Atmos Energy 2004 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2004 Atmos Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LETTER TO SHAREHOLDERS 7

Industry experts estimate that large

resources of natural gas remain to be

tapped. However, only when additional

supplies come to market will gas com-

modity prices moderate and reduce

the volatility of gas price spikes that are

hurting consumers, businesses and

utilities alike.

BOARD CHANGES

Two significant milestones in our corporate governance

occurred during 2004. The first was the retirement of one

of our longtime directors, Carl S. Quinn. Carl’s service

to Atmos Energy was matched only by his legacy in the

natural gas industry as one of its leading statesmen.

We shall miss his wise counsel, steady direction and

solid integrity.

However, we were pleased in August when we

marked a second milestone, the addition of our first

woman director, Nancy K. Quinn. Ms. Quinn brings a

wealth of experience in investment banking and energy

industry financing. She also is a respected woman entre-

preneur and benefactor of the arts. We feel honored

that she agreed to join our board.

FUTURE EXPECTATIONS

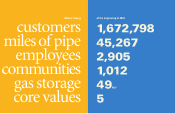

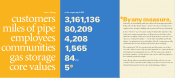

As we look to 2005, we are excited about

the tremendous potential that we

foresee. Our acquisition of TXU Gas has

given us greater size and scale. Our

existing utility operations continue to

achieve exceptional results. Our non-

utility operations are positioned to make

complementary contributions in the future.

We remain committed to keeping Atmos Energy a

financially successful company by showing respect for

all who deal with us and by expecting the highest ethical

behavior of all who work for us. We anticipate growing

earnings at 3 percent to 6 percent a year and continuing

to pay higher annual dividends. Being financially successful

is the best way we can reward our investors, serve our

customers, invest in our employees and contribute to our

1,500 communities.

We intend to continue to operate the business

through a dedication to a strong financial foundation,

a disciplined attitude to operations, a successful approach

to making and integrating acquisitions, a devotion to

serve our customers exceptionally well and an adherence

to our core values.

In addition, we have advocated that states adopt a

measure similar to a Texas law that allows for faster

recognition in rates of essential capital investment needed

to maintain the system and serve new customers. The

Gas Reliability Infrastructure Program in Texas reduces

the effects of regulatory lag on cash flow and earnings.

CUSTOMER SERVICE EXCELLENCE

Excellence in customer service stands as a key part of our

corporate vision—we call it our Spirit of Service.

SM

Our reputation in the community is directly influenced

by how we perform. During the past two years, we

have conducted extensive training efforts and intend to

expand the programs further in 2005. We also are

organizing programs to help our employees better under-

stand the dynamics ofour business as it grows.

INVESTMENT IN A STRONG

CORPORATE CULTURE

Another intangible, but essential, investment that we are

pursuing is to build a strong corporate

culture. In 2004, we took additional

steps to invest in our employees through

expanded training, improved benefits

programs and increased communications.

Instilling our core values through-

out the organization is essential to

our future success. As we have integrated

major acquisitions into our operations, we have found

that our values make a tangible difference. Having the

right corporate culture guides us in dealing appropriately

with business issues. Moreover, the right corporate

culture emphasizes to our employees the values and

integrity on which we will continue to grow.

NEED FOR A NATIONAL ENERGY POLICY

With the contentious 2004 elections now past, we

trust that Congress and the Administration can focus on

one of the most pressing national issues that received

almost no attention during the campaign—the need for

a comprehensive national energy policy.

Natural gas prices have continued to rise during

the past five years. In the 2004–2005 heating season,

home heating bills will likely go up from 10 percent

to 15 percent above bills of last winter. These price

increases are the result of normal market responses.

Yet, that response is prompted by our nation’s lack

of a national energy policy.

We need a policy that permits

additional drilling for natural gas in

the United States and incentives to

build new pipeline capacity, such as

a pipeline to transport abundant

natural gas supplies from the North

Slope of Alaska to the contiguous

48 states.

6 LETTER TO SHAREHOLDERS

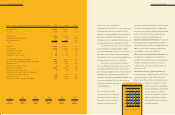

NET INCOME

$90.0

75.0

60.0

45.0

30.0

15.0

0.00 2000 2001 2002 2003 2004

Consolidated net income (in millions)

Robert W. Best

Chairman, President and Chief Executive Officer

November 19, 2004