Alcoa 2003 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2003 Alcoa annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Afew years ago, we raised the bar

on Alcoa’s stated Vision of being

the best aluminum company

in the world to that of aspiring to be the

best company in the world. While we

have much to be proud of as we enter a

new year, we know that we have more

to do… and that this goal is about more

than delivering strong financial perform-

ance. It is about sustained financial suc-

cess, while building for the future. And

it is about delivering on all of Alcoa’s

seven Values.

Despite what was a challenging

business environment in many markets

across the globe, we did make significant

strides in 2003:

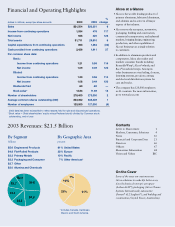

• Income from continuing operations

rose 117% to $1.034 billion, or $1.20

per share, in 2003, and every segment

demonstrated higher profitability;

• Our disciplined approach to capital allowed us to pay down

more than $1 billion in debt, providing us with additional flexi-

bility in pursuing profitable growth opportunities;

• We surpassed our second three-year, cost-savings challenge by

reaching $1.012 billion of annualized savings (the first, in

1998-2000, achieved $1.1 billion in savings), which helped

drive gross margins higher;

• Revenues increased 6% to $21.5 billion; and

• We recorded the lowest lost workday rate in the Company’s

history.

Reflecting this performance, in part, Alcoa’s total share-

owner return for 2003, including dividend reinvestment, was

70%. For comparative purposes, the Dow Jones Industrial

Average, of which we are a component, returned 25% during

the same period.

Goals and Strategies for 2004 and Beyond

In 2004, we are committed to our financial goals:

1. Profitable Growth – We will continue the drive to profitably

grow our revenues as well as to join the first quintile of the S&P

Industrials measured in terms of Return on Capital (ROC).

2. Cost Savings – Financial fitness is key to our future. In sup-

port of our profitable growth challenge, we have launched our

third three-year, cost-savings challenge to eliminate an addi-

tional $1.2 billion in costs by the end of 2006. When we set

our first billion-dollar, cost-savings goal in 1998, it was diffi-

cult, but we achieved it. The second billion-dollar challenge,

Fellow Shareowners:

which we completed and surpassed last

year, was even more challenging. The

new goal will be equally tough, but we

have the talent, a proven Alcoa Business

System (ABS), and the determination to

reach it. Upon its completion, we will

have eliminated more than $3.3 billion

in costs, which will help offset the impact

of tough global conditions we have

experienced over the last three years and

benefit us when markets resume their

growth patterns.

While we have made strides toward

our ROC goal of permanent member-

ship in the first quintile of the S&P

Industrials, we still have a long way to

go. Our fourth quarter 2003 ROC on

an annualized basis was 7.6% versus

a company ROC of 4.2% in 2002. The

first quintile entry point, however, is

currently around 16%.

This goal is not about the honor of membership in the first

quintile. It is about earning the right from shareowners, through

our performance and consistency, to continue to profitably

grow. It will provide us the opportunity to plan for the future,

continue to offer challenging jobs, and pursue growth opportu-

nities for shareowners, for Alcoans, and other stakeholders.

All our efforts are based upon two precepts: deliver short-

term performance while positioning the company to be successful

for years to come. The steps we are implementing are improving

both short-term and long-term profitability… and laying the

foundation for our continued leadership position for generations

to come. We are:

• Continuing to refine our portfolio of businesses;

• Strengthening our asset base and improving its productivity;

• Extending our global reach and repositioning our primary

businesses lower on the cost curve;

• Strengthening our connection to customers; and

• Building on the transformation of our businesses – from

making products to delivering solutions… working across

businesses in order to help our customers be successful within

their markets.

Portfolio Reconfiguration

Last year, we announced a program to divest a number of busi-

nesses that either did not have the ability to grow in excess of

GDP or did not have the ability to deliver superior returns in sec-

tors where Alcoa maintains a sustainable competitive advantage.

Alain Belda, Chairman and Chief Executive Officer

1