Avnet 2000 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2000 Avnet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AVNET, INC. FY 2000

WORLDWIDE SALES

$ billions % of Avnet

EM 6.64 72.4%

CM 1.86 20.3%

AAC 0.67 7.3%

Avnet is a dynamic industry

consolidator, integrating seven

acquisitions contributing more

than $1.7 billion in sales this year.

Electronics Marketing’s supply-chain management arm, Integrated Material Services

(IMS), continues its explosive global growth. In the United States alone, IMS has achieved

growth of more than 40 percent per year compounded annually. IMS ended FY’00 at

approximately $2.6 billion in sales, positioning Avnet as a premier material manager in

the electronics industry supply chain.

The Asian electronics market is booming, and Avnet’s business in the AsiaPac region

is growing even faster. Asia, including Japan, is now the world’s largest and fastest

growing economic region. China is the world’s second-largest national economy. We

are excited about our relationship with ChinaECNet, a Chinese government-sponsored

Internet venture that selected Avnet as its exclusive source of non-Chinese products,

logistics and technical services to indigenous Chinese original equipment manufac-

turers (OEMs).

Avnet’s EMEA region (Europe, the Middle East and Africa) is progressing. This follows

an intense period of focus on upgrading to SAP 4.0, a multi-lingual, multi-currency

client/ server system that allows us to operate across the continent and in Asia using

a single, IT platform.

Y2K is behind us. While the millennial turnover did not materially affect Avnet’s opera-

tions, anticipation of the event and a resultant slump in sales negatively impacted Avnet

Computer Marketing (CM) for most of the fiscal year. We are now, however, seeing a

return to robust growth rates in sales and profits for CM, and FY’01 is being ushered in

by a strong second half of FY’00.

Realignment of this operating group has delivered a greater focus on key suppliers

at Hall-Mark Global Solutions (rebranded Avnet Hall-Mark), and on the

end-user solutions integration business, Avnet Computer (rebranded Avnet

Enterprise Solutions).

We launched our newest operating group, Avnet Applied Computing (AAC), to serve

the embedded systems market. Since realigning our business to focus on this high

growth opportunity, AAC has grown operating profits sequentially each quarter.

More importantly, we have laid the foundation for what should be a very exciting and

productive billion dollar-plus global operating group for Avnet.

There are many highlights to share from each of our three operating groups, and I invite

you to read more about them in the succeeding pages of our Annual Report. Suffice it

to say, I’m very proud of our employees’ contributions to Avnet during this unprecedented,

dynamic and demanding fiscal year, and I welcome our new employees as we embark on

yet another exciting 12 months.

Now, on to the second of the dual engines, acquisitions.

Driven by the globalization of our customers and suppliers and our chosen role as industry

consolidator, Avnet’s acquisition strategy is moving full steam ahead. This year, we’ve

integrated companies in Europe, Asia and the Americas: Integrand Solutions (Australia);

SEI Macro Group (UK); Marshall Industries (US); Matica S.p.A. and PCD Italia S.r.l.

(Italy); Eurotronics, which did business as SEI (Netherlands); SEI Nordstar (Italy); and

Cosco Electronics/ Jung Kwang (Korea). Through these acquisitions, we have expanded

our customer and supplier base, strengthened relationships, increased our global reach

and added the invaluable intellectual capital of thousands of talented, knowledgeable

employees. We have become the number one value-added distributor of electronic

components in North America and, with our acquisition of Savoir Technology Group, Inc.

(US) just after the fiscal year ended, the number one value-added distributor of IBM

mid-range computing products in the world. The pending acquisition of EBV Elektronik,

WBC, Atlas Services (Europe) and Raab Karcher Electronic Systems (RKE), announced

on August 7, 2000, will further strengthen the position of all three of Avnet’s operating

groups throughout Europe with historical revenue of approximated $1.8 billion.

Additionally, while acquisitions can be difficult to complete and challenging to integrate,

Avnet has built a core competency in this arena. All our current acquisitions are planned

to be accretive to earnings immediately, or within their first year of integration, and

deliver return on capital employed that meets or exceeds our targets. Marshall

Industries was fully integrated with Avnet’s systems one full quarter ahead of schedule

and brought the Company over $85 million in annualized cost synergies by the end of

fiscal 2000. That acquisition, along with the others, helped produce the lowest selling,

general and administrative expenses (SG&A) as a percent of sales in our history, ending

FY’00 at 9.2 percent for the fourth quarter.

5

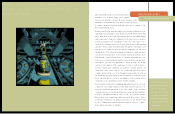

By the latter half of the decade,

successful enterprises will have

integrated the Internet into their

processes such that e-business

will be totally embedded in all

activities. Avnet expects to lead

the way as the industry shifts to

the click-and-mortar model.

Embedded systems technicians

working at the new Avnet

Applied Computing Lab,

Network Operating Center,

Tempe, Arizona.