Airtran 2003 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2003 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

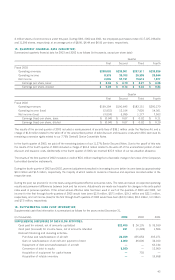

4 million shares of common stock under this plan. During 2003, 2002 and 2001, the employees purchased a total of 117,125, 196,424

and 31,396 shares, respectively, at an average price of $8.00, $4.44 and $6.93 per share, respectively.

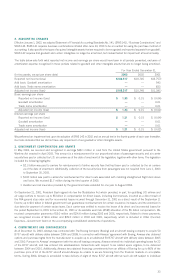

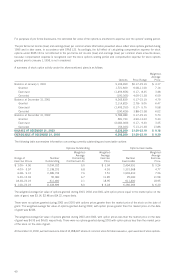

15. QUARTERLY FINANCIAL DATA (UNAUDITED)

Summarized quarterly financial data for 2003 and 2002 is as follows (in thousands, except per share data):

Quarter

First Second Third Fourth

Fiscal 2003

Operating revenues $208,002 $233,901 $237,311 $238,826

Operating income 8,378 30,703 26,393 20,844

Net income 2,036 57,191 19,613 1,677

Earnings per share, basic $ 0.03 $ 0.79 $ 0.27 $ 0.26

Earnings per share, diluted $ 0.03 $ 0.74 $ 0.24 $ 0.24

Quarter

First Second Third Fourth

Fiscal 2002

Operating revenues $159,304 $190,645 $183,151 $200,270

Operating income (loss) (2,932) 12,154 7,620 14,361

Net income (loss) (3,034) 5,099 1,177 7,503

Earnings (loss) per share, basic $ (0.04) $ 0.07 $ 0.02 $ 0.11

Earnings (loss) per share, diluted $ (0.04) $ 0.07 $ 0.02 $ 0.10

The results of the second quarter of 2003 included a reimbursement of security fees of $38.1 million under the Wartime Act and a

charge of $1.8 million related to the write off of the unamortized portion of debt discount and issuance costs when BCC exercised its

remaining conversion rights related to our 7.75% Series B Senior Convertible Notes.

In the fourth quarter of 2003, we paid off the remaining balance of our 11.27% Senior Secured Notes. Due to the payoff of this note

the results of the fourth quarter of 2003 included a charge of $10.4 million related to the write off of the unamortized portion of debt

discount and issuance costs. Additionally in the fourth quarter of 2003, we reversed $15.9 million of our tax valuation allowance.

The results of the first quarter of 2002 included a credit of $5.6 million resulting from a favorable change in fair value of the Company’s

fuel-related derivative instruments.

During the fourth quarter of 2003 and 2002, year-end adjustments resulted in increasing income before income taxes by approximately

$0.3 million and $1.5 million, respectively, the majority of which relates to revisions of revenue and expenses recorded earlier in the

respective year.

During the year, we provide for income taxes using anticipated effective annual tax rates. The rates are based on expected operating

results and permanent differences between book and tax income. Adjustments are made each quarter for changes in the anticipated

rates used in previous quarters. If the actual annual effective rates had been used in each of the quarters of 2003 and 2002, net

income for the first through fourth quarters of 2003 would have been $2.0 million, $57.1 million, $19.3 million and $22.1 million,

respectively, and net income (loss) for the first through fourth quarters of 2002 would have been ($3.2) million, $5.3 million, 1.2 million

and $7.5 million, respectively.

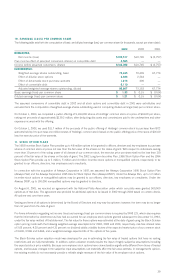

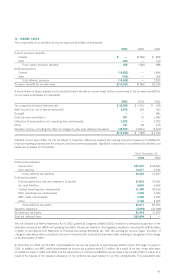

16. SUPPLEMENTAL CASH FLOW INFORMATION

Supplemental cash flow information is summarized as follows for the years ended December 31,

(in thousands): 2003 2002 2001

SUPPLEMENTAL DISCLOSURE OF CASH FLOW ACTIVITIES:

Cash paid for interest, net of amounts capitalized $22,400 $ 26,135 $ 35,530

Cash paid (received) for income taxes, net of amounts refunded 231 (1,328) 1,506

Noncash financing and investing activities:

Purchase and sale/leaseback of aircraft 22,359 455,654 305,271

Gain on sale/leaseback of aircraft and payment of debt 3,000 46,000 34,100

Repayment of debt and sale/leaseback of aircraft —— 63,144

Conversion of debt to equity 5,500 — 12,000

Acquisition of equipment for capital leases —703 —

Acquisition of rotable inventory —— 19,658

43