Audiovox 1999 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 1999 Audiovox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiscal 1999 was by far, the most exciting year in our Company’s history.

For the first time our sales exceeded 1 billion dollars increasing by 88%

over fiscal 1998. Our share price increased 362%, closing at $29.75 on

November 30, 1999 and subsequently has reached as high as $58.38 per

share. Our market valuation, which was $125.7 million at the beginning

of fiscal 1999, rose to $597.6 million at year-end and is over $1.2

billion today. In February we completed a follow on offering that has

increased our public float by 2.3 million shares. And, after the close of

our fiscal year, we moved from the American Stock Exchange to the

NasdaqT. As a rapidly expanding leader in the telecommunications and

consumer electronics industries, we now find ourselves trading along-

side other high tech companies.

The growth experienced throughout our fiscal year can be attributed

to the success of both our operating groups and the increasing demand

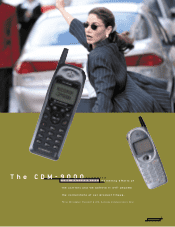

for our products. Audiovox Communications Corp. (ACC), our majority-

owned wireless subsidiary grew 110% and reached record sales of 6.1

million phones. Our digital handset sales rose from 18% in fiscal 1998 to

56% in fiscal 1999. Dataquest currently ranks ACC number three in over-

all North American wireless handset market share and the number two

supplier of CDMA handsets in North America. CDMA is the wireless

industry’s fastest growing platform.

We achieved our stated goal to begin supply of TDMA and GSM

phones during 1999, and we expect to ramp up shipments of these tech-

nologies during 2000. We have introduced a full line of GSM dual band

phones scheduled for shipment in fiscal 2000 and expect that these new

products will increase our market share in Europe and Southeast Asia

where GSM is the strongest technology.

The outlook for our wireless group is good. We estimate wireless

industry worldwide growth between 48% for year 2000 and 36% for

2001. Our intent is to build on our role as a major branded supplier both

here and abroad, while gaining increased market share. In addition, we

will continue to introduce new products, such as smart phones for

data/web applications, as new technologies that support them develop.

Our electronics division also had a very good year, posting a strong

31% growth over fiscal 1998. Our FRS two-way radios first introduced in

1998 gained substantial acceptance and captured a 20% market share

during the year. Our Mobile Video sales grew an outstanding 420% to

approximately $52 million. We recently announced a contract with

Nissan to supply an OE version of our EZFIT center console as standard

equipment on the Nissan Quest 2000. We continued our commitment to

AUDIOVOX

2

Chairman’s Letter to

SHAREHOLDERS