESS Strong ï¬nancial performance is good news to the millions of Canadians who own bank shares, our 33,400 employees who earned $2.6 billion in salaries... -

Page 17

... Canadian or U.S. Money-Centre bank. Our primary measure of success in maximizing shareholder value - the ï¬ve-year annualized return on investment - was 23.3% in 1998, exceeding the Toronto Stock Exchange 300 Composite Index by 1320 basis points over the same period. From a longer-term perspective... -

Page 18

...the lines of business, Emï¬sys TM, the new technology and process division launched at the beginning of the ï¬scal year, will also contribute substantially to the maximization of shareholder value. ADVANCIN G RISK MANAGE ME NT We continued to redefine traditional branch banking in 1998 by opening... -

Page 19

... most appropriate mutual fund and optimal asset mix to deliver the anticipated return within acceptable risk levels. We continued to improve electronic access for our corporate customers thanks to the electronic launch of our Foreign Exchange transfer and Canadian Treasury Money Market services. The... -

Page 20

...personal best. In 1998, that belief translated into an average of 7.2 training days per employee and a $63 million investment in training. With the long term ï¬rmly in mind, our Institute for Learning also sowed the seeds of a people management initiative designed to revolutionize the way we relate... -

Page 21

... in North America (the North American peer group). Top tier means being in the top two of the Canadian peer group and in the top six of the North American peer group. Deï¬nitions of the ten ï¬nancial measures are provided in the Management Analysis of Operations section of the 1998 Annual Report... -

Page 22

... of 66.5% and below the North American peer group average of 63.1%. 62.0 66.5 64.3 63.4 64.4 Canadian Peer Group: Average North American Peer Group: Below Average 94 95 96 97 98 Bank of Montreal Canadian Peer Group Average North American Peer Group Average Top tier means being in the top two... -

Page 23

... for ranking purposes. (c) The reported numbers for National Bank of Canada were restated to reflect the addition to the general allowance for credit losses as a charge to current year income instead of a direct charge to retained earnings. (d) Condition ratios are as at October 31, 1998. 2 Top Tier... -

Page 24

... in 1997. Expense growth reflected strategic development spending, foreign exchange rate impact on U.S.-based expenses and business volume growth, net of productivity improvements and offset in part by the impact of a 1997 fourth quarter charge of $75 million. â- 94 95 96 97 98 NET INCOME BY... -

Page 25

... Market Risk Liquidity Risk Operational Risk More information can be found on page 43. â- Credit Risk Management â- Our asset quality remained high. The provision for credit losses as a percentage of average loans and acceptances for 1998 was 0.09% compared to 0.23% for 1997. Loan portfolios... -

Page 26

... of equity and allowance for credit losses, Tier 1 ratio and cash and securities-to-total assets. Our below average revenue growth and expense-to-revenue ratios in 1998 reflected the unusual market conditions in the fourth quarter on several of our institutional businesses and Bancomer, as well as... -

Page 27

RELATIVE FINANCIAL CONDITION Top tier means being in the top two of the Canadian peer group, and in the top six of the North American peer group. Bank of Montreal Canadian Peer Group Average North American Peer Group Average PROVISION FOR CRE DIT LOS SES A S A % O F AV E R A G E LOA N S A N D A C ... -

Page 28

...Services Electronic Financial Services Harris Regional Banking Investment and Corporate Banking Portfolio and Risk Management Group Financial Condition 43 49 51 54 Enterprise-wide Risk Management Capital Management Economic Outlook and Global Developments Supplemental Information From time to time... -

Page 29

... of long-term success in increasing shareholder value. Five-year ROI is calculated as the annualized total return earned on an investment in Bank of Montreal common shares made at the beginning of a five-year period. Total return includes the effect of the change in share price and the reinvestment... -

Page 30

... is then deducted to arrive at NEP. The rate applied to capital to determine the charge is calculated as the average yield on 10-year Government of Canada Bonds, plus a 5% premium for the risk of investing in Bank of Montreal common shares. This charge is labelled cost of equity in the table on this... -

Page 31

... groups. Corporate Support also includes the impact of asset securitizations as described in the Capital Management section on page 50. In 1998 our retail and commercial segment had a strong year while the results of our institutional segment were negatively impacted by unusual capital market... -

Page 32

...be found in the Credit Risk section of Enterprise-wide Risk Management on page 44. Expense growth of 4.7%, the lowest level in nine years, was driven by continued strategic initiatives such as mbanx® and telephone banking, the foreign exchange rate impact on U.S.-based expenses and ongoing business... -

Page 33

...minimum standard is the economic threshold, which reï¬,ects the rate of return that can be earned on a long-term, "risk-free" investment plus an appropriate risk premium. This threshold is set conservatively by the Board of Directors at the beginning of each ï¬scal year, based on the projected cost... -

Page 34

... change 1998 63 10 31 95 31 (3) 227 1997 59 8 26 80 23 1 197 % change Personal and Commercial Financial Services Electronic Financial Services Harris Regional Banking Investment and Corporate Banking Portfolio and Risk Management Group Corporate Support Total Bank Total Bank margin (basis points... -

Page 35

... charges, commission revenue and trading revenue. 1998 1997 1996 1995 1994 Deposits and payment service charges Lending fees Capital market fees Card services Investment management and custodial fees Mutual fund revenues Trading revenue Securitization revenues Other fees and commissions Total... -

Page 36

... Banking Total Trading - Global Financial Products (derivatives) - Foreign Exchange - Global Distribution Trading - Institutional Equities, Fixed Income & Other Proprietary Trading Total Trading - Other Total Portfolio and Risk Management Group Total Trading - Collateralized Bond Obligations Harris... -

Page 37

...Employees 34% Suppliers 26% Loan Losses 2% Net Income Before Government Taxes and Levies 38% Shareholders 56% Government 44% Dividends Increased Capital in the Bank *Note: Investment Revenue represents capital market fees, investment management and custodial fees and mutual fund revenues; Canadian... -

Page 38

...expense growth. Expense growth in 1998 was 4.7% compared to 16.8% last year. Contributing to expense growth this year were increased business volumes resulting from a strong North American economy, increased spending on strategic development and the foreign exchange impact of a lower Canadian dollar... -

Page 39

... & Corporate Banking Portfolio & Risk Management Group Corporate Support (b) Total Consolidated 1998 1997* 1998 1997* 1998 1997* 1998 1997* 1998 1997* 1998 1997* 1998 1997* Net Income Canada United States Mexico Other Countries Total Average Assets Canada United States Mexico Other... -

Page 40

...businesses across Canada, and in 1998 contributed 48.1% of our net income for the year and 27.9% of our total average assets. Customer Proï¬le: PCFS provides a full range of ï¬nancial products and services to Canadian individuals and small to medium-sized businesses in all market sectors. Changing... -

Page 41

... small business loan processing services to small and medium-sized U.S. ï¬nancial institutions. Formed Corporate Finance Teams in Toronto, Vancouver and Montreal to deliver leading edge ï¬nancial engineering solutions, capital market alternatives and loan syndications. TM â- â- Developed the... -

Page 42

... of Technology New functionality was added to the on-line MasterCard web site, allowing cardholders to use self-serve secure Internet web pages to check account balances, examine recent transactions, review statements and make special requests, such as credit limit increases and address changes... -

Page 43

... merchant and retail card businesses, partly offset by narrower credit card margins due to intense competition from new foreign competitors. Corporate EFS beneï¬ted from higher foreign exchange gains, strong growth in NACM and the success of Cebra's new product offerings. Higher expenses relate... -

Page 44

... transfer and ninth-largest bond indenture provider in the United States. Harris is the centrepiece of our U.S. strategy, providing 17.0% of our total net income in 1998, and holding 13.7% of our total average assets. Customer Profile: Harris serves individuals, small and lower mid-market businesses... -

Page 45

... as securities gains, higher revenues from trust and syndication fees and income from other customer services. Non-interest expenses increased by $149 million, or 21.8%, in 1998 as a result of expanding banking operations, and the resulting business growth. The provision for credit losses increased... -

Page 46

...range of ï¬nancial products and services to individual investors and, together with Global Corporate Banking, offers products to address the capital and advisory needs of our corporate, government and institutional clients. Treasury provides foreign exchange, money market, derivative products, loan... -

Page 47

...-term assets. Within Treasury, revenue growth came primarily from foreign exchange and derivative products which beneï¬ted from volatility in interest rates and currency markets. The Merchant Bank was successful in 1998 realizing a gain on the sale of one of its initial investments. Expenses were... -

Page 48

... of Montreal Investor Services Limited, provides clients in Canada with direct electronic access to their trading accounts. Institutional money management is conducted through Jones Heward Investment Counsel and Harris Investment Management, Inc. Teams of investment counselors manage pension funds... -

Page 49

...group, and manage credit risk taken by Global Treasury in its trading activities. The Collateralized Bond Obligation†Group uses state-of-the-art risk management techniques to provide investors in high-yield instruments with leading-edge portfolio management services. Global Financial Institutions... -

Page 50

... as FC CBO II) for US$1 billion closed in 1998, adding to the ï¬rst US$1 billion (FC CBO) established last year. At present, the CBO portfolio has just over US$2 billion in assets under management, which ranks the CBO Group among the largest high-yield managers in Canada and among the Top 25 in the... -

Page 51

... Treasury products. The same credit process is used for all forms of credit risk with the same clients. MA RK ET CRE DI TR I S K RI SK Market risk is the potential for loss arising from potential adverse changes in underlying market factors, including interest and foreign exchange rates... -

Page 52

... predominant lending product in the loans to individuals portfolio, representing 66.4% of total loans to individuals. Credit card assets represent only 0.4% of our total assets as a result of our card securitizations ($2.5 billion to date) in Canada and the sale of our U.S. card business to Partners... -

Page 53

... impaired loan totals in recent years was the generally favourable economic environment in our major markets. In addition, our monitoring models for larger corporate loans assisted us in detecting quality deterioration early, providing us with a broader range of options to address emerging problems... -

Page 54

... risk. These measures calculate the impact on net income over the next 12 months of a onetime increase in market rates or prices and the impact on the value of our assets and liabilities of adverse changes in market rates or prices over the period that would be required to eliminate open positions... -

Page 55

... rate and cross-currency swaps, forward rate agreements (FRAs), caps and floors, as well as other types of options†. We use financial derivatives to manage market risk for both trading and hedging purposes. We also offer derivative products to customers for their own risk management and investment... -

Page 56

... capital markets usually involves funds that are two to ten years in term. Asset securitization provides an alternate source of funds through the sale of assets. During 1998 we securitized $9.7 billion of assets. Further information about securitization can be found in the Capital Management section... -

Page 57

... line of business. Its primary use is evaluating investment decisions and measuring performance through RAROC. Improved Capital Ratios Our Tier 1 Ratio increased to 7.26% in 1998 from 6.80% in 1997, while risk-weighted assets increased 12.4%. This was made possible by active balance sheet management... -

Page 58

...: How does this affect us? Reduced net interest revenue Increased other income Reduced provision for credit losses Impact on net income before tax Improved Tier 1 Ratio (basis points) 1998 1997 (128) 68 (50) (10) 35 (17) 16 - (1) 10 For additional information refer to note 7 to the consolidated... -

Page 59

... the U.S. economy. Increases in short-term interest rates between June 1997 and August 1998 dampened consumer and business spending in Canada. As a result, the Canadian unemployment rate, though down slightly from late 1997, remained above 8%. Low commodity prices also pushed the Canadian dollar to... -

Page 60

... of fragile emerging markets is to restrict our exposures to: short-term treasury activities with leading banks; trade ï¬nance primarily in support of our North American exporting clients; and â- â- selective project and corporate ï¬nancings predicated on hard-currency cash flow generating... -

Page 61

...business risks imposed by the year 2000 issue are addressed. We have established a governance structure to deal with this issue, which includes a Project Management Ofï¬ce and regular monitoring of progress by the Bank's Year 2000 Steering Committees and the Board of Directors. The process for year... -

Page 62

... income (TEB) (c) Other income Total revenues (TEB) (c) Provision for credit losses Non-interest expense Income before provision for income taxes and non-controlling interest in subsidiary Provision for income taxes (TEB) (c) Non-controlling interest in subsidiary Net income/(loss) Year-over-year... -

Page 63

... U.S. dollar and other currencies spread (%) Other Income Deposit and payment service charges Lending fees Capital market fees Card services Investment management and custodial fees Mutual fund revenues Trading revenue Securitization revenues Other fees and commissions Revenue from insurance-related... -

Page 64

...year ended October 31 Average balances Average interest cost (%) Interest expense Average balances Average interest cost (%) Interest expense Average balances Average interest cost (%) Interest expense Liabilities Canadian Dollars Deposits Banks Businesses and governments Individuals Total... -

Page 65

... balance Average rate Assets Canadian Dollars Deposits with other banks Securities Loans Residential mortgages Non-residential mortgages Consumer instalment and other personal loans Credit card loans Loans to businesses and governments (a) Total loans Change in Canadian dollar interest income... -

Page 66

... 31 of each respective year. It represents the position outstanding at the close of the business day and may change significantly in subsequent periods based upon customer preferences and the application of the Bank's asset and liability management policies. The assumptions for 1998 are as follows... -

Page 67

... charge Business process improvement initiative charge Total non-interest expense Government Levies and Taxes (c) Government levies other than income taxes Payroll levies Property taxes Provincial capital taxes Business taxes Goods and services tax and sales tax Deposit insurance Total government... -

Page 68

...Canada (a) As at October 31 United States (a) 1995 1994 1998 1997 1996 1995 1994 1998 1997 Mexico (a) 1996 1995 1994 1998 1997 1996 Allowance for credit losses (ACL), beginning of year Provision for credit losses Transfer of allowance Recoveries Write-offs (e) Other, including foreign exchange... -

Page 69

... Mining/Energy Service industries Retail trade Wholesale trade Agriculture Transportation/Utilities Communications Other Total commercial, corporate and institutional (c) Net charge to earnings for general provision Designated lesser developed countries Total provision for credit losses (PCL) 7 26... -

Page 70

...noted) Canada (a) As at October 31 United States (a) 1995 1994 1998 1997 1996 1995 1994 1998 1997 Mexico (a) 1996 1995 1994 1998 1997 1996 Individuals Residential mortgages Cards Personal loans Total individuals Diversified commercial (b) General allowance Designated lesser-developed countries... -

Page 71

...Specific Allowance by Industry Financial institutions Commercial mortgages Construction (non-real estate) Commercial real estate Manufacturing Mining/Energy Service industries Retail trade Wholesale trade Agriculture Transportation/Utilities Communications Other Total diversified commercial specific... -

Page 72

...-developed countries (LDC) Associated corporations High yield securities /distressed portfolio (f) Other securities General allowance for credit losses Fair value of past due interest bonds Loans to designated LDC 885 41 2 928 Total (a) Loans and acceptances returning to performing status, sales... -

Page 73

... Total Canadian dollar deposits U.S. Dollar and Other Currencies Deposits Banks Businesses and governments Individuals Total U.S. dollar and other currencies deposits Total deposits (a) Changes to the capital adequacy guidelines require risk-weighted balances to include market risk. Market risk... -

Page 74

... 32,522 Balance Sheet Data Total assets Cash resources Securities Loans (net) Acceptances Other assets Deposits Total capital funds Common equity Average assets (a) Total pledged assets Statement of Income Interest, dividend and fee income Loans Securities Deposits with banks Total interest income... -

Page 75

... for credit losses (g) Tier 1 ratio* (h) Cash and securities-to-total assets (i) Credit rating (j) Other Financial Ratios (%) Return on average total equity (k) Return on common shareholders' investment (l) Return on average assets Return on average assets available to common shareholders Net income... -

Page 76

...This section of the Annual Report presents our Consolidated Financial Statements for the year ended October 31, 1998, Statement of Management's Responsibility for Financial Information and Shareholders' Auditors' Report. The audited Consolidated Financial Statements present our ï¬nancial condition... -

Page 77

... (note 3) Securities (notes 4 & 6) Investment (market value $24,460 in 1998 and $19,023 in 1997) Trading Loan substitutes Loans (notes 5, 6 & 7) Residential mortgages Consumer instalment and other personal loans Credit card loans Loans to businesses and governments Securities purchased under... -

Page 78

... for credit losses Net Interest Income After Provision for Credit Losses Other Income Deposit and payment service charges Lending fees Capital market fees Card services Investment management and custodial fees Mutual fund revenues Trading revenues Securitization revenues (note 7) Other fees and... -

Page 79

... a foreign currency Balance at End of Year 1998 Common Shares (note 14) Balance at beginning of year Issued under the Shareholder Dividend Reinvestment and Share Purchase Plan Issued under the Stock Option Plan Issued on the exchange of shares of Bank of Montreal Securities Canada Limited Purchased... -

Page 80

...deferred loan fees Net (increase) decrease in unrealized gains and amounts receivable on derivative contracts Net increase in unrealized losses and amounts payable on derivative contracts Net (increase) decrease in trading securities Net increase (decrease) in current income taxes payable Changes in... -

Page 81

... of foreign currencies and report our consolidated financial statements in Canadian dollars. Assets, liabilities and shareholders' equity related to foreign currency transactions are translated into Canadian dollars at the exchange rate in effect at the balance sheet date. The income and expense... -

Page 82

... note 5. 1998 5 to 10 years Yield % Yield % Over 10 years Yield % Total book value Yield % Term to maturity Within 1 year 1 to 3 years Yield % 3 to 5 years 1997 Total book value Investment Securities Yield Issued or guaranteed by: % Canadian federal government $ 1,536 4.83 Canadian provincial and... -

Page 83

... Gross unrealized losses 1998 Market value Book value Gross unrealized gains Gross unrealized losses 1997 Market value Investment Securities Issued or guaranteed by: Canadian federal government Canadian provincial and municipal governments U.S. federal government U.S. states, municipalities and... -

Page 84

... classiï¬ed as impaired: Canada United States Mexico Other countries Total 1998 Residential mortgages Consumer instalment and other personal loans Credit card loans Loans to businesses and governments Securities purchased under resale agreements Securities of designated countries Loan substitute... -

Page 85

... in the allowance for credit losses are: Specific allowances General allowance Country risk allowance Total 1998 Balance at beginning of year Provision for credit losses Transfer of allowance Recoveries Write-offs Other, including foreign exchange rate changes Balance at end of year $ 366 20 - 64... -

Page 86

..., average assets, loans and deposits, is set out in the tables on pages 31 to 42 of our Management Analysis of Operations. Non-interest bearing Payable after notice Payable on a fixed date Total 1998 Deposits by: Banks Businesses and governments Individuals Total Booked in: Canada United States... -

Page 87

... not own at the time of sale. These obligations are recorded at their market value. Adjustments to the market value as at the balance sheet date and gains and losses on the settlement of these obligations are recorded as interest, dividend and fee income from securities in our Consolidated Statement... -

Page 88

... starting... Redeemable for... Convertible... Convertible starting... Convertible into... Dividend Rate and Terms Preferred Shares Class A At our option Series 4 September 20, 1999 $25.00 cash per share or an equivalent value of our common shares. Not convertible - - Quarterly, non-cumulative... -

Page 89

... Nesbitt Burns Corporation Limited, a subsidiary of Bank of Montreal Securities Canada Limited, has issued non-voting Class D shares which are exchangeable for our common shares. However, we have the option of redeeming these shares for cash, if we choose, with the amount based on the net book value... -

Page 90

...) related to foreign currency translation reported in shareholders' equity Total Components of Total Income Taxes Canada: Current income taxes Federal Provincial Future income taxes Federal Provincial 1998 $ 804 1997 $ 840 1996 $ 757 Changes in Accounting Policies The Canadian Institute of... -

Page 91

... pension expense Canada and Quebec pension plan contribution Total annual pension expense Actuarial Assumptions Weighted average discount rate for projected benefit obligation Weighted average rate of compensation increase Weighted average expected long-term rate of return on pension plan assets... -

Page 92

... Institutions Canada. The risk-weighted equivalent value is used in the ongoing assessment of our capital adequacy ratios. 1998 Contract amount Risk-weighted equivalent Contract amount 1997 Risk-weighted equivalent Credit Instruments Guarantees and standby letters of credit Securities lending... -

Page 93

... sheet positions, including derivatives, which are marked to market. The revenue generated by these units is disclosed on page 28 of the Management Analysis of Operations. Losses incurred on defaults of counterparties charged to the allowance for credit losses in the years ended October 31, 1998... -

Page 94

... swaps 5,345 - Cross-currency interest rate swaps 25,433 3,165 Forward foreign exchange contracts 265,912 9,257 Purchased options 38,381 - Written options 45,025 - 380,096 Exchange traded Futures Purchased options Written options 1,655 2,615 421 4,691 Total Foreign Exchange Contracts 384,787 12,422... -

Page 95

..., 1997. Transactions are conducted with counterparties in various geographic locations and industries. Based upon the ultimate risk, the replacement cost of contracts is recorded from customers located in: 1998 Canada United States Mexico Other countries Total $ 3,554 4,349 16 4,913 $ 12,832 28% 34... -

Page 96

... Foreign Exchange Contracts Cross-currency swaps Cross-currency interest rate swaps Forward foreign exchange contracts Futures Purchased options Written options Commodity Contracts Swaps Futures Purchased options Written options Equity Contracts Total Fair Value Total Book Value Average Fair Value... -

Page 97

...Securities and Exchange Commission to report all material differences between Canadian and United States accounting principles. There are no material differences in the consolidated total assets and liabilities as at October 31, 1998 and 1997 or the consolidated net income, consolidated shareholders... -

Page 98

...C.A. (signed) Executive Vice-President and Chief Financial Officer SHAREHOLDERS' AUDITORS' REPORT To the Shareholders of Bank of Montreal We have audited the consolidated balance sheets of Bank of Montreal as at October 31, 1998 and 1997 and the related consolidated statements of income, changes in... -

Page 99

... Montreal Global Capital Solutions Ltd. Bank of Montreal Holding Inc. Bank of Montreal Asia Limited Bank of Montreal Insurance (Barbados) Limited Bank of Montreal Securities Canada Limited The Nesbitt Burns Corporation Limited and subsidiaries BMO Investments Ltd. Bank of Montreal Investor Services... -

Page 100

... the transfer, modiï¬cation or reduction of current or expected risks from changes in interest rates, foreign exchange rates, and equity and commodity prices. See also individual deï¬nitions of forwards and futures, forward rate agreements, options and swaps. Duration A measure of the average time... -

Page 101

... governance. In 1998, Investor Relations Magazine presented the Bank with one of its Canada Awards in recognition of corporate governance policies that best support the interests of shareholders. The Bank also this year received the 1998 Annual Report Award, sponsored by the Canadian Institute... -

Page 102

... well as the process for selection of independent directors. Governance Committee is also responsible for director succession planning. All committees are composed of outside directors except Executive Committee, of which Chairman and CEO and President and COO are members, and Risk Review Committee... -

Page 103

... meeting fees in stock or deferred share units. â- â- Directors' compensation is annually benchmarked against Canadian and North American peer groups. Governance Committee recommends to the Board the level and nature of directors' compensation. Management Executive compensation is determined... -

Page 104

... The Nesbitt Burns Corporation Limited Lloyd F. Darlington Chief Technology Ofï¬cer and General Manager, Emfisys Yvan J.P . Bourdeau Executive Vice-President, Treasurer and Head of Portfolio and Risk Management Group Ellen M. Costello Executive Vice-President Global Treasury Investment Bank William... -

Page 105

...Secretary's Department, 21st Floor, 1 First Canadian Place, Toronto, Ontario M5X 1A1. SHAREHOLDER DIVIDEND REINVESTMENT AND SHARE PURCHASE PL AN Typesetting: Moveable Type Inc. For information about Bank of Montreal or to obtain supplemental ï¬nancial data, please contact Investor Relations, 18th... -

Page 106

9