Airtran 1999 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 1999 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

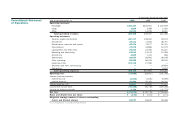

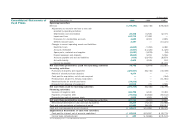

increased service levels, offset by a 21.7% decrease in price per gallon in 1998

from 69.0 cents per gallon to 54.0 cents per gallon. Maintenance costs increased

21.7% due to additional check lines and engine overhauls principally resulting from

an increase in the number of operating aircraft from 44 at December 31, 1997,

to 50 at December 31, 1998. Commissions expense increased 246.1% largely

due to the increase in passenger volume and the increase of travel agency bookings

through the Airline Reporting Corporation (“ARC”), which we joined in September

1997. Landing fees and other rents increased 28.2%, from $18.2 million in 1997

to $23.4 million in 1998, due to a 72% increase in number of departures. Marketing

and advertising increased 13.6% from $13.3 million in 1997 to $15.1 million in

1998. However, as a percentage of revenue, marketing and advertising decreased

2.9 percentage points from 6.3% in 1997 to 3.4% in 1998, which is more in line

with industry standards. Aircraft rent increased from $0.9 million in 1997 to

$7.2 million in 1998 due to a full year of B737 rent expense versus only six weeks

of aircraft rent expense recognized after the acquisition of Airways Corporation in

November 1997. Depreciation expense remained flat year over year. Additional capital

spending increased depreciation expense by $12 million offset by a $12 million

reduction due to revising the salvage values on our DC-9 equipment. See Note 1 to

the consolidated financial statements. Other operating expenses increased 37.3%,

or $18.0 million, in 1998 as compared to 1997, primarily as a result of increases

in passenger and aircraft servicing expenses.

In the fourth quarter of 1998, we decided to accelerate the retirement of four owned

Boeing B737 aircraft as a result of the elimination of their original route system

and continued operating losses upon their redeployment to other routes. The B737s

are intended to be replaced with B717 aircraft. In connection with our decision to

accelerate the retirement of these aircraft, which were acquired in the acquisition

of Airways Corporation, we per formed an evaluation to determine, in accordance

with SFAS No. 121, whether future cash flows (undiscounted and without interest

charges) expected to result from the use and eventual disposition of these aircraft

would be less than the aggregate carrying amount of these aircraft and related

assets and an allocation of cost in excess of net assets acquired resulting from

the acquisition of Airways Corporation. SFAS No. 121 requires that when a group of

assets being tested for impairment was acquired as part of a business combination

that was accounted for using the purchase method of accounting, any cost in excess

of net assets acquired that arose as part of the transaction must be included as part

of the asset grouping. As a result of the evaluation, we determined that the estimated

future cash flows expected to be generated by these aircraft would be less than their

carrying amount and allocated cost in excess of net assets acquired, and therefore

these aircraft are impaired as defined by SFAS No. 121. Consequently, the original

cost bases of these assets were reduced to reflect the fair market value at the date

the decision was made, resulting in a $27.5 million impairment loss. We considered

recent transactions and market trends involving similar aircraft in determining the

fair market value. See Note 10 to the consolidated financial statements.

During 1997, we incurred $30.1 million of costs attributable to rebranding the airline

and shutdown and other nonrecurring costs attributable to the continued effects of

the reduced schedule after the 1996 suspension of operations. No such costs were

incurred during 1998.