Airtran 2003 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2003 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We have various leases with respect to real property, and various agreements among airlines relating to fuel consortia or fuel farms at

airports, under which we have agreed to standard language indemnifying the lessor against environmental liabilities associated with the

real property covered under the agreement, even if we are not the party responsible for the environmental damage. In the case of fuel

consortia at the airports, these indemnities are generally joint and several among the airlines. We cannot quantify the maximum potential

exposure under these indemnities, and we do not currently have liability insurance that protects us against environmental damages.

Under certain contracts with third parties, we indemnify the third party against legal liability arising out of an action by a third party.

The terms of these contracts vary and the potential exposure under these indemnities cannot be determined. Generally, we have liability

insurance protecting us from obligations undertaken under these indemnities.

From time to time, we are engaged in other litigation arising in the ordinary course of our business. We do not believe that any such

pending litigation will have a material adverse effect on our results of operations or financial condition.

During December 2002, we broke ground for a planned $14.5 million hangar facility at Hartsfield-Jackson Atlanta International

Airport. The 56,700-square-foot hangar will be large enough to hold two of our B717 aircraft simultaneously and will also have a

20,000-square-foot, two-story office building attached to the hangar to house engineers and other support staff. Completion of

construction is expected by May 2004. The City of Atlanta is financing construction of the facility. Upon completion, we intend to

consummate a long-term lease agreement for the hangar facility.

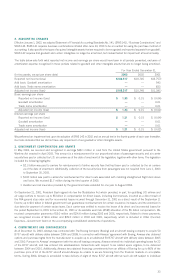

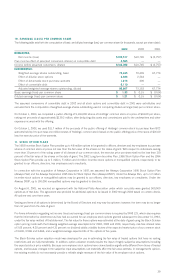

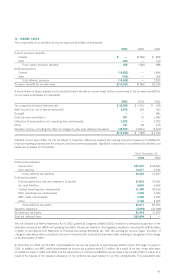

5. DERIVATIVES AND OTHER FINANCIAL INSTRUMENTS

Our results of operations can be significantly impacted by changes in the price and availability of aircraft fuel. Aircraft fuel expense for

the years ended 2003, 2002 and 2001 represented approximately 21.5 percent, 22.0 percent and 21.2 percent of our operating

expenses, respectively.

Our efforts to reduce our exposure to increases in the price and availability of aviation fuel include the utilization of fixed-price fuel

contracts and fuel cap contracts. Fixed-price fuel contracts consist of an agreement to purchase defined quantities of aviation fuel

from a third party at defined prices. Fuel cap contracts consist of an agreement to purchase defined quantities of aviation fuel from a

third party at a price not to exceed a defined price, limiting our exposure to upside market risk. As of December 31, 2003, utilizing

fixed-price fuel contracts we agreed to purchase approximately 29 percent and 12 percent of our anticipated fuel needs through

December 2004 and 2005, respectively, at a price no higher than $0.75 per gallon of aviation fuel for 2004 and 2005, including delivery

to our operations hub in Atlanta and other locations. During the first quarter of 2004, we entered into an additional fixed-price fuel

contract and a fuel cap contract. These new contracts increased our total future fuel purchase commitments to approximately 35 percent

of our estimated fuel needs during 2004 at a price no higher than $0.77 per gallon of aviation fuel. During 2003 and 2002, our fixed-

price fuel contracts and fuel cap contracts reduced our fuel expense by $7.4 million and $4.7 million, respectively.

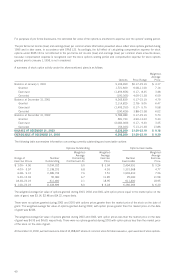

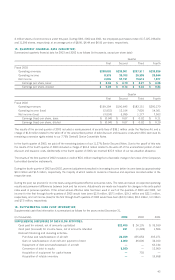

During 2001, we used swap agreements to hedge our fuel requirements. We have accounted for our derivative instruments used to

hedge fuel costs as cash flow hedges in accordance with SFAS 133. Therefore, all changes in fair value that are considered to be

effective are recorded in “Accumulated other comprehensive loss” until the underlying aircraft fuel is consumed. During 2003, 2002 and

2001, we recognized losses of $0.5 million, $6.0 million and $2.5 million, respectively, representing the effective portion of our hedging

activities. These losses are included in “Aircraft fuel” in the consolidated statement of operations. We recognized gains of approximately

$5.9 million and $2.2 million during 2002 and 2001, respectively, representing the ineffectiveness of our hedging relationships. This

gain is recorded in “SFAS 133 adjustment” in our consolidated statements of operations.

On November 28, 2001, the credit rating of the counterparty to all of our fuel-related hedges was downgraded and the counterparty

declared bankruptcy on December 2, 2001. Due to the deterioration of the counterparty’s creditworthiness, we no longer considered

the financial contracts with the counterparty to be highly effective in offsetting our risk related to changing fuel prices because of the

consideration of the possibility that the counterparty would default by failing to make contractually required payments as scheduled

in the derivative instrument. As a result, on November 28, 2001, hedge accounting treatment was discontinued prospectively for our

derivative contracts with this counterparty in accordance with SFAS 133. Gains and losses previously deferred in “Accumulated other

comprehensive loss” continue to be reclassified to earnings as the hedged item affects earnings. Beginning on November 28, 2001,

changes in fair value of the derivative instruments were marked to market through earnings. This resulted in a charge/(credit) of ($5.8)

million and $0.2 million during 2002 and 2001, respectively, which is included in the amount presented as “SFAS 133 adjustment”

in our consolidated statements of operations.

In March 2002, we terminated all our derivative agreements with the counterparty. The fair market value of the derivative liability on

the termination date was approximately $0.5 million. Since this was an early termination of our derivative contracts, losses of $6.8 million

at December 31, 2001, deferred in other comprehensive loss will be reclassified to earnings as the related fuel is used through

September 2004. During 2003 and 2002, we recognized approximately $0.5 million and $6.0 million, respectively, of the losses

deferred in other comprehensive loss. Approximately $0.3 million in net unrealized losses are expected to be realized in earnings during

2004. Upon the adoption of SFAS 133 on January 1, 2001, we recorded unrealized fuel hedge gains of $1.3 million, of which $1.2 million

was realized in earnings during 2001.

35