BT 2003 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2003 BT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The year

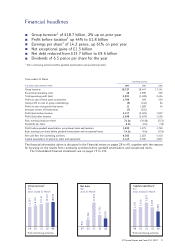

This has been a really good year for BT. We said

12 months ago that, in a turbulent market, your

company had taken the hard decisions and necessary

actions early. Events have shown that we were right to

do so and that we have now established a strong base

for sustainable growth. Earnings per share in the year

increased by 61% and net debt reduced by over

£4 billion. The group generated free cash flow of

£1.7 billion. The full year dividend of 6.5 pence per

share reflects the group’s financial performance,

operational strength and confidence in the future.

In the past two years, our net debt has been

reduced from £27.9 billion as at 31 March 2001 to

£9.6 billion as at 31 March 2003, a reduction of 66%.

The foundations of the progress in 2003 were the

achievement of operating efficiencies and the sale of

non-core assets, such as our stake in Cegetel, which

we sold for £2.6 billion. Progress was sustained by

improving service in our traditional markets, and our

growing success in such new-wave markets as

broadband, mobility, information and communications

technology (ICT) and solutions. We continue to invest

in and to transform our network to help take our

20 million customers into a future shaped by new

communications possibilities.

Purpose and responsibilities

As a business, our purpose is to connect the worlds

of our customers. In achieving that purpose we will

provide the greatest customer satisfaction and enjoy

commercial success if we make every experience of

our services simple and complete.

Your company’s broader responsibilities include

the maintenance of a good reputation, definitive

standards of governance and a coherent corporate

social responsibility programme, all vital to

encouraging investors to put their trust in us,

customers to buy from us and the best people to

work for us. This sense of responsibility runs through

the whole of our organisation.

Pensions

BT takes its responsibilities to its pensioners, existing

and prospective, very seriously. The result of a recent

valuation of the main BT pension scheme, carried out

by the independent actuary appointed by the Scheme

trustees, showed a funding deficit of £2.1 billion. This

compares to £1 billion at the last formal valuation in

1999. BT has agreed it will make good this deficit with

additional annual payments of £232 million, compared

to the £200 million additional annual payments that BT

has been making.

Strength of the BT Pension Scheme

The BT Pension Scheme, which has been closed to new

members since 31 March 2001, is backed by BT. The

Scheme assets are controlled by trustees who must act

in the best interests of its members. Any deficit has to

be made good by the company, and no changes can be

made to the rules and benefits that apply to Scheme

members without the agreement of the trustees.

Chairman’s message

4BT Annual Report and Form 20-F 2003

Sir Christopher Bland, Chairman, reports on a year in which BT further

reduced debt, grew its dividend significantly and continued to invest in

the future.