Atmos Energy 2000 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2000 Atmos Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

........

8

atural gas may be the energy

success story for the next 20 years.

The American Gas Foundation

and other organizations project

average annual U.S. natural gas consumption will

increase from the current level of 22 quadrillion

Btus to 30 – 35 quadrillion Btus by 2020. Atmos

is positioned to benefit from the bright future

of natural gas.

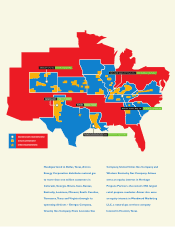

Atmos’ core business remains the distribution

of natural gas through its five operating divisions:

Energas Company, Greeley Gas Company,Trans

Louisiana Gas Company, United Cities Gas

Company and Western Kentucky Gas Company.

We intend to increase earnings by profitably

growing our residential, commercial and industrial

customer bases, improving our efficiency and

earning our allowed rates of return in each

state in which we operate. We will continue to

strengthen our utility business by providing

superior customer service and reliability, by

providing competitive gas rates and by effective

cost management.

Financial Performance

Utility operations reported net income of

$22.4 million on revenues of $740 million in

Running Our Utilities ExceptionallyWell

2000, or about 63 percent of total net income.This

compares with utility net income of $10.8 million

on revenues of $621.2 million in 1999. Utility net

income was higher in 2000 primarily due to the

positive impact of new rate designs and revenue

increases approved in recent regulatory proceed-

ings, as well as the addition of approximately 48,000

customers as the result of the closing of the ANG

Missouri acquisition. Reduced operating costs in

fiscal 2000 also contributed to improved net income.

Enhancing Efficiency

and Convenience

A major part of Atmos’ strategy for increasing

its earnings is managing costs through efficient oper-

ations. Atmos is one of the most efficient operators

in the industry, with operating and maintenance

costs of $135 per meter compared to an average

of $220 per meter for

our peer group.We

are ahead of many

companies in having the

technology that provides

Atmos the foundation for

delivering exceptional

customer service while

N

CUSTOMER SUPPORT CENTER

...................