Aer Lingus 2010 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2010 Aer Lingus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2010

7

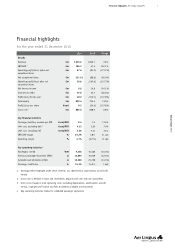

Operating and fi nancial review Aer Lingus Group Plc

The combination of the actions taken in late

2009, the adoption of the market positioning

described above and the implementation of

the actions below, has resulted in the return of

the Group to profi tability in 2010. As

explained in the Financial Review (below) the

Group has produced an operating profi t before

exceptional items of €57.6 million for 2010

against a loss of €81.0 million in the prior

year. This turnaround has been achieved on

fl at revenues in an overall declining market

(e.g. 10% decline in year-on-year Dublin

airport passenger volumes). Revenue was up

0.8% at €1,215.6 million. The fundamental

elements of the strategy and their contribution

to the turnaround are summarised below.

Better matching of capacity

to demand

Short-haul capacity (measured by ASKs) was

reduced by 7.8% compared to 2009, with the

load factor reducing by only 0.5 percentage

points to 74.9%. It is important to note that

the focus in 2010 was not just to reduce

short-haul capacity but to better manage and,

where required, re-deploy short-haul capacity

with the objective of better serving

underlying, natural demand, strengthening the

Aer Lingus network and gaining market share.

In long-haul, capacity was reduced by 24.1%,

leading to a 5.3 percentage point increase in

load factor to 78.4%. Overall, capacity was

reduced by 13.9%, and the load factor increased

by 1.6 percentage points to 76.1%. The

reduction in capacity without an adverse effect

on load factors illustrates that we achieved a

better match between the seats we offered in

2010 and the natural demand in our markets.

Focus on yields

We changed our pricing policy to optimise yield

rather than load factors. Aer Lingus continues

to operate in very price sensitive markets and

the bulk of seats continue to be offered at

what are designed to be attractive low fares.

However, our yield management policy now

recognises that a proportion of the demand for

many of our fl ights is driven by passengers

who are more time than price sensitive,

allowing us to improve yields for bookings that

are made closer to the departure date. Our

changed approach to yield management

resulted in an 11.4 % increase in average fare

per short-haul passenger and a 19.0% increase

in average fare per long-haul passenger.

Connectivity

We have emphasised connectivity, both within

our own network and between our network and

that of our interline partners, as a means of

compensating for weak demand in the Irish

market. Improved interline revenue was a

target in 2010 and we delivered year-on-year

increases in volume and yield. Interline

revenue represented 7.7% of system revenue in

2010 compared with 6.7% in 2009 and we have

continued to invest in relationship management

with our key bilateral partners. This emphasis

on connectivity meant that 34% of transatlantic

sales in 2010 connected behind or beyond our

gateway airports vs. 23% in 2009.

Partnerships & Alliances

A key element of our connectivity strategy was

the launch of the Aer Lingus Regional service

at the end of March 2010. This is operated by

our franchisee Aer Arann. The arrangement

allows us to offer a service and earn a

franchise fee, on routes that would otherwise

be uneconomic with a jet aircraft, as well as

generating transatlantic connections from

provincial UK cities. 20,000 such connections

were generated in 2010. We also launched, in

early 2010, an extended codeshare agreement

with United Airlines to operate a service

between Washington to Madrid. The single

aircraft extended codeshare was launched as a

proof of concept and it has been profi table in

2010.

Aer Lingus needs partners in order to deliver

on its core mission of connecting Ireland with

the rest of the World and we are continuously

evaluating opportunities with airline peers

which will enable us to expand our service

offering. We feel that our product quality and

competitive cost base makes us an attractive

partner.

Review of 2010

The combination of snow and ash disruptions

resulted in an ASK reduction of approximately

5% in 2010 compared to plan. This impacted

revenue performance as a result of cancelled

fl ights and also resulted in costs relating to

passenger compensation and other items. In

addition, unit cost performance was negatively

impacted as fi xed cost remained unchanged

despite reduced capacity compared to plan.

The fi rst quarter of 2010 showed an

approximate halving of operating losses,

largely attributable to lower fuel prices. Early

indications of the success of the shift in

commercial strategy became apparent with the

12.4% increase in long-haul average fare per

passenger, coupled with a 3.8 percentage point

increase in load factor. However, improvement

in short-haul fare per passenger was only 3%

as we had not, at that point, been able to

reduce excess capacity at the London Gatwick

base. This occurred at the start of the summer

schedule at the end of March 2010.

In addition, Q1 2010 was adversely affected

by the Irish airport departure tax, which was

introduced in March/April 2009. March saw

fi nal approval of the Greenfi eld cost reduction

programme following a 74% positive staff

ballot, March also saw the launches of the Aer

Lingus regional franchise and the extended

codeshare agreement with United Airlines for

the Washington to Madrid service.

As we moved into the second quarter,

operations were disrupted by airspace closures

caused by ash from the Icelandic volcanic

eruption. Despite the associated cancellations,

the Group reported an operating profi t before

exceptional items of €18.8 million, compared

with a loss of €18.2 million for the same period

in 2009. The second quarter provided early

evidence of the success of our commercial

strategy with short-haul yields up 13.8% and

long-haul yields up 20.9%. We also started to

implement the Greenfi eld programme and, by

the end of June, had achieved staff cost

savings with an annual value of €29.6 million.