Aviva 2006 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2006 Aviva annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview Business review Governance Financial statements Other information

Aviva plc

Annual Report and Accounts 2006 9

Financial results

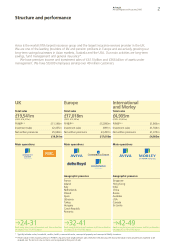

Our pre-tax operating profit** of £3,245 million (2005: £2,904 million) reflects continued strong operational

performances from our portfolio of businesses and the success of our proven strategy. Our return on equity

shareholders’ funds was 13.1% (2005: 15.0%).On an IFRS basis, the group operating profit before tax

was £3,110 million (2005: £2,128 million).The group delivered an overall profit before tax attributable to

shareholders of £2,977 million (2005: £2,528 million).

Retirement

In January, I announced my intention to retire in July this year. I’m proud to have had the opportunity to help

create a leading company in the global insurance industry. With almost ten years as group chief executive under

my belt, there are other dimensions to my life and other things that I want to achieve in both international

charity work and the business world. Now is the right time for me to set out on those adventures while I have

the energy and desire to make a difference. I wish Andrew Moss and Philip Scott every success as they step

into their new roles of group chief executive and group finance director, respectively.

Our people

In September, we conducted our second global employee survey, and our first to cover all business units in the

group. The results of the survey are helping us to identify the differing needs of employees around the world,

share examples of good practice and provide a fulfilling and supportive work environment.

We are a diverse organisation, something that I see as an important strength. Diversity not only

benefits individuals, it enriches our pool of talent, offers new ways of thinking and improves our

understanding of customers.

Outlook

We are continually working to get the right balance between risk, return and growth, and I think that this set

of results shows that we are making excellent progress. Managing risk against return is integral to everything

that we do and will remain a consistent theme in 2007. We continue to benefit from our diverse geography,

distribution and product range and we actively use this balanced portfolio approach to manage away a

significant proportion of risk.

In the stable and mature markets of the UK and continental Europe, I believe that access to distribution will

be our key driver of growth. We will seek to expand our bancassurance channel and significantly enhance our

direct capability. Wesee the capital generated by our general insurance and health businesses and our superior

understanding of customer needs as key differentiators.

The rapidly developing markets in the Asia-Pacific region represent a substantial longer term area of growth

for us. Wewill be looking to accelerate our growth in India and China, while continuing to explorethe potential

of other markets. Across the region, we will be working to expand distribution through bancassurance,

independent financial advisers and the direct sales force.

In North America, the AmerUs acquisition provides us with a scalable platform for growth in what is the

largest single market in the world. Our focus is on successfully integrating AmerUs and achieving our projected

costs savings.

Ibelieve that we arein the right markets, at the right time. Wehave produced an excellent set of results

for 2006 and have put ourselves in a strong position to build on these results in 2007.

Richard Harvey

Group chief executive

* Growth ambitions are annual averages after minority interests, before acquisitions, and assuming no major changes in economic conditions.

** On an EEV basis.