BT 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 BT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Bringing it all together

Annual

Report &

Form 20-F

2007

BT GROUP PLC ANNUAL REPORT AND FORM 20-F 2007

Table of contents

-

Page 1

Bringing it all together Annual Report & Form 20-F 2007 -

Page 2

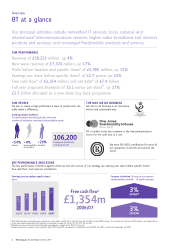

BT Group plc Annual Report & Form 20-F 2 4 6 BT at a glance Chairman's message Chief Executive's statement Our vision is to be dedicated to helping customers thrive in a changing world. Our mission is to be the leader in delivering converged networked services. 9 30 49 Business review Financial ... -

Page 3

...b Dividends per share represents the dividend paid and proposed in respect of the 2007 financial year. c Amounts presented in respect of years ended 31 March 2004 and 2003 are presented in accordance with UK GAAP. UK GAAP is not directly comparable with IFRS. a 2 BT Group plc Annual Report & Form... -

Page 4

...Revenue mix by customer segment year ended 31 March 2007 27% Wholesale 36% Major corporate Andy Green CEO Group Strategy and Operations BT DESIGN BT OPERATE Two new business units will be responsible for developing and operating the platforms, systems and processes that will support our services... -

Page 5

... billion share buy back programme which we expect to be completed by 31 March 2009. BUSINESS PROGRESS We continued to implement our strategy for proï¬table growth. New wave revenue now accounts for 36% of our total business. We are a major player in the global networked IT services market, meeting... -

Page 6

... joined the Board on 24 April 2007 as Chief Executive BT Global Services (in which role he succeeds Andy Green who became CEO of Group Strategy and Operations). As President of BT International, Franc ¸ois established a record of exceptional growth in BT's operations outside the UK... Services that... -

Page 7

...narrowband, ï¬xed-line communications business, to a broadband company harnessing the power of modern networks to help our customers communicate anywhere, any time, using whatever devices they happen to choose. We've brought levels of choice and control to our customers at home, at work, or out and... -

Page 8

... global network enables us to serve customers in all the world's key commercial centres - either directly or through partnership arrangements. Major contracts in the 2007 ï¬nancial year included a deal with Dutch electronics giant, Philips, to provide data, voice, conferencing and mobile services... -

Page 9

... Reporting Statement on the Operating and Financial Review issued by the Accounting Standards Board. 22 Corporate reputation and brand strength 23 Motivating our people and living the BT values 24 Research and development 24 IT Support 24 Property 24 Our commitment to society 27 Group risk factors... -

Page 10

.../mobile products and services. (with effect from 1 July 2007) Our customers BT GLOBAL SERVICES BT GROUP BT RETAIL BT WHOLESALE OPENREACH BT DESIGN BT OPERATE OUR STRATEGY Our strategy is to: r pursue proï¬table growth in new wave markets r defend our traditional business r transform our networks... -

Page 11

...using whatever device they choose, and we offer a range of mobility services in both the consumer and business markets. In the 2007 ï¬nancial year, group mobility revenues were £294 million. The emphasis was increasingly on new services that give customers the best of ï¬xed and the best of mobile... -

Page 12

...in the 2007 ï¬nancial year, we obtained both national and international long-distance licences through our venture, BT Telecom India. Markets in Japan and China will also become increasingly important. In the 2007 ï¬nancial year, BT Global Services experienced particularly strong revenue growth of... -

Page 13

...) and WLR (wholesale line rental). However, the rate of revenue decline has been slowing and ARPU (average revenue per user) is strong. Networked IT services revenue for BT Global Services for the 2007 ï¬nancial year was £4,048 million, an 8% increase compared with the 2006 ï¬nancial year. We... -

Page 14

... mobile service BT Group plc Annual Report & Form 20-F 13 Report of the Directors In the consumer market we aim to provide customers with a range of services that help them communicate more effectively, access entertainment and manage their lives. By increasing revenue from broadband, mobility... -

Page 15

...% in the 2006 ï¬nancial year. New wave and value-added services for business and major corporate customers Broadband is increasingly critical to the success of small and medium-sized businesses and BT Business Broadband remained the leading internet service provider for SMEs in the UK. In the 2007... -

Page 16

... of managed mobile services to UK and global customers who either outsource their mobile communications entirely or rely on BT to provide speciï¬c managed services. During the 2007 ï¬nancial year, we launched a number of new services designed to integrate business and corporate customers' ï¬xed... -

Page 17

... and added value services. DSL broadband connections (million) quarter end 12 10 8 6 4 2 0 BT Wholesale BT Wholesale is evolving into a leading provider of innovative business solutions. Our 21CN programme is replacing the existing network and will provide the platform to offer a seamless customer... -

Page 18

...Products Wholesale Line Rental WLR, which enables communications providers to offer telephony services with their own brand over BT's network, currently generates around two-thirds of Openreach's revenue. We anticipate that this will decline as customers increasingly migrate to LLU. In December 2006... -

Page 19

...BT to announce plans to reduce our wholesale broadband prices - offering communications providers a cost-effective alternative to LLU. Ethernet Openreach continues to develop a comprehensive portfolio of Ethernet products to support backhaul and access services for LLU operators and a growing number... -

Page 20

... Indian market. March 2007 We acquired International Network Services Inc. (INS), a leading global provider of IT consulting and software solutions, based in California. The company has almost 900 employees in 12 countries and has served 75% of Fortune 500 enterprises. March 2007 We increased our... -

Page 21

... the Directors Business review Post-balance sheet acquisition In April 2007, we entered into a conditional agreement to acquire Comsat International - a leading provider of data communication services for corporations and public sector organisations in Latin America - through its parent company, CI... -

Page 22

...quarter ended 30 September 2005. CPS (carrier pre-selection) has been the main contributor to the loss of share in the ï¬xed-voice market. BT had 38% of the market for business ï¬xed-voice calls (deï¬ned as including local, national and international) for the BT Group plc Annual Report & Form 20... -

Page 23

... in certain member states we may be required to contribute towards an industry fund to pay for the cost of meeting universal service obligations in those countries. Following the European Commission's formal investigation into the way the UK Government set BT's property rates and those paid by... -

Page 24

easy to use, we will help those customers succeed in their business and personal lives. taken into account in any decisions affecting employees' interests. We also operate a pan-European works council (the BTECC). Our Chief Executive and other senior executives have regular meetings with the BTECC ... -

Page 25

...solutions and in managing a secure and resilient infrastructure. In addition to the work for 21CN, signiï¬cant systems development effort in the 2007 ï¬nancial year was focused on providing support for Openreach's operations. Speciï¬cally, our IT teams delivered the 24 BT Group plc Annual Report... -

Page 26

... Working together BT Group plc Annual Report & Form 20-F 25 Report of the Directors During the 2007 ï¬nancial year, the implementation of our revised CSR strategy, which was discussed and agreed by the Board, was a top priority. There are four key strands to this strategy: maintaining current... -

Page 27

... 2005 2006 2007 We believe that an inclusive approach to product design is good for customers and good for business. We are proud, for example, of our reputation for developing products that can be used by all our customers, regardless of age or ability. For example, we offer a wide range of phones... -

Page 28

... for BT customers to route some or all of their calls over our competitors' networks) and the introduction of wholesale access products. BT Group plc Annual Report & Form 20-F 27 Report of the Directors Regulatory controls Business Reduction in our share of the ï¬xed-network market may lead to... -

Page 29

... a number of complex and high-value networked IT services contracts with customers. Our pricing, cost and proï¬tability estimates for major contracts generally include anticipated long-term cost savings that we expect to achieve over the life of the contract. These estimates are based on our best... -

Page 30

... new wave services as we drive value from transforming the business. 9 Business review Financial review 49 Corporate governance Financial review 30 Introduction to the Financial review 31 Summarised group income statement 32 Group results 33 Line of business results for 2007 and 2006 34 BT Global... -

Page 31

... dabs.com in the 2007 ï¬nancial year have also strengthened our online sales and service capabilities as well as helping us to provide our customers with the most that broadband can offer. In this Financial review the commentary is focused principally on the trading results of BT Group before speci... -

Page 32

... GROUP INCOME STATEMENT Year ended 31 March 2007 £m 2006 £m 2005 £m Revenue Other operating incomea Operating costsa Operating proï¬t: Before speciï¬c items Speciï¬c items Net ï¬nance expense: Finance expense before speciï¬c items Finance income before speciï¬c items Speciï¬c items Share... -

Page 33

...the growth of value added propositions have more than offset the lower call revenues. Wholesale (UK and global carrier) revenue in the 2007 ï¬nancial year increased by 10% to £5,485 million driven by WLR and LLU. New wave revenue increased by 36% driven by the 32 BT Group plc Annual Report & Form... -

Page 34

continuing growth in broadband. Global carrier revenue decreased by 3% in the 2007 ï¬nancial year. In the UK, BT had 10.7 million wholesale broadband DSL and LLU connections, including 1.9 million LLU lines, at 31 March 2007, an increase of 2.6 million connections in the year. Group operating costs... -

Page 35

... from services provided outside the UK continued to increase during the 2007 ï¬nancial year, further supporting BT's transformation into a global networked IT services company serving multi-site organisations. Line of business summary Revenue 2007 £m 2006 £m b Operating proï¬t (loss) 2007... -

Page 36

... two years is summarised as follows: 2007 £m 2006 £m a BT Retail revenue Traditional Networked IT services Broadband Mobility and other New wave Total a 6,630 375 946 463 1,784 8,414 7,143 363 730 271 1,364 8,507 Restated to reflect the creation of Openreach. Operating proï¬t (loss) before... -

Page 37

... Directors Financial review Traditional revenue comprises calls made by customers on the BT ï¬xed line network in the UK, analogue lines, equipment sales, rentals and other voice products. Traditional revenue was 7% lower in the 2007 ï¬nancial year driven by high levels of migration to broadband... -

Page 38

...nancial year. Openreach manages the 'ï¬rst mile' of the UK access network on behalf of the telecommunications industry. It operates and delivers ubiquitous services on an open and even-handed basis, to any and all communications providers, including to BT's own BT Group plc Annual Report & Form 20... -

Page 39

...contributed to a decrease in operating proï¬t of 12% to £363 million. 38 BT Group plc Annual Report & Form 20-F BT Retail's results demonstrated a continued strategic shift towards new wave products with growth in broadband, networked IT services and mobility revenues. Despite the substitution by... -

Page 40

.... Investment in legacy network technologies continues to be lower than last year. In the 2006 ï¬nancial year, revenue totalled £9,232 million, an increase of 2%. External revenue increased by 11% to £4,226 million in the 2006 ï¬nancial year (an increase of 15% BT Group plc Annual Report & Form... -

Page 41

...in the network and investment in service levels. Other operating costs include the maintenance and support of our networks, accommodation, sales and marketing costs, research and development and general overheads. SPECIFIC ITEMS Speciï¬c items for the 2007, 2006 and 2005 ï¬nancial years are shown... -

Page 42

... group disposed of a number of non core businesses in the 2007 ï¬nancial year, resulting in a total loss on disposal of £5 million. This principally comprised a loss on disposal of £7 million relating to the sale of satellite broadcast assets. In the 2006 ï¬nancial year speciï¬c operating costs... -

Page 43

...the group's net debt level and the strong cash ï¬,ow generation, we have decided to introduce a new £2.5 billion share buy back programme whilst increasing dividends and continuing to invest in the growth of the business. The buy back programme is expected to be completed by 31 March 2009. BT seeks... -

Page 44

... raised, adjusted to amortise any discount over the term of the debt. For the purpose of this analysis current asset investments and cash and cash equivalents are measured at the lower of cost and net realisable value. BT Group plc Annual Report & Form 20-F 43 Report of the Directors Financial -

Page 45

...outï¬,ows associated with investing in infrastructure and ï¬nancing operations. In addition, free cash ï¬,ow excludes cash ï¬,ows that are determined at a corporate level independently of ongoing trading operations such as 44 BT Group plc Annual Report & Form 20-F OFF-BALANCE SHEET ARRANGEMENTS As... -

Page 46

... 2006 and 2005 ï¬nancial years, respectively. Capital expenditure is expected to remain at around £3.2 billion in the 2008 ï¬nancial year as the group continues to invest in its 21st century network (21CN) programme. BT Group plc Annual Report & Form 20-F 45 Report of the Directors Financial -

Page 47

... we launched a new deï¬ned contribution pension scheme for people joining BT after that date which is to provide beneï¬ts based on the employees' and the employing company's contributions. This change is in line with the practice increasingly adopted by major UK groups and is designed to be more... -

Page 48

... the accounting policies on page 84 to 85. US GAAP The group's net income and earnings per share for the three ï¬nancial years ended 31 March 2007 and shareholders' equity at 31 March 2007 and 2006 under US Generally Accepted Accounting Principles (US GAAP) are shown in the United States Generally... -

Page 49

... Pension funds 70 Payment of suppliers 70 Financial statements 70 Financial instruments 71 Internal control and risk management 71 US Sarbanes-Oxley Act of 2002 71 Disclosure controls and procedures 71 Internal control over ï¬nancial reporting 72 Shareholders and Annual General Meeting 72 Relations... -

Page 50

... Executive, Group Strategy and Operations on 24 April 2007. Since joining BT in 1986, he has held a number of positions, including Chief Executive of Global Services, Chief Executive of BT Openworld and Group Director of Strategy and Development. Andy was a member of the former Executive Committee... -

Page 51

... Investment, Clerical Medical Investment Group and Halifax Financial Services, and previously chief executive of Zurich Life and Eagle Star Life. Phil is a non-executive director of Business in the Community and chairman of the HBOS Foundation. Aged 49. b,d,e 50 BT Group plc Annual Report & Form... -

Page 52

... Key to membership of Board committees: a Operating Audit c Remuneration d Nominating e Community Support f Pension Scheme Performance Review Group g Equality of Access Board b All the non-executive directors are considered independent of the management of the company. BT Group plc Annual Report... -

Page 53

... dealing code. Principal Board committees The Operating Committee, the company's key management committee, meets weekly and is chaired by the Chief Executive. The other members are the Group Finance Director and the Chief Executives of BT Retail, BT Wholesale, BT Global Services and Group Strategy... -

Page 54

... reports regularly to the Board. Its terms of reference are available on the company's website. The Board also has a Community Support Committee and a Pension Scheme Performance Review Group. New York Stock Exchange The company, as a foreign issuer with American Depositary Shares listed on the New... -

Page 55

... risks relating to IT security, fraud and related matters, are properly identiï¬ed and managed, the effectiveness of internal control, ï¬nancial reporting, accounting policies and procedures, and the company's statements on internal controls before they were agreed by the Board for the annual... -

Page 56

... The terms of reference of the Nominating Committee are posted on the company's website at: www.bt.com/committees The minutes of Nominating Committee meetings are sent, at their request, to directors who are not members of the Committee, where appropriate to do so. BT Group plc Annual Report & Form... -

Page 57

... directors. The Committee also reviews the remuneration of other senior executives reporting to the Chief Executive. This includes approving changes to the company's long-term incentive plans, recommending to the Board those plans which require shareholder approval and overseeing their operation... -

Page 58

... market sector challenges to BT and are within the sector in which BT competes for capital. BT Group plc Annual Report & Form 20-F 57 Report of the Directors wave services, generated mainly from networked IT services and broadband, have been developed to provide revenue growth. To ensure that key... -

Page 59

... This mitigates the effects of share price volatility. A positive change between the initial and end values indicates TSR growth. Incentive shares For the ï¬nancial year 2006/07, the Committee granted incentive shares to executive directors, senior executives, key managers and professionals. Awards... -

Page 60

... of retirement beneï¬ts. Additionally, a BT Group plc Annual Report & Form 20-F 59 Report of the Directors Governance Total remuneration comprises base salary, annual bonus - cash and deferred shares - and the expected value of awards under BT's long-term incentive plans, excluding retention... -

Page 61

... to hold these shares until they retire from the Board. This policy is not mandatory. No element of non-executive remuneration is performancerelated. Non-executive directors do not participate in BT's bonus or employee share plans and are not members of any of the company pension schemes. Outside... -

Page 62

... or understandings between any director or executive ofï¬cer and any other person pursuant to which any director or executive ofï¬cer was selected to serve. There are no family relationships between the directors. BT Group plc Annual Report & Form 20-F 61 Report of the Directors Governance } -

Page 63

...BT has been a constituent of the FTSE 100 throughout the ï¬ve-year period and the index is widely used. TSR is the measure of the returns that a company has provided for its shareholders, reï¬,ecting share price movements and assuming reinvestment of dividends. 62 BT Group plc Annual Report & Form... -

Page 64

...f Deferred annual bonuses payable in shares in three years' time, subject to continued employment. g Sir Anthony Greener retired as a director on 30 September 2006. h Lou Hughes retired as a director on 31 March 2006. a BT Group plc Annual Report & Form 20-F 63 Report of the Directors Governance -

Page 65

... company paid £55,665 into his personal pension plan, plus a cash payment of £101,835 representing the balance of the pension allowance for the ï¬nancial year 2006/07. BT also provides him with a lump sum death in service beneï¬t of four times his salary. Andy Green is a member of the BT Pension... -

Page 66

...as options granted on 24 June 2004 - see e above. The market price of a BT share at 31 March 2007 was 303.75p (2006 - 222p) and the range during the ï¬nancial year 2006/07 was 209.25p - 321.75p (2005/06 196.5p - 235p). BT Group plc Annual Report & Form 20-F 65 Report of the Directors Governance -

Page 67

...'s ordinary shares provisionally awarded to directors, as participants under the ISP and RSP are as follows: Total number of award shares 31 March d Lapsed 2007 Monetary value of vested award £000 1 April 2006 Awarded Dividends re-invested Vested Expected vesting date Price on grant Market... -

Page 68

... the end of the three-year deferred period if those participants are still employed by BT Group. Total number of award shares 31 March 2007 Monetary value of vested award £000 1 April 2006 a Awarded Vested b Dividends re-invested Lapsed Expected vesting date Price at grant Market price at... -

Page 69

... the Directors Corporate governance Share awards under the Employee Share Investment Plan at 31 March 2007, or date of appointment if later 1 April 2006 Awarded Vested Total number of award shares 31 March 2007 Expected vesting date Sir Christopher Bland ESIP 2003 ESIP 2004 ESIP 2005 ESIP 2006 186... -

Page 70

... BT locations and meetings with members of the Operating Committee and other key senior executives. Each year, directors participate in BT's 'Back to the Floor' programme, BT Group plc Annual Report & Form 20-F 69 Report of the Directors an activity that demonstrates commitment to our customers... -

Page 71

Report of the Directors Corporate governance BUSINESS POLICIES Responsible business To reinforce our commitment to achieve best practice in our standards of business integrity and ethics, we have had in place for nearly eight years a written statement of business practice (The Way We Work). This ... -

Page 72

... the 2007 ï¬nancial year that have BT Group plc Annual Report & Form 20-F 71 Report of the Directors Governance New subsidiaries acquired during the year have not been included in the above risk management process. They will be included for the 2008 ï¬nancial year. Material joint ventures and... -

Page 73

... PCAOB. Their report is on page 75. SHAREHOLDERS AND ANNUAL GENERAL MEETING Relations with shareholders Senior executives, led by the Chief Executive and the Group Finance Director and including, as appropriate, the other executive directors, hold meetings with the company's principal institutional... -

Page 74

...144 Report of the independent auditors - parent company 145 Financial statements of BT Group plc 148 Subsidiary undertakings and associate 149 Quarterly analysis of revenue and proï¬t 150 Selected ï¬nancial data 154 Financial statistics 156 Operational statistics BT Group plc Annual Report & Form... -

Page 75

...maintenance and integrity of the corporate and ï¬nancial information included on the group's website. Legislation in the United Kingdom governing the preparation and dissemination of ï¬nancial statements may differ from legislation in other jurisdictions. 74 BT Group plc Annual Report & Form 20-F -

Page 76

... the Financial Services Authority, and we report if it does not. We are not required to consider whether the board's statements on internal control cover all risks and controls, or form an opinion on the effectiveness of the group's corporate governance procedures or its risk and control procedures... -

Page 77

... that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. PricewaterhouseCoopers LLP Chartered Accountants and Registered Auditors London, United Kingdom 16 May 2007 76 BT Group plc Annual Report & Form... -

Page 78

... risk management 133 Post balance sheet events 134 United States generally accepted accounting principles 100 Earnings per share 101 Cash and cash equivalents 101 Net debt 102 Free cash ï¬,ow 102 Intangible assets 104 Property, plant and equipment 105 Investments 106 Associates and joint ventures... -

Page 79

... basis in the future. Speciï¬c items for the current and prior years are disclosed in note 4. Accounting policies in respect of the parent company, BT Group plc, are set out on page 145. These are in accordance with UK GAAP. 78 BT Group plc Annual Report & Form 20-F (II) BASIS OF CONSOLIDATION The... -

Page 80

... will ï¬,ow to the group and the cost of BT Group plc Annual Report & Form 20-F 79 Financial statements solutions, revenue is recognised by reference to the stage of completion, as determined by the proportion of costs incurred relative to the estimated total contract costs, or other measures of... -

Page 81

... lease term or their useful economic life. Residual values and useful lives are re-assessed annually and if necessary changes are recognised prospectively. (X) ASSET IMPAIRMENT (NON FINANCIAL ASSETS) (VIII) RESEARCH AND DEVELOPMENT Research expenditure is recognised in the income statement in the... -

Page 82

... allowing for non market The following are the key accounting policies used from 1 April 2005 onwards to reï¬,ect the adoption of IAS 32, 'Financial Instruments: Disclosure and Presentation' and IAS 39, 'Financial Instruments: Recognition and Measurement'. BT Group plc Annual Report & Form 20-F 81... -

Page 83

... recognition. Loans and other borrowings are subsequently measured at amortised cost using the effective interest method and if included in a fair value hedge relationship are revalued to reï¬,ect the fair value movements on the hedged risk associated 82 BT Group plc Annual Report & Form 20-F -

Page 84

... 2005, are set out below. Financial assets were held at the lower of cost and net realisable value in accordance with UK GAAP. Debt instruments are stated at the amount of net proceeds adjusted to amortise any discount over the term of the debt. BT Group plc Annual Report & Form 20-F 83 Financial... -

Page 85

... require management judgement in determining the amounts to be recognised. In particular, judgement is used when assessing the extent to which deferred tax assets should be recognised with consideration given to the timing and level of future taxable income. 84 BT Group plc Annual Report & Form 20... -

Page 86

... carried on the balance sheet at fair value, with changes in fair value reï¬,ected in the income statement. Fair values are estimated by reference in part to published price quotations and in part by using valuation techniques. IFRIC 8, 'Scope of IFRS 2' (effective from 1 April 2007) IFRIC 8 clari... -

Page 87

... (2006: £912 million, 2005: £786 million), as shown in note 7. Dividends proposed in respect of the 2007 ï¬nancial year were 15.1 pence per share (2006: 11.9 pence, 2005: 10.4 pence) which amounts to £1,247 million (2006: £993 million, 2005: £883 million). 86 BT Group plc Annual Report & Form... -

Page 88

...specific items is provided in note 4. Group statement of recognised income and expense For the year ended 31 March 2007 Notes 2007 £m 2006 £m 2005 £m Actuarial gains relating to retirement beneï¬t obligations Exchange differences: - on translation of foreign operations - fair value loss on net... -

Page 89

... of ordinary shares by subsidiary Net cash used in ï¬nancing activities Effect of exchange rate changes on cash and cash equivalents Net (decrease) increase in cash and cash equivalents Cash and cash equivalents at the start of the year Cash and cash equivalents at the end of the year 9 (1,054... -

Page 90

Consolidated ï¬nancial statements Group balance sheet As at 31 March 2007 Notes 2007 £m 2006 £m Non current assets Intangible assets Property, plant and equipment Derivative ï¬nancial instruments Investments Associates and joint ventures Trade and other receivables Deferred tax assets 12 13 18... -

Page 91

...broadband, mobility, data, internet and multimedia services and from providing managed and packaged communications solutions to consumers and small and medium sized business customers in the UK. BT Wholesale derives its revenue from providing network services and solutions to communication companies... -

Page 92

...continued Business segment results for the years ended 31 March 2007 and 2006 - new segment structure BT Global Services £m Year ended 31 March 2007 BT Retail £m BT Wholesale £m Openreach £m Other £m Intra-group £m Total £m Revenue External revenue Internal revenue Total revenue 7,467... -

Page 93

...Year ended 31 March 2006 (restated) BT Global Services £m BT Retail £m BT Wholesale £m Openreach £m Other £m Total £m Results Operating proï¬t before speciï¬c items Speciï¬c items Segment result Share of post tax proï¬t of associates and joint ventures Proï¬t on disposal of joint venture... -

Page 94

... continued Segment results for the years ended 31 March 2006 and 2005 - as previously reported (excluding Openreach) BT Global Services £m Year ended 31 March 2006 BT Retail £m BT Wholesale £m Other £m Intra-group £m Total £m Revenue External revenue Internal revenue Total revenue 7,151... -

Page 95

... ï¬nancial statements 1. SEGMENTAL ANALYSIS continued Year ended 31 March 2005 BT Global Services £m BT Retail £m BT Wholesale £m Other £m Total £m Results Operating proï¬t before speciï¬c items Speciï¬c items Segment result Share of post tax loss of associates and joint ventures Net... -

Page 96

... on disposal of property, plant and equipment Income from repayment works Other operating income Other operating income before speciï¬c items Speciï¬c items (note 4) Other operating income 13 68 155 236 (3) 233 2 74 151 227 - 227 22 64 107 193 358 551 BT Group plc Annual Report & Form 20-F 95... -

Page 97

... to the consolidated ï¬nancial statements 3. OPERATING COSTS 2007 £m 2006 £m 2005 £m Costs by nature Staff costs: Wages and salaries Social security costs Pension costs Share based payments Total staff costs Own work capitalised Net staff costs Depreciation of property, plant and equipment... -

Page 98

... (2006: net credit of £330 million) relating to fair value movements on derivatives recycled from the cash flow reserve. BT Group plc Annual Report & Form 20-F 97 Financial statements a In the current year the group disposed of some non-core businesses. The loss on disposal relates primarily... -

Page 99

... the cash flow reserve. 6. TAXATION 2007 £m 2006 £m 2005 £m Analysis of taxation (credit) expense for the year United Kingdom: Corporation tax at 30% (2006 and 2005: 30%) Adjustments in respect of prior periods Non-UK taxation: Current Adjustments in respect of prior periods Total current tax... -

Page 100

... statements. The proposed dividend will be payable to all shareholders on the Register of Members on 24 August 2007. BT Group plc Annual Report & Form 20-F 99 Financial statements Current tax charge on exchange movements offset in reserves Deferred tax charge (credit) relating to losses on cash... -

Page 101

... share impact of speciï¬c items: Net loss on sale of group undertakings Proï¬t on sale of non current asset investments Property rationalisation costs Creation of Openreach Write off of circuit inventory and other working capital balances Costs associated with settlement of open tax years Interest... -

Page 102

...7,534 219 11 124 26 7,914 7,893 (199) - (75) (85) 7,534 Non-cash transactions Other non-cash movements in 2006 includes £87 million relating to the early redemption of the group's US dollar convertible bond for shares in LG Telecom. BT Group plc Annual Report & Form 20-F 101 Financial statements -

Page 103

... IFRS measure. Free cash ï¬,ow is not deï¬ned in IFRSs but is a key indicator used by management to measure operational performance. 2007 £m 2006 £m 2005 £m Cash generated from operations before taxation Income taxes paid, net of repayments Net cash inï¬,ow from operating activities Included in... -

Page 104

... Impairment tests of goodwill During the 2007 ï¬nancial year the group made a number of acquisitions. INS, Counterpane and I3IT have been fully integrated into BT Global Services, which is considered to be the relevant cash generating unit (CGU). The group also acquired dabs.com and PlusNet, for... -

Page 105

... of £353 million (2006: £460 million) in respect of assets held under finance leases. The depreciation charge on those assets for the year ended 31 March 2007 was £116 million (2006: £134 million). Other mainly comprises motor vehicles and computers. 104 BT Group plc Annual Report & Form 20-F -

Page 106

...-for-sale assets Current available-for-sale assets 11 7 - - (4) 14 14 - 1,156 195 86 35 (1,461) 11 9 2 Available-for-sale ï¬nancial assets consist mainly of listed corporate debt securities and notes denominated in sterling. BT Group plc Annual Report & Form 20-F 105 Financial statements -

Page 107

... LG Telecom joint venture (carrying value £86 million), was transferred to available-for-sale assets in connection with the early redemption of the group's US dollar convertible 2008 bond. Details of the group's principal associate at 31 March 2007 are set out on page 148. 106 BT Group plc Annual... -

Page 108

...a designated cash flow and fair value hedge. d Commercial paper is denominated in sterling (2007: £25 million, 2006: £35 million), US dollar (2007: £nil, 2006: £66 million) and euro (2007: £769 million, 2006: £371 million). BT Group plc Annual Report & Form 20-F 107 Financial statements 624 -

Page 109

...240 755 78 3 - - 1,310 318 992 1,310 - 49 20 12 7 - - 88 69 19 88 405 304 417 16 5 3 2 1,152 332 820 1,152 Analysed as: Current Non current 27 25 52 Details of hedges in which the derivative ï¬nancial instruments are utilised are disclosed in note 33. 108 BT Group plc Annual Report & Form 20-F -

Page 110

... property rationalisation costs and £30 million relating to the estimated incremental and directly attributable costs arising from the group's obligation to set up Openreach and meet the requirements of the Undertakings, see note 4. BT Group plc Annual Report & Form 20-F 109 Financial statements -

Page 111

... £m Share based payments £m Other £m Total £m At 1 April 2005 Charge (credit) to income statement Charge (credit) to equity At 31 March 2006 Deferred tax (asset) Deferred tax liability At 31 March 2006 Charge (credit) to income statement Charge (credit) to equity At 31 March 2007 Deferred tax... -

Page 112

... ordinary shares (2006: 26 million) were reserved to meet options granted under employee share option schemes. b The share premium account, representing the premium on allotment of shares is not available for distribution. BT Group plc Annual Report & Form 20-F 111 Financial statements 24. SHARE... -

Page 113

... gains on cash ï¬,ow hedges Gains on available-for-sale investments Fair value loss on net investment hedge Recognised in income and expense in the year Tax on items taken directly to equity At 1 April 2006 Proï¬t for the year Foreign exchange adjustments Share based payments Dividends Net purchase... -

Page 114

... directors' remuneration, shareholdings, pension entitlements, share options and other long-term incentive plans is shown in the audited part of the Report on directors' remuneration, which forms part of the ï¬nancial statements. During the 2007 ï¬nancial year, the group purchased services... -

Page 115

... in the transaction and the goodwill arising were as follows: Book and fair value £m Intangible assets Property, plant and equipment Receivables Cash and cash equivalents Payables Net assets acquired Goodwill Total consideration 3 1 18 2 (12) 12 121 133 114 BT Group plc Annual Report & Form 20-F -

Page 116

... comprises principally the fair value of the skills and expertise of the acquired companies' workforce and both anticipated revenue and cost synergies. BT Group plc Annual Report & Form 20-F 115 Financial statements During the year ended 31 March 2007, the group acquired a number of other smaller... -

Page 117

... work force, expected cost savings and synergies. Other During the year ended 31 March 2006 the group acquired a number of other smaller subsidiary undertakings and businesses including principally SkyNet Systems Limited, the CARA Group and Total Network Solutions Limited. The combined net assets... -

Page 118

... at 60 years of age, are as follows: 2007 Number of years 2006 Number of years Male in lower pay bracket Male in higher pay bracket Female Future improvement every 10 years 22.6 25.0 25.6 1.0 22.5 24.7 25.4 1.0 BT Group plc Annual Report & Form 20-F 117 Financial statements Rate used to... -

Page 119

... are as follows: 2007 £m 2006 £m 2005 £m Current service cost (including deï¬ned contribution schemes) Total operating charge Expected return on pension scheme assets Interest on pension scheme liabilities Net ï¬nance income Total amount charged to the income statement 643 643 (2,292... -

Page 120

...) ordinary shares of the company with a market value of £43 million (2006: £33 million). The group occupies two properties owned by the BTPS scheme on which an annual rental of £0.1 million is payable (2006: £2 million). The expected long term rate of return and fair values of the assets of... -

Page 121

... assets are valued at market value at the valuation date; and, - scheme liabilities are measured using a projected unit credit method and discounted to their present value. The last three triennial valuations were determined using the following long-term assumptions: Real rates (per annum) 2005... -

Page 122

...selected employees and an employee stock purchase plan for employees in the United States. It also has several share plans for executives. All share based payment plans are equity settled and details of these plans are provided below. BT Group plc Annual Report & Form 20-F 121 Financial statements... -

Page 123

... 2005 GSOP was estimated as 36p. The following weighted average assumptions were used in that model: dividend yield of 5%, expected volatility of 25% and a risk free interest rate of 4%. Details of this plan are provided in the share options section of the Report on directors' remuneration. BT Group... -

Page 124

...Exercise price per share 2005 Number of options (millions) Normal dates of exercise BT Group Employee Sharesave Plans 2005 2006 2007 2008 2009 2010 2011 Total BT Group Legacy Option Plan 2001-2011 Total BT Group Global Share Option Plan 2005-2012 2004-2014 2007-2015 Total Total outstanding options... -

Page 125

...end of a speciï¬ed period, only if the employee is still employed by the group. During the 2007 ï¬nancial year participants were granted awards over 0.8 million shares (2006; 1.8 million shares; 2005: 1.6 million shares). Awards under the RSP were valued using the average middle market share price... -

Page 126

... should be linked to Openreach performance rather than BT targets or share price. However Openreach employees are allowed to participate in the BT HMRC approved all-employee share plans on the same terms as other BT employees. BT Group plc Annual Report & Form 20-F 125 Financial statements -

Page 127

...of its currency exposures arising from its overseas short-term investment funds and other non-UK assets, liabilities and forward purchase commitments. The ï¬nancial instruments used comprise borrowings in foreign currencies and forward currency contracts. 126 BT Group plc Annual Report & Form 20-F -

Page 128

... affected by changes in exchange rates. Most of the group's current revenue is invoiced in pounds sterling, and most of its operations and costs arise within the UK. The group's foreign currency borrowings which totalled £5.3 billion at 31 March 2007 (2006: £5.4 billion), are used to ï¬nance... -

Page 129

...forward currency contracts at the balance sheet date comprised assets of £15 million (2006: £6 million) and had a remaining term of less than three months (2006: less than two months) to match the cash ï¬,ows on maturity of the underlying commercial paper. 128 BT Group plc Annual Report & Form 20... -

Page 130

... balance sheet date. Carrying amount 2007 £m 2006 £m 2007 £m Fair value 2006 £m Non-derivatives: Financial liabilities: Listed bonds, debentures and notes Finance leases Other loans and borrowings 6,249 567 1,774 7,140 845 1,950 7,059 601 1,771 7,946 885 1,976 BT Group plc Annual Report & Form... -

Page 131

... AND RISK MANAGEMENT continued Financial liabilities The following tables set out the exposure of ï¬nancial liabilities to market pricing, interest cash ï¬,ow risk and currency risk. The maturity proï¬le of ï¬nancial liabilities reï¬,ects the contractual repricing dates. 2007 Listed Effect of... -

Page 132

... to non financial liabilities. c The carrying amount excludes £9 million of current and £24 million of non current provisions which relate to non financial liabilities. BT Group plc Annual Report & Form 20-F 131 Financial statements ï¬nancial liabilities based on contractual repricing dates -

Page 133

... LIBOR quoted rates. Financial assets The following tables set out the exposure of ï¬nancial assets to market pricing and interest cash ï¬,ow risk and currency risk. The maturity proï¬le of ï¬nancial assets reï¬,ects the contractual repricing dates. 2007 Current investments £m Effect of hedging... -

Page 134

... leaver costs which will be accommodated within existing policies and by voluntary means. We expect the majority of these costs to be incurred in the 2008 ï¬nancial year and to be classiï¬ed as a speciï¬c item in our 2008 results. BT Group plc Annual Report & Form 20-F 133 Financial statements -

Page 135

... 35. UNITED STATES GENERALLY ACCEPTED ACCOUNTING PRINCIPLES The group's consolidated ï¬nancial statements are prepared in accordance with International Financial Reporting Standards as adopted by the European Union (IFRS), which differ in certain respects from those applicable in the United States... -

Page 136

... with the revenue are deferred. Accordingly, an adjustment has been recognised for the ï¬rst time in the 2007 ï¬nancial year in respect of Openreach products which have a signiï¬cant connection and installation service charge. BT Group plc Annual Report & Form 20-F 135 Financial statements -

Page 137

... (i) Share-based payments Under IFRS 2 'Share-Based Payment', share options are fair valued at their grant date and the cost is charged to the income statement over the relevant vesting periods. The group adopted SFAS No. 123 (revised 2004) 'Share-Based Payment' with effect from 1 April 2005 using... -

Page 138

.... Net income Years ended 31 March Note 2007 £m 2006 £m 2005 £m Proï¬t for the year in accordance with IFRS Proï¬t (loss) attributable to minority interests Proï¬t attributable to equity shareholders in accordance with IFRS Adjustment for: Sale and leaseback of properties Pension costs... -

Page 139

... group's pensions obligations. The pension cost determined under FAS 87 was calculated by reference to an expected long-term rate of return on scheme assets of 6.5% (2006: 7.1%, 2005: 7.3%). The components of the net periodic pension cost for the BTPS comprised: 2007 £m 2006 £m 2005 £m Service... -

Page 140

... Employee contributions Adjustment for change in measurement date Beneï¬ts paid or payable Translation Fair value of scheme assets at the end of the year 34,293 3,978 919 18 551 (1,472) - 38,287 29,169 6,039 450 21 - (1,385) (1) 34,293 BT Group plc Annual Report & Form 20-F 139 Financial... -

Page 141

... the risk premium above, yields on government bonds and consensus economic forecasts on future returns. The expected return of 7.1% per annum used for the calculation of pension costs for the year ended 31 March 2006 is consistent with that adopted for IAS 19. 140 BT Group plc Annual Report & Form... -

Page 142

... BT from 1 April 2007. The group does not anticipate that the adoption of this new statement at the required effective date will have a signiï¬cant effect on its results of operations, ï¬nancial position or cash ï¬,ows. BT Group plc Annual Report & Form 20-F 141 Financial statements The total... -

Page 143

..., provides guidance for the classiï¬cation of the expense. EITF 06-01 is effective for the group's ï¬nancial year beginning 1 April 2008. The group is currently in the process of quantifying the impact, if any, on the consolidated ï¬nancial statements. 142 BT Group plc Annual Report & Form 20... -

Page 144

... Provision for doubtful debts Provisions Statement of recognised income and expense Reserves Share premium account ... Additional paid-in capital or paid-in surplus (not distributable) BT Group plc Annual Report & Form 20-F 143 Financial statements Shareholders' equity other than paid-up capital -

Page 145

Financial statements Report of the independent auditors - parent company Independent auditors' report to the members of BT Group plc We have audited the parent company ï¬nancial statements of BT Group plc for the year ended 31 March 2007 which comprise the balance sheet, accounting policies and ... -

Page 146

...year was £nil (2006: £nil). BT Group plc Annual Report & Form 20-F 145 Financial statements (vi) Share capital Ordinary shares are classiï¬ed as equity. Repurchased shares of the company are recorded in the balance sheet as treasury shares and presented as a deduction from shareholders' equity... -

Page 147

Financial statements Financial Statements of BT Group plc BT GROUP PLC COMPANY BALANCE SHEET 2007 £m 2006 £m Fixed assets Investments in subsidiary undertakings Total ï¬xed assets Current assets Debtorsa Investmentsb Cash at bank and in hand Total current assets Creditors: amounts falling due ... -

Page 148

... PLC COMPANY BALANCE SHEET continued Share a capital £m Share premium b account £m Capital redemption reserve £m Proï¬t and loss account £m a,c,d Total £m At 1 April 2005 Proï¬t for the ï¬nancial year Dividends paid Net purchase of treasury shares Arising on share issues At 31 March 2006... -

Page 149

...b of operations Telecommunications services provider 121,216,701 35%c India a Issued share capital comprises ordinary or common shares, unless otherwise stated. b Incorporated in the country of operations. c Held through an intermediate holding company. 148 BT Group plc Annual Report & Form 20... -

Page 150

...2p Year ended 31 March 2005 Quarters Revenue Other operating income Operating costs Operating proï¬t Net ï¬nance expense Share of post tax (losses) proï¬ts of associates and joint ventures Pro...) 1,829 21.5p 21.3p 2,080 18.1p 17.9p BT Group plc Annual Report & Form 20-F 149 Financial statements -

Page 151

... paid and/or year end exchange rate on proposed dividends c Dividends per share represents the dividend proposed in respect of the relevant financial year. Under IFRSs, dividends are recognised as a deduction from shareholders' equity when they are paid. 150 BT Group plc Annual Report & Form... -

Page 152

....4p 14.3p 198 276 (150) 293 (139) net exceptional costs early leaver costs exceptional costs (release) exceptional costs exceptional tax credit Based on actual dividends paid and/or year end exchange rate on proposed dividends BT Group plc Annual Report & Form 20-F 151 Financial statements 2,702 -

Page 153

... data Summary of group cash ï¬,ow statement - IFRS Year ended 31 March 2007 £m 2006 £m 2005 £m Net cash inï¬,ow from operating activities Net cash (outï¬,ow) inï¬,ow from investing activities Net cash used in ï¬nancing activities Effect of exchange rate changes on cash and cash equivalents Net... -

Page 154

... 2003 £m Group operating proï¬t Income before taxes Net income Basic earnings per ordinary share Diluted earnings per ordinary share Average number of ADSs used in basic earnings per ADS (millions) Basic earnings per ADS Diluted earnings per ADS Total assets Total shareholders' equity (deï¬cit... -

Page 155

...derivative financial assets and investments. The number of times net finance expense before net pension finance income is covered by total operating profit. Interest cover including net pension finance income is 11.6 times (2006: 5.6 times, 2005: 4.5 times). 154 BT Group plc Annual Report & Form 20... -

Page 156

... of property plant and equipment and software a The ratio is based on profit before tax, goodwill amortisation and interest on long-term borrowings, to average capital employed. b The number of times net interest payable is covered by total operating profit before goodwill amortisation. c Return on... -

Page 157

... (£m) People employed (Worldwide) Total employees ('000) a Rolling 12 month consumer revenue, less mobile polos, divided by average number of primary lines. b Includes line rental, broadband, select services and packages. 106.2 104.4 102.1 99.9 104.7 156 BT Group plc Annual Report & Form 20-F -

Page 158

... statements 159 Listings 159 Share and ADS prices 159 Capital gains tax (CGT) 160 Analysis of shareholdings at 31 March 2007 160 Dividends 160 Dividend mandate 161 Dividend investment plan 161 Global invest direct 161 Total shareholder return 161 Results announcements 162 Individual savings accounts... -

Page 159

..., market shares, prices and growth; expectations regarding the convergence of technologies; growth and opportunities in new wave business (such as networked IT services, broadband and mobility); BT's network development and plans for the 21st century network; plans for the launch of new products and... -

Page 160

... but are not listed, on the London Stock Exchange. Trading on the New York Stock Exchange is under the symbol 'BT'. SHARE AND ADS PRICES High pence Pence per ordinary share Low pence High $ US$ per ADS Low $ Years ended 31 March 2003 2004 2005 2006 2007 Year ended 31 March 2006 1 April - 30 June... -

Page 161

... sterling into US dollars using exchange rates prevailing on the date the ordinary dividends were paid. Per ordinary share Years ended 31 March Interim pence Final pence Total pence Interim £ Final £ Per ADS Total £ Interim US$ Final US$ Per ADS Total US$ 2003 2004 2005 2006 2007 a 2.25 3.20... -

Page 162

... the Dividend investment plan, cash from participants' dividends is used to buy further BT shares in the market. Shareholders could elect to receive additional shares in lieu of a cash dividend for the following dividends: Date paid Price per share pence 2003 2003 2004 2004 2005 2005 2006 2006 2007... -

Page 163

... year. Average price paid Total number of per share (pence - net of dealing costs) shares purchased Total number of shares purchased as part of publicly announced plans or programmes Maximum number of shares that may yet be purchased under the plans or b programmes Calendar month a April 2006... -

Page 164

... the directors to make this offer. Any dividend which has not been claimed for ten years after it was declared or became due for payment will be forfeited and will belong to the company unless the directors decide otherwise. BT Group plc Annual Report & Form 20-F 163 Shareholder information -

Page 165

... Directors' remuneration Excluding remuneration referred to below, each director will be paid such fee for his services as the Board decide, not exceeding £50,000 a year and increasing by the percentage increase of the UK Retail Prices Index (as deï¬ned by Section 833(2) Income and Corporation... -

Page 166

... activities of the partnership. A partner in a partnership that holds ordinary shares or ADSs is urged to consult its own tax advisor regarding the speciï¬c tax consequences of owning and disposing of the ordinary shares or ADSs. BT Group plc Annual Report & Form 20-F 165 Shareholder information -

Page 167

... securities market in the United States, or (ii) the non-US corporation is eligible for the beneï¬ts of a comprehensive US income tax treaty (such as the Convention) which provides for the exchange of information. BT currently believes that dividends paid with respect to its ordinary shares... -

Page 168

..., challenges and performance EAB Annual Report Quarterly results releases Current Cost Financial Statements Statement of Business Practice Publication date May May May May July, November, February and May September July 2004 BT Group plc Annual Report & Form 20-F 167 Shareholder information -

Page 169

..., NJ 07606-3408 United States Tel +1 800 634 8366 (toll free) or +1 201 680 6630 (from outside the USA) e-mail: [email protected] Website: www.adr.com A full list of BT contacts and an electronic feedback facility is available at www.bt.com/talk 168 BT Group plc Annual Report & Form 20-F -

Page 170

... Financial instruments and risk management Business review Pursue proï¬table growth in new wave markets Develop our global networked IT services capability Research and development IT support Financial statistics Financial review Additional information for shareholders Cautionary statement... -

Page 171

... senior management and employees Directors and senior management Compensation Financial review Off-balance sheet arrangements Financial review Capital resources Corporate governance Board of directors and Operating Committee Report on directors' remuneration Consolidated ï¬nancial statements Notes... -

Page 172

... 10I 11 The offer and listing Offer and listing details Plan of distribution Markets Selling shareholders Dilution Expenses of the issue Additional information Share capital Memorandum and articles of association Material contracts Exchange controls Taxation Dividends and paying agents Statement by... -

Page 173

... business markets r BT Retirement Plan (BTRP): a deï¬ned contribution-style pension arrangement that was introduced for new BT employees from 1 April 2001 r BT Wholesale: a BT line of business providing network services and solutions within the UK. It services more than 700 communications companies... -

Page 174

...12 cities with networks set up by BT providing wire-free, high-speed broadband coverage which can be used for easy access to information and services in city centre locations and offer a range of new services for consumers, businesses and local authority workers BT Group plc Annual Report & Form 20... -

Page 175

... wirelessly, and supports BT's full range of services including BT Total Broadband and BT Broadband Talk. r BT Home IT Advisor: a phone service that puts customers in touch with a highly trained advisor who can, for example, offer help with setting up an email account or a home network, and who... -

Page 176

... Intangible assets 79-80, 102-103 Investments 105-106 BT Group plc Annual Report & Form 20-F 175 Shareholder information G Geographical information 47, 95 Global Invest Direct 161 Glossary of terms and US equivalents 143 Group income statement, summarised 31 Group results 32-34 Group risk factors... -

Page 177

Shareholder information Index ... L Legal proceedings 22 Line of business results 33-39 Listings 159 Loans and other borrowings 82-83, 107-108 ... M Material contracts 165 Memorandum 163 Minority interests 111 ... N Net debt 2, 101 Nominating Committee, Report of the 55 ... O Off-balance sheet ... -

Page 178

... Printed on Revive 50:50 Silk, which is produced using 50% recovered waste fibre and 50% virgin wood fibre. All pulps used are elemental chlorine free (ECF). 50 www.bt.com PHME 52340 By Appointment to Her Majesty The Queen Suppliers of Communications, Broadband and Networked Services BT London