Audiovox 1999 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 1999 Audiovox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Information Technology Over the past several years, we have

made substantial investments in information technology to improve our

operations, prepare us for an increase in international business and

position us for future growth. In 1999, our sales grew by 88% without

placing a strain on our systems and operations. We believe that we

are prepared for the anticipated growth over the next several years.

In addition, we have invested in our Intranet and Internet capabilities

and this spring expect to turn on a new and vastly improved web site

for the Company.

Follow On Offering In February 2000, the Company completed a

follow on offering of 3,565,000 Class A common shares at a price to

the public of $45.00 per share. Of the 3,565,000 shares sold, the

Company offered 2,300,000 and 1,265,000 were offered by selling

shareholders. Audiovox received approximately $97.5 million after

deducting expenses. We will use these net proceeds to repay a portion

of amounts outstanding under our revolving credit facility, any portion

of which can be reborrowed at any time, and for general purposes.

The Company did not receive any of the net proceeds from the sale of

shares by the selling shareholders.

Credit Facility During 1999 the Company increased its bank credit

facility to $250.0 million, up from $112.5 million with an expiration date

of July 2004. Chase Manhattan bank is the agent for this new revolving

line of credit. This latest increase to our bank lines provides us with

additional resources to fund our future business plans.

Equity Investments Audiovox Corporation maintains equity

investments in unconsolidated entities that it utilizes to augment oper-

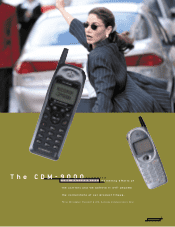

ations and distribution. Talk Corporation, a 31% investment, provides

us with wireless products. Automotive Specialty Applications (ASA)

provides us the ability to market products to the specialized van, truck,

RV and agricultural industries. Our 20% ownership of Bliss-tel in

Thailand provides a distribution outlet for our product in that country.

AUDIOVOX

10

Report of

THE CFO

Michael Stoehr

Senior Vice President &

Chief Financial Officer