American Home Shield 2003 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2003 American Home Shield annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

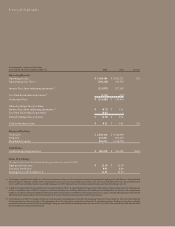

(In thousands, except per share data)

As of and for the years ended December 31 2003 2002 Change

Operating Results

Operating revenue $ 3,568,586 $ 3,500,721 2%

Operating income (loss)(1) (166,243) 335,393

Income (loss) from continuing operations(1,2) (221,975) 157,303

Loss from discontinued operations(3) (2,712) (309)

Net income (loss) $ (224,687) $ 156,994

Diluted earnings (loss) per share:

Income (loss) from continuing operations(1,2) $ (0.75) $ 0.51

Loss from discontinued operations(3) (0.01) –

Diluted earnings (loss) per share $ (0.76) $ 0.51

Cash dividends per share $ 0.42 $ 0.41 2%

Financial Position

Total assets $ 2,956,426 $ 3,414,938

Total debt 819,271 835,475

Shareholders’equity 816,517 1,218,700

Cash Flows

Cash from operating activities $ 283,538 $ 374,191 (24%)

Share Price Range

(Traded on the New York Stock Exchange under the symbol SVM)

High price for the year $ 12.10 $ 15.50

Low price for the year 8.95 8.89

Closing price as of December 31, 11.65 11.10

(1) The Company’s goodwill and intangible assets that are not amortized are subject to at least an annual assessment for impairment by applying a fair-value based test. During the third

quarter of 2003, the Company recorded a non-cash impairment charge associated with goodwill and intangible assets at its American Residential Services, American Mechanical

Services and TruGreen LandCare business units of $481 million pre-tax ($383 million after-tax). The impact on diluted earnings per share of this charge was $1.30.

(2) In 2003, the Company adopted Statement of Financial Accounting Standards (SFAS) 145, which eliminated the requirement to report all material gains and losses from the extinguishment

of debt as extraordinary items. In 2002, the Company recorded an extraordinary loss of $.03 per diluted share ($15 million pre-tax,$9 million after-tax) from the early extinguishment

of debt. As a result of the Company’s adoption of SFAS 145 in 2003, this loss has been reclassified into continuing operations interest expense,thereby reducing the previously reported

2002 income from continuing operations and related diluted earnings per share from continuing operations by the same amount.

(3) In the third quarter of 2003, the Company sold the assets and related operational obligations of the utility line clearing operations of TruGreen LandCare. The results of the utility line

clearing operations have been reclassified as “Discontinued operations”for all periods presented and are not included in continuing operations. Earnings per share from continuing

operations in 2002 were reduced $.01 and correspondingly earnings per share from discontinued operations were increased by $.01 to reflect the reclassification of the divested utility

line clearing business as discontinued operations.

Financial Highlights