Airtran 1999 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 1999 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

How would you describe the company’s

performance last year?

To put it simply, 1999 was an amazing year for our

company. It marked an unequivocal turnaround in

operational and financial health. Our plans to reduce

costs, boost revenues and sustain profitability were

tremendously successful. Our strategies not only

produced solid results last year, they created a

strong foundation upon which we will build even

greater value for our employees, our customers

and our shareholders for years to come.

What were the key financial results of

the turnaround?

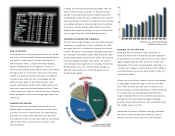

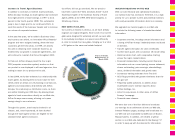

For starters, AirTran Airways, Inc., produced operating

profits in each quarter of 1999. Excluding a non-cash

fleet disposition charge and the gain from a litigation

settlement, we generated net earnings for the year of

$29.1 million on operating revenues of $523.5 million,

up 19.2 percent from 1998. AirTran Airways ended

the year with $76.2 million in cash, an improvement

of $51.8 million from the end of 1998.

And, how about traffic?

We attracted greater passenger traffic without sacrificing

yield. In fact, yield increased 8.0 percent over 1998.

Our revenue per available seat mile (RASM) rose 15.1

percent, higher than any major airline in the industry,

while operating cost per available seat mile rose only

3.5 percent. And, we did all this in the face of fierce

competition, higher fuel prices, Hurricane Floyd and a

variety of other challenges.

What did the company do to get such

positive results?

By focusing on our established routes from our Atlanta

hub last year, we were able to achieve all-time record

traffic, capacity and passenger enplanements. Load

factor for 1999 rose to 63.5 percent, an increase

of 3.9 points over 1998. That’s a 7.1 percent gain

in revenue passenger miles (RPMs), to 3.5 billion RPMs,

on 0.5 percent more capacity, or 5.5 billion available

seat miles (ASMs). More than 6.4 million passengers

flew with us in 1999, up from 5.5 million in 1998.

By virtually any measure, our 1999 numbers are solid.

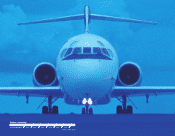

But the impression from 1999 that will endure, that

best signified the company’s turnaround, was that of

AirTran Airways’ first Boeing 717-200 touching down at

Hartsfield Atlanta International Airport on the 24th of

September. After years of anticipation, that new aircraft

and the 49 Boeing 717s that follow, embody AirTran

Airways’ transformation into an airline of the future.

How does the Boeing 717 benefit the company?

As the most passenger-friendly aircraft in its class,

the Boeing 717 will add dramatic operating efficiencies

to our already low cost structure. Despite impressive

power, its engines burn as much as 23 percent less

fuel per hour than the DC-9. With up to 60 percent

fewer parts in its environmental, avionics and electrical

systems, the Boeing 717 will also significantly lower

our fleet’s maintenance and inventory costs. The new

aircraft should reduce our overall seat-mile costs.

How did the company finance the new aircraft?

First, let me say that our Boeing 717 financing marks

our successful re-entry into the capital markets since

1997 and demonstrates that the financial community

believes in AirTran Airways’ turnaround. We financed our

first ten Boeing 717s with proceeds from the private

placement of $178.9 million aggregate principal amount

of enhanced equipment trust certificates (EETCs).

As part of our fleet disposition strategy, we have also

sold a total of thirteen DC-9-30 aircraft in 1999. AirTran

Airways will continue to operate seven of those DC-9s

through lease financing arrangements. We will continue

to retire our older aircraft, as conditions dictate, while

we bring more Boeing 717s into service — eight

new 717s are expected in 2000, sixteen in 2001,

and eighteen in 2002. At that point, we will have one

of the youngest jet fleets in the nation.

In addition to Boeing 717s, what else contributed

to the operational and financial turnaround?

Throughout 1999, we accomplished several other key

strategic goals outlined at the beginning of last year.

We strengthened our hub operations at Hartsfield Atlanta

International Airport in September by restructuring

our connecting banks. Recently, we also increased the

number of AirTran Airways’ gates from 18 to 22. We

improved customer-service training by implementing

an extensive and ongoing program aimed at further

developing an environment of Caring Customer Service.

And we expanded our route system to serve Newark and

the new Beau Rivage Resort in Gulfport/Biloxi, entering

only those markets that offered attractive returns.

But, the biggest reason for our tremendous success

in 1999 is our people. We have nearly 4,000 of the

most dedicated and enthusiastic employees in the

industry. Without them, we could not have achieved

our extraordinary turnaround.

What does the future hold for the company?

We have a simple long-term vision for our success.

We will strive to grow by being an industry leader.

After all, the world doesn’t need another ordinary

airline. But, millions of people will value an airline

that changes things for the better. That means

constantly working to be the best in safety, technology

and Caring Customer Service.

We achieved things in 1999 few people thought possible.

Our leadership team and employees are ready and eager

to continue the good fight and make more airline history

in 2000.