Atmos Energy 2002 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2002 Atmos Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Woodward Marketing turned in impressive contribu-

tions from increased volumes due to acquisitions

we made in 2001. These include the nonutility assets

of LGS Natural Gas, a large natural gas storage

field in Kentucky and two gas marketing companies.

Woodward also realized increased sales of wholesale

gas, favorable margins on gas trading and gains on

sales of gas from inventory.

Woodward Marketing differs fundamentally

from other gas marketing companies that have been

experiencing difficulty. Five of its strengths

stood out in 2002:

Years of success Woodward Marketing

has grown steadily throughout its

17

-year

history. It is an established competitor

in the natural gas marketing business,

and its employees are highly experi-

enced

in this business.

Excellent service Woodward Marketing

knows natural gas marketing and

how to serve its customers extremely

well; in industry surveys, customers

consistently rank it as one of the best

in customer service.

Continual contributions Woodward Marketing’s

contribution to Atmos Energy’s consolidated net

income increased every quarter of fiscal 2002.

Strategic acquisitions Woodward Marketing’s volumes

have grown by making strategic acquisitions and by

managing other Atmos Energy assets.

Stable and growing book of business The bulk of

Woodward Marketing’s business is built on long-term

relationships and excellent customer service.

Woodward has retained approximately 90 percent of

its customers since it was founded in 1985. It has

been ranked consistently among the top three mid-tier

gas marketers in the United States. Its continuity

of business and commitment to service have created

stable and growing contributions

to our earnings.

For these reasons, we take great

confidence in the outlook for our

nonutility operations. This past

July, others showed their confidence,

too, when Woodward Marketing

renegotiated its uncommitted demand

credit facility and increased the

facility’s limit by $85 million to $210

million. This increased credit

facility will be used to support our

growing gas marketing business.

Our nonutility operations — gas

marketing and trading, storage and transportation, and

small distributed power generation — are vital and

honorable businesses. We have great confidence in

the future of Woodward Marketing and our other

nonutility units.

7

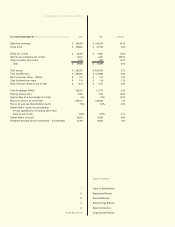

Atmos Energy paid dividends during fiscal 2002

of $1.18 per share. Our annual indicated dividend

rate for fiscal 2003 is $1.20.

Atmos Energy Dividend History

‘03

‘02

‘01

‘00

‘99

‘98

‘97

‘95

‘96

‘94

‘93

‘92

‘91

‘90

‘89

‘88

‘87

.20 .40 .60 .80 1.00 1.20

‘86

‘84

‘85

1.20

1.18

1.16

1.14

1.10

1.06

1.01

.98

.96

.91

.82

.79

.75

.74

.73

.71

.54

.50

.40

.35

$0.00