Airtran 2003 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2003 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

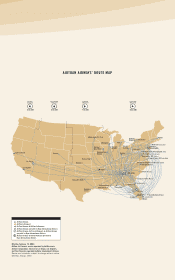

Many of our competitors have experienced significant financial and operational hardships, including bankruptcy protection and capacity

reductions. As these competitors downsize their operations, market opportunities may become available to add frequencies in existing

markets and new markets between existing cities as well as adding new cities as opportunities arise. As a result, we expect to lower

costs, improve productivity and increase aircraft utilization.

Although we were able to generally offset the increased level of operating expenses in 2003 with lower maintenance and distribution

costs, there can be no assurance we will be able to continue to offset any additional expenses, particularly resulting from increases in

the price of fuel, further changes to security procedures or increases in aircraft insurance costs.

RESULTS OF OPERATIONS

2003 COMPARED TO 2002

SUMMARY

For the year 2003, we recorded operating income of $86.3 million, net income of $100.5 million and diluted earnings per common

share of $1.21. These results reflect a credit of $38.1 million for a payment from the United States government under the Emergency

Wartime Supplemental Appropriations Act of 2003 (Wartime Act), a charge of $12.3 million for the write off of debt discount and debt

issuance costs due to early payoff of debt and the conversion of debt to equity and a credit of $15.9 million created by the reversal of a

tax valuation allowance. Our diluted earnings per common share were increased by $0.48 upon recognition of these items (see Notes 3,

7 and 12 to the Consolidated Financial Statements). For the comparative period in 2002, including special items, we recorded operating

income of $30.6 million, net income of $10.7 million and diluted earnings per common share of $0.15. Our 2002 results included a

credit of $0.6 million for a government grant received pursuant to the Air Transportation Safety and System Stabilization Act

(Stabilization Act). Our diluted earnings per common share for the year ended December 31, 2002 were increased by $0.01 upon

recognition of the government grant (see Note 3 to the Consolidated Financial Statements).

OPERATING REVENUES

Our operating revenues for the year increased $184.7 million (25.2 percent) primarily due to an increase in passenger revenues. The

increase in passenger revenues was primarily due to a 28.0 percent increase in traffic, as measured by revenue passenger miles (RPMs).

During 2003, we took delivery of 23 Boeing 717 aircraft and retired nine owned DC-9 aircraft and five leased DC-9 aircraft (total of 14

DC-9 aircraft). As a result, our capacity, as measured by available seat miles (ASM), increased by 21.7 percent. When coupled with

our RPM growth of 28.0 percent, our load factor increased 3.5 percentage points to 71.1 percent.

While we continued to grow our operations by adding new aircraft to our fleet, new destinations to our route network and additional

frequencies between existing city pairs, we continued to experience a decline in yields during 2003. Our average yield, as measured by

revenue per passenger seat mile, decreased 2.6 percent to 12.46 cents per RPM. The reduction in yield resulted from a 3.3 percent

increase in our average fare to $76.38 and a 6.1 percent increase in our average passenger trip length, as measured by RPMs divided

by revenue passengers, to 613 miles. This decline in yield, when combined with our 3.5 percentage point increase in passenger load

factor, resulted in a 2.5 percent increase in passenger unit revenues, or passenger RASM, to 8.86 cents per ASM.

Cargo revenues declined $0.5 million primarily due to reduced levels of mail transported for the U.S. Postal Service. In general, the

demand for short-haul cargo transportation has diminished and we continue to focus our resources on passenger transportation.

OPERATING EXPENSES

Our operating expenses for the year increased $128.9 million (18.3 percent) on an ASM increase of 21.7 percent. This increase is

due to operating an average of eight additional aircraft for the entire year and the end of the warranty period on our aircraft engines

resulting in increases to maintenance expense.

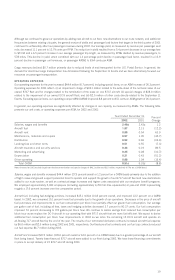

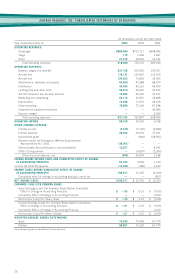

In general, our operating expenses are significantly affected by changes in our capacity, as measured by ASMs. The following table

presents our unit costs, or operating expenses per ASM, for 2003 and 2002:

Year Ended December 31, Percent

2003 2002 Change

Salaries, wages and benefits 2.31¢ 2.46¢ (6.1)

Aircraft fuel 1.78 1.87 (4.8)

Aircraft rent 1.24 0.88 40.9

Maintenance, materials and repairs 0.63 0.57 10.5

Distribution 0.45 0.52 (13.5)

Landing fees and other rents 0.52 0.51 2.0

Aircraft insurance and security services 0.20 0.36 (44.4)

Marketing and advertising 0.24 0.25 (4.0)

Depreciation 0.13 0.21 (38.1)

Other operating 0.78 0.88 (11.4)

Total CASM 8.28¢ 8.51¢ (2.7)

16