Avon 2006 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2006 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

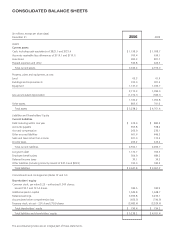

CONSOLIDATED BALANCE SHEETS

(In millions, except per share data)

December 31 2006 2005

Assets

Current assets

Cash, including cash equivalents of $825.1 and $721.6 $ 1,198.9 $ 1,058.7

Accounts receivable (less allowances of $119.1 and $110.1) 700.4 634.1

Inventories 900.3 801.7

Prepaid expenses and other 534.8 424.5

Total current assets 3,334.4 2,919.0

Property, plant and equipment, at cost

Land 65.3 61.9

Buildings and improvements 910.0 901.3

Equipment 1,137.0 1,033.7

2,112.3 1,996.9

Less accumulated depreciation (1,012.1) (946.1)

1,100.2 1,050.8

Other assets 803.6 791.6

Total assets $ 5,238.2 $ 4,761.4

Liabilities and Shareholders' Equity

Current liabilities

Debt maturing within one year $ 615.6 $ 882.5

Accounts payable 655.8 538.2

Accrued compensation 266.9 236.1

Other accrued liabilities 601.6 446.3

Sales and taxes other than income 201.0 172.4

Income taxes 209.2 224.2

Total current liabilities 2,550.1 2,499.7

Long-term debt 1,170.7 766.5

Employee benefit plans 504.9 484.2

Deferred income taxes 30.1 34.3

Other liabilities (including minority interest of $37.0 and $39.9) 192.0 182.5

Total liabilities $ 4,447.8 $ 3,967.2

Commitments and contingencies (Notes 12 and 14)

Shareholders' equity

Common stock, par value $.25 – authorized 1,500 shares;

issued 732.7 and 731.4 shares 183.5 182.9

Additional paid-in capital 1,549.8 1,448.7

Retained earnings 3,396.8 3,233.1

Accumulated other comprehensive loss (656.3) (740.9)

Treasury stock, at cost – 291.4 and 279.9 shares (3,683.4) (3,329.6)

Total shareholders' equity $ 790.4 $ 794.2

Total liabilities and shareholders' equity $ 5,238.2 $ 4,761.4

The accompanying notes are an integral part of these statements.