Autodesk 2008 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2008 Autodesk annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

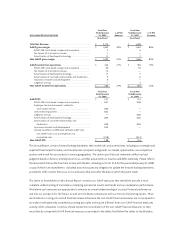

NON-GAAP RECONCILATIONS

Fiscal Year

Ended January

31, 2008

% of Net

Revenue

Fiscal Year

Ended January

31, 2007

% of Net

Revenue

(in millions) (in millions)

Total Net Revenue ........................................ $ 2,172 $ 1,840

GAAP gross margin ....................................... $ 1,965 90% $ 1,623 88%

SFAS 123R stock-based compensation expense .......... 56

Tax impact of stock option review ....................... 1—

Amortization of developed technology .................. 11 7

Non-GAAP gross margin .................................. $ 1,982 91% $ 1,636 89%

GAAP income from operations ............................ $ 446 21% $ 350 19%

SFAS 123R stock-based compensation expense .......... 99 94

Tax impact of stock option review ....................... 14 —

Amortization of developed technology .................. 11 7

Amortization of customer relationships and trademarks . . 98

In-process research and development ................... 6—

Litigation accrual ...................................... —5

Non-GAAP income from operations ....................... $ 584 27% $ 463 25%

Fiscal Year

Ended January

31, 2008

Fiscal Year

Ended January

31, 2007

GAAP EPS ............................................... $ 1.47 $ 1.19

SFAS 123R stock-based compensation expense .......... 0.41 0.38

Employee tax reimbursements related to

stock option review ................................. 0.06 —

Investment impairment ................................ 0.02 —

Litigation accrual ...................................... — 0.02

Amortization of developed technology .................. 0.04 0.03

Amortization of customer relationships and

trademarks ......................................... 0.04 0.03

In-process research and development ................... 0.02 —

Income tax effect on difference between GAAP and

non-GAAP total costs and expenses at a

normalized rate ..................................... (0.18) (0.12)

Non-GAAP EPS ........................................... $ 1.88 $ 1.53

This Annual Report contains forward-looking statements that involve risks and uncertainties, including our strategies and

expected financial performance, our future business prospects and growth, our market opportunities, our competitive

position and trends for our products in various geographies. We caution you that such statements reflect our best

judgment based on factors currently known to us, and that actual events or results could differ materially. Please refer to

the documents that we file from time to time with the SEC, including our Form 10-K for the year ended January 31, 2008,

a copy of which is enclosed herein. Autodesk does not assume any obligation to update the forward-looking statements

provided to reflect events that occur or circumstances that exist after the date on which they were made.

The Letter to Stockholders in this Annual Report contains non-GAAP measures that we believe provide a more

complete understanding of Autodesk’s underlying operational results and trends and our marketplace performance.

We believe such measures are appropriate to enhance an overall understanding of our past financial performance

and also our prospects for the future, as well as to facilitate comparisons with our historical operating results. There

are limitations in using non-GAAP financial measures because the non-GAAP financial measures are not prepared in

accordance with generally accepted accounting principles and may be different from non-GAAP financial measures

used by other companies. Investors should review the reconciliation of the non-GAAP financial measures to their

most directly comparable GAAP financial measures as provided in the tables that follow the Letter to Stockholders.