Atmos Energy 2014 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2014 Atmos Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Natural gas is

the foundation

fuel of our

economy

and meets

PERCENT

of the nation’s

energy needs

today.

27

Atmos Energy’s pipeline infrastructure investments are occurring at

an opportune time. Financing costs for both debt and equity have been

favorable. And, the cost of natural gas has remained relatively low.

12

FUELING THE FUTURE

Natural gas is the essential fuel to achieve key

environmental goals of fewer pollutants and cleaner

air. For this reason, major environmental groups

support using more natural gas, especially to replace

coal for generating electricity.

Approximately 28 percent of the electricity in the

United States today is generated at 1,700 natural gas-

red power plants. Virtually all new power plants

built during the past decade use natural gas for fuel

because of its abundant domestic supply, low cost

and low emissions.

With the rapid retirements of many coal-red

power plants, natural gas is becoming the country’s

foundation fuel source as well as the backup fuel to

complement renewables development. To supply

more gas-red power plants, new natural gas pipe-

lines and greater capacity on existing transmission

lines are needed.

e U.S. Energy Information Administration

projects that total natural gas consumption in the

United States will grow from 25 trillion cubic feet

(Tcf) a year today to 30 Tcf by 2040. is growth will

be caused by the increased use of gas

both to generate electricity and to fuel

manufacturing and process industries.

In 2013, for example, Mississippi

regulators adopted a policy to en-

courage more expansion of the state’s

natural gas infrastructure to attract

industrial investment and to promote

economic development. e state’s

Public Service Commission approved

a Supplemental Growth Rider that

allows Atmos Energy to spend up to $5 million a

year on infrastructure expansions to support new

industrial projects and added jobs.

Historically, it has been dicult to justify extend-

ing natural gas pipelines to certain industrial projects

because the initial expected gas volumes and reve-

nues were insucient to pay for the investment. is

new Mississippi program funds gas infrastructure

investments for their rst 10 years in service. Any

new gas revenues generated by the investments will

help recoup the cost of the program, which is being

paid for by customers in Mississippi.

ADVANTAGEOUS TIMING

Atmos Energy’s pipeline infrastructure in-

vestments are occurring at an opportune time.

Financing costs for both debt and equity have been

favorable. And, the cost of natural gas has remained

relatively low.

Because of extremely low interest rates, issu-

ing debt has been very attractive for companies,

like Atmos Energy, that must raise hundreds of

millions of dollars of new capital each year. e

company has taken advantage of this opportunity

not only to renance its debt issues at lower prices,

but also to lock in a portion of the interest rate on

future debt renancings.

At the same time, investors have expressed strong

condence in Atmos Energy’s stock. Accordingly,

the market price of Atmos Energy shares has risen

during the period from October 1, 2010, to October

1, 2014, at a compounded average growth rate of

approximately 13 percent a year.

Atmos Energy has issued more than 10.2 million

shares of common stock during the past four scal

years to raise additional capital and to keep its

debt-to-capitalization ratio in balance.

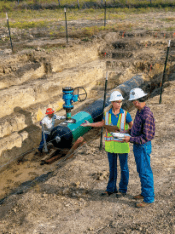

Brad McDaniel, senior service technician, reviews drawings of

Atmos Energy’s pipeline supplying gas to the new Yokohama Tire

Company plant at West Point, Mississippi. Now in the first phase of a

four-phase expansion program, the complex eventually will employ

2,000 workers and will exceed 100 acres under roof by 2018.

Working with the Mississippi Public Service Commission, Atmos

Energy secured a special economic development rider to help recover

infrastructure costs that support new industry and jobs for the state.

ATMOS ENERGY: INVESTING FOR SAFETY

CO2

CO2 AND OTHER EMISSIONS ARE MUCH

LESS WITH NATURAL GAS THAN WITH COAL

Source: American Clean Skies Foundation

COAL

227,052,854

POUNDS OF CO2 PER YEAR

331,545

POUNDS OF NOX PER YEAR

740,450

POUNDS OF SO2 PER YEAR

NATURAL GAS

91,743,152

POUNDS OF CO2 PER YEAR

6,273

POUNDS OF NOX PER YEAR

784

POUNDS OF SO2 PER YEAR