BT 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 BT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report and Form 20-F 2003

annual

report

Table of contents

-

Page 1

Annual Report and Form 20-F 2003 annual report -

Page 2

... 160 BT Group plc is a public limited company registered in England and Wales, with listings on the London and New York stock exchanges. This is the annual report for the year ended 31 March 2003. It complies with UK regulations and is the annual report on Form 20-F for the Securities and Exchange... -

Page 3

... & ï¬nancial discipline & broadband - at the heart of BT & value-added solutions for multi-site organisations with European operations & a clear network strategy, with uniï¬ed management of all UK networks & a clear strategy for each customer group, including new services and brand extension... -

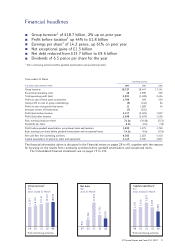

Page 4

... ended 31 March Continuing activities In £ million unless otherwise stated 2003 2002 2001 Group turnover Exceptional operating costs Total operating proï¬t (loss) Proï¬t on sale of ï¬xed asset investments (Loss) proï¬t on sale of group undertakings Proï¬t on sale of property ï¬xed assets... -

Page 5

... a business, our purpose is to connect the worlds of our customers. In achieving that purpose we will provide the greatest customer satisfaction and enjoy 4 BT Annual Report and Form 20-F 2003 commercial success if we make every experience of our services simple and complete. Your company's broader... -

Page 6

... awarding them 2% of the pre-tax proï¬ts, £36 million, in the form of BT shares. We believe the company is well placed - ï¬nancially, operationally and managerially - to meet new challenges and to seize new opportunities. Sir Christopher Bland Chairman 21 May 2003 BT Annual Report and Form... -

Page 7

... be even simpler, making minute-by-minute charges for evening and weekend calling a thing of the past 6 BT Annual Report and Form 20-F 2003 we are the UK's leading internet service provider for small and medium businesses & the order book for our solutions business is very strong and orders worth... -

Page 8

... connected to an ADSL-enabled exchange, and our development of new business models, coupled with technological breakthroughs, could put 90% of the UK's homes and small businesses within reach of broadband services within the next few years. And as well as signing up customers, we are moving quickly... -

Page 9

...and our existing customer base, and also through developing and marketing new, higher-value broadband and internet products and services. BT consists principally of three lines of business: BT Retail, BT Wholesale and BT Global Services (formerly BT Ignite). In the year ended 31 March 2003 (the 2003... -

Page 10

... the key elements of which were: & the UK's largest-ever rights issue - 1.98 billion new shares were issued to shareholders who took up their rights, raising £5.9 billion, net of expenses & the demerger of the majority of BT's mobile businesses to create two separate listed companies - BT Group plc... -

Page 11

...the customer 10 BT Annual Report and Form 20-F 2003 and supplier contracts that we originally contributed to Concert. Concert assets that have been returned to us are now managed by BT Global Services while Concert customers that have been returned to us are now managed partly by BT Global Services... -

Page 12

... year of BT Broadband is key to our approach to helping build the broadband market in the UK. For £27 per month, BT Broadband customers get instant connection to the internet, unlimited access with no time restrictions, the opportunity to use the phone and surf at the same BT Annual Report and Form... -

Page 13

.... & Major outsourcing deals signed by BT Retail in conjunction with BT Global Services during the year include a £125 million deal with Abbey National to install and manage a consolidated company-wide integrated voice and data telecommunications solution; 12 BT Annual Report and Form 20-F 2003 an... -

Page 14

... of sale through integrated web and desk-based access, and on increasing market reach and adding value through our strategic partners. Signiï¬cant cost savings were delivered by deploying online service support to 500 customers, handling 3,000 transactions per day by the end of March 2003. The new... -

Page 15

...capable of meeting many years of future customer demand for voice, video and data services. This will be designed to make BT simpler and more efï¬cient to deal with. The objective is to build this network using stringent capital return criteria and taking an 14 BT Annual Report and Form 20-F 2003 -

Page 16

... page 12, BT Global Services entered into a number of other signiï¬cant customer contracts in 2003. Examples include: & In November 2002, working closely with BT Retail, we signed a seven-year contract worth around e1 billion with Unilever, to manage and develop the company's global communications... -

Page 17

... our research and development work, and has a policy of commercial exploitation of our technology through patent licensing (including a contract with ipValue to secure revenues from US and Canadian companies), and the incubation of new technology companies. 16 BT Annual Report and Form 20-F 2003 -

Page 18

... rights to create new, start-up businesses with BT Exact, using our extensive and developing intellectual property portfolio. NVP Brightstar purchased the majority of the existing portfolio of technology ventures developed by BT Exact's corporate incubator, Brightstar. Our people Number of employees... -

Page 19

...among UK telecommunications operators. 18 BT Annual Report and Form 20-F 2003 With limited exceptions, a licence under the Telecommunications Act is required to run a telecommunication system in the UK. The Secretary of State is responsible for issuing licences after consulting the Director General... -

Page 20

... come into force in Member States by 30 October 2003. This Directive may have cost implications for industry. Communications Bill and Ofcom The UK Government has completed a review of telecommunications and broadcasting regulation. A new regulatory body has been established, called the Ofï¬ce of... -

Page 21

...network competitors are generally not subject to direct price controls, although there are some controls on mobile network operators. Retail price controls We are subject to two sets of UK retail price controls, one on certain public-switched telephony call charges and exchange line rentals, and one... -

Page 22

... to the Director General and other licensed operators if it intends to amend existing charges or to offer new services. Wholesale Access Charge Control The charges for the Wholesale Access services agreed by BT in July 2002 are subject to price control. The charges for the line rental (residential... -

Page 23

... prices, which interconnecting operators can use to form local tail-parts of end-to-end circuits offered to their retail customers. The Direction resulted from an investigation into the cost base of this relatively new wholesale product group (PPCs were initially launched in August 2001). The... -

Page 24

...Initially launched in 2000, this group of products is the normal means of providing interconnecting operators with a service to support ï¬,at-rate internet access packages via internet service providers to end users. Most FRIACO use involves interconnection at local exchange level, and the period of... -

Page 25

... scheduling and remedial works. Digital inclusion The digital divide is a key public policy issue and we are working together with the UK Government and the voluntary sector to ï¬nd effective ways to use communications technology to tackle social exclusion. 24 BT Annual Report and Form 20-F 2003 -

Page 26

... and provide more ï¬,exible lifestyles. Increasingly, BT has to address social and environmental matters when bidding for business. In the 2003 ï¬nancial year, contracts to the value of more than £300 million required us to demonstrate expertise in managing these issues. BT Annual Report and Form... -

Page 27

... e Net interest payable includes exceptional costs (credits) f Group's share of operating proï¬t (loss) of associates and joint ventures includes exceptional costs (release) Based on actual dividend paid and/or year end exchange rate on proposed dividends 26 BT Annual Report and Form 20-F 2003 -

Page 28

...) Total assets less current liabilities Loans and other borrowings falling due after one year Provisions for liabilities and charges Minority interests Total assets less liabilities Called up share capital Share premium account Other reserves Proï¬t and loss account Total equity shareholders' funds... -

Page 29

...results Line of business results BT Retail BT Wholesale BT Global Services Other operating income Operating costs Group operating proï¬t (loss) Associates and joint ventures Total operating proï¬t (loss) Proï¬t on sale of group undertakings and ï¬xed asset investments Proï¬t on sale of property... -

Page 30

... and total £m 2002 2001 Continuing activities £m Total* £m Continuing activities £m Total* £m Total turnover Group's share of associates' and joint ventures' turnover Trading between group and principal joint venture Group turnover Other operating income Operating costs Group operating... -

Page 31

...ï¬ciencies achieved during the year were offset by a £90 million increase in leaver costs, the negative group operating proï¬t effects of unwinding the Concert global venture and the Telereal property sale and leaseback transaction. In total, these effects reduced group operating proï¬ts by over... -

Page 32

... line revenue through new wave initiatives in the information, communications and technology (ICT), broadband and mobility markets. In the 2003 ï¬nancial year, the results include those of the re-integrated Concert business relating to UK multinational customer accounts, BT Annual Report and Form... -

Page 33

... BT Together residential packages, BT Business Plan was launched in January 2003 to combat the effect of CPS, a competitive package which places a ceiling of 10 pence on national and local business calls, rewards loyalty and provides a single BT customer contact. BT Annual Report and Form 20-F 2003... -

Page 34

... communications, lower service costs resulting from improvements in service quality, billing initiatives and similar cost reduction programmes. These cost savings were net of the costs of the investment in new wave activities. BT Retail comfortably exceeded its target of £200 million sales, general... -

Page 35

... and solutions business, serving customers worldwide. It is an ICT service provider, offering integrated data and value-added services to meet the European needs of global multi-site corporates and the global needs of European corporates. BT Global Services now includes the former Concert managed... -

Page 36

Financial review Carrier divisions within BT Global Services reï¬,ect the majority of the results of the returning Concert businesses in the 2003 ï¬nancial year. In the 2003 ï¬nancial year BT Global Services turnover was £5,251 million representing an increase of 17% compared to the prior year. ... -

Page 37

... in the 2002 ï¬nancial year, include the maintenance and support of the networks, accommodation and marketing costs, the cost of sales of customer premises equipment and non pay related leaver costs. The increase in the 2003 ï¬nancial year includes the property rental costs of around £190 million... -

Page 38

... review Other exceptional items in the 2002 ï¬nancial year included: & costs of £172 million associated with the unwind of the Concert global venture, discussed further on page 38 & charges of £68 million in relation to the BT Retail call centre rationalisation programme, reducing the number... -

Page 39

Financial review Exceptional items within the operating proï¬ts from joint ventures and associates are as follows: 2003 £m 2002 £m 2001 £m Impairment of Concert Concert unwind costs Impairment of investments and charge (release) of related exit costs Goodwill impairment Subscriber acquisition ... -

Page 40

... minimum payments of £20 million. interest in J-Phone Communications on 1 June 2001 In addition, in the 2002 ï¬nancial year we and subsequently its interest in J-Phone group recognised an impairment charge of £347 million in companies. The total proceeds of sale were relation to the ï¬xed asset... -

Page 41

... values for the property and compensation to Telereal covering funding costs and equity return. BT can also re-acquire the reversion of the general estate (non-operational buildings such as ofï¬ces and warehousing) at the end of the headlease term of 999 years. BT has the right to renew the lease... -

Page 42

... for capital Dividends expenditure on plant and equipment of £4,756 million The board recommends a ï¬nal dividend of 4.25 pence and £4,208 million invested in mmO2's per share to shareholders, amounting to £366 million. third-generation mobile licences. BT Annual Report and Form 20-F 2003 41 -

Page 43

... market conditions allowed and also to raise further signiï¬cant ï¬nance in the 2001 ï¬nancial year to meet the ï¬nancing needs of the UK thirdgeneration mobile licence, won in April 2000, increased capital expenditure and acquisitions of interests in subsidiaries, joint ventures and associates... -

Page 44

...-UK investments in its subsidiaries and ventures and on any imbalances between the value of outgoing and incoming international calls. To date, these imbalances have not been material. As a result, the group's proï¬t has not been materially affected by movements in exchange rates in the three years... -

Page 45

... of businesses, mainly located outside the UK. The total amount invested, 44 BT Annual Report and Form 20-F 2003 including further funding of existing ventures, was £14,501 million. In April 2000, we took an equity interest, jointly with Japan Telecom, in a number of regional Japanese mobile phone... -

Page 46

.... The payment expected to be made in December 2003 is £100 million in relation to leavers in the calendar year ended 31 December 2002. The group continues to account for pension costs in accordance with UK Statement of Standard Accounting Practice No. 24 (SSAP 24). The group's total annual pension... -

Page 47

...its main UK markets for ï¬xed network calls and provision of exchange lines, although competition has eroded BT's 46 BT Annual Report and Form 20-F 2003 market share signiï¬cantly in key market sectors, in particular areas of the UK and for certain products and services. This trend shows signs of... -

Page 48

... volatile reï¬,ecting movements in the value of the scheme assets and interest rates. Pension fund actuarial gains and losses, including investment returns varying from the assumed returns, will be recorded in full in the statement of total recognised gains and BT Annual Report and Form 20-F 2003 47 -

Page 49

...in place to meet agreed business strategy for the possibility of euro changeover in the UK. US GAAP The group's net income (loss) and earnings (loss) per share for the three ï¬nancial years ended 31 March 2003 and shareholders' equity at 31 March 2003 and 2002 under US Generally Accepted Accounting... -

Page 50

... units based on their relative fair values. This consensus guidance will be applicable to agreements entered into after 15 June 2003. BT is currently evaluating the impact of this new pronouncement. In January 2003, the EITF reached a consensus on EITF 02-18, ''Accounting for Subsequent Investments... -

Page 51

.... He was a senior vice president of Xerox Corporation since 50 BT Annual Report and Form 20-F 2003 1997. He is a non-executive director of Hays plc. A French national, he is aged 47. Andy Green Chief Executive, BT Global Servicesa Andy Green was appointed to the Board on 19 November 2001. He was... -

Page 52

... 61. Key to membership of principal Board committees: a Operating b Audit c Remuneration d Nominating e Community Support f Pension Scheme Performance Review Group All the non-executive directors are considered independent of the management of the company. Operating Committee Ben Verwaayen Chief... -

Page 53

... are included in the Report on directors' remuneration on pages 62 and 63 and the discussion on Corporate governance on page 53. Substantial shareholdings At 21 May 2003, the company had received notiï¬cations from Legal & General Investment Management Limited and Barclays PLC under Part VI of the... -

Page 54

... consultants before the Committee meets short-listed candidates. Between them, the current non-executive directors bring experience and independent judgement, gained at the most senior levels, of international business operations and strategy, marketing, technology, communications and political and... -

Page 55

...sub-committee of its own the Management Council monitors the performance of the BT Pension Scheme, draws material matters on pensions policy to the Board's attention, reviews public policy, regulatory and Government activities in the pensions area and oversees internal and external communications on... -

Page 56

...the key risks are addressed. Line of business audit committees monitor the standards of internal controls in the lines of business. & senior management report regularly to the Group Finance Director on the operation of internal controls in their area of responsibility. & the Chief Executive receives... -

Page 57

...area of corporate governance and business practice standards. A copy of the statement has been sent to every employee and is also available on the company's intranet site. These high-level principles are supported by a comprehensive communications programme and 56 BT Annual Report and Form 20-F 2003... -

Page 58

Corporate governance The Chief Executive and Group Finance Director after evaluating the effectiveness of BT's disclosure controls and procedures within 90 days of the date of the group's Annual Report and Form 20-F, have concluded that, at that date, BT's disclosure controls and procedures were ... -

Page 59

... Directors' interests Performance graph Remuneration review (Audited) Directors' remuneration Former directors Loans Pensions Share options Share awards Deferred Bonus Plan Share awards under all-employee share ownership plans Operating Committee 59 65 58 BT Annual Report and Form 20-F 2003 -

Page 60

... This part of the report is not subject to audit. BT's executive remuneration policy is to reward employees competitively, taking into account individual performance, company performance, market comparisons and the competitive pressures in the information and communication technology industry. Base... -

Page 61

...all capital actions and dividend payments that occur during the performance periods. Share options The price at which shares may be acquired under the Global Share Option Plan (GSOP) is the market price at the date of grant. Other than for new recruits, the size of option grant is based on corporate... -

Page 62

... be no increase in base pay for executive directors in 2004. For the achievement of target, performance-related remuneration will be approximately 67% of total remuneration (excluding pension) for the Chief Executive and 54% for the other executive directors. Under his current service agreement the... -

Page 63

..., the market value of shares awarded under an employee share ownership plan or deferred bonus plan that have not vested, together with a year's salary and the value of any beneï¬ts. The Committee intends to review contracts in the 2004 ï¬nancial year taking into account the joint statement of best... -

Page 64

... from 1 April 2003 to 15 May 2003, Paul Reynolds purchased 138 shares under the BT Group Employee Share Investment Plan. c Includes free shares awarded under the Employee Share Investment Plan and Employee Share Ownership Scheme - details are set out on page 71. d Ian Livingston joined the Board on... -

Page 65

... in the Employee Share Investment Plan. Performance graph This graph illustrates, as required by the Directors' Remuneration Report Regulations 2002, the performance of BT Group plc measured by TSR (adjusted for the rights issue and the demerger of BT's mobile business in the 2002 ï¬nancial year... -

Page 66

...: company car, fuel and driver, personal telecommunications facilities and home security, medical and dental cover for the director and immediate family, professional subscriptions and personal tax and ï¬nancial counselling. Deferred bonuses payable in shares in three years' time, were awarded to... -

Page 67

... increase from 1 June 2003 in basic salaries. Annual bonus awards to executive directors ranged from 72% to 121% of salary in the 2003 ï¬nancial year. These payments are not pensionable. Former directors Yve Newbold, who retired from the Board in June 1997, remains a member of the Community Support... -

Page 68

... pension in column (e), less directors' contributions. As explained above, Philip Hampton's pension beneï¬t was increased on leaving the company. The entitlement shown above is after taking account of this increase, which was allowed for in last year's accounts. BT Annual Report and Form 20-F 2003... -

Page 69

... 2001 under the Employee Sharesave Scheme, in which all employees of the company are eligible to participate. Details of the GSOP and performance conditions are set out on page 60. b c d e f g h There were no unrealised gains on the above share options at 31 March 2003, based on the market price... -

Page 70

... that date the market price of a BT Group share was 199p. The market price on the date of grant was 455.5p. The ï¬ve year performance cycle for the award ended on 31 July 2002 and on the basis of BT's TSR position, 32.5% of the performance shares under award, including re-invested dividends, vested... -

Page 71

Report on directors' remuneration Vesting of outstanding share awards and options Details of options granted under the GSOP and awards of shares under the ESP and ISP which would vest based on BT Group's TSR compared with the other companies in the FTSE 100 for the relevant performance period up to... -

Page 72

...be transferred to participants at the end of the three-year deferred period if those participants are still employed by BT Group. e Awarded cf Vested d Lapsed 1 April 2002 Total number of award shares 31 March Dividends 2003 re-invested Expected vesting date Market value 2003 £000 Market value... -

Page 73

... table on page 65. No options were granted under the BT Group Employee Sharesave Scheme to OC members, other than directors, during the 2003 ï¬nancial year (2002 - 5,650). The members of the OC beneï¬cially own less than 1% of the company's outstanding ordinary shares. By order of the Board Sir... -

Page 74

... and the group as at the end of the ï¬nancial year and of the proï¬t or loss and cash ï¬,ows of the group for that period. The directors consider that, in preparing the ï¬nancial statements for the year ended 31 March 2003, on pages 75 to 135 the company has used appropriate accounting policies... -

Page 75

... group and company balance sheets, group cash ï¬,ow statement, group statement of total recognised gains and losses and the related notes which have been prepared under the historic cost convention and the accounting policies set out in the Accounting Policies section and the United States Generally... -

Page 76

... accounting policy and presentation and discontinued activities Segmental analysis Turnover Other operating income Operating costs Group's share of operating proï¬t (loss) of associates and joint ventures Proï¬t on sale of ï¬xed asset investments and group undertakings Proï¬t on sale of property... -

Page 77

... Expenditure on research and development is written off as incurred. IV Leases Operating lease rentals are charged against the proï¬t and loss account on a straight-line basis over the lease period except where the contractual payment 76 BT Annual Report and Form 20-F 2003 terms are considered to... -

Page 78

... sheet of the company at cost less amounts written off. Amounts denominated in foreign currency are translated into sterling at year end exchange rates. Investments in associates and joint ventures are stated in the group balance sheet at the group's share of their net assets, together with any... -

Page 79

... the term of the debt, and further adjusted for the effect of currency swaps acting as hedges. (b) Derivative ï¬nancial instruments The group uses derivative ï¬nancial instruments to reduce exposure to foreign exchange risks and interest rate movements. The group does not hold or issue derivative... -

Page 80

...Operating costs Group operating proï¬t (loss) Group's share of operating proï¬t (loss) of joint ventures Group's share of operating proï¬t (loss) of associates Total operating proï¬t (loss) Proï¬t on sale of ï¬xed asset investments Loss on sale of group undertakings Proï¬t on sale of property... -

Page 81

... principal joint venture Group turnover Other operating income Operating costs Group operating proï¬t (loss) Group's share of operating proï¬t (loss) of joint ventures Group's share of operating proï¬t (loss) of associates Total operating proï¬t (loss) Proï¬t on sale of ï¬xed asset investments... -

Page 82

... group and principal joint venture Group turnover Other operating income Operating costs Group operating proï¬t (loss) Group's share of operating loss of joint ventures Group's share of operating proï¬t (loss) of associates Total operating proï¬t (loss) Proï¬t on sale of ï¬xed asset investments... -

Page 83

... year ended 31 March 2003 2003 £m 2002 £m 2001 £m Proï¬t (loss) for the ï¬nancial year: Group Joint ventures Associates Total proï¬t (loss) for the ï¬nancial year Currency movements arising on consolidation of non-UK: Subsidiaries Joint ventures Associates Unrealised gain (loss) on transfer... -

Page 84

Group cash flow statement for the year ended 31 March 2003 2003 £m 2002 £m 2001 £m Notes Net cash inï¬,ow from operating activities Dividends from associates and joint ventures Returns on investments and servicing of ï¬nance Interest received Interest paid, including ï¬nance costs Net cash out... -

Page 85

...,283 28, 37 28 28 28 28 The ï¬nancial statements on pages 75 to 135 were approved by the board of directors on 21 May 2003 and were signed on its behalf by Sir Christopher Bland Chairman Ben Verwaayen Chief Executive Ian Livingston Group Finance Director 84 BT Annual Report and Form 20-F 2003 -

Page 86

... was such that BT transferred the mmO2 business to mmO2 plc and BT Group Investments Limited (BTGI) became the immediate parent company of BT on 16 November 2001. On 19 November 2001, mmO2 plc transferred the shares in BTGI to BT Group, as consideration for the issue to former BT shareholders of one... -

Page 87

... of exchange lines and from the calls made over these lines, the leasing of private circuits and other private services, the sale and rental of customer premises equipment to the group's UK customers and other lines of business and from its narrowband and broadband internet access products. & BT... -

Page 88

... financial statements 2. Segmental analysis continued Turnover External £m Internal £m Group total £m Operating proï¬t (loss) of associates and joint ventures £m Year ended 31 March 2001 Depreciation and amortisation £m Total operating proï¬t (loss) £m BT Retail BT Wholesale BT Global... -

Page 89

... joint ventures and associates. The group turnover from continuing activities as disclosed in the group proï¬t and loss account includes intra-group trading with discontinued activities. 2003 £m 2002 £m Group ï¬xed assets are located UK Europe, excluding the UK Americas Asia and Paciï¬c Total... -

Page 90

... transit international calls by country of origin and turnover with non-UK joint ventures and associates would be treated differently but would not lead to a materially different geographical analysis. See the ''information about geographic areas'' above. 2003 £m 2002 £m 2001 £m Group operating... -

Page 91

...respect of international calls made to and from the UK and for services provided to Concert in the UK for the multinational customers transferred to Concert, is eliminated in arriving at total turnover, including the proportionate share of the group's associates and joint ventures, and is added back... -

Page 92

...charges. b Amount set aside for the year for allocation of ordinary shares in the company to eligible employees. c Includes £61 million of leaver costs associated with the rationalisation of the BT Retail call centres in the year ended 31 March 2002. d The accounting of all the mmO2 operating units... -

Page 93

... surplus in the BT Pension Scheme and the amount provided for pension costs within provisions for liabilities and charges. Includes £61 million of leaver costs associated with the rationalisation of the BT Retail call centres in the year ended 31 March 2002. 92 BT Annual Report and Form 20-F 2003 -

Page 94

... the BT Pension Scheme and the amount provided for pension costs within provisions for liabilities and charges. The accounting of all the mmO2 operating units was aligned; this resulted in a write off of previously capitalised costs in certain non-UK operations. BT Annual Report and Form 20-F 2003... -

Page 95

... proï¬t recognised relates to those shares that were marketable. In June 2001, the group sold its effective 20% interest in Japan Telecom Co. Limited and its 20% interest in J-Phone Communications Co. Limited to Vodafone plc for £3,075 million in cash. Under the sale agreement, the group also sold... -

Page 96

... on rates refunds received in the year ended 31 March 2001, relating to prior years. 11. Interest payable Interest payable and similar charges in respect of: Bank loans and overdrafts Other borrowingsab Group Joint ventures Associates Total interest payable a b 2003 £m 2002 £m 2001 £m 82... -

Page 97

...2003 £m 2002 £m 2001 £m United Kingdom: Corporation tax at 30% Taxation on the group's Taxation on the group's Prior year adjustments Non-UK taxation: Current Taxation on the group's Taxation on the group's Prior year adjustments share of results of associates share of results of joint ventures... -

Page 98

...number of shares in issue after deducting the company's shares held by employee share ownership trusts. In calculating the diluted earnings (loss) per share, share options outstanding and other potential ordinary shares have been taken into account. The weighted average number of shares in the years... -

Page 99

... call centre rationalisation costs BT Wholesale bad debts costs Rates refunds relating to prior years Write off of subscriber acquisition costs Goodwill impairment in associates and joint ventures Impairment of investment in associates and joint ventures and release (charge) for related exit costs... -

Page 100

... on demand are reported under the heading of management of liquid resources. 18. Acquisitions and disposals Acquisition of subsidiary companies and businesses Year ended 31 March 2003 a Concert £m b Other £m Total £m Consideration: Cash Carrying value of Concert global venture Total - 338 338... -

Page 101

...in other subsidiary companies and the consideration given comprised: Book value and fair value £m Fixed assets Current assets Current liabilities Group's share of original book value of net assets and fair value to group Goodwill Total cost 3 5 (6) 2 33 35 100 BT Annual Report and Form 20-F 2003 -

Page 102

...-border international networks, its international trafï¬c, its business with selected multinational customers and its international products for business customers, as well as Concert Communications. AT&T contributed a similar set of assets and businesses. BT Annual Report and Form 20-F 2003 101 -

Page 103

... a direct 18% interest in the J-Phone companies. During the year ended 31 March 2001, the group held an effective 23% interest in J-Phone. The impact of the combined J-Phone/Japan Telecom ownership structure, however, led the group to reï¬,ect 63% of the J-Phone results at the turnover and operating... -

Page 104

...& Co, Manx Telecom and Genie. m On 22 June 2001, BT completed the sale of the Yell Group. The Yell Group consisted of the Yellow Pages division of British Telecommunications plc, Yellow Pages Sales Limited and Yellow Book USA Inc., and its group undertakings. BT Annual Report and Form 20-F 2003 103 -

Page 105

...the financial statements 19. Net debt At 1 April 2002 £m Cash ï¬,ow £m Acquisition of subsidiary undertakings £m Other non-cash changes Currency movement £m £m At 31 March 2003 £m Analysis of net debt Cash in hand and at bank Overnight deposits Bank overdrafts Other current asset investments... -

Page 106

... value of land and buildings comprised: Freehold Long leases (over 50 years unexpired) Short leases Total net book value of land and buildings 374 27 202 603 2003 £m 343 34 194 571 2002 £m b Expenditure on tangible ï¬xed assets comprised: Plant and equipment Transmission equipment Exchange... -

Page 107

...principal operating subsidiary undertakings, joint ventures and associates are set out on page 135. Associates and joint ventures Associates: Goodwill Loans Share of other net assets Total associates Joint ventures: Loans Share of other net assets Total joint ventures Net book value at 31 March 2003... -

Page 108

... Plan (note 34). They also include ordinary shares of the company, with a net book value of £37 million (2002 - £108 million) and a market value of £25 million (2002 - £127 million), held in trust for employee sharesave schemes. In the group balance sheet at 31 March 2003, listed investments... -

Page 109

... to the financial statements 24. Current asset investments Listed investments a Other short-term deposits and investments Total current asset investments Market value of listed investments a 2003 £m 2002 £m 267 6,073 6,340 268 231 4,350 4,581 246 Included within other short-term deposits and... -

Page 110

..., BT does not discount the provision. £m Balance at 1 April 2002 Credit against proï¬t for the year Transfer to current tax Acquisition Total deferred tax provisions at 31 March 2003 2003 £m 2,140 (102) (23) 2 2,017 2002 £m Tax effect of timing differences due to: Excess capital allowances... -

Page 111

... the year ended 31 March 2002 the company issued shares at a market value of £154 million (2001 - £400 million) in respect of the exercise of options awarded under its principal savings-related share option scheme. Employees paid £84 million (2001 - £145 million) to the group for the issue of... -

Page 112

... its operations. Otherwise, the group generally carries its own risks. The group has provided guarantees relating to certain leases entered into by O2 UK Limited prior to its demerger with mmO2 on 19 November 2001, amounting to US$96 million (£61 million) as at 31 March 2003. mmO2 plc has given BT... -

Page 113

... linked securities, deposits and short-term investments. At 31 March 2003, the UK equities included 37 million (2002 - 55 million, 2001 - 51 million) ordinary shares of the company with a market value of £58 million (2002 - £154 million, 2001 - £258 million). BT Pension Scheme Funding valuation... -

Page 114

...of 15 years. The group will continue to make annual deï¬ciency payments until the deï¬cit is made good. The BTPS was closed to new entrants on 31 March 2001 and the age proï¬le of active members will consequently increase. Under the projected unit method, the current service cost, as a proportion... -

Page 115

... position of pension schemes. The accounting requirements under FRS 17 are broadly as follows: & scheme assets are valued at market value at the balance sheet date; & scheme liabilities are measured using a projected unit method and discounted at the current rate of return on high quality corporate... -

Page 116

Notes to the financial statements 31. Pension costs continued The long-term expected rate of return on investments does not affect the level of the deï¬cit but does affect the level of the expected return on assets within the net ï¬nance cost charged to the proï¬t and loss account under FRS 17. ... -

Page 117

... ended 31 March 2001 is entirely attributable to former directors. More detailed information concerning directors' remuneration, shareholdings, pension entitlements, share options and other long-term incentive plans is shown in the report on directors' remuneration on pages 58 to 72. 116 BT Annual... -

Page 118

... purchase plan for employees in the United States. It also has several share plans for executives. Share option schemes The major share option scheme, the BT Group Employee Sharesave Scheme, is savings related and the share options are normally exercisable on completion of a three or ï¬ve year Save... -

Page 119

...value of options granted where the exercise price equals the market price at date of grant or options granted under approved Sharesave schemes. See United States Generally Accepted Accounting Principles - IV Accounting for share options for the treatment under US GAAP. 118 BT Annual Report and Form... -

Page 120

... listed on the London Stock Exchange, as rated by the Financial Times (the FTSE 100 index), at the beginning of the relevant performance period. Under the RSP the length of retention period before awards vest is ï¬,exible. Awards may vest in annual tranches. The shares are transferred at the end... -

Page 121

... of the company's performance over the plans' conditional periods, relating to those portions of the plan conditional periods from commencement up to the ï¬nancial year end. Employee Share Investment Plan From December 2001 the BT Group Employee Share Investment Plan (ESIP) was in operation. The... -

Page 122

...the UK for the years ended 31 March 2003, 31 March 2002 and 31 March 2001: 2003 £000 2002 £000 2001 £000 Rights issue, restructuring and demerger projects Regulatory audit and associated services Tax services Concert global venture related work Systems advice Corporate Finance advice Other Total... -

Page 123

... to limit the group's exposure to interest rate increases given the substantial size of the group's debt portfolio at the time. During the second quarter of the year ended 31 March 2001, it was not practical for the group to issue longer-term debt in the global capital markets. The group therefore... -

Page 124

...was estimated by calculating the present value, using appropriate discount rates in effect at the balance sheet dates, of affected future cash ï¬,ows translated, where appropriate, into pounds sterling at the market rates in effect at the balance sheet dates. BT Annual Report and Form 20-F 2003 123 -

Page 125

... to mature within one year of the balance sheet date. The maturity proï¬le of ï¬nancial liabilities is as given in note 25. Financial assets After taking into account the various interest rate swaps and forward foreign currency contracts entered into by the group, the interest rate proï¬le of the... -

Page 126

... losses on hedges accounted for by adjusting the carrying amount of a ï¬xed asset. During the year ended 31 March 2003, the group entered into two derivatives contracts as an investment in a UK listed equity, with limited net overall exposure. At 31 March 2003, the two contracts had a net value of... -

Page 127

... account of the company is presented. i Ordinary shares allotted during the year were as follows: Nominal value Consideration Number £m £m Savings related schemes Other share option schemes Totals for the year ended 31 March 2003 3,944 152,614 156,558 - - - - - - 126 BT Annual Report and Form... -

Page 128

... principles Net income and shareholders' equity reconciliation statements Minority interests Accounting for share options Consolidated statements of cash ï¬,ows Current asset investments Pension costs US GAAP developments 128 130 131 131 131 132 132 134 BT Annual Report and Form 20-F 2003 127 -

Page 129

...of 20 years. (g) Financial instruments Under UK GAAP, investments are held on the balance sheet at historical cost, and own shares held in trust for share schemes are recorded in ï¬xed asset investments. Gains and losses on instruments used for hedges are not 128 BT Annual Report and Form 20-F 2003 -

Page 130

... book value of assets contributed by the group to the joint venture is amortised over the life of the items giving rise to the difference. (i) Employee share plans Certain share options have been granted under BT save-as-you-earn plans at a 20% discount. Under UK GAAP, the share issues are recorded... -

Page 131

... Years ended 31 March 2003 £m 2002 £m 2001 £m Net income (loss) applicable to shareholders under UK GAAP Restatement for deferred tax under FRS 19 Net income (loss) applicable to shareholders under UK GAAP as previously reported Adjustment for: Sale and leaseback of properties Pension costs... -

Page 132

United States Generally Accepted Accounting Principles II Net income and shareholders' equity reconciliation statements continued 2003 £m 2002 £m Shareholders' equity At 31 March Shareholders' equity under UK GAAP Adjustment for: Sale and leaseback of properties Pension costs Capitalisation ... -

Page 133

...bank and in hand reported under UK GAAP. 2003 £m 2002 £m 2001 £m Net cash provided by operating activities Net cash provided by (used in) investing activities Net cash (used in) provided by ï¬nancing activities Net increase (decrease) in cash and cash equivalents Effect of exchange rate changes... -

Page 134

...the year Actual return on scheme assets Employers' contributionsa Employees' contributions Other changes Beneï¬ts paid or payable Fair value of scheme assets at the end of the year 26,597 (3,255) 607 156 13 (1,361) 22,757 2003 £m 29,031 (2,355) 1,023 180 27 (1,309) 26,597 2002 £m Funded status... -

Page 135

United States Generally Accepted Accounting Principles VIII US GAAP developments In July 2001, the Financial Accounting Standards Board (FASB) issued SFAS No. 143 ''Accounting for Asset Retirement Obligations'' which is applicable to ï¬nancial years commencing after 15 June 2002. SFAS No. 143 ... -

Page 136

... d Management Limited BT (Hong Kong) Limited BT Fleet Limitedd BT Global Networks Limited BT Holdings Limited BT Nederland NVdf BT Americas Inc.dg BT Property Limited d d d d d d International telecommunication network systems provider Investment holding company Communication related services and... -

Page 137

... of associates' and joint ventures' turnover Group turnover Other operating income Group operating proï¬t Group's share of operating proï¬t of associates and joint ventures Total operating proï¬t Proï¬t (loss) on sale of ï¬xed asset investments and group undertakings Proï¬t on sale of property... -

Page 138

...group and principal joint venture Group turnover Other operating income Group operating proï¬t (loss) Group's share of operating loss of associates and joint ventures Total operating proï¬t (loss) Proï¬t (loss) on sale of ï¬xed asset investments and group undertakings Proï¬t on sale of property... -

Page 139

... and interest on long-term borrowings, to average capital employed. Capital employed is represented by total assets, excluding goodwill, less current liabilities, excluding corporate taxes and dividends payable, and provisions other than those for deferred taxation. Year-end ï¬gures are used in the... -

Page 140

... to growth in absolute call minutes. 1999 2000 2001 2002 2003 UK exchange line connections Business ('000) % growth over previous year Residential ('000) % growth over previous year Service providers ('000) % growth over previous year Total exchange line connections ('000) % growth over previous... -

Page 141

...rates and the general trend towards longer life expectancy, all of which are outside the control of BT. In the event that investment returns decline, the cash funding cost to BT may increase and may have a signiï¬cant effect on the ï¬nancial resources of BT. 140 BT Annual Report and Form 20-F 2003 -

Page 142

...and ADS prices Capital gains tax (CGT) Rights issue Demerger of mmO2 Analysis of shareholdings Dividends Dividend mandate Dividend investment plan Global Invest Direct Total shareholder return Results announcements Individual savings accounts (ISAs) ShareGift Unclaimed Assets Register Exchange rates... -

Page 143

... the London and New York stock exchanges on 19 November 2001. BT Group was incorporated in England and Wales on 30 March 2001 as Newgate Telecommunications Limited with the registered number 4190816. The company changed its name to BT Group plc on 11 September 142 BT Annual Report and Form 20-F 2003 -

Page 144

... in November 2001 adjusted the value for capital gains tax purposes of BT shares. Rights issue An explanatory note on the effects of the rights issue on the CGT position relating to BT shareholdings is available from the Shareholder Helpline (see page 155). BT Annual Report and Form 20-F 2003 143 -

Page 145

... who are resident in the United States or Canada for tax purposes, but before deduction of UK withholding taxes. Dividends have been translated from pounds sterling into US dollars using exchange rates prevailing on the date the ordinary dividends were paid. 144 BT Annual Report and Form 20-F 2003 -

Page 146

...approval at the annual general meeting. The US dollar amount of the ï¬nal dividend of 42.5 pence per ADS to be paid to holders of ADSs will be based on the exchange rate in effect on 8 September 2003, the date of payment to holders of ordinary shares. As dividends paid by the company are in pounds... -

Page 147

... our TSR performance (adjusted for the rights issue and demerger of our mobile business in the 2002 financial year) relative to the FTSE 100. Source: Bloomberg The graph shows relative price performance of BT and European Telco Sector using the FTSE 100 as a base. Results announcements Expected... -

Page 148

...the exchange rates between pounds sterling and US dollars based on the noon buying rate in New York City for cable transfers in pounds sterling as certiï¬ed for customs purposes by the Federal Reserve Bank of New York (the Noon Buying Rate). Years ended 31 March 1999 2000 2001 2002 2003 Period end... -

Page 149

... on the dates stated for the payments of those dividends. The directors can offer ordinary shareholders the right to choose to receive new ordinary shares, which are credited as fully paid, instead of some or all of their cash dividend. Before they can do this, the company's shareholders must have... -

Page 150

... year the company must hold an annual general meeting. The Board can call an extraordinary general meeting at any time and, under general law, must call one on a shareholders' requisition. (i) Limitations on rights of non-resident or foreign shareholders The only limitation imposed by the Articles... -

Page 151

...next following annual general meeting. A retiring director is eligible for re-election. Directors' borrowing powers To the extent that the legislation and the Articles allow, the Board can exercise all the powers of the company to borrow money, to mortgage or charge its business, property and assets... -

Page 152

... included the transfer of approximately 350 employees from BT to Land Securities Trillium (Telecom). Telereal will be responsible for providing accommodation and estates management services to BT. In return, we pay Telereal around £190 million of annual rental, increasing at 3% a year, for use of... -

Page 153

... to allow it to continue its global operations, and offer telecommunication services, in various geographic regions where BT may no longer have infrastructure as a result of the transfer of certain assets to AT&T. In connection with the termination of the Concert joint venture, AT&T has acquired... -

Page 154

... than one year at the time of disposition. The deductibility of capital losses is subject to signiï¬cant limitations. Capital gains of an individual US Holder are subject to US federal income tax at preferential rates if speciï¬ed holdings periods are met. BT Annual Report and Form 20-F 2003 153 -

Page 155

...and environment report at www.bt.com/betterworld. Document Publication date Annual Review including summary ï¬nancial statement Annual Report and Form 20-F Quarterly results releases Current Cost Financial Statements for the Businesses and Activities and Statement of Standard Services (as required... -

Page 156

...Group plc BT Centre 81 Newgate Street London EC1A 7AJ United Kingdom Tel (020) 7356 5000 Fax (020) 7356 5520 From overseas: Tel +44 20 7356 5000 Fax +44 20 7356 5520 A full list of BT contacts, and an electronic feedback facility, is available at www.bt.com/talk. BT Annual Report and Form 20-F 2003... -

Page 157

... lease Fiscal year Non-current investments Ownership with absolute rights in perpetuity Leverage Local and long-distance calls Securities of equity investees Treasury shares Indebtedness of equity investees not current Book value Net operating income Other current assets Costs of group's employees... -

Page 158

... in this Annual Report Section Page 1 2 3 3A Identity of directors, senior management and advisors Offer statistics and expected timetable Key information Selected ï¬nancial data Not applicable Not applicable Five year ï¬nancial summary Additional information for shareholders Exchange rates Not... -

Page 159

... Pension costs Directors 58-72 112-116 116 6C Board practices 6D Employees 6E Share ownership Board of directors and Operating Committee Report of the directors Directors Corporate governance Report on directors' remuneration Statement of directors' responsibility Business review Lines... -

Page 160

...Financial statements 53-57 Not applicable Report of the independent auditors Accounting policies Consolidated ï¬nancial statements United States generally accepted accounting principles Quarterly analysis of turnover and proï¬t 74 76-78 75-126 127-134 136-137 BT Annual Report and Form 20-F 2003... -

Page 161

...143 Return on capital employed 45, 138 Rights issue 9, 28, 110, 119 Risk factors 140 Risk management 121-125 Sarbanes-Oxley Act 54, 55, 56-57 Segmental analysis 86-89 Share and ADS prices 143 Share capital 27, 84, 110, 126 Share option schemes 110, 117-120 Shareholder communication 155 Shareholdings... -

Page 162

BT Group plc Annual Report and Form 20-F 2003 BT Group plc Registered ofï¬ce: 81 Newgate Street, London EC1A 7AJ Registered in England and Wales No. 4190816 Produced by BT Group Designed by Paufï¬,ey Typeset by Greenaways Printed in England by Pindar plc Printed on paper which meets international ...