Atmos Energy 2004 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2004 Atmos Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

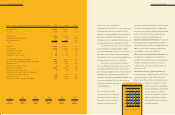

RESULTS OF OPERATIONS

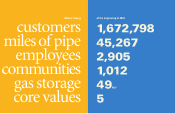

Atmos Energy’s consolidated net income for fiscal 2004

was $86.2 million, or $1.58 per diluted share. That compares

with $71.7 million, or $1.54 per diluted share, in fiscal

2003. Utility operations contributed 73 percent of earnings,

and nonutility operations provided 27 percent. Return

on average shareholders’ equity was 9.1 percent, and total

return to our shareholders was 10.4 percent. We paid

cash dividends in 2004 of $1.22 per share for an annualized

dividend yield at year-end of 4.8 percent.

TXU GAS ACQUISITION

On June 17, Atmos Energy announced it would acquire

the natural gas distribution and pipeline operations of

TXU Gas Company, the largest

gas utility in Texas.After receiving

the required approvals from

three state utility regulatory

commissions, we completed the

transaction on October 1, 2004,

paying an adjusted cash price

of $1.905 billion.

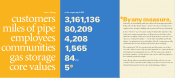

Adding TXU Gas’ 1.5

million utility customers made Atmos Energy the largest

natural-gas-only utility in the United States. The

operations also provide us above-average annual growth

in customer accounts, the ability to earn a return on

capital investments promptly through automatic rate

adjustments and the opportunity to deliver more

gas to wholesale customers through one of the largest

intrastate gas pipeline systems in Texas.

Because of these factors, we estimate that the

TXU Gas operations, since renamed our Mid-Tex Division,

will contribute from 5 cents to 10 cents to earnings

per diluted share in fiscal 2005. Adding the TXU Gas

operations increased Atmos Energy’s proportion of

operating income from regulated operations to about

90 percent.

OTHER ACQUISITIONS AND DIVESTITURES

In February, we acquired the natural gas distribution

assets of ComFurT Gas, Inc., a privately held gas utility

system in Buena Vista, Colorado.

We paid $1.95 million cash for

a 49-mile distribution system,

serving approximately 1,800

utility customers.

During 2004, we and three

other utility partners completed

the sale of our interests in the

general partnership and limited

partnerships of Heritage Propane Partners, L.P. We

received cash proceeds of approximately $26.6 million

and recorded a $5.9 million pretax book gain, ending

our interest in the propane business.

18 OPERATIONS REVIEW OPERATIONS REVIEW 19

WEATHER AND THROUGHPUT

Weather during fiscal 2004 was 6 percent warmer than in

fiscal 2003 and 4 percent warmer than normal, as adjusted

for jurisdictions with weather-normalized operations.

Primarily because of lower consumption, our

utility gas throughput in 2004 declined about 1 percent

from that in 2003 to 246.0 billion cubic feet (Bcf). Of

this total, utility gas transportation volumes were 72.8

Bcf. In our nonutility segment, natural gas marketing

sales volumes

declined 1.5

percent from

those in 2003

to 222.6 Bcf.

In states

with warmer

winter weather, we have sought weather-normalization

adjustments in our rates. Weather normalization protects

our customers from steep increases in their winter gas

bills when the weather turns unusually cold and it protects

our earnings when the winter is unseasonably warm.

We now have weather normalization or higher base

rates in eight of our largest states. About 17 percent of our

margins are exposed to weather in the 2004–2005 heating

season, an increase from 10 percent due to the addition

of the Mid-Tex operations.

RATE ADJUSTMENTS

During 2004, we added $16.2 million in net revenues from

rate filings in Kansas, Texas and Mississippi. We expect

to add $15 million to $20 million a year in average annual

rate increases over the next five years. To keep our

actual rates of return as close as possible to our allowed

returns, we are seeking other rate adjustments, as well.

We are proposing weather normalization in juris-

dictions with warmer weather, shifting more revenue

from the gas

commodity

charge to base

rates, improv-

ing our rate

design to miti-

gate the effects

of declining usage per customer, recovering the gas

cost portion of bad debt expense and working to eliminate

regulatory lag for capital spending on gas utility infra-

structure improvements.

NATURAL GAS PRICES

Natural gas prices continued to rise during fiscal 2004.

Our utility system’s average cost of gas purchased for

customers was $6.55 per thousand cubic feet (Mcf), an

increase of 13.7 percent over the $5.76 per Mcf we paid

in fiscal 2003. The increase was largely due to a tightening of

natural gas supply and demand. Although gas resources

CUSTOMER COMPARISON

Atmos Energy

AGL Resources

ONEOK

Southwest Gas

WGL Holdings

3.0

2.5

2.0

1.5

1.0

0.5

0.0

Customers (millions)

Customers before TXU Gas acquisition (millions)

Adding TXU Gas’1.5 million customers

made Atmos Energy the largest natural-

gas-only utility in the United States.