Avon 2006 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2006 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

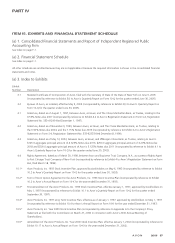

PART II

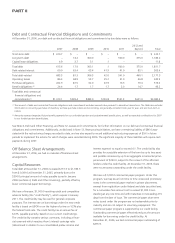

Debt and Contractual Financial Obligations and Commitments

At December 31, 2006, our debt and contractual financial obligations and commitments by due dates were as follows:

2007 2008 2009 2010 2011

2012 and

Beyond Total

Short-term debt $ 610.7 $ – $ – $ – $ – $ – $ 610.7

Long-term debt – 14.2 300.0 – 500.0 375.0 1,189.2

Capital lease obligations 4.9 3.7 3.1 .1 – – 11.8

Total debt 615.6 17.9 303.1 .1 500.0 375.0 1,811.7

Debt-related interest 69.9 63.4 63.4 41.9 41.9 85.1 365.6

Total debt-related 685.5 81.3 366.5 42.0 541.9 460.1 2,177.3

Operating leases 86.3 68.9 52.7 35.2 31.0 66.8 340.9

Purchase obligations 222.9 87.5 62.0 47.9 16.3 79.4 516.0

Benefit obligations (2) 24.4 1.7 1.7 1.7 2.0 14.7 46.2

Total debt and contractual

financial obligations and

commitments (1) $1,019.1 $239.4 $482.9 $126.8 $591.2 $621.0 $3,080.4

(1) The amount of debt and contractual financial obligations and commitments excludes amounts due pursuant to derivative transactions. The table also excludes

information on recurring purchases of inventory as these purchase orders are non-binding, are generally consistent from year to year, and are short-term in

nature.

(2) Amounts represent expected future benefit payments for our unfunded pension and postretirement benefit plans, as well as expected contributions for 2007

to our funded pension benefit plans.

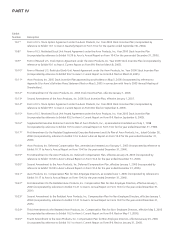

See Note 4, Debt and Other Financing, and Note 12, Leases and Commitments, for further information on our debt and contractual financial

obligations and commitments. Additionally, as disclosed in Note 13, Restructuring Initiatives, we have a remaining liability of $86.0 asso-

ciated with the restructuring charges recorded to date, and we also expect to record additional restructuring expenses of $9.6 in future

periods to implement the actions for which charges were recorded during 2006. The significant majority of these liabilities will require cash

payments during 2007.

Off Balance Sheet Arrangements

At December 31, 2006, we had no material off-balance-sheet

arrangements.

Capital Resources

Total debt at December 31, 2006 increased $137.3 to $1,786.3

from $1,649.0 at December 31, 2005, primarily due to the

$500.0 principal amount of notes payable issued in January

2006 (see Note 4, Debt and Other Financing), partially offset by

lower commercial paper borrowings.

We have a five-year, $1,000.0 revolving credit and competitive

advance facility (the “credit facility”), which expires in January

2011. The credit facility may be used for general corporate

purposes. The interest rate on borrowings under the new credit

facility is based on LIBOR or on the higher of prime or 1/2% plus

the federal funds rate. The credit facility has an annual fee of

$.675, payable quarterly, based on our current credit ratings.

The credit facility contains various covenants, including a finan-

cial covenant which requires Avon’s interest coverage ratio

(determined in relation to our consolidated pretax income and

interest expense) to equal or exceed 4:1. The credit facility also

provides for a possible extension of the term by up to two years

and possible increases by up to an aggregate incremental princi-

pal amount of $250.0, subject to the consent of the affected

lenders under the credit facility. At December 31, 2006, there

were no amounts outstanding under the credit facility.

We have a $1,000.0 commercial paper program. Under this

program, we may issue from time to time unsecured promissory

notes in the commercial paper market in private placements

exempt from registration under federal and state securities laws,

for a cumulative face amount not to exceed $1,000.0 out-

standing at any one time and with maturities not exceeding 270

days from the date of issue. The commercial paper short-term

notes issued under the program are not redeemable prior to

maturity and are not subject to voluntary prepayment. The

commercial paper program is supported by our credit facility.

Outstanding commercial paper effectively reduces the amount

available for borrowing under the credit facility. At

December 31, 2006, we had commercial paper outstanding of

$335.9.